Month: January 2021

We’re pleased today to grant you access to the Winter 2021 issue of Money Metals Insider – a FREE benefit for you, our valued reader.

This special newsletter is packed with actionable information about the markets, plus details on some special offerings from Money Metals Exchange.

Things are heating up right now, so now is a good time to be paying especially close attention.

Don’t miss our 2021 forecast for the precious metals markets. We also issue a new warning about holding gold in the form of exchange-traded-fund (ETF) shares.

Plus, we report on an unfortunate incident involving another corrupt “rare coin” dealer, answer some common customer questions, and rank all 50 states on their friendliness to sound money.

Here are the highlights from your free Money Metals Insider newsletter:

- Dollar Debasement, Rising Demand to Drive Metals Markets in 2021

- Alarming Developments in GLD ETF Reaffirm Need to Own PHYSICAL Gold

- Q & A: Frequently Asked Questions

- Sound Money Index: “Is Your State Destroying Your Money?”

- Loan Program: Get Cash Without Selling Your Precious Metals!

- A Crooked TV-Based “Rare Coin” Dealer Strikes Again

So download the PDF of this fantastic free newsletter right now – and pass it around to your friends! It’s another free benefit for those who have signed up for the Money Metals email list.

Silver: A Powerful Advance Believed Imminent

Source: Clive Maund for Streetwise Reports 01/04/2021

Technical analyst Clive Maund charts silver and explains why he believes the metal is primed to move much higher.

The silver setup could scarcely look better. We have already seen in the parallel Gold Market update how gold is in position to slingshot vertically higher out of a giant Bowl pattern, having already made new highs last year. While silver’s chart does not look as strong as gold’s—yet—that is normal at this stage in the cycle.

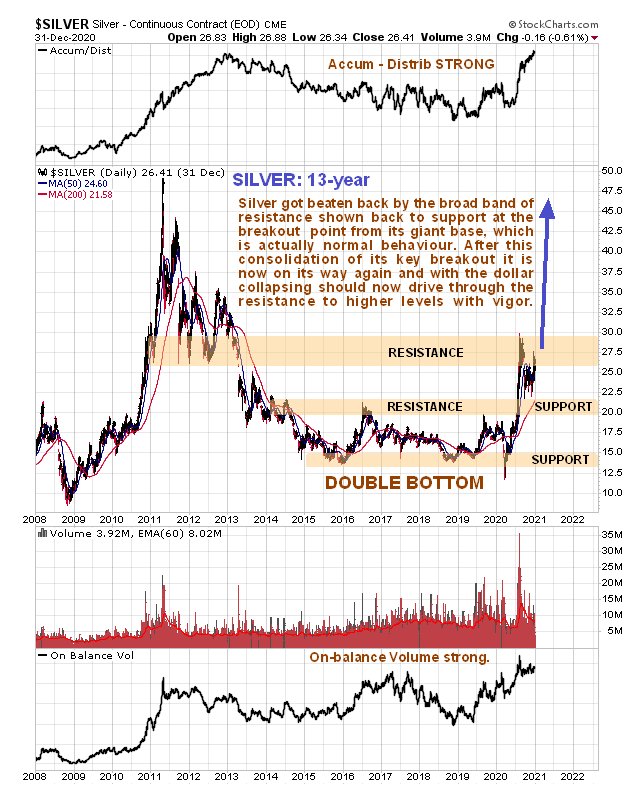

On silver’s latest 13-yeat chart we can see how, after breaking out of its giant base pattern in the middle of last year, it was beaten back by the resistance shown to then successfully test the breakout point, and has already started higher again and this time it should have little trouble driving through this resistance because the dollar is collapsing. Note how strong the volume indicators are on this chart, with the Accumulation line already making new highs.

The 1-year chart is most interesting as it shows us in detail all that has happened during what has turned out to be an eventful year for silver. Back last March silver suffered a false breakdown from the giant Double Bottom base pattern shown on the 13-year chart, which was triggered by the general market crash at that time. It then recovered and went on to make a decisive breakout from the base pattern in July which sparked a strong rally. This rally was capped by a quite strong zone of resistance whose origins are visible on the 13-year chart, leading to a normal reaction back to test what had become support at the upper boundary of the giant base pattern, after which it has started higher again with what is believed to be a major new uptrend now gaining traction. With the dollar believed to be heading for freefall for reasons discussed in the Gold Market update, silver looks set to have little trouble driving through the resistance shown and could soon ascend to challenge its 2011 highs surprisingly quickly.

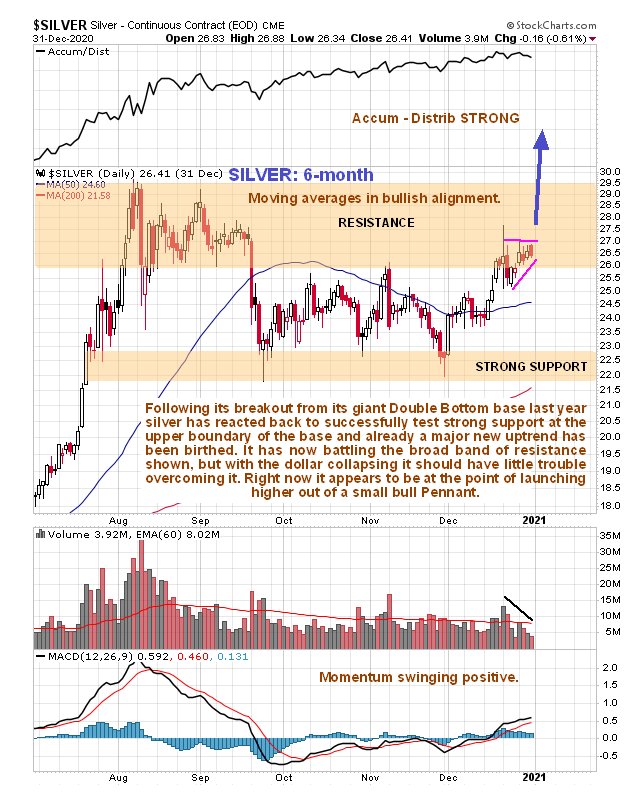

On the 6-month chart we can see recent action in more detail, and in particular how silver looks like it is on the point of breaking out of the small bull Pennant that has formed over the past week or two. Note the bullish volume pattern as this Pennant has formed, how momentum (MACD) is swinging positive and the strongly bullish alignment of price and moving averages.

