Month: October 2020

The threat of economically crippling lockdowns, the promise of unending monetary stimulus, and the uncertainty of game-changing political outcomes – this is the “new normal” for investors.

The COVID pandemic won’t be eradicated anytime soon. And even when it finally is, the economic and social costs will continue to be borne for years to come.

In such an environment, all conventional asset classes carry heightened risk. Certain types of assets, though, may now be well positioned to shine.

Among them is silver.

With politicians and central bankers desperately trying to paper over real economic losses with artificial stimulus, the outlook for the value of the U.S. dollar looks bleak.

A record $3.1 trillion federal budget deficit combined with an explicit new inflation-raising campaign by the Federal Reserve puts holders of dollar-denominated paper assets in jeopardy.

Hard assets in general and precious metals in particular act as a natural countermeasure to currency depreciation.

Some commodities, such as crude oil, have suffered greatly in recent years amid the push for “green” alternatives to fossil fuels. Dramatic growth in electric vehicles and solar energy installations is likely to continue, regardless of the upcoming election outcome.

The upshot is that all viable alternatives to fossil fuels require massive amounts of metals – from copper to nickel to silver to rare earths.

“Silver is found in virtually every electronic device. If it has an on/off button, it’s likely that silver is inside,” according to the Silver Institute. “Silver’s excellent electrical conductivity makes it a natural choice for everything from printed circuit boards to switches and TV screens.”

As cars become more technologically advanced and more likely to be powered by batteries, they will require larger quantities of strategic metals including silver. The motor vehicle industry already consumes over 36 million ounces of silver per year – and that number will surely grow as global demand picks back up.

The trend toward more metals-intensive energy development could accelerate if Joe Biden wins the presidency and Democrats take over the Senate.

Biden now says he rejects the most extreme planks of AOC’s “Green New Deal” platform, including a ban on fracking. But he is still vowing to push through a multi-trillion-dollar green energy program of his own.

Regardless of the election outcome, most of America’s largest corporations will continue to pursue environmental, social, and governance (ESG) targets. In recent years, shareholder activists including government pension funds have successfully foisted their ESG demands upon corporate America.

It’s why today fast-food companies feel compelled to virtue signal their support for everything from reducing their carbon footprint to implementing critical race theory to celebrating transgenderism. What does any of this have to do with selling burgers?

It has to do with the fact that taking up politically fashionable causes is nearly a prerequisite for doing business as a publicly traded company. A low ESG score means being protested by activists and shunned by institutional investors.

A company can score ESG points by making commitments to “diversity” or capital investments in solar panels, for example. This means that demand for green technologies can far exceed the actual utility they deliver.

Demand for photovoltaic solar systems is expected to explode in the years ahead. This year solar-related stocks have been among the hottest performers in the market.

But as demand continues to grow, the solar industry could soon run into a serious supply problem in critical metals including silver.

Photovoltaics are one of the fastest growing sources of industrial demand for the white metal. Silver saw a 7% increase in such demand last year to over 85 million ounces.

Meanwhile, investment demand for silver bullion has been surging in recent months at the same time as mining supply is contracting due to adverse economic and political (lockdown) conditions.

Silver often trades in a volatile manner. That volatility could be amplified depending on how the election turns out and how much of a toll the virus takes in the coming weeks.

Regardless of whether the futures market reads a particular development as “good” or “bad” on any given day, three major long-term drivers of silver price appreciation appear unstoppable:

- The Fed will continue to pursue inflationary stimulus regardless of the election outcome.

- Insatiable demand for solar energy and various electronic applications will continue to use up more silver.

- A mining supply deficit in silver will contribute to market tightness and possible bottlenecks that render refined silver products difficult to obtain by investors and industrial users alike.

At some point, higher silver prices will send market signals that alleviate the supply and demand crunch. But that point may be years away – and multiples of price appreciation ahead.

