Month: February 2021

Source: Peter Epstein for Streetwise Reports 02/23/2021

Peter Epstein of Epstein Research takes a look at Sassy Resources’ foray into Newfoundland in addition to its British Columbia project in the Eskay Camp.

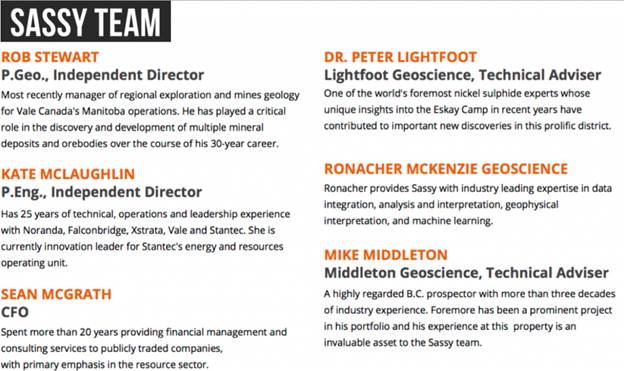

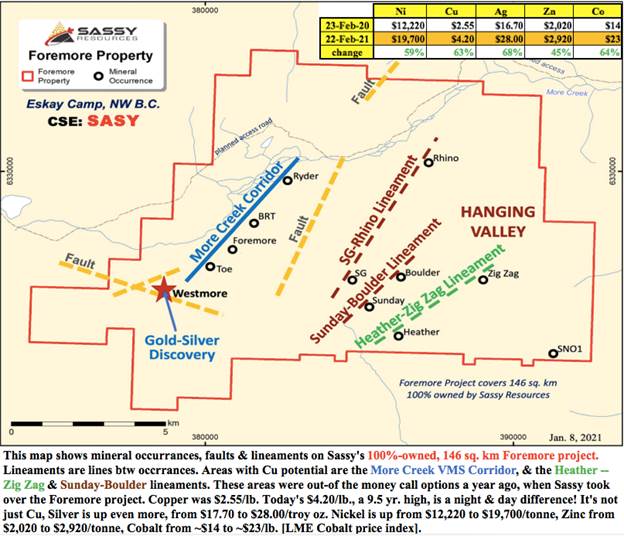

For several months, investors in Sassy Resources Corp. (SASY:CSE; SSRYF:OTCQB) have been waiting for all the drill results from the sizable, 100%-owned, flagship Foremore project in the Eskay Camp, at the heart of the Golden Triangle, in northwestern British Columbia. Eleven of 17 holes have been reported, along with highlights of more than 1,000 samples.

Nicobat to be spun-out for shares in exciting new battery metals play

As we were waiting, shareholders were advised to watch for news on non-core asset Nicobat and for possible acquisitions outside the Golden Triangle. Well, that news arrived last week. Sassy is close to monetizing Nicobat by optioning it (for shares and a multi-year work commitment) to a private Canadian battery metals junior.

That company plans to list on the CSE in coming months. Management remains optimistic about the prospects for battery metals, and Sassy would hold a meaningful position in this prospective play. Sassy’s team has executed very well in its short history as a public company.

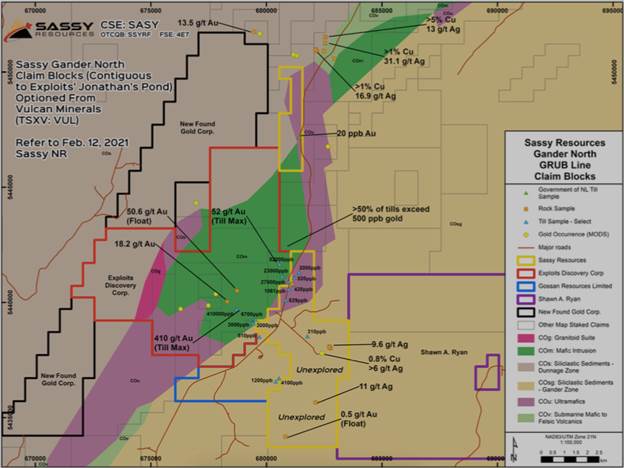

While the Nicobat news is very good, the more exciting development is that Sassy has formed a wholly owned subsidiary, Gander Gold Corp. (GGC) to pursue opportunities in the province of Newfoundland and Labrador (NF). CEO Mark Scott has started in NF by optioning eight promising claim blocks from Vulcan Minerals.