The conclusion is that silver is headed much higher and soon, and so therefore are silver ETFs and most silver mining stocks.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Gold Is Still a Bargain

Source: Peter Krauth for Streetwise Reports 01/04/2021

Peter Krauth discusses the confluence of factors that points to the gold bull market having plenty of upside ahead.

In investing, as in life, perspective is everything.

To some, gold at $1,525 as we started out 2020 seemed expensive. Today, it’s trading at $1,940, producing a 27% gain.

And yet, from several viewpoints, gold still looks cheap at current prices. Debt, easy money and geopolitical risks are ever present. And these have all been tough on the U.S. dollar. Ongoing weakness in the greenback looks set to continue, providing a huge tailwind for gold prices.

So much, well beyond the kitchen sink, has been thrown at trying to support the economy and kick-start activity. Yet we can’t ignore vital indicators. Negative-yielding debt levels, ongoing negative real interest rates and anemic money velocity despite exploding money supply mean rising hard asset prices look inevitable.

I think 2021 will see these trends continue. As a result, I expect gold will not only regain its all-time high set in August, but establish a markedly higher new record level this year.

As a result, gold at $1,940 is likely to look like a bargain by the end of 2021.

Economic Activity Is Weak, For Now

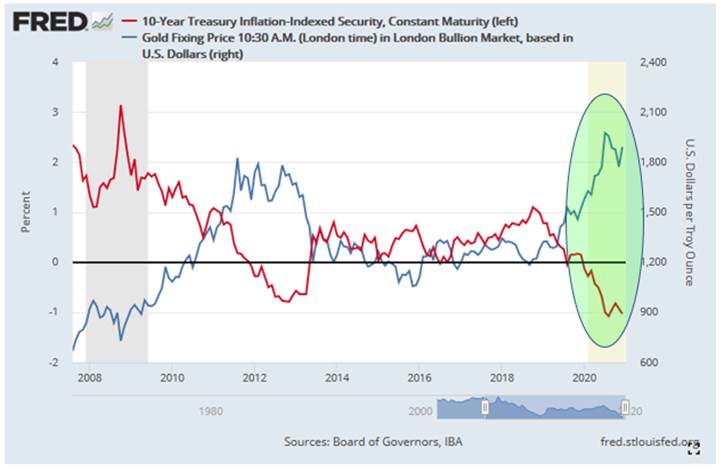

Some charts are important for investors to know and understand. But few, if any, surpass a comparison of real interest rates with the price of gold. One thing is certain, gold investors need to keep a close watch on it.

The visibly high negative correlation between these two assets is undeniable.

As a result, investors need to ask themselves what direction they think real rates will follow from here. I’d simply like to point out that, since late 2019 when real rates crossed into negative territory then headed sharply lower, kicked off a big rally in gold.

If someone argues that gold doesn’t pay a dividend, you can tell them neither do many “safe” bonds, which now lose money instead.

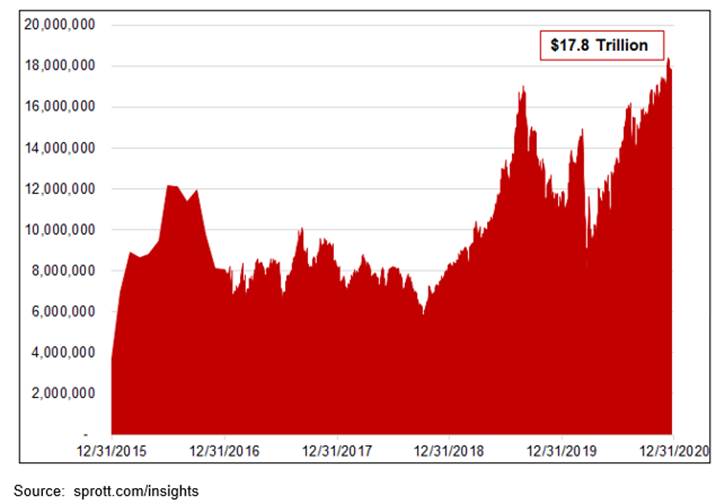

Global negative yielding debt is close to an all-time record of its own, nearing $18 trillion as we begin 2021. How long are pension funds and other institutional investors likely to keep pushing such bonds higher when they guarantee the holder a negative return, even before accounting for inflation?

If ever there was a clear bubble, this could well be it.

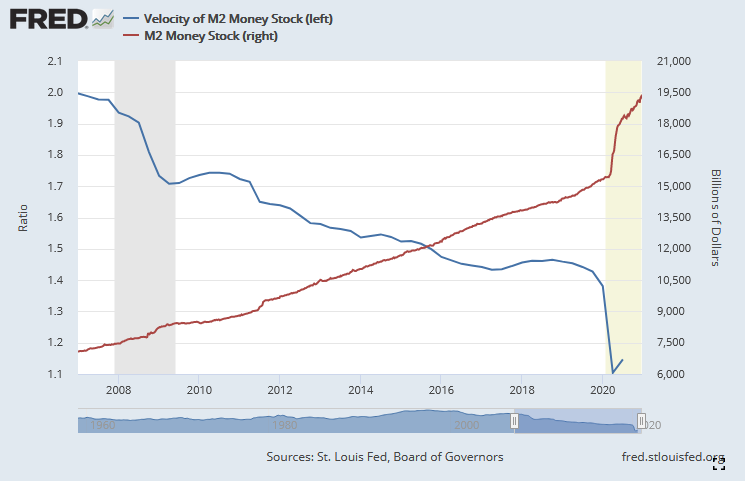

And finally, a look at M2 Money Supply versus the Velocity of that money is also very revealing.

