Stefan Gleason, president of Money Metals Exchange, appeared on the Arcadia Economics channel to discuss the recent extraordinary developments in the silver market. Get the inside skinny on these fast moving developments by watching below!

Stefan Gleason, president of Money Metals Exchange, appeared on the Arcadia Economics channel to discuss the recent extraordinary developments in the silver market. Get the inside skinny on these fast moving developments by watching below!

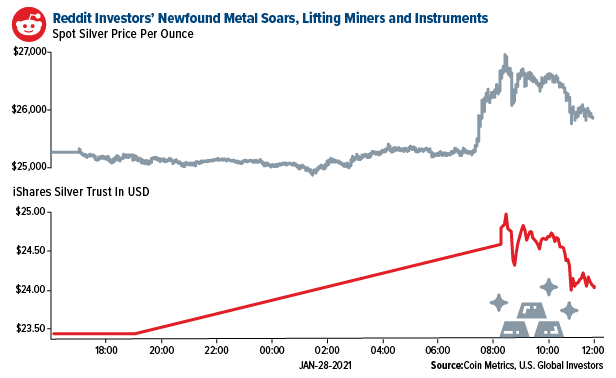

As extreme market conditions drive tremendous volatility in silver spot prices, buyers are exerting unprecedented pressures on retail physical bullion products.

Record-setting buying volumes pushed the silver price toward a multi-year breakout on Monday. Silver hit an eight-year high of over $30/oz during the day, closing at $29.41.

On Tuesday, however, the silver market got slammed – along with stocks that had been heavily bid up based on internet discussion board campaigns. As GameStop (GME) shares suffered a 60% meltdown, silver plunged by close to 10% to just under $27/oz.

As of Wednesday morning, silver has recovered slightly to $27.15. Meanwhile, coins, bars, and rounds continue to be in very short supply, and premiums are elevated.

For an in-depth discussion on the developments in recent days, watch my interview on Arcadia Economics here.

What happens next? Was the recent price spike and demand surge in silver a fleeting Reddit-driven fluke?

Much of the mainstream financial media’s coverage of the moves in the silver market has focused on the “WallStreetBets” angle – implying silver is just another ticker symbol subject to being pushed higher by day traders for no fundamental reason.

In fact, real physical demand for the white metal is manifesting outside of Robinhood accounts. While exchange-traded funds linked to silver saw enormous inflows, so did bullion dealers. By Monday, inventories of most common silver bullion products were cleared out.

Buyers of coins, rounds, and bars aren’t the sort to trade in and out of their holdings based on daily blips. By and large, they are long-term holders who believe in the fundamental value of physical precious metals as contrasted with nontangible financial assets that trade on exchanges.

If you have recently bought or plan to buy silver solely because you hope internet chatter will quickly drive prices higher, then quite frankly you may be making a mistake.

The fundamental case for higher silver prices has nothing to do with GameStop or other faddish trading frenzies.

Instead, the case for investing in silver is based on the realities of exploding U.S. currency supply, COVID-strained mining output, rising industrial demand from solar energy, electric vehicles, and other high-tech applications, and, yes, rising retail demand for physical bullion.

That said, there is also a case to be made for a “short squeeze” event that breaks the overhanging concentrated selling pressure (manipulation) in silver futures. This is a point many in online trading communities have been harping on.

They are not wrong to do so.

After Monday’s big pop in silver prices, the CME Group sprung into action to help short sellers. Its COMEX futures exchange announced it would raise margins on silver trading by 18%.

That had the predictable effect of forcing traders to pare back their positions. And as prices began to fall precipitously, some sold in a panic.

Newcomers to silver trading learned a hard lesson. Those who control the levers over the paper silver market are still, for now, able to manipulate the market – sometimes openly in the case of the CME’s margin tightening; sometimes secretly in ways that are illegal.

“Over the past few years, some of the biggest banks in the world have paid hundreds of millions of dollars in fines for rigging and manipulating the precious metals markets,” notes Zacatecas Silver CEO Bryan Slusarchuk.

In an interview with FoxBusiness earlier this week, Slusarchuk provided some insider context that is normally missing from Wall Street-centric discussions of gold and silver.

