Source: Michael Ballanger for Streetwise Reports 02/16/2021

Sector expert Michael Ballanger examines how recent news from Getchell Gold primes the company—and its investors—for profit.

As a newsletter writer and gold/silver market commentator, I carry over forty-four years of capital market battle scars into the emergency ward of debate over the prices of metals and companies searching for, developing, or producing those metals. As fiercely competitive as the newsletter business is, I will rarely, if ever, say a bad word about any competitor, because the precious metals have enough competition from other asset classes like crypto and cannabis for me to concern myself with personalities. I also try to avoid “talking my book” by pumping up certain companies in which I have invested for the pure purpose of shameless self-promotion and subscription sales.

However, there are occasions where I feel a responsibility to advertise positive news and in doing so, reward subscribers by exposing their holdings to a new crowd of potential new investors.

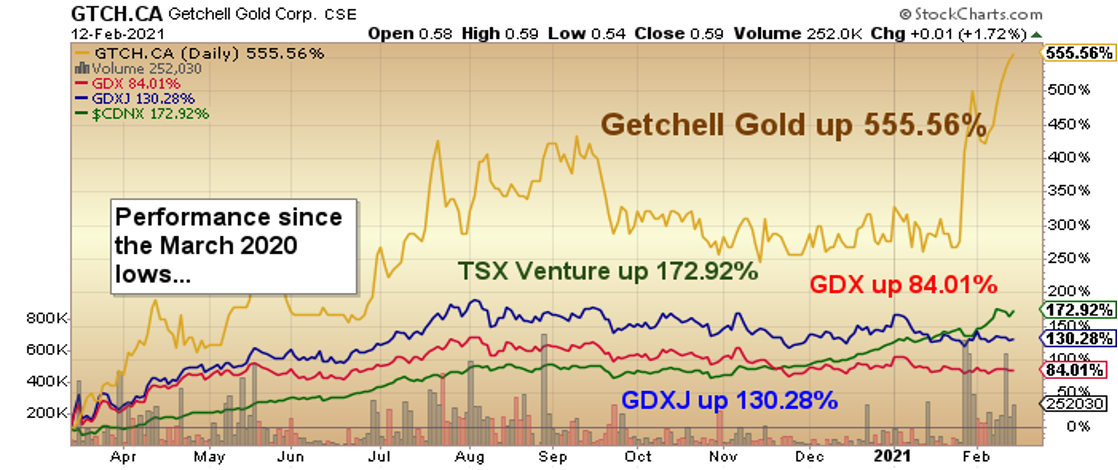

I learned a great many years ago that, in the lifeline of all junior exploration and development companies, early investors usually pay the lower prices, because it is they that absorb the majority of the early-stage risk—and believe me, in the resource sector, they can be both hazardous and substantial. So, when a company that I follow brings forth news that justifies the early risks, and closes at an all-time high after delivering “the goods,” I have no reservation whatsoever in telling the world, especially when management has spelled out the risks early and professionally. The company to which I refer is Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) (CA$0.59/US$0.464 per share).

In the first two weeks of February, the company reported surprisingly good results from their six-hole, 1,995-metre exploration program on their Fondaway Canyon project, completed in late 2020. For most of 2019 and 2020, I have been pounding the table and urging investors to own this name on the basis of their historical resource, consisting of 409,000 ounces Indicated and 660,000 ounces Inferred gold-bearing mineralization valued substantially below the accepted 2021 valuation benchmark of US$80/ounce.

In fact, there are those that would value in-ground gold in Nevada at closer to US$100/ounce, which is precisely the value proposition, because at the Feb. 12 close at US$0.464/share, the market valued the company at a mere US$30.36/ounce on an undiluted basis.