It took a huge expansion in M2 just to get velocity to tick higher. By all accounts, the Fed needs the velocity to pick up, and has limited means to achieve that. But with Modern Monetary Theory (MMT) rapidly gaining acceptance, weak velocity could reverse in a marked way as the government itself fires up spending.

With all this in mind, it’s not a shocker to see gold performing well, and likely to continue doing so.

Gold’s Heading in the Right Direction

After multiple years of consolidation, gold surpassed its 2011 nominal high, and is closing in on its all-time high established in August.

Now gold appears to be breaking out from its downward trend channel, which started back in August.

We can see not only that the RSI and Momentum indicators confirm a bottom in late November, but also that the gold price has been mostly above its 50-day moving average since mid-December.

And looking at the gold stocks to gold ratio, some progress is appearing there as well.

The ratio has been establishing higher low and lower highs, with support from the momentum indicators since late November. I expect a breakout soon to the upside, which will likely confirm both higher gold stocks and probably also higher gold prices.

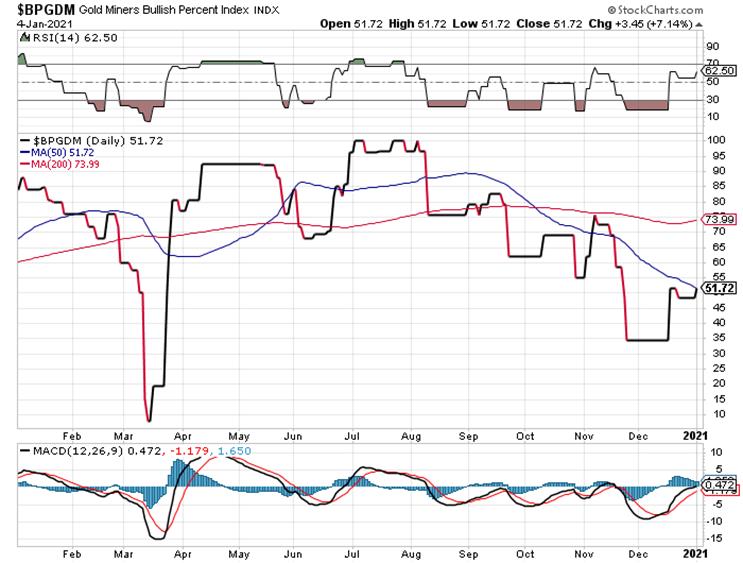

Additionally, we have the Gold Miners Bullish Percent Index, which also turned higher in mid-December, suggesting a new upleg for gold stocks since reversing from a low of 35.

Americans are unemployed at the highest rate since the Great Depression. The Fed is hell bent on destroying the dollar (it has no other choice). And with interest rates at zero, investors are effectively being forced to take on risk or lose purchasing power.

This confluence of factors continues to shine brightly on hard assets in general, and gold and gold stocks in particular. Gold’s bull market has plenty of upside ahead. A few month’s correction like we’ve just experienced should not dissuade you. Instead, that needs to be used to reassess and buy the dip, if need be.

Being well informed provides perspective. And perspective helps make better decisions.

Gold’s clearly done correcting and is still cheap. I think we’ll see $2,300 gold in 2021. Enjoy this next rally.

–Peter Krauth

Peter Krauth is editor of Silver Stock Investor https://silverstockinvestor.com, a silver-focused investment newsletter. He is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals, and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg, Financial Post, Seeking Alpha, Talk Markets and Investing.com. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Gold Set to Soar as Hyperinflation Looms

Source: Clive Maund for Streetwise Reports 01/04/2021

Technical analyst Clive Maund discusses the dollar’s fall and what it means for gold.

We now have a very rare setup for gold which is in position to “go ballistic” as the dollar collapses. The dollar is being intentionally destroyed by the Fed, which is creating dollars in vast unprecedented quantities in order to buy up distressed assets on the cheap and in order to pave the way for the new “digital dollar.” We are in the last stages of the fiat endgame where money creation goes vertical, quickly leading to it becoming worthless, as happened in Venezuela and Zimbabwe, and of course hyperinflation is a great way to pay off debt, because you can do so with worthless currency.

One worry that has been vexing would be investors in the precious metals sector in recent weeks is that gold and silver won’t rise much because big banks like JP Morgan will cap it by dumping onto the paper market. The key point to keep in mind is that gold is “real money” and this being so the idea that a currency like the dollar can collapse towards zero and gold won’t go up because the banks will be selling it on the paper market is both absurd and ridiculous – what would happen is that an untenable massive gap would develop between the price on the paper market and the price on the physical market, and the paper market would become rapidly irrelevant and obsolete, so we don’t have to worry about that. In fact, to the extent that they are actually suppressing the gold price, all they are doing is creating a “pressure cooker” effect that will lead to a massive upside explosion, but you certainly don’t want to wait for that to happen before you take positions across the sector.

Now let’s proceed to look at gold’s latest charts and various other related charts.