He pointed out that “the paper silver market is hundreds of times the size of the actual market for physical silver. And what you continue to see are these open contracts get kicked further and further down the road with most participants in the silver market having no real ability nor inclination to ever deliver physical.”

“Now physical is in short supply,” he added. “And that leads us I think to the potential for the mother of all short squeezes.”

In such a scenario, the “squeeze” would be driven by demand for delivery of actual physical silver. That’s what many newbies who recently jumped into exchange-traded instruments linked to silver or mining companies are missing.

It’s not enough to target paper markets with “buy” orders. In order to truly break the backs of the short sellers, they need to be confronted with a surge in real physical demand.

The scenario is starting to take shape, but it won’t play out fully in a matter of just a few days. Silver investors would be well served to avoid succumbing to either extremes of greed or fear during periods of heightened market volatility.

Unleveraged longs enjoy the benefit of being able to play the long game, riding out the wild swings within their emerging major bull market.

As mining executive Bryan Slusarchuk put it, “I hope that the ultimate outcome here is that a new generation of investors and speculators realize that silver is money. Silver was money thousands of years ago. Silver remains money today. And silver will be money in a thousand years from now.”

Source: Peter Krauth for Streetwise Reports 02/02/2021

Peter Krauth, editor of Silver Stock Investor, explains why he believes silver’s movements this past week were just a small taste of its opening act.

TEMPORARILY OUT OF STOCK.

That’s the message most hopeful physical silver buyers have been getting since the last days of January. Odds are bullion dealers going to have a tough time keeping any silver in stock.

Everyone is buying, and no one is selling the physical metal. Dealers are asking for 35% premiums…and that’s if you can get your hands on any silver at all.

And yet I remember well, less than a year ago in mid-March, when the world started a major lockdown in response to the Covid-19 pandemic. Gold and silver bullion dealers were nearly completely sold out within days. In some cases, silver premiums reached historic highs, near 100% of spot prices.

In the recent #silversqueeze hype, silver traded at an 8-year high, as demand was exploding. Silver’s given back $2 since its $29 peak on Feb. 1. But it’s still up 20% since late November, and has gained 125% since its March lows.

And silver stocks have been surging. It’s all related to the now infamous WallStreetBets calls to action, the latest of which targeted silver. It was enough to cause the Comex to raise silver margins by 18% after just two up days.

But silver’s story is still in its early days. Dramatically higher silver prices are still squarely ahead.

Here’s What Really Happened to Silver

A Reddit subgroup called WallStreetBets sent out a call-to-action to buy silver on January 28. Retail investors piled in en masse and kept doing so on Friday, Jan. 29 and Monday, Feb. 1. By Sunday, January 31, most bullion dealers were outright sold out. By Monday, February 1, silver was up nearly 8% from the Friday close.

Silver had gained almost 20% in just three trading days.

Silver had soared to an 8-year high. Silver stocks were ripping higher, and many were seeing their trading volumes explode anywhere from 6-10 times normal levels.

The Global X Silver Miners ETF (NYSE:SIL) went from $40 to $49 in just three days. The ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ) went from $13.60 to $17.80 in that same time.

On Friday alone (Jan. 29), the iShares Silver Trust (NYSE:SLV), the world’s largest silver-backed exchange traded fund, added nearly $1 billion of inflows.

Some of this move will turn out to be a short-term speculative buying frenzy. But what this whole saga has done is to introduce a massive new following to the silver space.

More importantly, I believe silver still remains fundamentally cheap.

Silver Supply and Demand Drivers

Huge forces are going to keep pushing silver higher for years to come.

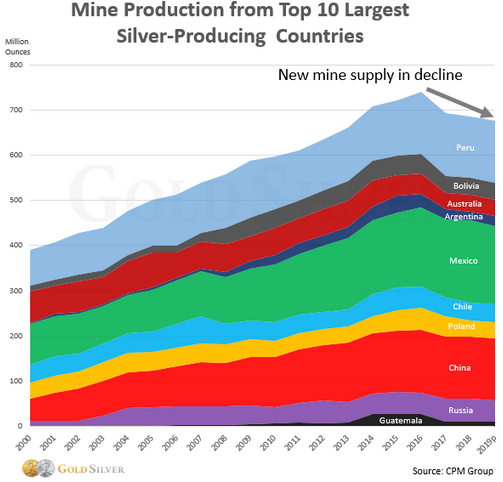

Supply has been falling consistently for the last five years.

