Month: February 2021

Ruh Roh Silver, 2 February

Sometimes you can count on the manipulation conspiracy theorists to get it exactly wrong. Not just a little bit wrong, nor halfway wrong. Not even mostly wrong. Totally wrong, backwards.

Michael Crichton, in talking about the Gell-Mann Amnesia Effect said this:

“You open the newspaper to an article on some subject you know well. In Murray’s [Gell-Mann] case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the ‘wet streets cause rain’ stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate. You turn the page, and forget what you know.”

The headlines blaring about the “disconnect” between paper and physical silver have got it even worse than this. They are, in effect, saying “wet street caused sunshine!”

So What Happened?

Paper was bought up at a furious rate, by speculators using leverage. We assume that they are trying to front-run a GameStop-level gain of 12X.

Don’t believe what you read: that the price of physical silver has moved much higher than the price of paper. In fact, it’s the price of a futures contract which took off. When last we wrote (on Friday), the premium to buy a March futures contract, compared to spot silver, was 10 cents.

On Monday, this premium hit 50 cents, as we shall see below.

The conspiracy mongers prey on confusion between silver Eagles and spot silver. Retail customers often buy these coins. But coin manufacturing depends on tooling, which is inelastic. It does not increase its capacity when a million retail buyers read an article on Reddit. So the premium for minted silver products can skyrocket.

This is a premium on Eagles, not on silver metal per se.

The global silver market does not use a 1-ounce retail product as the benchmark of the price. Just like the global coffee market does not use a Starbucks mocha latte in Midtown as the benchmark.

Miners, refiners, financiers, manufacturers, and warehousemen do not deal in 1-ounce retail products. That would be like looking at the rising price of a cup of coffee in a town that is increasing its downtown zoning restrictions, restricting truck unloading hours, adding more taxes and regulations, and hiking its minimum wage… and thinking that the price of coffee beans in Colombia must be rising.

Looking at the Data

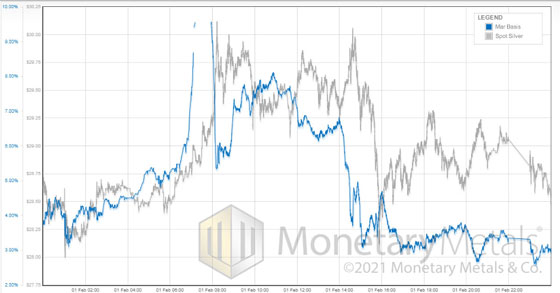

Here is a graph showing the premium of “paper silver” (i.e. silver futures) to spot silver (i.e. physical metal).

At the peak of the price madness, traders paid such a high premium for “paper” compared to spot that the March contract traded at an (annualized) 10% more than “phys”. That works out to around 50 cents. Now that you have seen this, you know that anyone telling you that metal trades at a premium to futures is either misinformed—or trying to misinform you.

Monetary Metals has the best data, and the best algorithms to remove noise and show the cleanest signal. It took years of careful research and development to create the software to produce these graphs, including a variety of disciplines – not just computer science and software engineering and economics, but also economics and of course gold and commodities markets. Anyone who would dismiss this graph is asking you to trust his feelings and ignore the data.

Note that there is some discontinuity for around an hour early Monday morning (times are GMT). This is not a period when the market is especially liquid, as only Asia is normally active at that hour. However, such was the frenzied pace of trading (mostly buying, obviously) that market makers could not keep up until things slowed down.

It is what it is. Don’t get mad at us, get mad at all the Reddit users who didn’t buy silver metal! Just kidding—it is what it is.

At the same time that the conspiracy mongers falsely assure you that the price of “phys” is divorcing to the upside from “paper”, they also mutter darkly about CME hiking margin to hold a futures contract. Margin is set based on volatility. If the price is moving 10% in a day, then there is a risk that the clearinghouse could go bankrupt. So they increase margin, which protects them from this risk. But also means that those buying with extreme leverage must reduce to a slightly-less extreme leverage. And thus sell futures contracts.

If “phys” was launching to da moon, while paper was dropping—why would this be a problem? Why would it matter, if they restrict the amount of paper that can be held with a minimal down payment? How would this affect the price of “phys”, which is divorcing from this paper?

There ought to be a term for when someone offers two arguments, without noticing that one contradicts the other. Either phys is divorcing from paper, or margin requirements for paper is hurting the price of phys. Pick one horse to ride, but not both!

Of course, there is a force, that keeps the prices of silver in the “phys” and “paper” markets tied together. That force is arbitrage. The arbitrageur is buying spot and selling futures like mad. How often do you get to pocket 50 free cents per ounce, just to warehouse silver for two months?

Source: Peter Epstein for Streetwise Reports 02/01/2021

Peter Epstein of Epstein Research presents his investment thesis for Blue Lagoon Resources, which has three projects.

The views expressed in the following article are solely that of its author, Peter Epstein. Any commentary by Mr. Epstein about potential mining activities or resource size are his opinions alone. All $ figures are C$, unless indicated otherwise. “Au” = gold, “Ag” = silver.