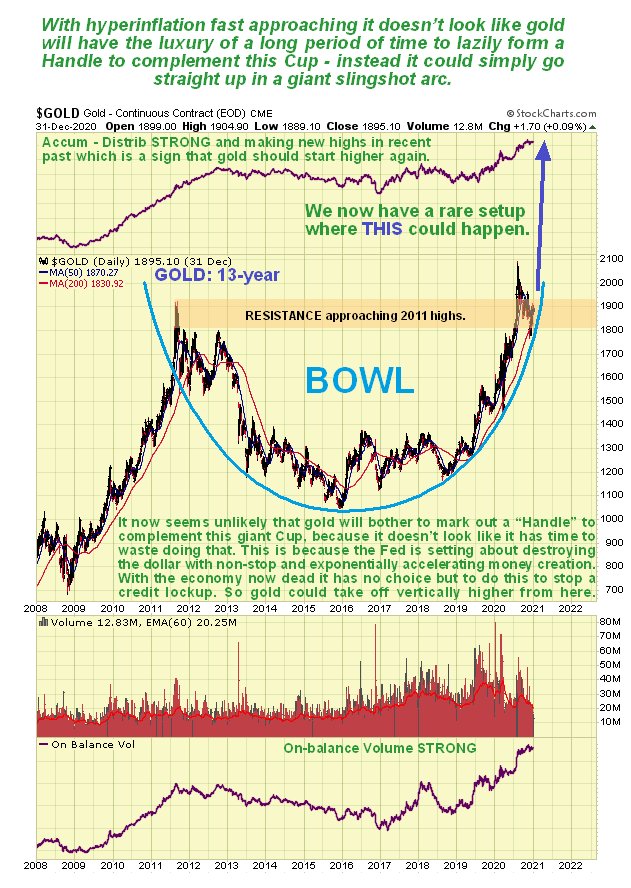

Starting with the 13-year chart, we see that gold is in the process of breaking out of a gigantic Bowl pattern. This is a very unusual setup that could slingshot it vertically higher soon. Gold has already punched through its 2011 highs last year, but has since reacted back below them which is thought to be a normal reaction prior to renewed advance. A big concern with a pattern like this is that it could stall out for a long time marking out a Handle to complement the Cup before continuing higher, but this doesn’t look likely on this occasion because the dollar looks like it is on the verge of collapse with the Fed set to continue attacking it relentlessly.

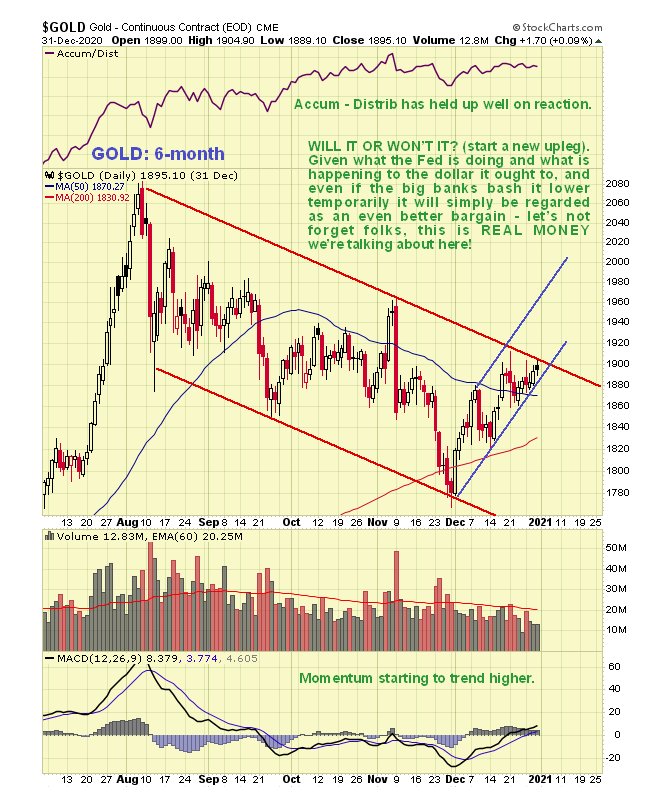

On the 6-month chart we can see gold’s corrective downtrend from its highs of last August in detail. Right now it is at the upper boundary of this downtrend and so it could react back again. However, various factors suggest that it will soon get on with it and break out of this downtrend, which should lead to a vigorous ascent. If it should react back somewhat short-term it will simply be viewed as another buying opportunity.

On the 1-year chart for GDX we can see that stocks are in a rather similar situation to gold itself, with the downtrend from the August high still in force, but various bullish factors coming into play that make an upside breakout likely soon, in particular the now tight bunching of the price and its moving averages and the fact that GDX is now in a zone of strong support.

The Gold Miners Bullish Percent index shows that sentiment is now much better having dropped from 100% bullish when the correction started to its current level with less than 50% of investors bullish, so there is certainly room for a significant uptrend to get started.

The dollar’s charts look frightful, which is hardly surprising considering what the Fed is doing to it, with the Fed’s balance sheet having doubled in less than a year and looking set to continue to expand at an ever greater rate. On the 10-year chart for the dollar index we can see that as recently as November it broke down from a giant Diamond Top and it looks like once it breaches the last ditch support in the 88 – 90 zone, it could go into freefall. If this happens it can be expected to “light a fire” under the precious metals sector.

The 6-month chart for the dollar shows an entirely bearish picture with the current severe downtrend that started early in November remaining in force.

Originally published on CliveMaund.com on January 3, 2021.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Source: Erik Wetterling aka “The Hedgeless Horseman” for Streetwise Reports 01/04/2021

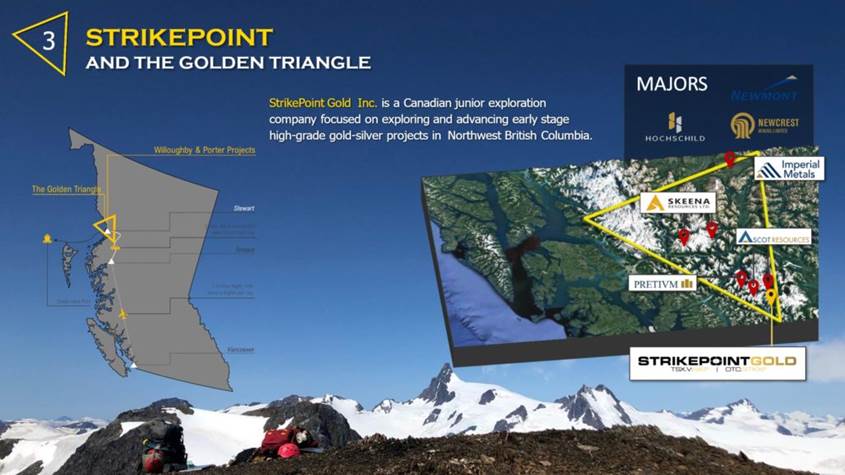

Erik Wetterling, aka “The Hedgeless Horseman,” provides his investment thesis for StrikePoint Gold.

In this article I will explain why I own StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) and why I was happy to have the company on as a passive banner sponsor.