Not one of the top 10 silver producing countries has escaped this trend. Several consecutive years of low prices have led to underinvestment and underexploration. Output has dropped along with reserves.

And with 70% of mined silver is a by-product of mining other metals, those miners are not motivated to produce more even when silver rises: it’s too small a portion of their revenues.

All this is happening while multiple demand forces are building.

Vehicle demand for silver is soaring. Whereas internal combustion engines need 15–28 grams of silver, EVs need double that amount at 25–50 grams per vehicle. Globally, EV sales are projected rise dramatically. The Silver Institute projects a 50% rise in automotive silver demand, from 60M oz currently to over 90M oz in just five years.

Meanwhile, the solar sector is also likely to boost silver demand. It currently represents 100M oz of silver annually. And although efficiencies have been leading to lower silver consumption per solar panel, in my view expanding volumes will more than make up for that.

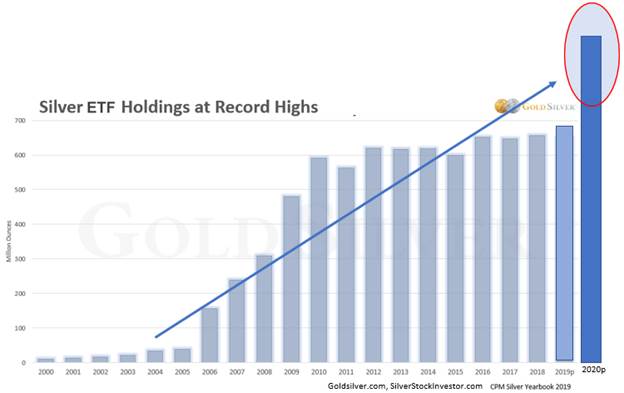

However, I believe the wild card will be investment demand for silver. Even without the dramatic, explosive action in silver markets over the last week, investment demand has been gradually increasing over the last five years. 2019 saw an impressive increase of 12% over 2018. But 2020 was an absolute standout, with a 16% increase over 2019. None of this happened with any hype.

That translates into global silver ETF holdings now in the 1 billion ounce range.

Consider that these total holdings are the equivalent of a whole year’s silver supply: mine production and recycling.

And yet silver remains stunningly cheap, especially relative to gold.

The gold-silver ratio has reversed in a dramatic way from its all-time high last March at 125, and has just broken below support at 70. I believe it’s heading towards 55 or even 50. Silver remains cheap on a fundamental basis, a relative basis and an historical basis.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks offer the best prospects as this bull market progresses. I recently added three companies to the portfolio, which I believe have exceptional potential to double or better in the next 12 months.

In the end, this pullback is just par for the course, especially in silver. The way I see it, all it does is give us more time and another opportunity to keep accumulating silver and silver miners at discount prices.

The mania stage still lies ahead. This past week was just a small taste of the opening act.

Stay long silver.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Global X Silver Miners ETF (SIL). I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Source: Bill Powers for Streetwise Reports 02/02/2021

Bill Powers of Mining Stock Education profiles FPX Nickel, which is exploring the Baptiste nickel deposit in the Decar nickel district in British Columbia.

Significant nickel discoveries are rare, but when they do occur the market greatly rewards them. In March of last year, Chalice Mining (OTC:CGMLF) was trading around US$.08. Then Chalice announced a major nickel discovery hole at its Julimar project in Western Australia that hit 19m at 2.59% nickel, 1.04% copper, 8.37gpt palladium and 1.11gpt platinum. Shares immediately began to soar. Due to the company’s continued success with the drill bit over the past year, it recently cost US$3.70 to buy a Chalice Mining share. This nickel discovery propelled Chalice Mining’s market cap over US$1 billion and provided a potential gain of 4,500% for those who owned Chalice shares pre-discovery.