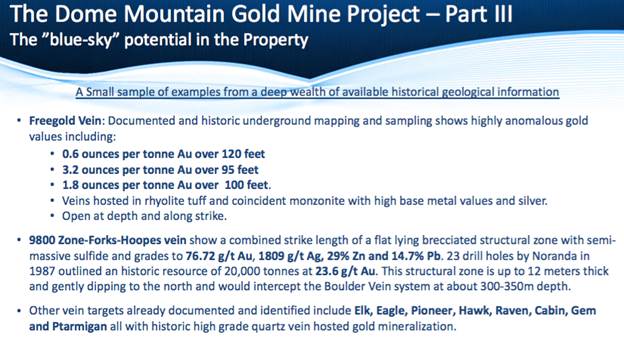

Blue Lagoon Resources (CSE: BLLG) / (OTCQB: BLAGF) recently announced its fall 2020 prospecting results, and importantly, the addition of a second drill rig to its largest ever 20,000+ meter program on the 18,935-hectare, Dome Mountain Gold-Silver project, (15 known high-grade vein systems, 20 km geological strike), 50 minutes from the storied mining town of Smithers, B.C.

The company has other meaningful assets, including the 100%-owned, 7,120 hectare Pellaire (Gold) and 4,810 hectare Big Onion (porphyry copper) projects. More on those later, as Dome Mountain is the main focus.

Over $100M (in today’s $) spent exploring just 10% of the Dome project…

In today’s dollars, over $100 million has been invested into exploration and development by serious companies including Noranda and Timmins. In 1987 Noranda outlined a resource of ~20k tonnes at 23.6 g/t gold (“Au”) [not NI 43-101 compliant], at the Forks target. That’s just one of 15 known vein systems on the property. Forks is ~500 meters south of the company’s existing resource of ~190k Au E. oz, at a weighted average grade of ~10.1 g/t.

Amazingly, decades of investment was directed at chasing the Boulder Vein system across just ~10% of the recently enlarged Dome Mountain project. Recently, for the first time, a property-wide airborne geophysics program was flown.

Five very attractive targets were readily identified, but the technical team is still analyzing the data and believes there’s probably a dozen or more.

Later this year, Dome Mountain could have line-of-sight to a high-grade resource approaching a million gold equivalent ounces. And, there would still be substantial blue-sky potential across the other 14 high-grade vein systems on the 18,935 ha footprint.

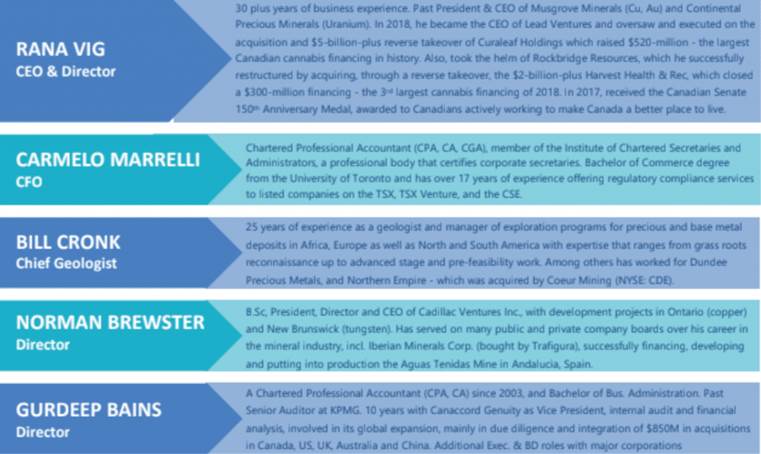

Consider this exclusive quote by CEO Rana Vig:

“Our approach to drilling the Dome property is two-fold. Firstly, from data we have, there’s a high degree of confidence that we can grow the resource on the Boulder Vein system by more than five times by following up on 2016 drilling, and drilling a known 800-meter extension to the west. That, and expanding upon the limited drilling done at depth — which is known to be high-grade...

…Secondly, we will chase substantial blue-sky potential by drilling some of the 15 known high-grade gold-silver vein systems, especially new targets recently identified by the first ever property-wide airborne survey. Regarding our ongoing drill program — visually we can see we’re hitting mineralization, but we won’t get any assays back until early March.“

As Mr. Vig points out, the area around the Boulder Vein system remains open at depth. Last year, hole DM-20-139 (drilled to ~600 m depth), intersected 3.1 m of 18.6 g/t Au Eq. from 335.5 to 338.6 m.

Most historical holes were half (or less) as deep. Finally, the resource was calculated with a 3.42 g/t gold cut-off grade. Lowering the cut-off (due to the higher Au/Ag prices) would increase the number of ounces.

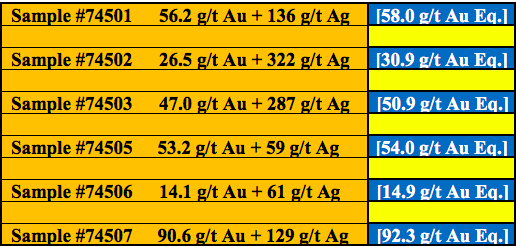

HIGHLIGHTS OF NEW ROCK SAMPLE DATA

Booked ounces are especially valuable at Dome Mountain because management can potentially start exploiting them by year-end. Blue Lagoon holds both an Environmental Management Act Permit, and a Mining Permit that, (with routine amendments and modest capital outlay in coming months), will allow for a 75k tonne/year operation. Neither permit has an expiration date. Dome Mountain could be the very next gold-silver mining operation in B.C.

