Bill Murphy, Chairman and Director of the Gold Anti-Trust Action Committee (GATA), says we are now in the “End Game,” in which the physical market finally overpowers the paper market, and gold and silver prices never look back.

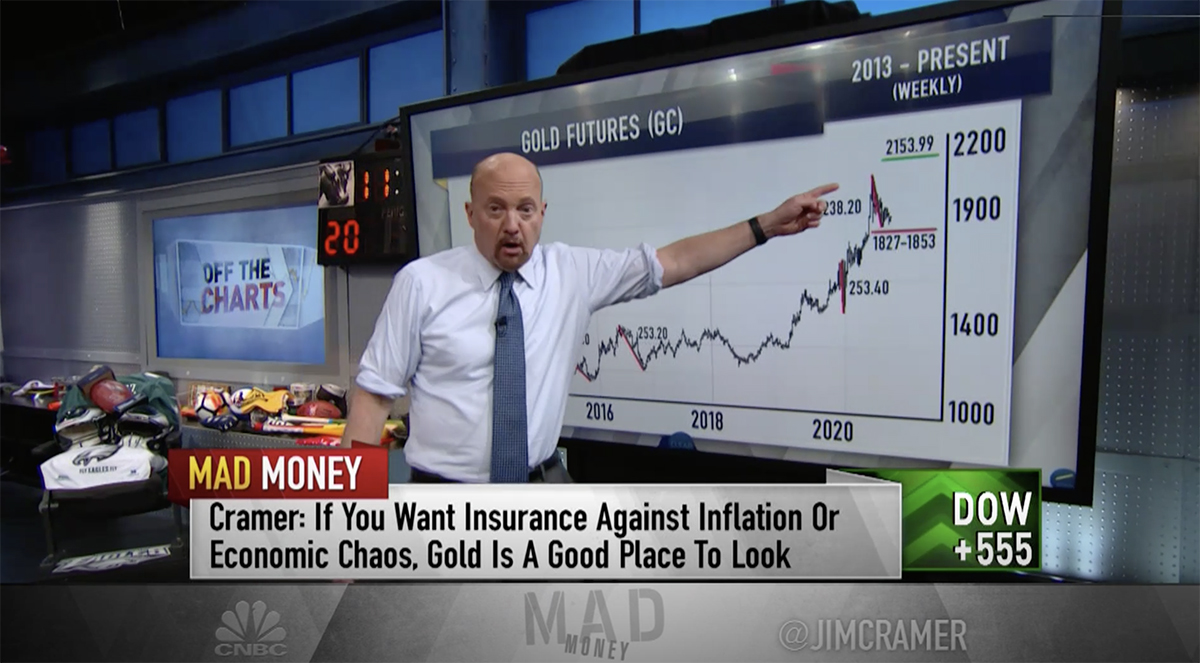

Have you been wondering if gold and silver’s record bull market’s run out of steam? Well, STOP now. Because the market fundamentals suggest these two precious metals are just getting started.

Never have gold and silver had more reasons to rise in price when you consider the following 8 factors:

- National and worldwide debt is rising exponentially and now beyond repair. On top of the recent $900 billion stimulus package in play, President-elect Joe Biden just proposed another $1.9-trillion package1.

- Interest rates are at historical lows.

- COVID-19 is back on the rise.

- Europe is in a complete state of lockdown. Eventually, the vaccine should triumph, but for now, the already-permanent damage has taken a devastating toll. And, the vaccine is taking much longer than planned to implement.

- Chinese investors have flooded back into the gold market. U.S. retail gold demand is surging because many Americans are concerned our country is heading down a dark road. In fact, the U.S. Mint ran out of American gold eagle coins, and retailers nationwide are now experiencing delivery delays. With COVID-19 curtailing production and disrupting supply chains, you can expect this shortage to persist.

- Commodities prices are at 6-year highs.

- And, on top of everything else, the Fed confirmed—for the second time—that they will continue to ease indefinitely and support higher inflation.

- Lastly, throw in the recent storming of the White House and the Democratic sweep of Congress, and we have the perfect recipe for a weaker dollar, stronger inflation, and higher gold and silver prices.

Why Haven’t Gold and Silver Prices Jumped Yet?

If the outlook for gold and silver prices is so bullish, why have they drifted sideways for months now?

Interest Rates

Some blame the recent rise in interest rates, including the ten-year treasury yield to over 1%. But, interest rates are still well below the rate of inflation.

Plus, history tells us that gold can thrive even as interest rates rise.

In the 1970s, the Fed funds rate went from 6% to 19%, while the price of gold rose from $35/oz to $1,875/oz. (In the ‘70s, interest rates rose with inflation. And inflation, of course, is good for gold). In addition, higher interest rates are ultimately negative for stocks, bonds, and real estate…

….AND higher rates make it costlier to pay off government debt, so the Fed will do everything in its power to continue easing (i.e., keeping interest rates low).

Market Manipulation

Most likely, however, the “lethargic” gold and silver prices are due to the ongoing manipulation by the bullion banks2.

If you haven’t heard, bullion banks like J.P. Morgan have been raiding the paper market for years. By selling gold and silver on the London and N.Y. Exchanges, these bullion banks drive the paper price down, allowing them to buyback paper AND physical gold at lower prices.

If you own physical gold and silver, these raids can be frustrating, but…

…Understanding These Dynamics Offers a Huge Advantage:

- These raids allow you to pick up physical gold and silver at artificially low prices.

- Every time gold and silver prices are manipulated down, more physical metal is taken off the market (permanently), which will cause prices to rise that much further in the future.

The End Game for the Fed’s Grand Experiment

Of course, it’s not just gold and silver prices being manipulated. The Fed is doing everything possible to keep the stock market, bond market, and dollar propped up.

The resulting “wealth effect” has provided a superb diversion to the deeply inherent problems below the surface. But ultimately, the Fed is doomed to fail. The debt is too great. The economy is too weak.

The only Fed “bullet” left? Allow inflation to rise, which, in turn, allows future debt to be paid off in cheaper dollars.

The financial markets—which have lost touch with reality—will come down from their lofty levels with an ugly thud, either caused by inevitable higher interest rates and/or an economic “event.”

The Fed’s “monetary fountain of youth” and effortless “print and spend” program is going to end in crisis. In 2008, our government bailed out the banks. This time around? It will be our government, and governments worldwide, that will need bailing out.

Most Americans will be completely blindsided.

Don’t be one of them.

See how to properly diversify your portfolio and protect your wealth from the Fed’s grand experiment. Because the End Game is here.

Request your FREE Precious Metals Investment Guide now.

“We Are Now on Borrowed Time”

“My concern is that the Fed and other leading central banks will soon fail in their attempt to sustain financial asset prices via printed money. On that basis alone, we are now on borrowed time. As soon as the Fed loses control of the bond market, the financial crash will take down the dollar with it. Gold is sound money. I’m not going to talk gold and silver prices because they are irrelevant. Anyone who does not have physical metal will suffer mightily from these evolving conditions.”

— Alasdair Macleod, Head of Research for London based GoldMoney