A similar opportunity for a potential world-class nickel discovery is hidden in one of Canada’s best nickel development companies, FPX Nickel Corp. (FPX:TSX.V; FPOCF:OTC). FPX Nickel is primarily known for its Baptiste nickel deposit, which is a PEA-stage development project, located in its 100%-owned Decar nickel district in British Columbia. But CEO Martin Turenne shared in a recent Mining Stock Education interview that he does not believe the market has realized the Decar nickel district’s massive exploration potential that is about to be drilled this year:

The Decar land package is large. We do think of it as a district. It covers 245 square kilometers. So within that, the Baptiste deposit, which supports the PEA and it’s one of the largest nickel deposits in the world, represents only about 1% of that land mass. So there’s massive exploration potential that we’ve identified in geological reconnaissance work throughout the rest of the project that suggests there could be multiple deposits of that scale within the land package. Most notably at the Van target, where we have delineated a drill target there based on outcropping surface samples of bedrock that covers an area about three square kilometers of outcrop. So that is the target scale. By way of comparison, the lateral footprint of Baptiste is only about two and a half square kilometers. And the other thing that we see at Van is not only is it larger in its scale conceptually at surface than Baptiste, but the grades are higher. The grades are about 10% to 15% higher in surface samples (0.16% DTR Ni).

Van has never been drilled. It had been previously inaccessible to us due to dense forest in the area, which has been cut away by the logging companies that are active in our area. So that’s allowed us to go in to take those samples and to initiate this summer the first ever drill program at Van with a potential to delineate or to demonstrate that we have another world-class ore body within the land package. And I think that’s something that investors, oftentimes I find when I talk to them, they aren’t even aware that we have that. And it certainly, we think not at all reflected in our share price.

We have an initial plan for about 3,000 meters of drilling, which doesn’t sound like a lot. However, this style of mineralization is disseminated and very homogeneously distributed, which means that you can do very wide-spaced drilling and prove up tonnage very quickly. Just to give you a sense, we’ve done about 32,000 meters of drilling at Baptiste and proved up a resource that’s about two and a half billion tonnes. So the amount of tonnage per meter drilled there, that ratio is very, very high. And it’s due to that sort of very homogeneous distribution of this style of nickel mineralization that we have, which means a couple things. One, we can be very efficient with our dollars and prove up tons very quickly. And the other thing about this style of mineralization is that the visual returns that you get as you’re pulling core up, tell you a lot. And so it gives you great flexibility from a drilling standpoint to expand programs or to move the drill around as need be without having to wait sort of that two to three month period for assays to understand what you in fact have.

The Van target will be diamond-drilled in June or July this year and FPX Nickel has all the permits already in place. If the visual inspection of the core looks positive, Martin shared that “we will be well positioned to potentially expand the program very quickly if we like what we see.” Drilling at the Van target is capable year-round but it is most cost efficient from May to October.

FPX Nickel is fully funded for its 2021 exploration and development and has the cash to expand the Van target drill program if results warrant it. The company has CA$5.9 million in the treasury now with 2021 budgeted expenditures of about CA$3.8 million which including drilling, metallurgical programs, other work programs and G&A.

Not only does the Baptiste deposit’s fundamental value undergird FPX Nickel’s current share price and provide investors downside protection if the Van target’s drill holes disappoint, but Martin also believes Baptiste provides investors with further share price upside. He points out that when compared with its peer group the Baptiste deposit is grossly undervalued and due for a further upward rerating:

The 2020 PEA that we just completed showed a net present value on a Canadian dollar basis after tax of, in excess of 2 billion Canadian dollars. And we currently have a market cap of around just over 100 million Canadian dollars. So we trade at about 5% of our project value in our study. Typically base metal projects at this stage of development in the PEA to PFS stage, they often will trade at 15% to 20% of their project value.

FPX Nickel’s management has done an excellent job maintaining a share structure that protects its investors’ upside. There are zero warrants outstanding. And although FPX Nickel first IPO’d twenty-five years ago, it only has 181 million shares outstanding and has never done a share consolidation or rollback. This speaks to management’s discipline around dilution and concern about protecting potential outsized gains for its investors.

