ZeroHedge/Reprint of Harley Bassman analysis/2-7-2021

“When one hears hoof beats, look for horses not zebras. There is no reason to ruminate over exotic possibilities when the problems we face are quite clear. Once again, ignore the merits of the public policy response – what is important is that there is wide support from both the Democrats and Republicans to offer significant Fiscal relief supported by massive Monetary expansion. Will this be inflationary – Yes; but it is unclear how soon.”

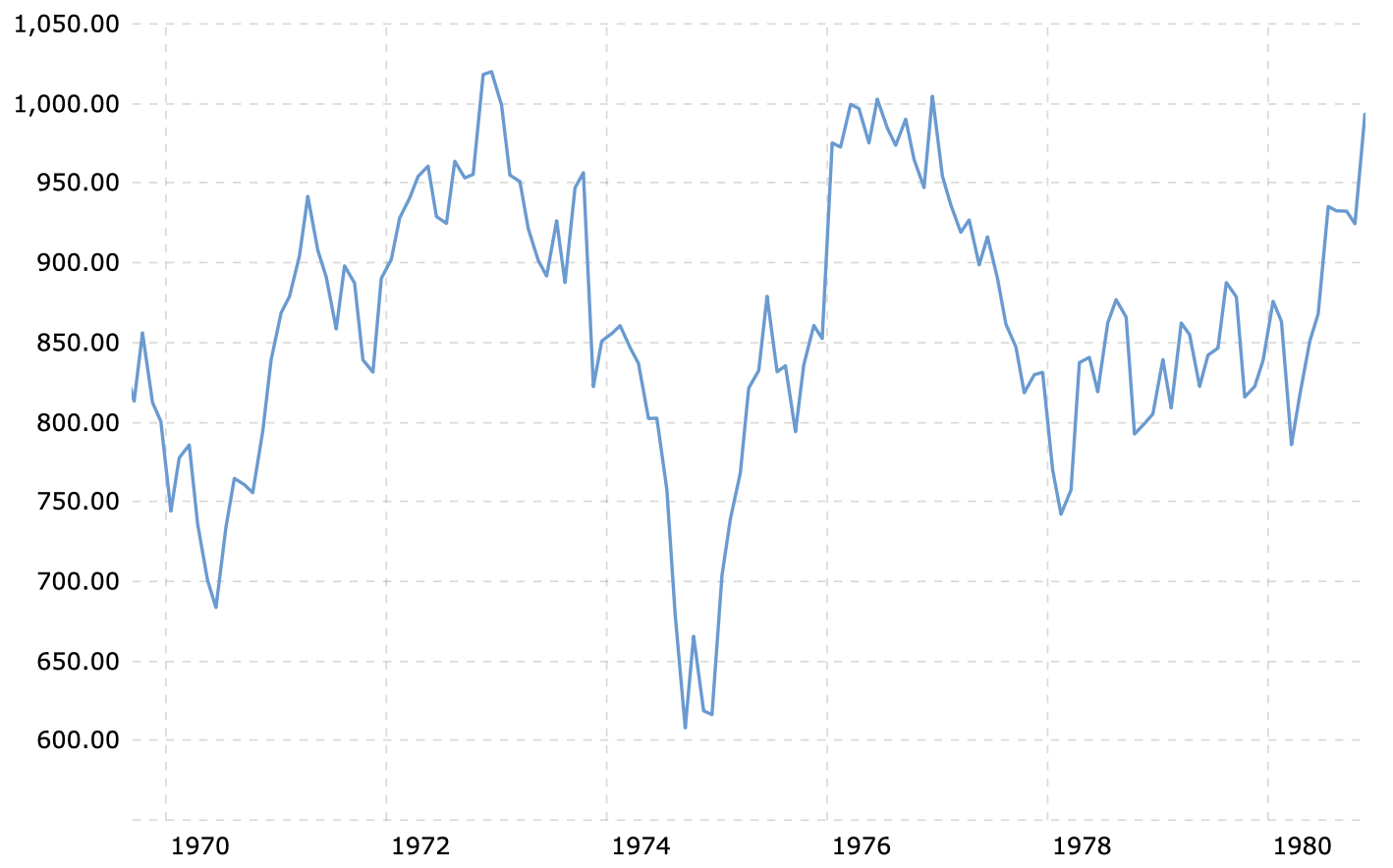

USAGOLD note: Why a white swan? Because, as the highly respected Mr. Bassman reveals, unlike a black swan which by definition is a surprise, anyone can see a white swan coming and that’s what he sees on the horizon brought on by debt and printing money. He recommends “real assets” and reminds his readers that stocks survived Germany’s Weimar monetary debacle inflating along with everything else. However, that is not, as the chart below shows, what happened during the 1970s inflation. The Dow Jones Industrial Average seesawed wildly going from just over 1000 in 1972 to roughly 600 in 1974 (as gold peaked), then back to 1000 in 1976 before dropping to 750 in 1978. It finished the decade right at 800 – the point being that for the stock market the 1970s were a lost decade. Stocks on average certainly did not keep up with inflation. It is anyone’s guess what will happen the next time around.

Dow Jones Industrial Average

(The 1970s)

Chart courtesy of MacroTrends.net • • • Click to enlarge

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

![]()

“In a stock market filing, Tesla said it ‘updated its investment policy’ in January and now wanted to invest in ‘reserve assets’ such as digital currencies, gold bullion or gold exchange-traded funds.”

“In a stock market filing, Tesla said it ‘updated its investment policy’ in January and now wanted to invest in ‘reserve assets’ such as digital currencies, gold bullion or gold exchange-traded funds.”