NF is one of the most exciting exploration districts in Canada. It’s the focus of a mini gold rush. Much of the action is in the Central Newfoundland Gold Belt, a large region stretching across the island, ~250 km in length. For centuries NF was mined for base metals, but it was not until much more recently that gold became a primary target.

Sassy enters mini gold rush in Newfoundland, still at early stage

In the 1980s Noranda did a lot of drilling all over NF, but in many cases (reportedly) did not bother assaying for gold! As New Found Gold’s (NFG) corporate presentation explains, “the Fosterville epizonal high-grade model was not understood at that time.”

GGC will enable Sassy to pursue options to generate shareholder value through meaningful project diversification outside of the Eskay Camp, with minimal shareholder dilution. NF offers under-explored opportunities, high-grade gold/silver plus base metal potential, relatively low-cost drilling and the ability to explore year-round.

Management plans to mobilize to execute reconnaissance/orientation diamond drilling on drill-ready targets at Gander East this Spring. Gander East adjoins Jonathan’s Pond, where some of the highest grade till anomalies ever discovered in NF (up to 410 g/t Au!) were found. That mineralization trends onto parts of Sassy’s optioned property. Sassy now controls the closest claim block to NFG’s new Eastern Pond discovery.

Exploration programs this year will cover the rest of that property, plus the other seven blocks—plus any new properties added to the portfolio in coming months—with airborne geophysical surveys and pattern soil/till sampling and prospecting over the 2021 field season.

Although not mentioned in the press release, it seems reasonable to wonder if one day GGC might be spun out into its own publicly traded vehicle. Perhaps not anytime soon, and not without some exploration successes, but something to think about.

Mark Scott, President and CEO, commented:

“We’ve taken some creative, forward-looking steps aimed at year-long value creation with Sassy establishing a major foothold in the prolific Eskay and Newfoundland mineral districts during transformational periods for each region. The Gander Gold subsidiary gives us various attractive options to leverage success for our shareholders.”

Sassy entered into an option agreement with Vulcan Minerals to acquire a 100% interest in eight claim blocks, (624 claims, 156 sq. km) including the drill-ready Gander North, a compelling target intersected by a major regional fault zone (the GRUB Line) ~15 km northeast of NFG’s tremendous new discovery—the Keats zone of its Queensway project.

NF stars Marathon Gold and New Found Gold leading the way….

In late 2019, NFG hit 93 g/t Au over 19 meters and has had many other high and very-high-grade intercepts since then. Eight rigs are now turning as part of a 200,000 meter grid drill program. NFG’s Keats zone is one of the most significant discoveries in Canada of the past 20 years. (NFG market cap = $500 million, pre-maiden resource). 200,000 meters will focus a lot of attention on NF!

NFG’s Queensway project ranks among the top five pre-maiden resource projects in Canada, along with projects owned by Great Bear Resources in the high-grade Red Lake mining district in Ontario (GBR market cap = $800 million) and Eskay Mining’s (ESK) 50,000+ hectares near the center of the Golden Triangle in B.C. (ESK market cap = $375 million).

Since NFG’s discovery, a better understanding of the Gander Gold Belt’s blue-sky potential is emerging, making Sassy’s untested Gander North and its other claim blocks highly prospective. Near Gander North’s western and northern boundaries, there are some extremely high gold-in-till anomalies.

Over a 4-year period, Sassy will pay $400,000 in cash to Vulcan, incur $2 million in exploration expenditures and issue 2.5 million shares. Vulcan will retain a 3.0% NSR on the entire 624 claims, of which Sassy can repurchase 1.5% for $2 million plus 500,000 shares.

Marathon Gold has an enterprise value (EV) {market cap + debt – cash} of ~C$560 million. Its single project, at PFS-stage, is in central NF. The Valentine project is expected to reach production within three years. At US$1,550/oz. gold, the after-tax NPV(5%) of the 12-year mine = C$671 million/[48.8% internal rate of return].

The AISC = US$739/oz (bottom quartile). An NPV of C$671M million is 2.5x the project’s upfront cap-ex of C$272 million, making it one of the best in North America, which is why Marathon enjoys a premium valuation; EV/NAV = 0.83x.