The FPX Nickel investment value proposition is compelling and offers mining speculators a lower risk opportunity to participate in a potential world-class nickel discovery. Chalice Mining’s nickel discovery last year propelled its share price upward an astounding 4,500%. And if FPX Nickel’s Van target drilling this year has even a fraction of the success Chalice Mining experienced, then FPX Nickel shareholders could be greatly rewarded by the market.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: FPX Nickel. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: FPX Nickel is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

( Companies Mentioned: FPX:TSX.V; FPOCF:OTC,

)

Source: Maurice Jackson for Streetwise Reports 02/02/2021

Maurice Jackson of Proven and Probable sits down with Millrock CEO Gregory Beischer to talk about recent developments at the prospect generator.

Maurice Jackson: Joining us for a conversation is Gregory Beischer, the CEO of Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQB).

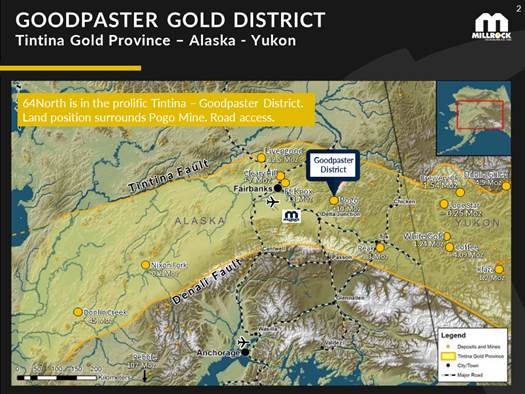

It’s been a couple of months since we last spoke. Let’s get readers up-to-date on the latest developments on the 64 North Project, as well as some of the upcoming drill programs that you may have slated coming up within the property bank of Millrock Resources. Speaking of the 64 North, several interesting developments are moving there simultaneously from road cutting sampling, assay results, trenching, and today the announcement of a 30% earn-in with Resolution Minerals. Let’s visit the Aurora targets. What can you share with us regarding the latest assay results, sir?

Gregory Beischer: Well, there’s been a lot of water under the bridge, since it has been a couple of months since we spoke, Maurice. As you know, we aggressively drilled at 64 North, well throughout 2020, but even as late as December, we were finishing up the last two holes. However, I would say that all the drilling results were quite disappointing in terms of their gold content. Some of the holes appear to have excellent looking alteration features and veining, and we thought we’d tied into the system, but the gold wasn’t there. I certainly don’t rule out the prospect by any means. It was just about the first nine holes ever drilled in that part of the world. So lots of potential remains, but disappointing nevertheless. However, in tandem with that drilling work, we also completed a lot of trenching work and geophysical surveys. And we’ve developed with our partner Resolution Minerals three more targets.

One of them is quite close to the Aurora. The drill trail that we constructed to Aurora goes right over what’s now called the Sunrise prospect where we sampled the road. That’s over 137 meters of road-cut; we detected strongly anomalous gold values continuously over that entire distance around 0.3 grams per ton. Its intrusion hosted mineralization is different than the nearby Pogo Mine, but perhaps more akin in its style to what one would see at the Fort Knox Mine, which is close to where I presently am located in Fairbanks. And of course, Fort Knox is a fantastic mine and a deposit style that we wouldn’t be discouraged if we found one similar to it. And that is the sort of style and we are keeping an open mind, the flat line veins at Pogo, very high-grade. That would be great to find, but we always keep an open mind when we’re in a gold-rich system like this. It could be any style-related to these intrusions.

So, the Sunrise prospect well worth following up, and additionally, east of the Pogo mine at the Boundary prospect and southwest of the mine, the Eagle prospect, there are three great drill-ready prospects now that were developed between Resolution last year. And they’ve indicated their intention to continue to drill and test those projects in the coming year.

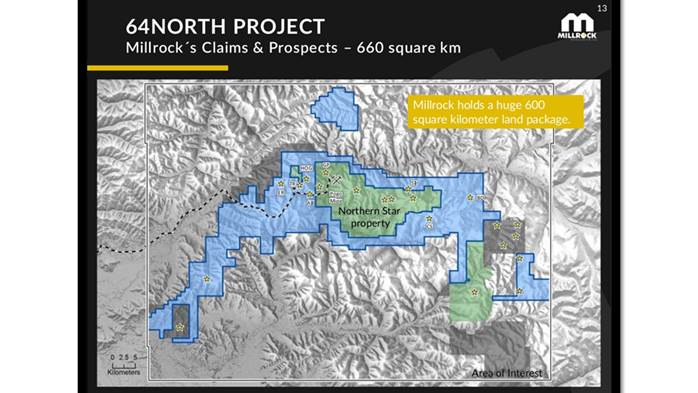

Maurice Jackson: How many square kilometers are we talking about here?

