Month: February 2021

- Hedge funds bet rally in Canadian silver-mining stocks to run out of steam Reuters

- Silver jumps 8%, touches 8 year high as Reddit traders try their squeeze play with the metal CNBC

- Canadian silver mining companies give up Monday’s gains as apparent squeeze fails Yahoo Canada Finance

- Why Precious Metals Miners Like Silvercorp Metals and McEwen Mining Fell Hard in Early Trading Today The Motley Fool

- Silver’s sudden price surge bumps Canadian mining stocks BNN

- View Full Coverage on Google News

- Silver price retreats rapidly in blow to new retail buyers Financial Times

- Takeaways from surge in silver prices after Reddit hyped it up like GameStop WPEC

- Silver price plunges nearly 10% as Reddit rally reverses – MINING.COM MINING.com

- Look past Reddit silver volatility, fundamentals to drive silver to $35 an ounce – Bank of America Kitco NEWS

- Silver prices reach five-month high Fox Business

- View Full Coverage on Google News

CNBC/Jesse Pound/2-1-2021

CNBC/Jesse Pound/2-1-2021

USAGOLD note 1: Does it not reduce to a simple formulation? Should we not be assessing who has the greatest staying power – the silver shorts or the Reddit raiders – an outcome yet to be determined? We appreciate what El Erian is saying, but we also question whether or not he is jumping the gun. As mentioned in the just-released February edition of News & Views: “There is a great deal of space, however, between making a few posts and moving a market the size scope of the global silver market. Getting the lion to jump through that fiery hoop might be slightly more difficult than it would appear on the surface.”

News & Views sign-up for the February edition – Free Subscription.

Prospective clients welcome.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Seeking Alpha/Jason Tillberg/2-1-2021

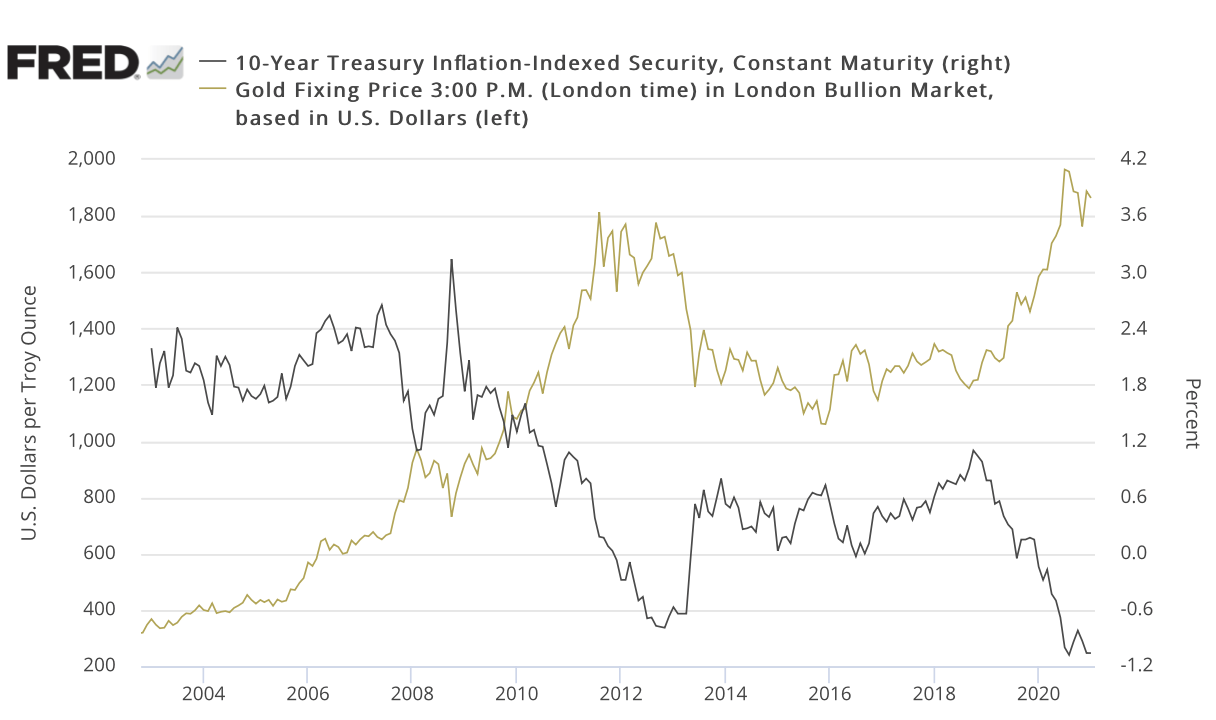

“If there is one catalyst that is a driving factor for higher gold prices, it’s negative real rates. Nobody likes the very thought of seeing their savings accounts or fixed income bonds paying a rate that is less than the rate of inflation.”

USAGOLD note: Tilberg touches on why the declining real rate of return will shine the spotlight on gold using the 1970s as an historical example. The chart below shows the strong relationship between declining real rates and the price of gold.

Sources: St. Louis Federal Reserve, Board of Governors, ICE Benchmark Administration

Click to enlarge

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.