CEO Vig believes this year will be another strong one for gold and silver prices. Many analysts see gold at $2,000–$2,400/oz. and silver at $34–$42/oz. in 2021-22. Yet, even at today’s price of ~$1,862/oz., Blue Lagoon is in fantastic shape—with an Enterprise Value (“EV”) {market cap + debt – cash} of $36 million and >$5 million in cash.

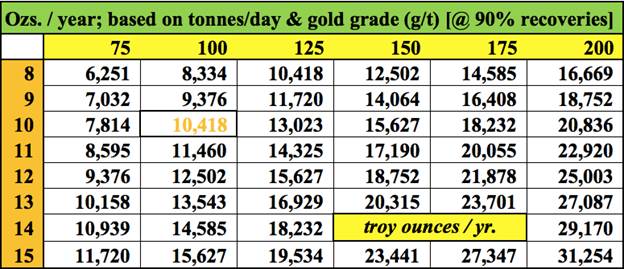

The chart below shows scenarios ranging from mining 75 to 200 tonnes/day at [Au Eq.] grades of 8 to 15 g/t. A run-rate of 9–12k oz/year could be achieved this year. By 1Q or 2Q 2022, management plans to have ramped up from 100 to 200 tpd. Depending on grade, that could mean a run-rate of 18–25k oz/year.

If achieved, millions of dollars in cash flow (after a profit split with B.C. mill owner and junior miner Nicola Mining), would fund a lot of exploration and development, while mitigating the need for private placements.

Small-scale production from Dome Mountain could start within a year!

I assumed a 90% mill recovery rate for both gold and silver. However, in 2016, 5,700 tonnes of Dome Mountain ore was processed through Nicola’s Mill. The average grade was 9 g/t gold equivalent. The gold recovery was 95%, silver about 85%. Since then, Nicola has reportedly improved its silver recovery to ~88–89% for mineralization like that found at Dome Mountain.

The 9 g/t bulk sample from 2016 compares to a reported 43,900 tonnes mined at 12 g/t, in the early 1990s. The project hosts roughly four ounces of silver for each ounce of gold.

Drilling is underway at Dome Mountain (20,000+ m) and will continue into the spring. Initial results are expected in early March. The technical team likes what they’re seeing, but grades cannot be estimated, we have to wait for assays.

A second drill rig has been deployed to follow-up on high-grade results in hole DM-20-114, which hit 107 g/t Au + 278 g/t Ag over 1.4 m (incl. 165.3 g/t Au + 398 g/t Ag over 0.7 m) at a depth of 69 m. That’s 1.4 m of 110.8 g/t Au Eq. found at

I believe Dome Mountain alone is worth well more than Blue Lagoon’s entire EV—especially if/when new discoveries are made. Dome is the type of project, (possibly large-scale, very high-grade, near-surface resource, with good regional infrastructure, in a great jurisdiction) that should attract mid-tier and major gold-silver producers.

Pellaire and Big Onion: two other meaningful and valuable projects

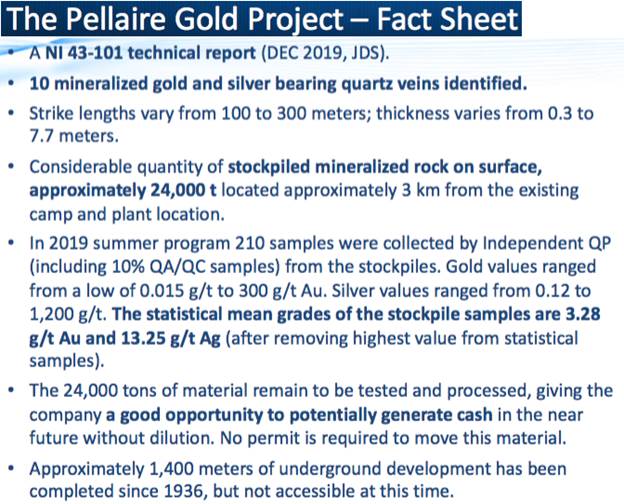

As great as the flagship Dome Mountain project is, two of the company’s other assets are quite compelling as well. The 100%-owned, 7,120 hectare Pellaire Gold project is 220 km due north of Vancouver. It contains at least 10 narrow high-grade, gold-bearing vein systems that outcrop at surface at an elevation of ~2,500 meters.

The camp and mill site are below at an elevation of ~1,690 meters. The project has ~1,300 meters of narrow underground workings from five historical surface adits. None of the underground workings is currently accessible.

Importantly, there’s ~24,000 tonnes of stockpiled material at Pellaire, (not waste or tailings, but ore) at an estimated grade of 5.5 g/t gold. This is a fairly straightforward, multimillion dollar cash flow opportunity (over a 5-6 month period) expected to start this summer.

For a variety of reasons, management believes there’s a chance that the 5.5 g/t grade assumption is too conservative, which could add a few million dollars to the operation. Cash from toll-milling the stockpile will be directed towards exploring the property’s high-grade vein systems.

According to prior studies, Pellaire’s metallurgy looks quite promising. For instance, a report by Ash Associates, in Oct. 1995 asserted,

“At the time of deposition, the mineralization of the Pellaire veins included significant sulfides and tellurides…. in this particular case — the sulfides and tellurides have been almost entirely leached out…. The absence of sulfides is an advantage, since high gold recoveries and low reagent usage tend to result from situations like this….”

