Month: January 2021

The recent explosion of money printing and debt-funded spending by the U.S. in response to the Covid-19 pandemic has sparked a renewed interest in the key role gold and silver play in hedging against systemic risks.

That’s why a group of Idaho legislators are working to secure a role for the monetary metals in hedging the Gem State’s government reserves.

Introduced by Representative Ron Nate (R-Rexburg) and Senator Steve Vick (R-Dalton Gardens), House Bill 7 would permit – but not require – the State Treasurer to hold some portion of state funds in physical gold and silver to help secure state assets against the risks of inflation and financial turmoil and/or to achieve capital gains as measured in Federal Reserve Notes.

The Idaho Treasurer is currently handcuffed when it comes to investment choices. State statutes provide extremely limited options for holding, managing, and investing Idaho’s “idle moneys” (which currently amount to several billion dollars).

As a result, Idaho’s reserves are invested almost exclusively in low-yielding debt paper – such as corporate bonds, tax-anticipation notes, municipal bonds, repurchase agreements, CDs, treasuries, and money market funds. Some refer to these instruments as “return free risk.”

These debt holdings appear to have low volatility, but they carry other risks – not the least of which is pernicious inflation and the steady erosion in real value of principal, coupled with interest rates that are negative in real terms.

An allocation to gold and silver provides a hedge against inflation, debt default risks, stock market declines, and volatility – and it historically increases overall returns. Gold and silver do not have the default or loss of purchasing power risks that bonds or other debt instruments carry.

Idaho House Bill 7 simply adds the authority to hold physical gold and silver directly – and in a manner that does not assume the counterparty and default risks involved with other state holdings.

Meanwhile, H7 does not grant any authority to buy stocks, futures contracts, or other gold and silver derivatives. The authority is confined to physical gold and silver, directly owned by the state and stored nearby in secure bailment.

Protecting State Funds with Sound Money a Growing Trend

A few other forward-thinking states are examining ways to implement a modest allocation of state funds to gold and silver.

The Texas Teacher Retirement Fund owns close to $1 billion in physical gold. Recently, the Ohio Police and Fire Pension Fund (currently valued at more than $15 billion) approved a 5% allocation to the yellow metal.

This year, South Carolina will consider the feasibility and efficacy of an in-state depository to securely store gold, silver, and other metals for the state’s reserves and other investments.

In 2019, Wyoming considered legislation to affirm the treasurer’s ability to invest reserve, trust, and pension funds in gold and silver. Wyoming is expected to consider this measure again in 2021.

The monetary metals can provide states with a meaningful way of hedging taxpayer funds against debt default risks, stock market declines, the federal policy of perpetual Federal Reserve Note devaluation. And a gold allocation has historically boosted overall investment returns while also reducing volatility.

An allocation to physical gold and silver fits squarely within the objective of protecting state funds against financial risks and would logically be included on any list of safe investment holdings. The Sound Money Defense League supports this measure and looks forward to working with Idaho legislators to ensure the State Treasurer has the authority to invest state funds in sound money.

Image credit: Pixy

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

As a new administration took power in Washington this week, investors weighed new opportunities as well as new risks.

The Biden administration promises to undo much of the policy agenda President Donald Trump had implemented. However, those expecting a new era in American politics are likely to be disappointed – or relieved, depending on their perspective.

Joe Biden is anything but new or transformational. He seems to view his mandate as that of reassembling the Obama-Biden administration for a third term.

Obama’s Federal Reserve Chair Janet Yellen is among the familiar faces Biden has picked to populate his cabinet. Yellen will take the helm as Treasury Secretary.

She testified before the U.S. Senate remotely ahead of the inauguration and urged lawmakers to commit to more fiscal stimulus.

Janet Yellen: Without further action, we risk a longer and more painful recession now and longer-term scarring of the economy later. Neither the President-Elect nor I proposed this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big. In the long run I believe the benefits will far outweigh the costs.

The government’s ability to borrow at low interest rates may seem limitless given the Fed’s unlimited capacity to buy Treasuries. But that doesn’t mean there aren’t costs and dangers involved. Chief among them is a decline in the value and global credibility of the U.S. dollar.

Inflation risks appear to be rising at the same time as the threat of higher taxes looms.

If Janet Yellen and Joe Biden get their way with Congress, then trillions of dollars in new taxes on businesses and investors could be coming down the pike. Yellen wants the Trump tax cuts repealed, which would revert the U.S. corporate tax rate to one of the highest in the developed world.