My Case For StrikePoint Gold in Short:

- Two semi-advanced gold and silver projects in the famous Golden Triangle

- Confirmed high-grade gold and silver in both projects

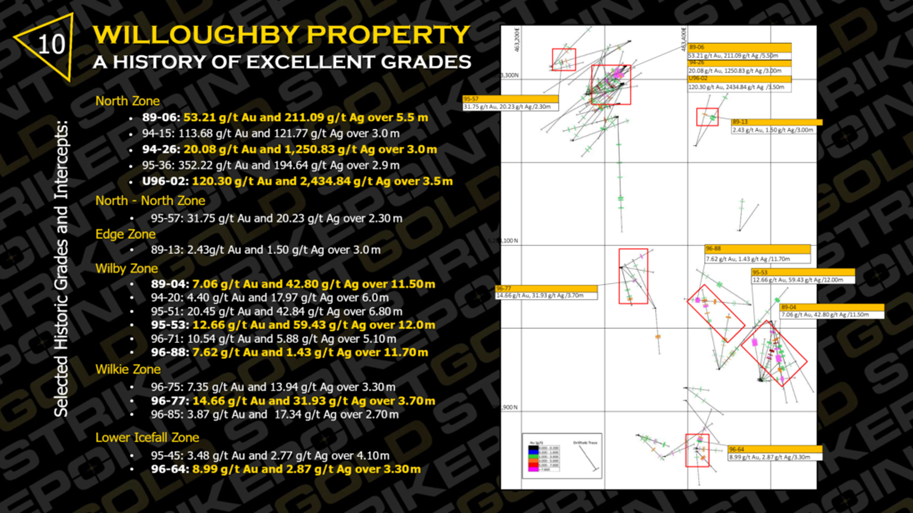

- Willoughby Project historical drilling highlights:

- North Zone: 53.21 g/t Au and 211.08 g/t Ag over 5.5 m

- North Zone: 20.08 g/t Au and 1,250.83 g/t Ag over 3.0 m

- North Zone: 120.30 g/t Au and 2,434.84 g/t Ag over 3.5 m

- Wilby Zone: 12.66 g/t Au and 59.34 g/t Ag over 12.0 m

- Wilby Zone: 7.62 g/t Au and 1.43 g/t Ag over 11.70 m

- Wilkie Zone: 14.66 g/t Au and 31.93 g/t Ag over 3.7 m

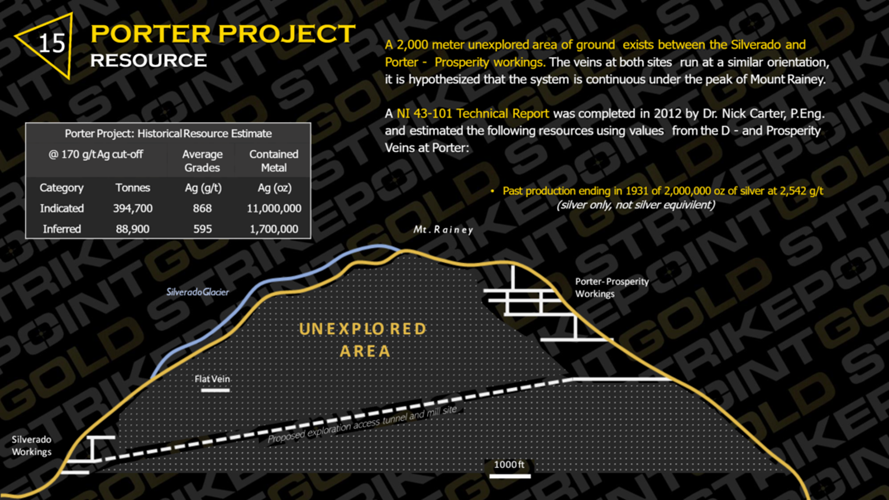

- Porter Project has a resource of 12.7 Moz of silver at very high grades (595-868 g/t Ag)

- Backed by Ascot Resources and Skeena Resources (potential future buyers)

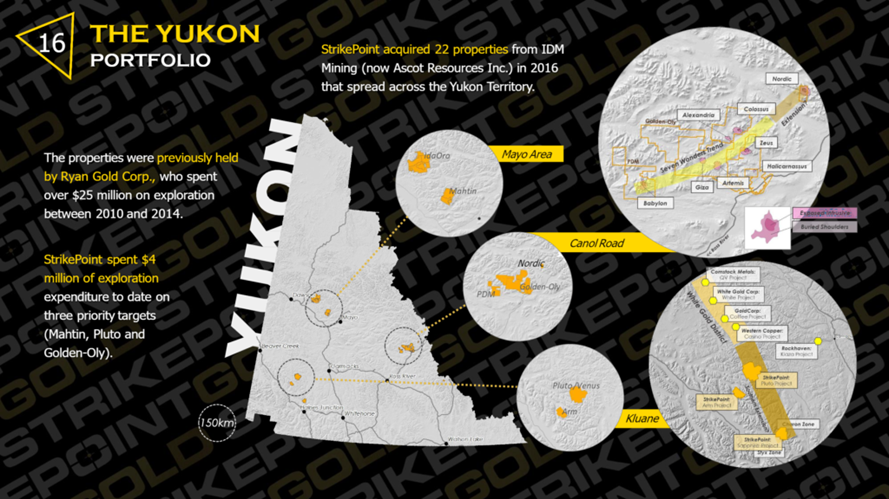

- Owns 22 properties across the Yukon territory to boot

Bottom Line:

For around C$35 M (@ 0$0.19/share) you get around C$5 M in cash, two semi-advanced flagship projects with confirmed high-grade gold and silver endowment, and the Porter Project already has a silver resource with bonanza-grades. This means that there is meat on the bones already and Strikepoint will have beta to gold and silver. I think this is important because I hate the thought of ending up with no gold or silver in a precious metal bull market. The fact that both are located in one of the hottest and best tier #1 jurisdictions is icing on the cake. With that said it is of course exploration which is the main attraction with the company. That there is exploration potential at Porter is obvious given that each side of the mountain has seen historical mining and if the company is able to connect the high-grade hits at Willoughby then that project could get really exciting. Lastly, the company has a huge portfolio of early stage projects in Yukon which could be sold, JV’d or worked on in a hopefully red hot precious metal market.