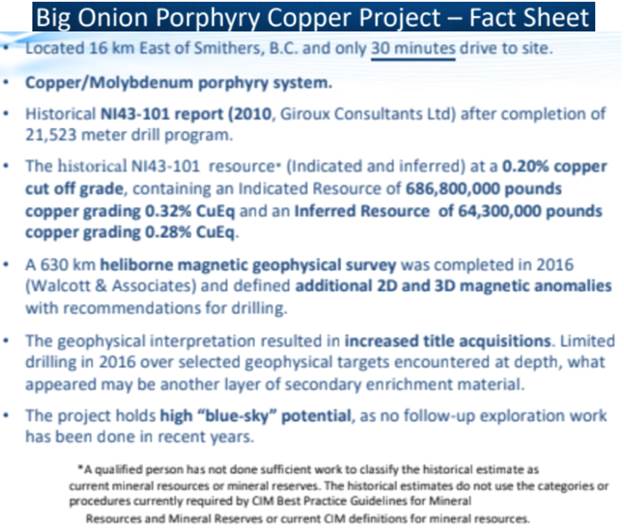

The 4,810 hectare Big Onion project has had 313 holes / 45,477 m drilled into it and has a historical (non NI 43-101 compliant) resource of >700M lb of copper (combined, Indicated + Inferred) at a grade of about 0.30% (+ some molybdenum). There are two large targets ready to drill.

Management believes there’s tremendous blue-sky potential to greatly expand the dimensions of the deposit, possibly up to 1 billion tonnes in this copper porphyry target. The historical resource is ~90M tonnes.

If the deposit is found to be much larger, (subject to more drilling) a higher cut-off grade could be used to demonstrate a fairly high grade (by porphyry-style standards) and fairly large (multi-billion pound) copper system.

Big Onion is very close to Dome Mountain. Management is working on many aspects of the two properties at the same time, saving time and money. As a promising copper porphyry target, Big Onion could attract companies that might not otherwise be interested in Blue Lagoon’s gold-silver heavy assets.

Copper offers excellent diversification from the company’s gold-silver focus. Copper is the best green energy / high-tech / battery metal, the only metal that benefits from growth in 1) renewable energy, 2) city-scale infrastructure builds and grid deployments, and 3) the EV revolution. Simply put, copper is absolutely crucial to global efforts to decarbonize the planet.

Conclusion

With Blue Lagoon, investors get three bites at the junior mining apple. This is a company with a strong management / technical team, and over $5 million in cash. Its flagship project Dome Mountain could have line-of-sight to 1 million high-grade gold equivalent ounces before too long. In my opinion, this alone in B.C., Canada, would be worth perhaps twice the company’s current Enterprise Value.

If there is a million ounces, as management envisions, that would mean the team’s understanding of structure and geology is sound, and that the project has good continuity—which could lead to a multi-million ounce, high-grade gold-silver deposit in 2022. Remember, it would cost over $100 million and take several years to replicate what has been done.

Both Pellaire and Big Onion are strong enough projects to be spun out into new entities. In my opinion, each could support market caps in the ten(s) of millions. Combined, Dome Mountain, Pellaire and Big Onion are worth A LOT more than Blue Lagoon Resources’ (CSE: BLLG) / (OTCQB: BLAGF) current valuation.

Blue Lagoon shares traded as high as $2.11 in early 2020, BEFORE management acquired Dome Mountain, and before a major move higher in gold and silver prices! There’s tremendous upside potential if management can execute on its plans this year.

{please watch short video clip on the Dome Mountain project}

The Company will evaluate a production decision once all permit requirements are in place. Any production decision in advance of obtaining a Feasibility Study, including mineral reserves demonstrating economic and technical viability of the project, is associated with increased uncertainty and risk of failure.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research[ER], (together, [ER]) about Blue Lagoon Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Blue Lagoon Resources was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: BLLG:CSE; BLAGF:OTCQB,

)

Source: Matt Badiali for Streetwise Reports 02/01/2021

Independent financial analyst Matt Badiali looks into Heliostar Metal’s recent drill results at its Alaska project.

I love field season.

Over the past fifteen years, I made it a point to get to as many projects as I can. I visited projects in New Guinea, Turkey, Haiti, Yukon Territory, Ireland, Mexico and the U.S. These days, I’m looking for quality projects to visit.

And I have my eye on one particular site right now.

It’s on an island in the Aleutians in Alaska called Unga. It’s the site of an old mining and fishing ghost town. It has Alaska’s first underground gold mine—the Apollo. They mined off the top of the ore, which had free gold. They simply crushed the rock and the gold fell out. But when they encountered more complex ore, the miners just walked away.

It’s a crazy story…and it’s just a small part of the story of Unga Island. Right now, a tiny junior miner, Heliostar Metals Ltd. (HSTR:TSX.V; RGCTF:OTC), owns the Unga Project. This company is new, it formed in October 2020 from a merger. The story isn’t widely known…yet.

But recent results from Unga started to get investors’ attention. You can see what I mean from the chart below:

The company just put out excellent drill results from last fall’s drilling. But slow assay labs continue to plague most of the juniors right now.

On January 25h, the company announced that the results from the first two holes (of a nine-hole program) came in. And they both hit high-grade gold, as you can see below:

- SH20-01A: 7.74 grams per tonne (g/t) gold and 27.0 g/t silver over 11.65 meters (m) from 12.95 m downhole. That includes 16.06 g/t gold and 37.7 g/t silver over 4.0 m from 12.95 m downhole.