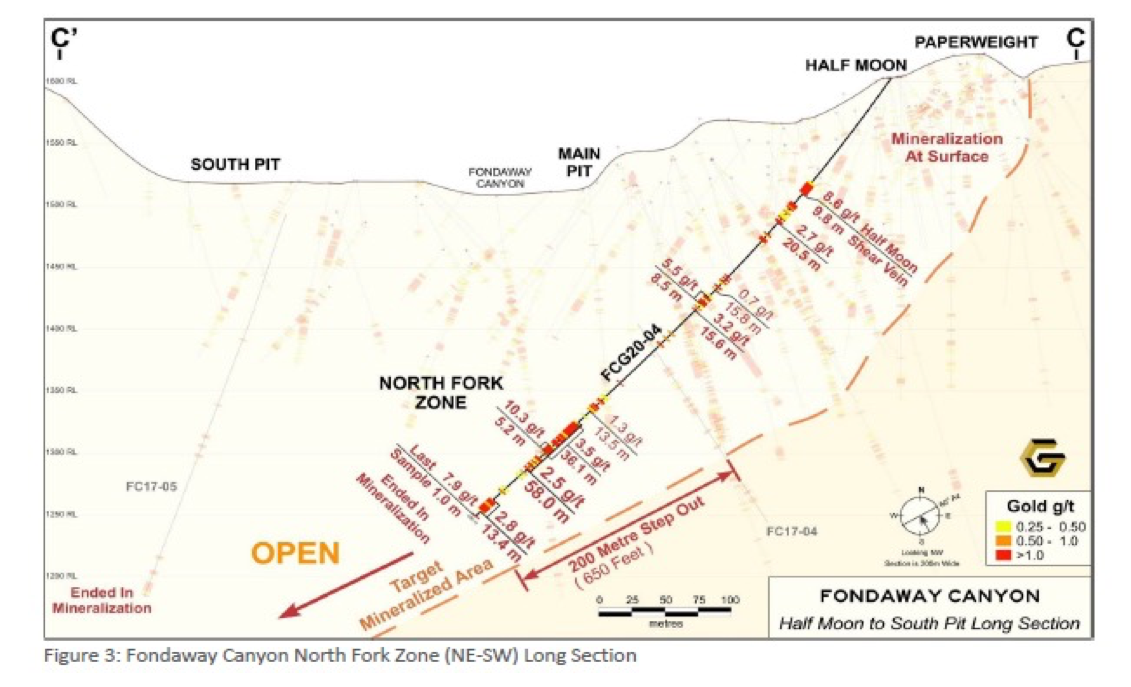

The Central Area of the Fondaway Canyon Project is a 1,000 x 700 meter, highly mineralized northeast-southwest extensional zone within a 3.5 kilometer-long east-west trending zone of gold mineralization. Within the Central Area is a 250 x 250 block called Paperweight that alone constitutes 500,000 ounces of the 1,069,000-ounce historical resource. Integral to the result announced last week was the emergence of a new zone known as the North Fork, where they encountered 144 meters of gold-bearing mineralization located over 200 meters from Paperweight.

For this investor, knowing that the cutoff grade used in the calculation of the historical million-ounce resource was 3.43 g/t gold (Au) brings great anticipation of the restatement of the resource using the more readily accepted 0.5-1.0 g/t cutoff later in 2021.

I believe that it is apparent that the Central Area is well on its way to establishing a multimillion-ounce resource and a subsequent reranking by the analytical community. I have long held that the Barrick-Newmont joint venture group rarely allows juniors to grow their ounces for very long, and since this is in their highly protected “backyard,” Getchell Gold will be in the crosshairs of the junior analysts looking for a fat merger-and-acquisition (M&A) fee.

The near-term outlook includes a step-up in marketing activity, rather than financing, because the company has CA$1.5 million in working capital and another $3 million plus in warrant funding currently “in-the-money.”

It is always a rewarding experience when you are an early investor and are forced to grind through challenging markets such as the March 2020 crash, and the August-November precious metals correction, where juniors have dropped as much as 70% into the year-end tax loss rout, only to come out of the other end of the tunnel achieving escape velocity into terrific news and escalating volumes.

The value opportunity for all prospective investors is to focus on the Central Area of Fondaway Canyon and listen to President Mike Sieb’s excellent presentation from Feb. 12, in which he lays out a compelling argument for owning Getchell Gold.

Further to Fondaway, I have been advising subscribers of the potential in the second half of 2021 of a major move in copper prices. Drastically reduced inventories in Shanghai and London, as well as the Comex, as well as depleting mine supply, has created a potential supply shortfall that, when combined with a global economic rebound, could lead to sharply higher prices by year-end. The current narrative also includes increased demand due to the needs of the electric car movement.

Rather than being seen as a one-trick pony, Getchell has two highly prospective copper-gold targets also strategically located.

The Star Point gold-silver-copper property (“Star Project”) is situated in Pershing County, Nevada, approximately 65 kilometers to the north of the company’s Fondaway Canyon advanced-stage exploration gold project. The Star Project comprises two main target areas:

- Star Point: the site of a historical, near-surface, high-grade copper oxide (tenorite) mining operation underlain by a magnetically defined anomaly exhibiting chargeability and resistivity highs, derived from a 2018 induced polarization (IP) geophysical survey; and interpreted as potential copper sulfide mineralization, possibly intrusion related.

- Star South: The 2018 IP survey reported the presence of a strong conductor below a concentration of historical artisanal shallow mining containing surface copper-gold oxide mineralization (tenorite) along northeast-trending faults and along the thrust fault boundary at surface.

The 2020 IP survey originally scheduled for commencement in mid-October has started three weeks ahead of schedule and it is anticipated to take four weeks to complete the field survey, processing, interpretation and reporting. The IP survey will consist of a total of 22.5 kilometers along five survey lines, and will expand upon the limited single-line 2018 IP survey at both the Star Point and Star South target areas. The objective is to refine the geophysical anomalies previous identified at both Star Point and Star South in preparation for a drill program planned for the first half of 2021.

As President Mike Sieb is quick to point out, “Getchell will be one of the most active juniors in the region in 2021.” Since they are funded, they can afford to be active, and if they are active, the newsflow will drive valuation. To be an active junior in the most favorable mining jurisdictions in North America, with an undervalued and growing resource, should be sufficient to create additional escape velocity to the benefit of all shareholders for the balance of the year.

Originally posted on Sunday, Feb. 14.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold, a company mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: GTCH:CSE; GGLDF:OTCQB,

)