When pressed by GOP Senator Mike Crapo, Yellen said she would push for a globally coordinated tax hike through the Organization for Economic Cooperation and Development. She decried the “global race to the bottom on corporate taxation” that makes other countries more attractive for capital investment.

Apparently, she thinks higher taxes wouldn’t deter economic activity if only everyone else adopted them too.

Also in Yellen’s crosshairs is cryptocurrency. The former central banker urged Congress to “curtail” the use of Bitcoin. She falsely claimed that its primary use is for “illicit financing.”

In fact, Bitcoin is held mainly as an alternative store of value by investors and speculators. Their purpose in acquiring it is for expected price appreciation – an entirely legal objective.

Unfortunately for Bitcoin holders, Yellen’s remarks contributed to a sharp selloff in cryptocurrency markets this week. Over $100 billion in total market value was erased.

Meanwhile, another alternative asset class – precious metals – fared much better despite pulling back a bit here today. Gold prices are up $30 or 1.6% this week to trade at $1,865 an ounce.

Spot silver checks in at $25.70 per ounce as of this Friday recording on the heels of a 3.2% weekly advance, exactly double of gold’s move this week in percentage terms. We’ll still need to see some more upside price action in silver in the days ahead before a significant technical breakout can be achieved.

Other metals, including copper, have already made new multi-year highs in 2021.

And platinum looks to be next. Platinum prices traded up near a five-year high on Thursday. The scarce metal currently comes in at $1,118 after gaining 2.8% since last Friday’s close.

And finally, its sister metal palladium is off 1.1% this week to trade at $2,392 an ounce.

Metals markets appear to be well positioned to benefit from the policies of the Democrat administration and the nonpartisan Fed.

For now, precious metals, unlike cryptocurrencies, aren’t being singled out for more regulations and restrictions. In an environment where the monetary authorities not only DON’T view inflation as a problem – but actively seek to generate higher rates of price increases in the economy – rising gold and silver prices are completely compatible with their objectives.

At some point that may change if gold and silver price spikes begin to reflect too negatively on the standing of the U.S. dollar on the global stage. For now, though, a weak dollar policy is in force as Washington favors stimulus over all other concerns.

Stimulus measures which President Trump himself supported will have a much better chance of passing an evenly divided Senate than a Biden tax hike package. Current political realities all point to more borrowing, more money printing, and more inflationary fuel for precious metals markets.

Meanwhile, this recent explosion of money printing and debt-funded spending over the last year has sparked a renewed interest among lawmakers in the key role gold and silver can play in hedging against systemic risks.

For example, a group of Idaho legislators are working right now to secure a role for the monetary metals in hedging the Gem State’s government reserves.

Introduced by Representative Ron Nate (R-Rexburg) and Senator Steve Vick (R-Dalton Gardens), House Bill 7 would permit the State Treasurer to hold some portion of state funds in physical gold and silver to help secure state assets against the risks of inflation and financial turmoil and/or to achieve capital gains as measured in Federal Reserve Notes.

The Idaho Treasurer, like a few treasurers in other states, is currently handcuffed when it comes to investment choices. State statutes provide extremely limited options for holding, managing, and investing Idaho’s “idle moneys” (which currently amount to several billion dollars).

As a result, Idaho’s reserves are invested almost exclusively in low-yielding debt paper – such as corporate bonds, tax-anticipation notes, municipal bonds, repurchase agreements, CDs, treasuries, and money market funds. Some refer to these instruments as “return free risk.”

These debt holdings appear to have low volatility, but they carry other risks – not the least of which is pernicious inflation and the steady erosion in real value of principal, coupled with interest rates that are negative in real terms.

An allocation to gold and silver provides a hedge against inflation, debt default risks, stock market declines, and volatility – and it historically increases overall returns. Gold and silver do not have the default or loss of purchasing power risks that bonds or other debt instruments carry.

A few other forward-thinking states are themselves examining ways to implement a modest allocation of state funds to gold and silver.

The Texas Teacher Retirement Fund owns close to $1 billion in physical gold. Recently, the Ohio Police and Fire Pension Fund (currently valued at more than $15 billion) approved a 5% allocation to the yellow metal.

This year, South Carolina will consider the feasibility and efficacy of an in-state depository to securely store gold, silver, and other metals for the state’s reserves and other investments.