Gregory Beischer: The 64 North Project is huge. We had the unique opportunity to stake hundreds and hundreds of claims in a wide-open district. Very unique that a mining district like this was wide open except for the mine itself practically. And it’s 660 square kilometers of highly prospective gold ground. So there’s lots more to explore and it appears that our earn-in partner shares our confidence as well. Although the results of the drilling weren’t what we hoped, we look at this project on a long-term basis and it costs us roughly USD 600,000 to develop and acquire all the mineral rights for the project. But at this point, we’ve recovered that investment. We’ve got a substantial shareholding and Resolution Minerals as a result of the deal, holding now about 14 million of its shares, which could still become highly valuable if there’s a discovery in the coming year or two. And we have every reason to believe that that success could come. So I think we’ve done our job for our shareholders sticking closely to our generator model.

Maurice Jackson: As a shareholder, one has to be fairly optimistic about the value proposition before us. If Resolution Minerals is demonstrating its commitment on a 30% earn-in, and I speak off the record with several respected names in the space and the recurring theme that I hear on the 64 North is: “it’s there, they just have to keep drilling,” but they have full confidence in the project. And I do wish to convey that I will be looking to add to my position at these prices.

Let’s move to Fairbanks, sir, please introduce us to the Treasure Creek project and the new relationship between Millrock Resources and Felix Gold on this project.

Gregory Beischer: Today I’m in Fairbanks at Millrock’s now northernmost office and surrounded by the Fairbanks gold mining district. The Goodpastor district just off to the southeast by about an hour and a half drive, that’s where the 64 North project is located that we’re just talking about. But more recently Millrock rolled three projects, Treasure Creek, Astrodome and Liberty Bell, all into a brand new company that’s called Felix Gold. The company is named after Felix Pedroni, who was the original prospector, discoverer of gold at Fairbanks, and a fantastic amount of alluvial or placer gold has been mined from this area. And there’s been several high-grade, past-producing underground gold mines, but by far, the star of the show is Kinross’ Fort Knox mine, which has so far produced over 7 million ounces, I believe, and has a total resource of 13 million ounces.

So a flagship mine for Kinross Gold, but a few years ago, Millrock started to build a property position in Fairbanks, a surprising amount of land, when it was still open. And we met people from what’s now Felix Gold, and they got very interested in Fairbanks. And so we formed a strategic alliance with them that’s meant to explore all over the Fairbanks district, but also aggressively drill on the toehold projects that we’ve got, Treasure Creek and Astrodome and Liberty Bell. And we’re going to start with Treasure Creek, perhaps is as early as May.

The Treasure Creek placers draining off our ground over 130,000 ounces of gold already recovered from the alluvial deposits, draining the uplands in which we’re searching for lode gold deposits. There has been some drilling in the past, some big, broad, modest grade intersections along the lines of Fort Knox, for example, 0.9 grams over a good 30-meter thickness and very close to surface, some higher-grade intersections to follow up. So we’ve done all the legwork that we need to do in terms of soil sampling and the like we’ve got our targets picked out and we’re just amending our exploration permit now and anticipate that Felix Gold will complete its initial public offering on the Australian securities exchange and become a trading company, a very well-funded one. And we’ll get to work drilling holes on the project here and hopefully repeat the success that Freegold Ventures has had.

Maurice Jackson: Switching gears, Millrock Resources in the past has focused on gold discoveries. That focus will now include more base metal commodities; which base metals will be the focus, where and why now?