Source: Peter Epstein for Streetwise Reports 10/19/2020

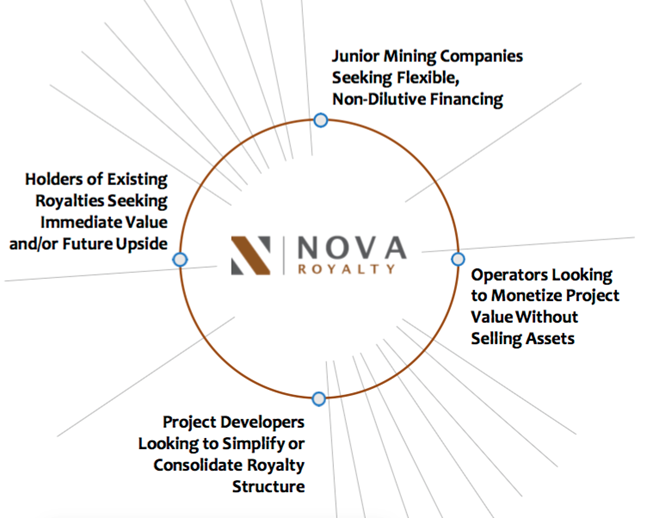

Peter Epstein of Epstein Research speaks with Alex Tsukernik, CEO of Nova Royalty Corp., one of the few royalty companies focused on battery metals.

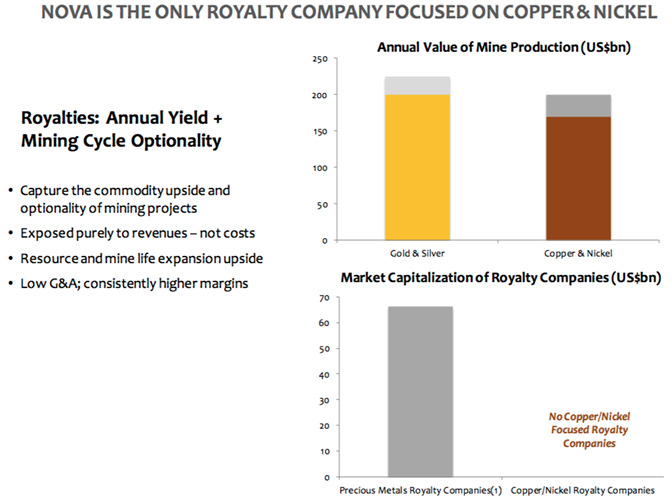

Investors in the royalty and streaming sector, most notably in precious metals, are well versed in the business model. Giants like Franco-Nevada and Wheaton Precious Metals trade at premium earnings multiples. Both have market caps above $30 billion and have enjoyed strong share price appreciation (+78% / +150%, from 52-week lows).

Readers may have noticed a dozen or more new royalty/streaming companies hitting the market this year alone. Competition for transactions on high-quality gold and silver projects or mines in safe, low-cost, prolific jurisdictions is soaring. At the same time, precious metal prices are near all-time highs, adding even more fuel to the valuation fire.

Surprisingly, very few players are focusing entirely on battery/high-tech, green-energy metals like nickel, copper, lithium, cobalt, manganese, vanadium and graphite. For a variety of reasons, some of these metals are not amenable to royalty and streaming activities. However, nickel and copper are thought to be well placed in this regard.

Why nickel and copper above the others? To find out, I spoke with Alex Tsukernik, CEO of newly listed Nova Royalty Corp. (NOVR:TSX.V).

Expert consultant groups, including Roskill, S&P Global Market Intelligence, CRU Group, Argus, mostly agree that both copper and nickel demand will grow at a faster annual rate in the 2020s than in the 2010s, and possibly faster still in the 2030s vs. the 2020s. Yet global supply growth to meet demand is a huge question mark.

If nickel and copper prices increase significantly in coming years, as I think they will, Nova Royalty’s long-lived assets could become considerably more valuable. Please continue reading to learn a lot more about nickel, copper and Nova Royalty Corp.

Peter Epstein: Can we get a brief history of Nova Royalty Corp.?