- SH20-02: 18.66 g/t gold and 11.5 g/t silver over 1.98 m from 50.75 m downhole.

Those are excellent intersections of high-grade gold. While those aren’t the true widths, they definitely increase the existing gold resource at the SH-1 target. There’s an existing high-grade Inferred resource of 384,318 ounces at 13.8 g/t gold.

And there are seven more drill holes left, sitting at the assay office.

As I said, Unga is loaded with potential. SH-1 is just one of many epithermal gold targets along the 8.4 km-long Shumagin fault corridor on Unga. Historical reports from the U.S. Geological Survey describe this area as a geologist’s dream. And Heliostar’s technical team think it’s a text-book epithermal gold complex.

That’s why I added Unga Island to my bucket list of projects to visit. If they keep up the drilling success, it will be the site of a major new high-grade gold discovery. That’s what I’d really like to see.

Good Investing,

–Matt Badiali

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Heliostar Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: I am a consultant to Heliostar Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: HSTR:TSX.V; RGCTF:OTC,

)

A Silver Squeeze and the SLV ETF

Source: Ron Struthers for Streetwise Reports 02/01/2021

Ron Struthers of Struthers Resource Stock Report delves into what’s going on in the silver market right now and discusses a handful of silver companies on his radar screen.

It appears silver is in a new uptrend with support from the longer term up trend channel. Silver should test recent highs, so is doing much better than gold. A close at $29 or higher would signal a breakout. There is a lot of scuttle but and rumors out there about the Reddit and Robinhood (Wallstreetbets) gang piling into silver and causing the greatest short squeeze of all time. JP Morgan has been known to have a large short position for a long time, but has covered its short position, according to Ted Butler who has been following this topic for years. However, many other banksters are still short. Last September JP Morgan was fined almost $1 billion for precious metals manipulation. JP Morgan is the custodian for physical silver in the iShares Silver Trust (SLV) ETF.

Thursday and Friday saw volume increases in many silver investments, including a big jump in volume on the silver ETF SLV. Whether driven by rumor or the Reddit army actually coming in, their plan is severely flawed. Their plan from a number of internet postings is to create huge buying volume into the ETF to drive silver prices higher.

This article suggests Wallstreetbets has started their move into silver.

It just so happens the SLV ETF posted a share prospectus on January 13. It looks like great timing to protect their butt. Below is some of the highlights in the prospectus, the bold highlighting is their doing.

“The Trust intends to issue Shares on a continuous basis. The Trust issues and redeems Shares only in blocks of 50,000 or integral multiples thereof. A block of 50,000 Shares is called a “Basket.” These transactions take place in exchange for silver. Only registered broker-dealers that become authorized participants by entering into a contract with the Sponsor and the Trustee (“Authorized Participants”) may purchase or redeem Baskets. Shares are created to reflect, at any given time, the market price of silver owned by the Trust at that time less the Trust’s expenses and liabilities.”

A short squeeze is not possible on the ETF because an unlimited amount of shares can be created. If these buyers believe that JP Morgan will be forced to buy more silver because of the rising demand in the ETF, they have all kinds of outs as reported in the prospectus.

“The Trustee may suspend the delivery or registration of transfers of Shares, or may refuse a particular deposit or transfer at any time, if the Trustee or the Sponsor think it advisable for any reason. Redemptions may be suspended only (i) during any period in which regular trading on NYSE Arca is suspended or restricted, or the exchange is closed, or (ii) during an emergency as a result of which delivery, disposal or evaluation of silver is not reasonably practicable.

If the process of creation and redemption of Baskets encounters any unanticipated difficulties or is materially restricted due to any illiquidity in the market for physical silver, the possibility for arbitrage transactions by Authorized Participants, intended to keep the price of the Shares closely linked to the price of silver may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV

The COVID-19 outbreak will have serious negative effects on social, economic and financial systems, including significant uncertainty and volatility in the financial markets. For instance, the suspension of operations of mines, refineries and vaults that extract, produce or store silver, restrictions on travel that delay or prevent the transportation of silver, and an increase in demand for silver may disrupt supply chains for silver, which could cause secondary market spreads to widen and compromise our ability to settle transactions on time. Any inability of the Trust to issue or redeem Shares or the Custodian or any subcustodian to receive or deliver silver as a result of the outbreak will negatively affect the Trust’s operations.

The Sponsor and its affiliates manage other accounts, funds or trusts, including those that invest in physical silver bullion or other precious metals, and conflicts of interest may occur, which may reduce the value of the net assets of the Trust, the NAV and the trading price of the Shares.

Furthermore, although the Custodian is generally regulated in the UK by the Prudential Regulatory Authority and the Financial Conduct Authority, such regulations do not directly cover the Custodian’s silver bullion custody operations in the UK. Accordingly, the Trust is dependent on the Custodian to comply with the best practices of the LBMA and to implement satisfactory internal controls for its silver bullion custody operations in order to keep the Trust’s silver bullion secure.

Silver transferred to the Trust in connection with the creation of Baskets may not be of the quality required under the Trust Agreement. The Trust will sustain a loss if the Trustee issues Shares in exchange for silver of inferior quality and that loss will adversely affect the value of all existing Shares.

Share Splits

If the Sponsor believes that the per Share price in the secondary market for Shares has fallen outside a desirable trading price range or if the Sponsor determines that it is advisable for any reason, the Sponsor may cause the Trust to declare a split or reverse split in the number of Shares outstanding and to make a corresponding change in the number of Shares constituting a Basket.”