I see StrikePoint has having some margin of safety due to already having confirmed silver resources and confirmed high-grade mineralization at both of the company’s flagship projects. If further success is made at one or both projects then there is obviously some serious upside potential from this valuation level. Having two larger companies invested in Strikepoint is a good kicker because a) Votes of confidence and b) Natural acquirers in case StrikePoint hits it big.

With a very impressive pipeline of projects it means that StrikePoint will have their hands full and not be forced to go out and acquire new projects in a potentially very hot market when valuations might be “stretched.” In this regard I salute Shawn Khunkhun for having been very pragmatic (acquired projects on the cheap during downturns) and forward looking (loading the company with projects BEFORE the mania phase of the bull market).

Meat and Potatoes

1. World Class Jurisdiction:

StrikePoint’s two flagship projects are located in the famous Golden Triangle district of British Columbia, Canada. This is an area that has seen a lot of mining and there are multiple mines up and running as we speak. Personally I have am relatively picky when it comes to jurisdictions nowadays so I really do prefer to invest in tier #1 jurisdictions due to a) I want to be able to keep whatever the company finds and b) I want larger companies to be comfortable acquiring (taking risk) and jurisdictional risk is obviously a big factor for a long term investment.

… As you can see in the slide above there are many players involved in this area and that includes Newmont, Hochschild and Newcrest. This signals that majors are indeed interested in mining operations in this area, which is very good. It is also worth pointing out that Ascot Resources and Skeena Resources, who both own a stake in StrikePoint, have projects nearby. This means that there should be potential for synergies if StrikePoint finds something material, which obviously would hike up the implied value in terms of a takeover.

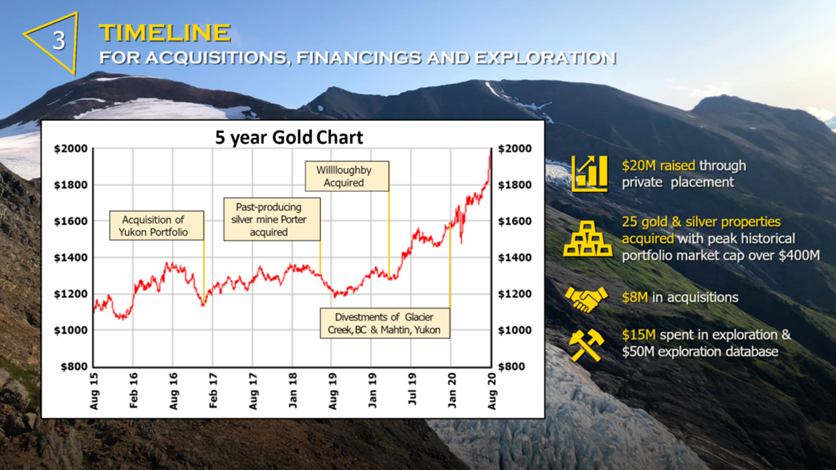

2. The Art of Value Creation

The next slide is a testament to how business savvy Shawn Khunkhun and Strikepoint have been:

… The company has been picking up projects for pennies on the dollar during short term downturns in the metal space. This is a sign of people who are well aware that their job is to create as much value as possible to shareholders. The acquisitions would have costed a lot more if they were done today. Forward looking, strategic thinking are traits one wants to see in the stewards of one’s capital.

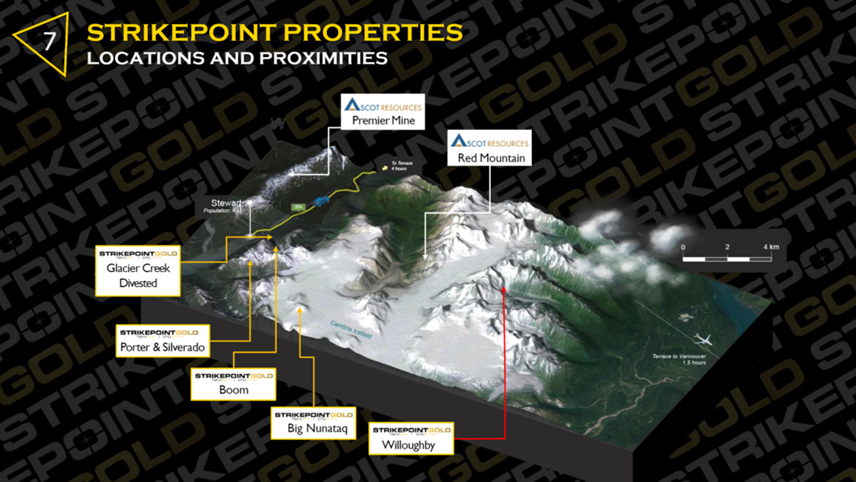

3. The Flagship Projects

Both of StrikePoint’s flagship projects are close to one another as well as close to Ascot Resources’s Premier Mine and Red Mountain Project:

… As stated earlier this beneficial both from a strategic and tactical stand point since it increases the implied value of the projects through the potential of becoming satellite deposits as well as the likelihood of being bought in the future. Furthermore it helps from a tactical stand point to have more people working in the area.