Alex Tsukernik: Yes, of course. We started Nova Royalty two years ago to create a royalty company focused on the most critical, supply-constrained portions of the electrification supply chain. We found copper and nickel mines to be the best places to focus on, and have completed three major acquisitions.

Our project owners include Teck, Newmont and Rio Tinto—some of the world’s largest mining companies—all investing significant capital into projects where we own royalties. Nova Royalty was listed on the TSX-V on October 1st and we announced a $15 million financing facility from Beedie Capital to help finance growth. Our market cap is ~C$70 million.

Peter Epstein: Why focus on just two battery / green-tech metals (nickel & copper)? What about lithium, cobalt, graphite, manganese or vanadium?

Alex Tsukernik: We believe copper and nickel are the most compelling battery metals for two main reasons:

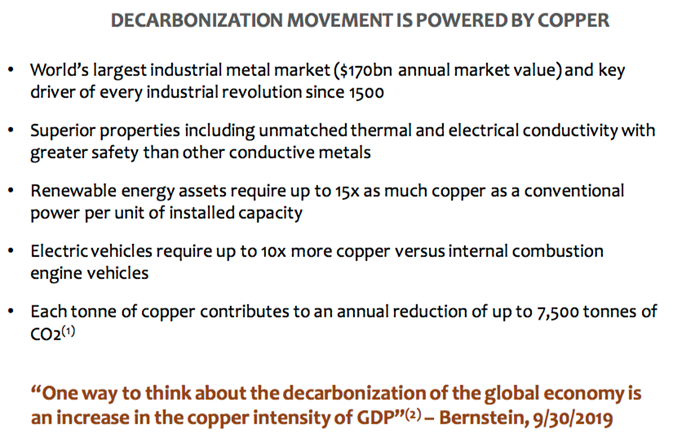

Mass adoption: Copper is the world’s largest industrial metal market and the biggest beneficiary of the electrification and decarbonization around the world. It’s the heir to oil as the world’s primary energy commodity.

Copper is the key ingredient in wind, solar, EV charging infrastructure and the EV itself. Renewable energy assets require as much as 15x more copper per unit of installed capacity compared to conventional power sources. EVs require up to 10x more copper per vehicle than Internal Combustion Engine (ICE) vehicles.

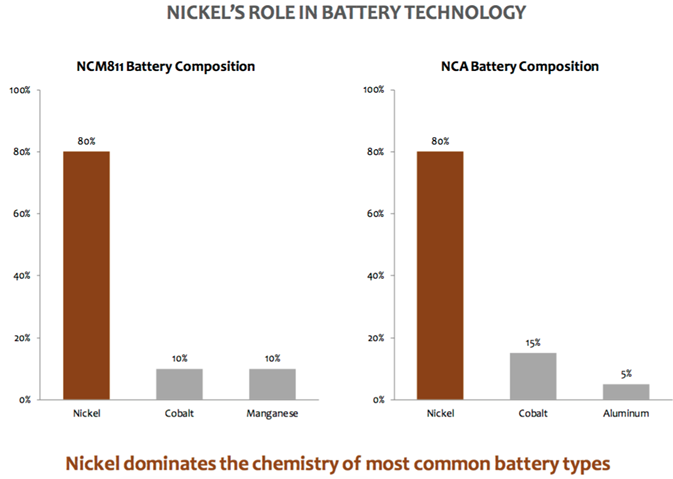

Nickel is a critical element in EV batteries, with the two most common battery types, NMC and NCA at ~80% nickel by mass. Global automakers have, almost in unison, embraced nickel-heavy batteries. While the battery race is still evolving, it’s hard to see an EV industry without nickel playing a major role.

We have yet to see cobalt, graphite, manganese and vanadium achieve anything close to mass penetration, which is why we stay away from those commodities.

We like scalable commodities around which we can build a consistent strategy, not bespoke one-off transactions. There’s a big gap between having a technology and gaining a sustainable foothold in the industry infrastructure.