Sassys Gander Gold subsidiary alone could be worth $20 million+

There are no majors or mid-tier gold producers in Newfoundland. However, I would not be surprised to see Marathon and New Found Gold acquired. After that, there are roughly three dozen juniors with gold prospects in NF, ~12 of which have market caps between $20-40 million, one ~$55 million.

If management can deliver good drill results, I think it’s reasonable to think that Sassy’s NF properties and exploration activities, (the assets held in GGC), could support a $20 million+ valuation. Given Sassy’s tight capital structure, a $20 million valuation for GGC alone would be worth ~$0.50 per Sassy share. Sassy’s shares are currently at $0.54.

And, if Sassy can conduct multiple drill programs that hit attractive grades, with multi-meter interval widths, then a valuation north of $25-30 million would be possible. Having said that, it might be necessary for Sassy to spin out GGC for its value to be more fully recognized by the market.

There’s more news to come from Sassy in NF. Management continues to review possible farm-ins and acquisitions of exciting properties/projects under attractive deal terms. And exploration/prospecting will be starting this spring, with the goal of identifying drill targets for 2H 2021.

The copper price soaring is great news for Sassy Resources!

Finally, with the #copper price soaring, late last week breaching $4.00/lb for the first time in nine years, readers are reminded that Sassy’s flagship Foremore project has considerable copper showings that warrant further exploration. Copper is now at $4.15/lb, a 9.5 year high. I asked CEO Scott about Sassy’s Cu prospects, he provided the following quote,

“There’s significant copper potential at the Foremore project, including along the >5 km More Creek VMS Corridor, and on several potentially multi-km long lineaments in the Hanging Valley. In 2019, the Heather showing produced a grab sample containing 21.4% Cu. The province of Newfoundland and Labrador has a long history of Cu and Zn exploration and production.

We will certainly be sampling for these metals as we explore our new holdings there. Most of the properties we have optioned have some form of anomalous Cu soil / till / lake-sediment / stream-sediment / outcrop samples, together with known gold / pathfinder occurrences and favorable structural environments.“

Conclusion

An investment in Sassy Resources (TSX-V: SASY) / (OTCQB: SSRYF) gives investors exposure to two potentially world-class, gold-silver projects. Both have copper kickers. Both are in safe, prolific jurisdictions. Both have high-grade potential. Both are sizable footprints (Foremore = 14,600 sq. km / Gander Gold Corp. 15,600 sq. km to start, expected to grow).

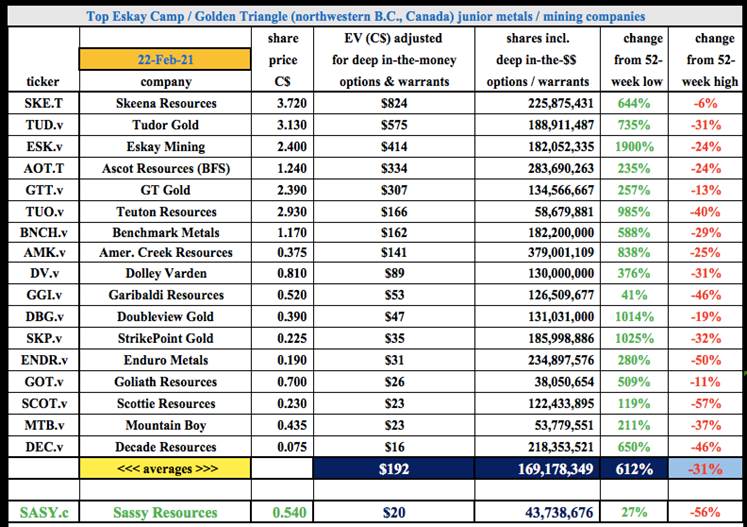

Management, led by CEO Mark Scott, is top tier, especially for a company with an EV of just C$20 million. The pullback in the gold price from >$2,060 oz. in early August 2020 to about $1,810/oz. today has caused many top-quality gold juniors to trade 40%–60% lower from their 52-week highs.

At $0.54/share, Sassy is down 56%. Freegold Ventures and Fury Gold Mines are each down 63%, producers OceanaGold Corp. and Victoria Gold are down 53% and 44%. So, Sassy is not alone in this junior market sell-off. There are likely some very attractive buy the dip opportunities this month.