In 2019, Wyoming considered legislation to affirm the treasurer’s ability to invest the state’s reserve, trust, and pension funds in gold and silver. Wyoming is expected to consider this measure again in 2021.

The monetary metals can provide states with a meaningful way of hedging taxpayer funds against debt default risks, stock market declines and the federal policy of perpetual Federal Reserve Note devaluation. And a gold allocation has historically boosted overall investment returns while also reducing volatility.

An allocation to physical gold and silver fits squarely within the objective of protecting state funds against financial risks and would logically be included on any list of safe investment holdings.

Let’s hope that these efforts across America continue to gain momentum.

Both Money Metals Exchange and the Sound Money Defense League are devoting staff time and resources to propel these initiatives forward – and we encourage you to reach out to your own representatives to encourage them to support these and other sound money reforms.

Well, that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.

One of the states that’s still taxing real money is hoping to do something about it.

Introduced by Representative Henry Zuber III (R-Jackson), House Bill 375 removes sales and use tax on purchases of gold, silver, platinum, and palladium coins and bullion in Mississippi.

Under current law, Mississippi citizens are discouraged from insuring their savings against the devaluation of the dollar because they are penalized with taxation for doing so. Passage of this measure would remove disincentives to holding gold and silver for this purpose. HB 375 is important for a few reasons:

- Levying sales taxes on precious metals is inappropriate. Sales taxes are typically levied on final consumer goods. Computers, shirts, and shoes carry sales taxes because the consumer is “consuming” the good. Precious metals are inherently held for resale, not “consumption,” making the application of sales taxes on precious metals inappropriate.

- Studies have shown that taxing precious metals is an inefficient form of revenue collection. The results of one study involving Michigan show that any sales tax proceeds a state collects on precious metals are likely surpassed by the state revenue lost from conventions, businesses, and economic activity that are driven out of the state.

The harm is exacerbated when you consider that many of Mississippi’s neighbors (Alabama and Louisiana) have already stopped taxing gold and silver. Arkansas and Tennessee are considering their own sales tax exemptions for precious metals this year.

- Taxing gold and silver harms in-state businesses. It’s a competitive marketplace, so buyers will take their business to neighboring states, such as Alabama or Louisiana (which have eliminated or reduced sales tax on precious metals), thereby undermining Mississippi jobs. Levying sales tax on precious metals harms in-state businesses who will lose business to out-of-state precious metals dealers. Investors can easily avoid paying $136.50 in sales taxes, for example, on a $1,950 purchase of a one-ounce gold bar.

In total, 39 states have reduced or eliminated sales tax on the monetary metals.

- Taxing precious metals is unfair to certain savers and investors. Gold and silver are held as forms of savings and investment. Mississippi does not tax the purchase of stocks, bonds, ETFs, currencies, and other financial instruments.

- Taxing precious metals is harmful to citizens attempting to protect their assets. Purchasers of precious metals aren’t fat-cat investors. Most who buy precious metals do so in small increments as a way of saving money. Precious metals investors are purchasing precious metals as a way to preserve their wealth against the damages of inflation. Inflation harms the poorest among us, including pensioners, Mississippians on fixed incomes, wage earners, savers, and more.

This measure is one of many sound money bills being introduced across the country this year. Idaho plans to consider a measure to empower the state treasurer to hold physical gold and silver in state coffers. Bills to remove taxation on sound, constitutional money are also being, or have been, introduced in Alabama, Hawaii, Iowa, South Carolina, Tennessee, and more.

Backed by the Sound Money Defense League, these measures protect Mississippi citizens by removing barriers to insulating their wealth with the only money proven to protect against the Federal Reserve Note’s ongoing devaluation.

Image credit: M4pletree OuO

How to Survive a Silver-Gold Sucker Punch

Anyone who owns precious metals, mining shares or metals’ ETFs knows the drill.

First, gold and silver begin to establish an uptrend on the charts. Analysts (like us) start writing about how prices are getting ready to make an upside run.

Then “out of nowhere” thousands of highly margined futures contracts hit the market on the short side, “re-painting” the charts, sending terror into the hearts of stackers and those who believe in “honest money.”

The reality is that honest money is being manipulated for personal gain by dishonest traders, enabled by “regulators” who, to put it charitably, look the other way.

It can be disheartening. It can make you feel helpless.

And worse, it can knock you off what David Morgan, Doug Casey, and others believe is destined to become the biggest precious metals and mining stock bull run of our lifetimes.

But you can get back up again and persevere on the path to the Winners’ Table.