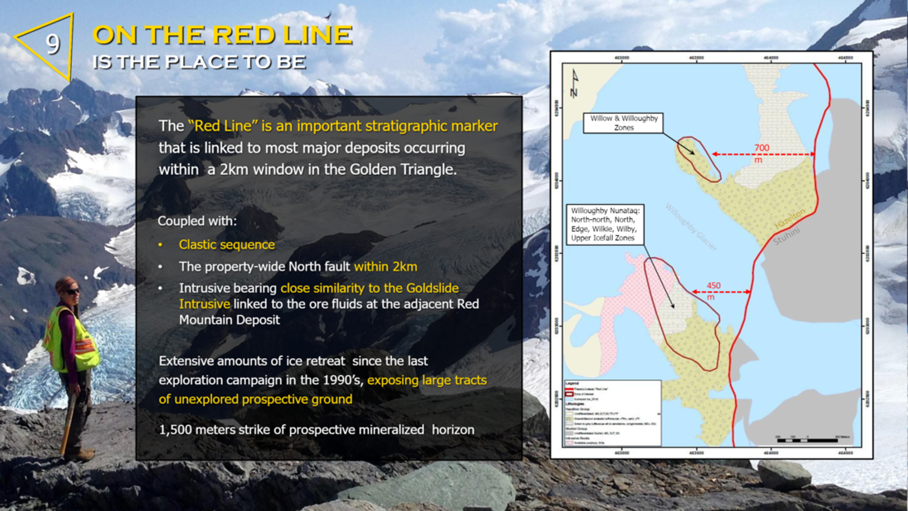

3.1 Willoughby

Willoughby seems to be located in the “right place” in that the current targets are proximal to an important stratigraphic marker that is “linked to most major deposits” as per:

As you will see in the slide below there have been some really great historical intercepts which hit high-grade gold and silver across multiple zones and the million dollar question is if some of these zones will end up being connected:

This following is from the September news release titled “STRIKEPOINT GOLD UPDATES 2020 EXPLORATION PROGRAM FOR NORTHWEST BC GOLD AND SILVER PROPERTIES”:

Willoughby Gold-Silver Property

The main objectives of the 2020 exploration program at the Willoughby gold-silver property has been to improve continuity of high-grade and to test broad zones of disseminated gold and silver mineralization encountered in previous drilling and surface sampling. Surface exploration commenced on July 29, 2020 and drilling began on August 10, 2020. The Property is located on the east side of the Cambria Icefield, seven kilometers east the advanced-stage Red Mountain Gold Deposit owned by Ascot Resources.

The Property is underlain by Upper Triassic Stuhini rocks and Lower Jurassic Hazelton volcanic and sedimentary rocks that have been intruded by an early Jurassic-aged hornblende-feldspar porphyry, similar to and potentially comagmatic with the Goldslide Intrusive suite at Red Mountain. Intrusive-related mineralized zones consist of strong pyrite mineralization with lesser pyrrhotite, sphalerite, galena, chalcopyrite, and native gold. Eight gold and silver mineralized zones have been identified to-date over the mineralized trend which extends onto Decade/Teuton Resources’ Del Norte Property.

Extensive surface sampling has been completed, targeting high-grade newly exposed mineralization with 262 surface samples collected, with all assays currently pending. In addition, over 1,700 meters of drilling in seven holes have been completed so-far in 2020, with all holes submitted for assay.

3.2 Porter Project

The second flagship project is the one called the “Porter Project,” which contains two past producing high-grade silver mines and a historical resource:

Similar to Willoughby the million dollar question here is if the veins that have been mined on opposite sides of Mt. Rainey will prove to be connected. The following snipped is from the previously mentioned news release:

Porter Silver Property

At the high-grade Porter Silver Property, the focus of the 2020 exploration season will be linking the two-past-producing high-grade silver mines on the property: the Silverado (northwest) and Prosperity/Porter Idaho (southeast) mines that outcrop 2,000 meters apart on the opposite sides of Mount Rainey, overlooking the town of Stewart, BC. Upcoming work will include exploration for new veins that have been identified outside of the historical resources and past producing areas. The Silverado glacier has retreated significantly over recent years, with prospecting planned in newly exposed areas. In steeper locations of the Property, experienced mountaineering crews and climbing geologists will be employed to sample new exposures. A drill program based out of Stewart has been planned to target high-grade silver veins previously reported through historical stoping, drilling, surface sampling as well as recent exploration programs by StrikePoint.

3.3 The Yukon Portfolio

StrikePoint also have a few other aces up their sleeve in the form of a very large portfolio of projects located in the Yukon Territory, Canada:

… I think none of these are reflected in the current valuation of the company and I think they might end up providing positive surprises when the market gets hot again. In other words I think there will be appetite for these projects when the bull market wakes up for real again and that Strikepoint might be able to sell, JV and/or to work on them when the time is right. I mean picture a scenario where gold, silver and miners are finally on fire. When this happens Strikepoint will be sitting on a Yukon portfolio that is big enough for multiple companies to split between them.