Readers are encouraged to dig deeper into the Sassy Resources story, review recent press releases, and watch for upcoming news on both the NF strategy and the flagship Foremore project. With copper, zinc, silver, nickel and cobalt up between 45%–68% from a year ago, it makes no sense for Sassy shares to be down so much from a high of $1.24.

At current levels, the company’s EV is just $20 million. This valuation could be a very good entry point for readers with an appetite for high risk/high potential reward investments.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Resources was an advertiser on [ER] and Peter Epstein owned shares & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sassy Resources, a company mentioned in this article.

( Companies Mentioned: SASY:CSE,

)

Silver Is Sticky Money

Source: Peter Krauth for Streetwise Reports 02/23/2021

Silver Stock Investor editor Peter Krauth discusses silver’s long history as a currency and recommends a way to avoid paying large premiums when buying silver.

Many don’t realize, but silver is considered to have been the first metal to serve as currency.

Could silver one day regain its role as money? Perhaps. It’s widely accepted that gold was used as money by Lydian merchants around 550 BC, roughly 2,500 years ago.

But even before that was silver, more than 4,000 years ago in ancient Greece. At the time, silver ingots were used as payment in transactions of trade. Back when Athens oversaw an empire, its silver coin was the tetradrachm.

But for now, silver’s fastest growing demand segment, by far, is investment. In fact, it’s exploding.

Although the #Silversqueeze movement has faded somewhat from the headlines, its effect has been dramatic and persistent. Bullion dealers continue to struggle to meet physical demand, with most still charging 50% premiums or more.

And that’s likely to continue leading to much, much higher silver prices ahead.

But there’s one option you can follow to buy silver for as little as a 0.5% premium, or perhaps even at a discount to the spot price. It’s not perfect, but it could make for an attractive silver investment option.

Silver Demand Remains Elevated

The tetradrachm is considered the first coin to attain “international standard” status, as it was used in trade across the Mediterranean. Today, of course, silver is no longer used as money in daily transactions. But for many, it still retains monetary characteristics and value.

In my view, there’s a reasonable possibility that silver may once again regain its role as money in the years to come. For now, the closest thing is silver’s booming investment demand; it’s been off the charts. There’s no doubt that the advent of silver ETFs has facilitated (or exacerbated, you choose) this phenomenon.

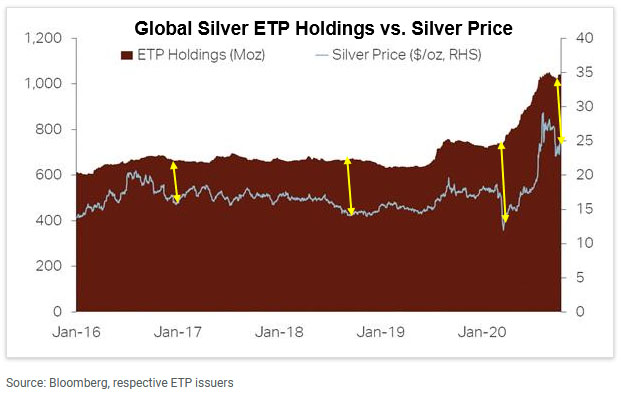

It’s certainly clear from the above chart that silver ETF investments tend to be what’s called “sticky money.” That means when investors buy, they tend to hold, even through price drops and even through significant ones. I’ve highlighted this phenomenon with yellow arrows in the above chart. Even as silver prices sold off several times since 2016, silver ETF holdings remained rather stable. The most dramatic example of this was last March when silver plunged temporarily to $12, while ETF holdings barely budged.

The Silver Institute confirms outsized, and growing, investment demand for silver. In a recent note, the Institute highlighted, “…global holdings in ETPs grew by an impressive 331 Moz to end 2020 at 1.04 billion ounces, and since then, global ETP holdings have continued to escalate. Through February 3, ETP holdings rose 137.6 Moz to a new record level of 1.18 billion ounces.”