As you can see JP Morgan has all kinds of outs from actually purchasing physical silver if you trust them in the first place. Ultimately as highlighted below, this ETF could just blow up and even be terminated.

“Authorized Participants with large holdings may choose to terminate the Trust. Holders of 75% of the Shares have the power to terminate the Trust. This power may be exercised by a relatively small number of holders. If it is so exercised, investors who wished to continue to invest in silver through the vehicle of the Trust will have to find another vehicle, and may not be able to find another vehicle that offers the same features as the Trust.”

The volatility could just cause it to blow up like the NUGT ETF last March. NUGT is supposes to be 2X the GDX and you can see it turned into 1/2 times.

Investors that bought GDX have a +60% gain while those in NUGT have a -30% loss over the shown time frame.

As of the close of business on January 13, 2021, the net asset value of the SLV Trust was $14,091,710,671 and the NAV was $23.54. Gamestop (GME) has traded twice this valuation and more in a single trading day.

The Wallstreetbets crowd could cause volatility and another likely outcome is a spillover into silver related stocks, the silver miners. I would avoid the SLV ETF. I prefer the Sprott Physical Gold and Silver Trust (CEF). It is 50/50 gold and silver. For a pure silver play, the Sprott Physical Silver Trust (PSLV). Before I get into some of the silver stocks, more on the silver metal itself.

Silver is a very unique metal. It is considered a precious metal and often referred to as “poor man gold.” I consider it a distant second to gold as a precious metal, but silver’s strong industrial demand is an advantage it has over gold. The other unique thing about silver is it’s very small market size. The Silver Institute is projecting mine supply for 2020 at 790.8 million ounces, which is eight year lows. At current prices around $25 this annual production is valued around $20 billion. Just one stock, Apple (AAPL) is valued 100 times higher. This very small market presents a challenge for investors because you will not find many $1 billion plus liquid investments.

Next, let’s look at the industrial demand. For investors this makes the silver market much less liquid and why there are high premiums on silver coins. So much silver is off the market lying in silver panels, jewelry and silverware.

Silver in solar panels grew 7% in 2019 to its second highest annual level ever. With a Biden victory, The Green New Deal is back in play so solar and consequently silver is in the limelight.

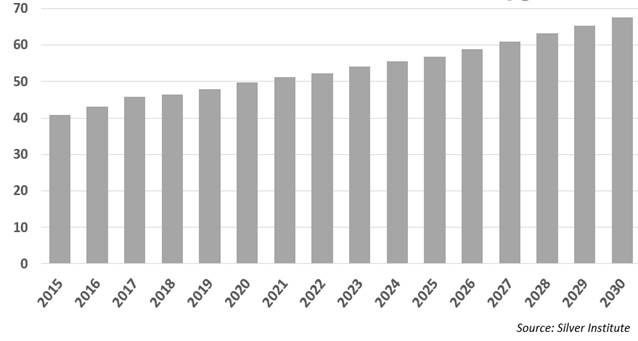

Silver is the best conductor of electricity and is in high demand with the electrification in the auto industry. Projections in the chart below show a steady increase into 2030.

Silver is known as poor man’s gold because it often runs up in price with gold and was once extensively used in coinage around the world. Currently the gold to silver ratio just came off historical highs and today is around 73, shown in this next chart.

Silver is more difficult to analyze than gold because gold has almost no uses except as money. (Gold is widely used in jewelry, but I consider gold jewelry a hard asset, what I call “wearable wealth.”)

Silver, has many industrial applications and is both a true commodity and a form of money. This means that the price of silver may rise or fall based on industrial use, but can also be influenced by monetary factors such as inflation, deflation and interest rates. Silver will always be a form of money. I have been commenting that all the recent money printing and more so under the Biden administration, that confidence will erode in central bank money. Investors and savers will increasingly turn to physical money (gold and silver) and non-central bank digital money (Bitcoin and other cryptocurrencies) as stores of wealth and a medium of exchange.

The issue for silver investors is the lack of highly liquid, $billion companies. Some favorites in the past like Hecla (HL) and Coeur Mining (CDE) are really more so gold miners. Coeur’s revenue from silver is only about 27% of revenue, the rest is gold, according to its Q3 report. Hecla is has a better silver to gold ratio, with about 48% of revenues from silver over 9 months according to its Q3 report and using today’s metal prices. Pan American Silver (PAAS) has only about 31% of revenue from silver according to its production numbers in its Q3 report and using its realized gold and silver prices.

The best leverage to silver for a major miner is First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) with a market cap last Friday of US$4 billion. According to its presentation, 65% of revenue is from silver and 35% from gold.

I have already suggested First Majestic and it is up substantially. The stock had a nice move in the last few days to $17.86 from $14. It could be attributed to increased interest with the Wallstreetbets news, but there was another development with First Majestic last week: its mines are in Mexico and for some time the company has been in dispute with the government over tax rates.

Bloomberg reported that First Majestic won a reprieve on criminal tax fraud charges in initial Mexican court hearings .A judge in Mexico City declined to charge the Canadian mining company with criminal tax fraud, said the people, who spoke on condition of anonymity as the matter is private. Prosecutors can still return to court and present additional evidence. One of the people said the judge delayed ruling until an audit by Mexico’s tax authority was finished and that the judge hadn’t ruled yet on the evidence presented in the case.