Lithium does have mass adoption, but lithium miners have little pricing power and are (at this stage) missing out on the major rewards of electrification.

Supply chain pricing power sits with miners: For both copper and nickel, most of the value in the supply chain stays with the miners. That makes royalties on copper and nickel deposits highly attractive.

Royalties give us rights to revenues before costs and also give us free optionality on exploration successes and production expansions—which are almost certain with large, strategic deposits that can operate for >50 years.

That’s not the case with lithium. Most of the value in the lithium supply chain is captured by processors that refine the mined lithium into finished products. There’s an abundance of mined lithium, which removes the long-term price support from that market.

By contrast, copper and nickel supply is naturally constrained at current prices, with the timeline and capital cost for new projects progressively increasing. We have acquired royalties on some of the largest, most strategic projects in the global copper/nickel pipeline—and we believe these projects will become a priority to bring into production sooner rather than later.

Focused royalty companies command investor attention and premium valuations: The purpose of public royalty companies is to give investors a better way to invest in a theme—and the commodities that drive that theme.

We have seen this with precious metal royalty companies focusing on gold and silver. Copper and nickel are emerging as the gold and silver of electrification.

We’re seeing a generational shift in how we live, and the massive energy transition is at the tip of the spear of that change. Royalties are the best way to participate in this energy transition—especially royalties in the largest, most strategic assets in the world.

Diversified royalty companies have traditionally traded at a discount to net asset value—we don’t want to pursue that strategy.

Peter Epstein: Are there mining jurisdictions that Nova is especially bullish on? Are there popular destinations that Nova is bearish on?

Alex Tsukernik: Most of our activity is throughout the Americas and Australia. Our current portfolio contains 14 royalties, 13 in Canada, one in Chile, and we just announced an acquisition of a world-class asset in Argentina last week. We will not invest in jurisdictions that do not have a consistent approach to successfully integrating the mining industry into their broader society.

Miners have struggled with social license, especially recently. Hence, our primary focus on making sure that the deposits we invest in have good reasons to be supported by their communities and local and federal governments.

Peter Epstein: Please describe to readers Nova’s bull case on copper.

Alex Tsukernik: Copper is the key ingredient in the decarbonization of the world. As I mentioned, everything from renewable energy assets to the EVs themselves will require a multiple of the copper that is currently being consumed.

The industry can meet that demand, but supply growth will have to dramatically increase from the roughly 1%/year we’ve been seeing. The price of copper will have to rise to incentivize companies to invest billions on new projects years before first production.

It takes decades to advance a major project from exploration to production, and operational challenges are not getting any easier. From what we have seen, risks across the spectrum (technical, social, environmental, financial, political) are only rising. It’s very hard to see a future copper industry at today’s $3/lb. Very few projects can justify the investment and risk at this price level.

Peter Epstein: Please describe to readers Nova’s bull case on nickel.

Alex Tsukernik: As of right now, there is no EV industry without nickel, in particular, Class 1 nickel from jurisdictions with sustainable production standards. By 2040, Bloomberg estimates 58% of car sales will be electric. That will require an annual Class 1 nickel supply that’s a multiple of today’s volumes. Massive copper projects are challenging to bring into production. Historically, nickel projects have been even more challenging.

Given the amount of new supply required and the prior operational challenges—the battery-grade nickel space will need to find a new, economically sensible price floor. The nickel price still largely reflects the dominance of the stainless steel space in its customer base. We believe that will change in coming years.