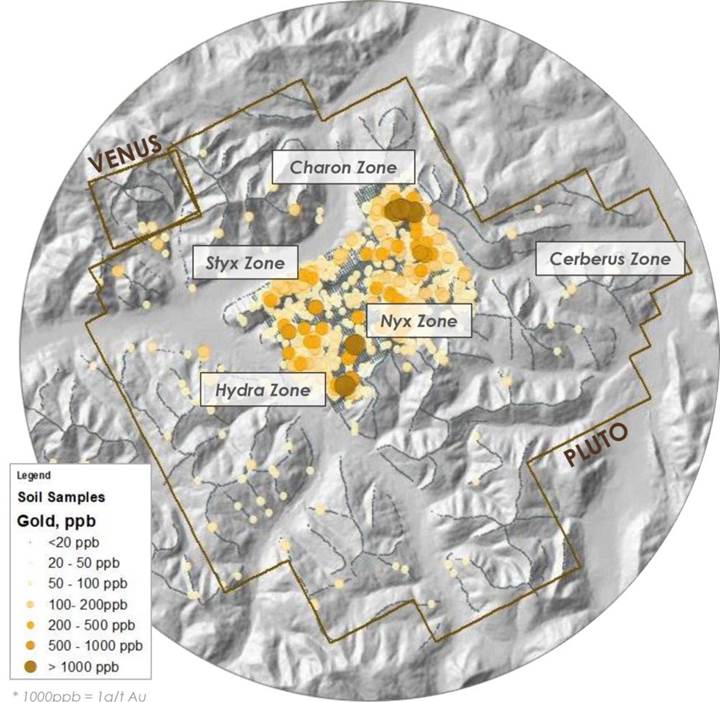

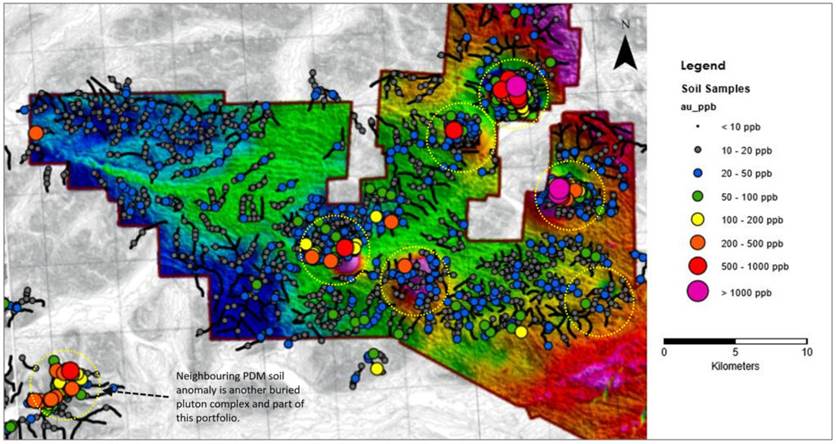

Take the massive Pluto Project for example (23 km at its widest point). This one has multiple areas with very high gold in soul numbers:

… Or how about the Golden Oly Project (note the scale):

… Again, I think nothing of the Yukon portfolio is reflected in the current valuation and that Shawn and the team will reward shareholders through value creation when the time is right. Nothing beats having a bunch of very large projects (with obvious golden smoke) in a tier #1 jurisdiction in a raging gold bull. Just because the market forgets about this side of the intrinsic value of StrikePoint doesn’t mean that you must do it as well. With that said, this value will probably take time before it is unlocked but in light of the company’s Enterprise Value which is around US$23 M, I reckon it could be very meaningful for current holders with a long term view.

Bottom Line

In StrikePoint Gold you get a focused team that have shown to be very smart in terms of creating value for shareholders and I know Shawn and his team will do everything within their power to make all shareholders happy. If I had to choose a few aspects of StrikePoint to press on it would be a) Both flagship projects are already confirmed to host high-grade gold and silver which decreases risk, b) StrikePoint has beta via its historical silver resource, c) The exploration potential at both flagship projects is obvious in terms of connecting already confirmed zones of mineralization, d) Hidden value in the Yukon portfolio which will probably be unlocked one day, and e) Both flagship projects are proximal to other development assets held by larger companies in a tier #1 jurisdiction.

Additional things to consider:

- Backed by Ascot Resources, Skeena Resources and Eric Sprott

- Proximity to the larger companies above

- Satellite deposit potential in a tier 1 district

- Decreasing the threshold in terms of reaching critical mass

- Increases the likelihood of being monetized

- Crescat Capital (Quinton Hennigh) has given StrikePoint thumbs up which goes a long way in my book

Lastly I would say that even though I don’t necessarily see tier #1 exploration potential in StrikePoint this belief is offset by the combination of the projects being de-risked (not grassroot exploration stage), close to larger projects and being in one of the best jurisdictions around. In other words I think “even” satellite deposits in this neighborhood could end up being worth quite a bit in a gold and silver bull. Especially if Tom Kaplan is correct in terms of his theory that companies operating in tier #1 jurisdictions might end up becoming a bubble within a bubble in the future. It’s also very nice to know that the company already has high-grade silver on the books which means there is no chance of the company ending up in a silver bull without any silver at least. Furthermore I got the sense from talking to Shawn that he wants StrikePoint to be very aggressive with the drill bit in 2021.

As always there are no guarantees of success but only good or bad risk/reward. Personally I think the risk/reward in StrikePoint is very good mostly thanks to the company’s (Shawn’s) ability to pick up a bunch of projects on the cheap in preparation for the most exciting stage of the bull market. Therefore I own shares of the company. I have no idea what the coming results will be from Willoughby but I don’t base my case on any single (smallish) drill campaign and not much in terms of success is priced in right now anyway.

Lastly, make up your own mind as always and don’t put all your eggs in one basket (spread your bets).

Upcoming Catalysts

- Drill results

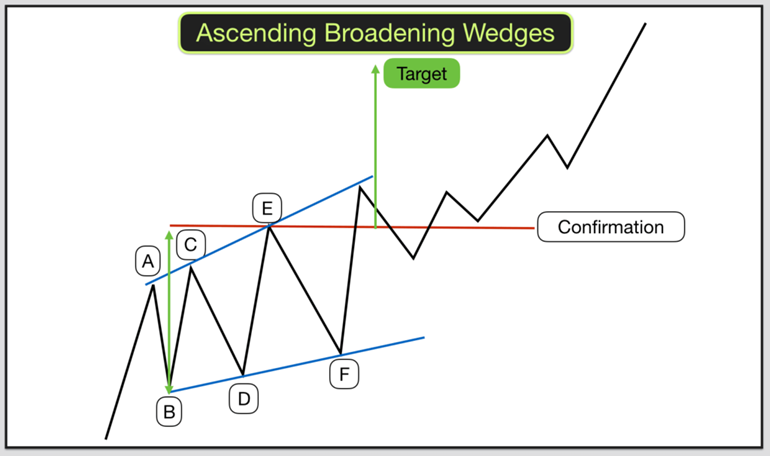

Some TA

Food for thought…

Best regards,

Erik Wetterling, aka “The Hedgeless Horseman”

www.thehedgelesshorseman.com

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I cannot guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of StrikePoint Gold in the open market and I participated in the latest private placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Erik Wetterling and “The Hedgeless Horseman” disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: StrikePoint Gold. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold, a company mentioned in this article.

Images provided by the author.

With the coronavirus pandemic serving as a backdrop, 2020 was a record-breaking year in many ways. And some of the economic records that fell were, shall we say, less than ideal. In fact, the impacts of these records will almost certainly ripple through the economy as we move into 2021. Here are three records that […]

The post Blog first appeared on SchiffGold.

The first trading day of 2021 was, as Peter Schiff put it, “atypical.” In his first podcast of 2021, Peter analyzed the unusual day on Wall Street and explored a significant question: are we beginning to see the decoupling in the global financial markets that he’s been predicting for years? The major indexes opened up […]

The post Blog first appeared on SchiffGold.