First Majestic has 146.5 million ounces silver equivalent in the Proven and Probable category plus 267.8 million ounces silver equivalent (M&I) Measured and Indicated Resources. The total is 414.3 million. Market cap at 222 million shares X $18.12 = $4.022 billion, less $238 million cash, plus $140 million debt cash gives a rough EV per silver ounce of $9.50.

This next graphic is from First Majestic’s presentation. It shows that BMO’s silver report is predicting 70% revenues from silver for First Majestic. It is also a good comparison to other silver producers.

The stock broke out above resistance Thursday/Friday. A short squeeze might also be in play here. Shortsqueeze reports the last short position at 45.8 million shares.

Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE) is worth a look and will trade with the silver price.

The company has Proven and Probable reserves of 82 million ounces silver equivalent plus 43.6 million ounces M&I for a total of 125.6 million ounces. There are 157 million shares out X $4.95 = $777 million market cap less $45 million cash, plus $7 million debt for a rough EV per ounce of $5.90.

Endeavour is valued cheaper than First Majestic on a per ounce basis but is a much smaller producer. Endeavour achieved its 2020 production guidance with 6.5 million ounces silver equivalent produced.

First Majestic produced 25.6 million ounces in 2019 and it looks like it will come in around 20 million ounces for 2020, a drop due to Covid-19 mine shutdowns.

Near term I prefer First Majestic because the break out on the chart and the large short position. The company provided this chart in its presentation that shows the large increase in the short position. I noted the 45.8 million shorts reported on the U.S. side and when we add in the 4.1 million shorts reported on Toronto, the total is almost 50 million for the period to January 15.

I am avoiding Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE) with a market cap around US$1.1 billion. All its production is in China. Relations are on the decline between China and Canada as well as the U.S. Recently in December Canada blocked a Chinese takeover of a gold mine in Nunavut, Canada.

Next is to explore further down the chain to the silver developers and explorers.

I have already presented Blackrock Gold Corp. (BRC:TSX.V; BKRRF:OTCMKTS), so this is some follow up developments. Despite its name, the company ended up discovering a high grade silver discovery in Nevada. Here are some recent drill results from its Tonopah West project in the Walker Lane Trend:

- Jan 14, 2021, news – TW20-061C cut 18.5 meters grading 295 g/t Ag Eq (142 g/t silver and 1.54 g/t gold) which included 1.52 meters of 1,791 g/t Ag Eq (808 g/t silver and 9.83 g/t gold)(Ag/Au = 100:1);

- and TW20-041C cut 3.11 meters grading 386 g/t Ag Eq (198 g/t silver and 1.88 g/t gold), including 0.31 meters of 1,121 g/t Ag Eq (571 g/t silver and 5.5 g/t gold);

- December 3, 2020 news – TW20-037 cut 3 meters returning 10.5 g/t gold and 1,188 g/t silver or 2,238 g/t Ag Eq along the Merton vein and indicates 290 meters of dip potential. Silver–gold ratio is 100:1 using a 200 g/t Ag Eq cut-off grade;

- and TW20-027 drilled 12.2 meters grading 297 g/t Ag Eq at Bermuda-Merton vein intersection;

- and TW20-022 intersected 4.5 meters grading 285 g/t Ag Eq on the Paymaster vein.

There was significant news on December 18 when Summa Silver Corp. (SSVR:TSX.V; SSVRF:OTC) reported results of core drilling along the eastern border of the Tonopah West project. It shows the Victor vein extends 480 meters to the east. Summa Silver’s drilling along strike of the Victor/Murray vein adjacent to Blackrock’s eastern border returned 1,079 g/t Ag Eq (5.19 g/t Au and 560 g/t Ag; Au/Ag=100/1) over a 0.9 meter interval in SUM20-17 (see Summa Silver (CSE: SSVR) news release December 17, 2020). Additional reported intercepts from Summa Silver in the Victor/Murray zone included 582 g/t Ag Eq (2.41 g/t Au and 341 g/t Ag) over 0.7 meters and 6.8 meters grading 212, which included a high interval 0.8 meters of 727 g/t Ag Eq (3.56 g/t Au and 371 g/t Ag).

These drill intercepts confirm the Victor/Murray vein system extends to the eastern border of the Tonopah West project giving an additional 480 meters of strike on Blackrock’s project. Blackrock is awaiting additional assays from further drill holes from this target area. This property and drill map of Blackrock’s project gives a good picture of its recent drilling. I pasted in a red arrow to point out the direction of Summa Silver’s recent drill hit.

This graphic is from Summa’s presentation and gives a better representation of their relevance to Blackrock Gold. I highlighted Summa’s relevant drilling with the red circle.

Summa Silver is a worthy silver play but the company is less advanced than Blackrock. It is not as well financed and the liquidity on the stock is far less. Junior exploration companies have to continue to raise cash because they have no cash flow. This is a risk factor with these exploration stocks, so their cash levels and finance ability are important. Blackrock’s last financial statements ending July 31,2020, reveal $10.7 million in cash and no long term debt. Furthermore, it just announced a $7 million bought deal financing with Red Cloud Securities that was increased to $9 million last Friday. Famed billionaire Eric Sprott, who is known to be very bullish on silver, is a major shareholder. Most liquidity for the stock is on the TSX.V, symbol BRC where it traded 2.3 million shares on Friday.