Gregory Beischer: Millrock has always had a steady pipeline of new projects and gold has been the main focus, gold and copper. The porphyries are the types of deposits we like to pursue because they really can be the huge ones that are worth a lot of money to the major mining companies, so we plan to keep adding to our copper portfolio. But more particularly, I think that nickel is a metallic commodity that’s going to be in huge demand as well as in a huge deficit in the coming decade. We have ideas on where to search for nickel, as you probably remember, a big part of my background was with INCO. And I learned a little bit about nickel exploration along the way there, so that, and maybe even zinc, we have probably one of the most spectacular zinc deposits in the world and Alaska operated by Teck, the Red Dog Mine, and there’s certainly geologic potential to find more incredible deposits like that. So those are the sorts of things we’ll be adding to over the coming months and year, while we continue to work on our existing projects.

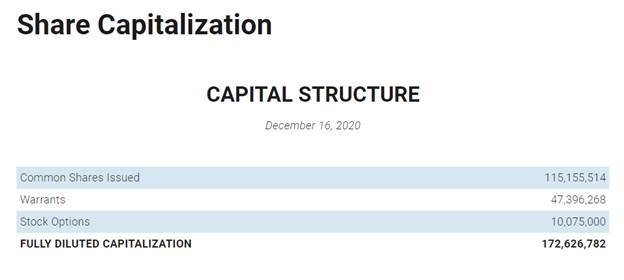

Maurice Jackson: Before we close, sir, please provide us with an update on the capital structure.

Gregory Beischer: Sure. Well, we have approximately 115 million shares outstanding right now; we’ll have to issue more shares shortly to raise the funding. We need to continue to aggressively acquire new projects and bring them towards drill readiness and partnership readiness. So, that’s going to be happening in the next few weeks. We’ll do financing.

Maurice Jackson: In closing, Mr. Beischer, what would you like to tell shareholders?

Gregory Beischer: We are confident that Millrock has a great year coming up. It appears that we’re going to be drilling on at least four different projects with partner funding. It may be more than that. We’re closing in on potential deals on two of our other projects, one of them in Sonora, one in southeast Alaska. And so it could be even more than four projects. That’s a lot of opportunities for drill hole success that can drive our share price higher. I think our company’s an absolute bargain right now. I appreciate that you’re going to be buying some shares and I can assure you that I’m going to be buying some too. So, I’m putting my money where my mouth is and I think Millrock’s going to be worth a lot more in the future.

You know, I look back at 2020, we were at the share price a year ago. We rose nicely through the summer in anticipation of strong drilling results. We were 20, 25, 30 cents a share. So folks that bought shares in our company a year or so ago, hopefully, took a little profit and did well. But I think that we’ll do that well again this year. And if we get a bit of lock-in some good drill holes, perhaps a lot more than that

Maurice Jackson: Luck is when opportunity and preparedness meet one another. And that’s what we have right here before us in Millrock Resources. Sir, last question. What did I forget to ask?

Gregory Beischer: You forgot to ask if the price of gold going to go up. I think the stage is set. We’ve been consolidating at these levels for a while, I’m no expert, but it just seems to be common sense that the price of precious metals is going to strongly increase soon. And you know, that’s what makes the investment money flow in our industry. So I’m hopeful, that’ll move soon and that we’ll all be happy shareholders and Millrock and the other junior companies that I know you and I both share.

Maurice Jackson: Mr. Beischer, for readers that wish to get more information on Millrock Resources, please share the contact details.

Gregory Beischer: Please visit www.millrockresources.com and you’ll find us.

Maurice Jackson: Mr. Beischer, it has been an absolute pleasure speaking with you today. Wishing you and Millrock Resources the absolute best, sir.

Before you make your next precious metals purchase make sure you contact me. I’m a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we have several options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium, and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at 855.505.1900 or email: maurice@milesfranklin.com. Finally, please subscribe to Proven and Probable, where provide Mining Insights and Bullion Sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Millrock Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Millrock Resources, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: MRO:TSX.V; MLRKF:OTCQB,

)

On Monday, Feb. 1, Peter appeared on NTD Business to talk about the attempted short squeeze on GameStop and silver. He said we shouldn’t compare GameStop stock to silver. Unlike GameStop, there are fundamentally sound reasons to buy silver, with or without the endorsement of the Reddit traders. When the Reddit Raiders turned their attention […]

The post Blog first appeared on SchiffGold.