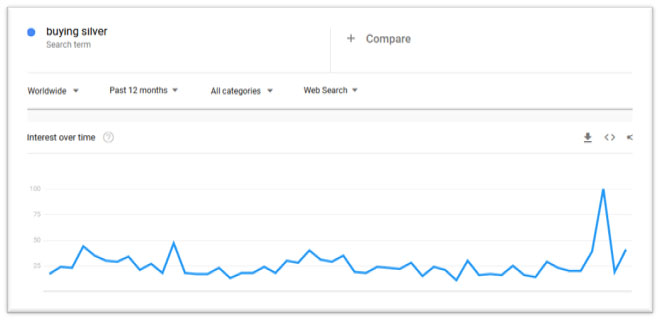

Consider that total annual supply in the silver market is about 1 billion ounces. So worldwide holdings in silver ETFs now surpass an entire year’s supply. And in my view, that’s likely to continue growing as interest remains elevated. Here’s a little bit of anecdotal evidence. The following Google Trends chart for the search term “buying silver” supports this idea.

Source: Google Trends

Although the recent massive spike has subsided, it appears to be on the rise again. Per the Silver Institute, “Further upside is expected this year for physical investment, which is anticipated to rise to a six-year high of 257 Moz…This projection reflects current demand in the all-important U.S. market, which has enjoyed a robust start to 2021, with overwhelming demand causing product shortages.”

So, with such outsized silver demand, investors who want the real thing have few options but to pay wild premiums and to wait out long deliveries, at least until things return to normal.

But there’s one option that could help you bridge this gap.

A Workaround for Huge Silver Premiums

Investors can purchase a silver ETF now in order to gain exposure to silver prices. It’s an alternative while they wait for premiums to return to more normal levels.

The Sprott Physical Silver Trust (TSX:PSLV; NYSE:PLSV)is a great option, but I do want to point out that this is not the same as owning physical silver coins or bars. PSLV is a claim on silver through the ownership of trust units, which are convenient exchange-traded shares.

That said, Sprott is one of the most recognized names in precious metals and resource investment management. PSLV does offer advantages over some of its competitors. The silver it owns is fully allocated, meaning it cannot be loaned out or claimed by another entity. Unitholders have the option to redeem their units for physical silver bullion, however the minimum requirements are quite high. There are potential tax advantages for certain non-corporate U.S. investors, where capital gains may be taxed at a lower rate than for most other precious metals ETFs, coins and bars. Storage of the metals is at the Royal Canadian Mint, which is a Federal Crown Corporation of the Government of Canada. PSLV has almost $2.5 billion in assets and an annual management expense ratio near 0.67%.

But here’s the kicker: currently, PSLV trust units trade at a small premium around 0.75% of their net asset value (NSV). And depending on the market’s sentiment, it sometimes trades at a discount to its NAV. So investors can own PSLV and pay very close to spot prices for silver. Once physical silver price premiums return to more normal levels, investors can then switch into physical.

Meanwhile, silver futures prices at such low levels versus physical prices are unsustainable. This gap will undoubtedly close. I think that will happen with futures prices rising to approach physical silver prices, but at considerably higher levels than currently. And it could happen suddenly.

That’s why gaining exposure to silver now makes sense. The Silver Institute forecasts robust global silver demand to reach an eight-year high in 2021 at 1.025 billion ounces, thanks to gains in industrial, jewelry, fabrication and physical investment demand.

In my view, it’s physical investment demand that will be the biggest disruptor to the silver market for some time.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks offer the best prospects as this bull market progresses. I recently added a primary silver producer to the portfolio, which has gained nearly 30% in just three short weeks, and I believe has exceptional potential to double or better in the next 12 months.

Investors need to have exposure to silver. Now.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: I am Long Sprott Physical Silver Trust PSLV. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Some policy shifts recently announced by the Indian government in its Union Budget will likely have a positive impact on the country’s gold market. India ranks as the second-largest gold-consuming country in the world, second only behind China. The three key policy changes that will likely affect the gold market are: A reduction in the gold […]

The post Blog first appeared on SchiffGold.

Fed Expands Record Holdings of US Debt

The Federal Reserve expanded its record holdings of US Treasuries in the fourth quarter of 2020 as it continued monetizing the massive federal debt. The Federal Reserve added another $253 billion to its Treasury holdings in Q4 according to the Fed’s Treasury International Capital data released on Feb. 16. That brought the central bank’s US […]

The post Blog first appeared on SchiffGold.