The stock has corrected a long way from its peak and has mostly filled the gap from last July. It has recently bounced off of support and I see as a good buy near recent lows. A close above $1.10 will confirm a new uptrend.

Another silver company I have followed for many years and is approaching the mine development stage is Discovery Metals Ltd. (DSV:TSX.V; DSVMF:OTCQX). The company was formerly known as Levon Resources and I had known CEO Ron Tremblay for many years. Sadly he passed away in March 2019. Subsequently Levon was combined with Discovery Metals in May 2019.

Discovery’s flagship project is its 100%-owned Cordero silver project in Chihuahua state, Mexico. The company’s drill results to date show that Cordero is developing all the attributes of a Tier 1 project—grade, scale, significant organic growth opportunities and well located in one of Mexico’s premier mining belts. The 43-101 resource in 2018 came in at 407,761,000 ounces silver Indicated with 8 billion pounds of zinc, 3.7 billion pounds lead and 1.27 million ounces of gold. This is a massive deposit at 1.5 billion ounces silver equivalent (Ag Eq) at a cutoff grade of 40 g/t Ag Eq, hence the high leverage to silver. I often commented in the past that Discovery has the largest leverage to the silver price and I still believe that today. That said, the company is progressing with a higher grade portion of the project.

Shares outstanding 307 million.

- Founders/Management 11%

- Eric Sprott 27% (his largest silver related holding)

- Institutions 28%

This slide from its presentation shows its focus to a higher grade portion of the project.

Discovery Metals outlined its 2021 work program and budget for its Cordero project, Mexico, in a January 19 press release. Taj Singh, president and chief executive officer, stated: “We anticipate 2021 will be a transformative year where we firmly establish Cordero as one of the few silver projects globally that offers margin, size and scaleability. Our focus is to both derisk the project by delivering a technically robust PEA [preliminary economic assessment] and to deliver resource growth by expanding known zones and making new discoveries. We plan to complete 66,000 meters of drilling.”

“Other key project development milestones for 021 include completion of social baseline assessment and progress on environmental baseline studies. Our planned work for metallurgy, processing, geotech and hydrology will go above and beyond what is typically included in a PEA study and will identify areas where we can accelerate prefeasibility work.

“Our current cash balance of approximately $82-million places us in a very strong position to fund our planned expenditures at Cordero this year of approximately $26-million.”

2021 drill plans

The company plans on completing 66,000 meters of drilling in 2021 based on four drill rigs operating throughout the year. This program and the number of drill rigs may be expanded when the company is confident that the health and safety risks related to COVID-19 can be managed effectively. This next slide from its presentation highlights the high grade area it will focus on. A central portion of this could be a high grade starter pit.

At C$1.85 close on Friday, the market cap is about C$568 million. Less $82 million cash, the EV per ounce of silver equivalent is around C$0.32 or around US$0.25 per ounce. This is very low because of the low grade of many of these ounces. If silver were to climb to $40 or more, suddenly a lot more ounces become economic. The project is also sensitive to zinc, that has increased to about $1.20 pound from $0.80 in March 2020.

This chart is in $Canadian where most volume trades under symbol DSV. The stock responded very well to silver’s rise in July. There was a healthy correction and a new up trend is underway. I am looking for the stock to test old highs over $2.50. A drop below $1.50 would be bearish.

Conclusion

I believe the silver ETF SLV is not a good way to play a rise in silver prices. The silver market is very small and a considerable amount of buying could absorb much or all of the physical metal. How SLV would respond if it cannot obtain and back the trust with physical metal is unknown and a considerable risk. Sprott’s PSLV trust does not automatically issue shares, but could do so at its discretion when physical metal can be obtained. They initiated at-the-market equity programs in Canada and the United States; Sprott (as the manager of the Trust) and the Trust entered into an amended and restated sales agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. At its discretion it could issue shares for aggregate gross proceeds to the Trust of up to $1,218,630,164.

First Majestic offers the leverage of a silver producer, is very liquid and has the added enhancement of a possible short squeeze.

Blackrock offers investors a possible high beta return because of the very high grade of their silver discovery. Discovery Metals offers high leverage to rising silver prices because of the low grade nature of a many of the silver ounces in their deposit.

First Majestic and Discovery Metals operate in Mexico, so there is some country related risk. Mexico is well known as a favorable country for mining and has deemed mining essential under Covid-19 protocols. Blackrock operates in Nevada, probably one of the best precious metal jurisdictions in the world.

Ron Struthers founded Struthers’ Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 – $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Sprott Central Fund CEF, First Majestic, Blackrock Gold and Discovery Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Blackrock Gold is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver, a company mentioned in this article.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

( Companies Mentioned: BRC:TSX.V; BKRRF:OTCMKTS,

DSV:TSX.V DSVMF:OTCQX,

EDR:TSX; EXK:NYSE; EJD:FSE,

FR:TSX; AG:NYSE; FMV:FSE,

SVM:TSX; SVM:NYSE,

SSVR:TSX.V; SSVRF:OTC,

)

Total gold supply fell 4% year-on-year in 2020 to 4,644 tons. It was the largest annual decline since 2013, according to data from the World Gold Council. The decline was primarily driven by disruptions in mine production due to the COVID-19 pandemic. Gold mine output fell 4% on the year. More significantly, it marked the […]

The post Blog first appeared on SchiffGold.