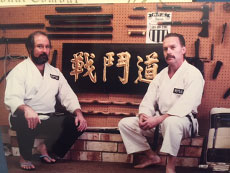

Years ago, when I was moving through the Dan ranks in martial arts’ study with my revered Sensei (who unexpectedly passed away last December, ending – at least on this plane – our 33 year relationship), I was given an assignment.

“Choose two or three self defense situations you’ve been in when you felt unable to respond, and design effective, multiple-response counter attacks,” he said.

The late Professor Bradley J. Steiner

with David H. Smith.

Remembering how in third grade I had been sucker punched by a supposed friend when I reached out to shake hands, and how terrible that felt, I went to work on a solution.

I trained full-out for five minutes, then stopped, breathed out fully – and held my breath to see what kind of offensive response(s) I could execute.

Surprisingly, even though my lungs were oxygen-deprived, I was able to perform several powerful empty hand and kicking techniques.

In the event, these would have provided an effective self-defense solution, even before breathing in to refill my lungs. (This capability also holds true for run, stop, draw-and-fire sidearm practice.)

Not long ago, when silver was dropping $2.50 an ounce, with gold down $75, a metals dealer had this to say:

“The Big money always moves way ahead of the crowd. And if you look at what sophisticated money on the planet is doing; they’re using price as a cover; manipulated price as a tool of misdirection, to accumulate.

Today, silver and gold are getting crushed like I’ve never seen (yet) our phones have been ringing off the hook for the past couple of days, as the price has dropped…and no one is selling anything… This is nothing more than a function of a paper price hit-and-run; a paper price drive-by shooting. As soon as the Commercials get to where they can cover, the price will turn around.

The whole concept of the art of war is misdirection.

They (the “Floor traders”) realize that people are so inundated with life that they don’t have time to look under the hood.

So how do you control price or sentiment? You beat the heck out of the price and espouse negative rhetoric across the gamut of big-business-controlled media…

This allows big money to accumulate gold and silver in copius amounts without being crowded out of their trade.

- Why did central banks reclassify gold as a Tier 1 (good as cash) asset?

- Why have central banks been massively accumulating? (Bloomberg reports, that in the last two years, central banks have acquired more than 1,300 tonnes of gold, which they’ve termed “the biggest gold-buying spree in half a century.”)

- Why are the most wealthy and influential people on the COMEX – the “Others” – pulling record amounts (physical gold and silver) off the COMEX?

In a daily column titled, “This is No Time to Give Up on Gold,” Rick Ackerman, of Rick’s Picks, commented about the metal’s swoon:

With gold’s gratuitous, 4% plunge on Friday, bullion has once again affirmed its reputation as one of the nastiest, most frustrating assets an investor can own. Its chief enemy is a global network of shamans, thimble-riggers and feather merchants who make their living borrowing bullion from the central banks for practically nothing, then lending it to everyone else for slightly more.

They are always looking for excuses to pound quotes so that they can replace what they’ve borrowed at a lower price. Helpful to this goal is a story that, however ridiculous, spooks gold bugs into dumping their holdings.

The massive selling of metals is an illusion. And yes, it’s been going on for quite a while.

During a 2010 CFTC hearing, CPM Group’s Jeff Christian testified that: “Precious metals trade in a multiple of a hundred times the amount of the underlying metal.” In other words, prices are manipulated and suppressed with bets placed on tons of imaginary or non-existent metals.

In his book “Rigged: Exposing the Largest Financial Fraud in History, Stuart Englert concludes that “More imaginary gold and silver is traded in a few days than is mined in an entire year.

Such large-scale trading is at the heart of the price suppression scheme. This supply illusion causes the paper metals’ price to be manipulated lower, even if demand is rising!”

So… how can YOU respond to these periodic “shakedowns”?

Ideally, as Master Miyagi in The Karate Kid movie would say, “Don’t be there.” You can sidestep a lot of the action by not trading on margin, buying your physical in tranches rather than all at once, and saving some capital to deploy during one of these take downs.

Of course, if you have a position, you’ll need to suffer through some short-term pain while prices get back to recognizing true supply/demand reality. But now that you know what’s going on, it should help you dial down the emotions – and certainly not give up!

One of the core principles that David Morgan at The Morgan Report teaches is that “The market is ultimately bigger than any attempts to subvert it.” Keeping this in mind can enable you to “stay long and strong” while the inevitable sorting out takes place, and metals prices bounce back quickly thereafter.