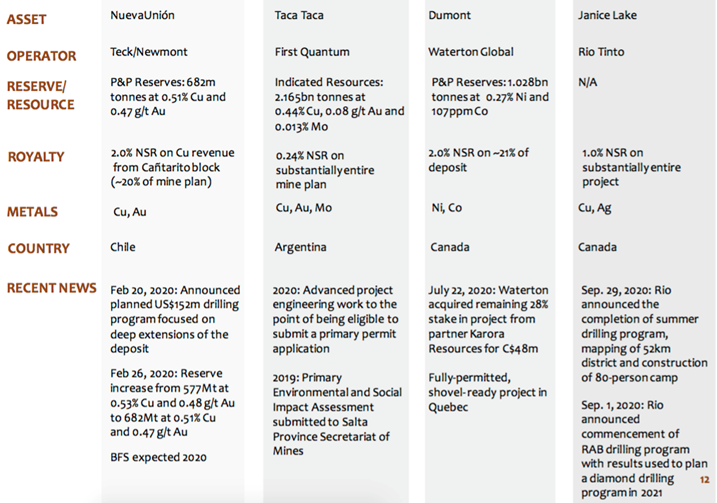

Peter Epstein: Please tell us about your most important assets.

Alex Tsukernik: Every major transaction that we have done has focused on an asset that’s either already—or has the potential to be—globally important in copper or nickel.

NuevaUnion: A 50/50 JV between Teck Resources and Newmont in Chile, one of the world’s largest copper development projects. Teck has been highly successful in developing mines in Chile, and Newmont understands copper-gold porphyries very well. We own a 2.0% Net Smelter Royalty (NSR) on ~20% of the La Fortuna deposit, which is already >1 billion tonnes of reserves and resources. Two days after our acquisition of this NSR, in February 2020, it was announced that Teck and Newmont are planning a $152 million drill program.

Although our royalty applies only to copper revenues, which comprise the majority of the project’s economic value, the precious metals component and the presence of Newmont, a gold major, are definite pluses in advancing the project.

To the degree possible, it’s beneficial to have multiple metal revenue streams to manage volatility and keep mine projects moving toward production.

Taca Taca: On October 8th we announced the acquisition of a 0.24% NSR on the Taca Taca project in Argentina, one of the world’s largest copper development projects. It has >13 million tonnes (28.7 billion pounds) of contained copper and gold and molybdenum credits.

First Quantum is the operator. Taca Taca has a chance to become one of the world’s great copper mines. Escondida, located on the other side of the Chile-Argentina border, is only ~90 km away.

Dumont: We own a 2.0% NSR on ~21% of the Dumont nickel-cobalt project in Quebec. Dumont is the world’s second largest nickel reserve, fully permitted and located in a highly supportive mining jurisdiction.

It’s 100%-owned by major private equity fund Waterton Global Resource Management, which recently bought the remaining 28% of Dumont, giving it 79% ownership. We’re confident the asset is in strong financial hands and in prime position to be developed.

Janice Lake: We own a 1.0% NSR on the Janice Lake copper-silver project in Saskatchewan being advanced by Rio Tinto. Rio has completed its Stage 1 earn-in requirements well ahead of time, has built an 80-person camp, and just completed its summer exploration program. Like Dumont, Janice Lake is in a great jurisdiction and near key regional infrastructure.

The deposit has an 8-km strike length and displays several large zones of mineralization, open in all directions. It’s rare to see a major company pursuing an exploration project with such clear intent.

We understand that Rio is planning a diamond drilling program in 2021 after doing rotary drilling this summer. We are keen to see the drill results in the next month or two. We also own a 1.0% NSR on the Wollaston project, located ~40 km away and on trend, from Janice Lake.

Peter Epstein: Thank you Alex, I will leave it there—four globally significant assets, operated by mining giants like Teck, Newmont, First Quantum, Rio Tinto—Nova Royalty seems to be in the right place at the right time in the right commodities (nickel + copper).

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures/disclaimers:

The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Nova Royalty Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Nova Royalty Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no stock, options or warrants in Nova Royalty Corp., and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada, a company mentioned in this article.

/p>

Despite JP Morgan’s record spoofing fine, deterrence questions remain? HINT: THERE IS NO DETERRENCE!!! THE FINES STOP NOTHING!!! by Jason Burack of Wall St For Main St Despite JP Morgan’s […]

The post US Mint Increases Prices on Silver Coins, More Paper Price Smashes Without Penalty appeared first on Silver Doctors.