Endeavour Silv…

Fri, 02/05/2021 – 12:37

Month: February 2021

U.S. commodities regulator monitoring silver markets activity: acting chairman

https://mobile.reuters.com/article/amp/idUSKBN2A13PO?__twitter_impressi…

SilverSeek.com

Mon, 02/01/2021 – 17:59

Can The Big Silver Shorts Be Squeezed?

David Kranzler

Mon, 02/01/2021 – 16:44

https://www.cnbc.com/2021/01/31/silver-futures-jump-7percent-as-reddit-…

SilverSeek.com

Mon, 02/01/2021 – 16:42

SilverSeek.com

Mon, 02/01/2021 – 16:34

- Reddit Not The Key Driver Of Higher Silver Prices, Analyst Says Forbes

- Silver Prices Surge to Eight-Year High Amid Reddit-Fueled Frenzy Bloomberg

- Silver price reaches eight-year high as small investors snap it up The Guardian

- Silver price hits eight-year high; Robinhood raises another $2.4bn – as it happened The Guardian

- Silver is the new GameStop: Price reaches highest level in almost 11 years NBC News

- View Full Coverage on Google News

Bloomberg/Saleha Mohsin and Liz McCormick/1-28-2021

“For Yellen, who this month set herself apart from previous Democratic administrations by rejecting a return to a ‘strong dollar’ policy, that could pose a challenge.”

USAGOLD note: The challenge posed in this article is a global currency war, a phenomenon likely to simultaneously drive up gold demand wherever the battle lines happen to be drawn. In 2020, as shown in the chart below, gold rose significantly in every major currency, including the U.S. dollar.

Chart courtesy of TradingView.com • • • Click to enlarge

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

A disappointment of growth and disinflation

Real Investment Advice/Lance Roberts/1-29-2021

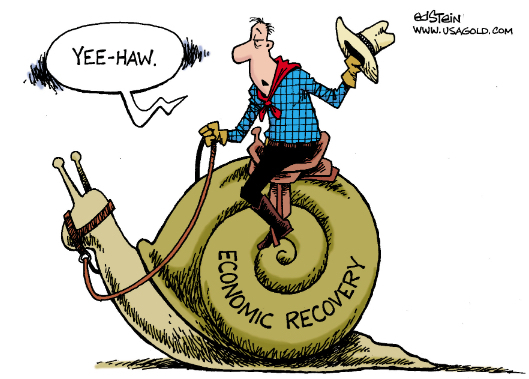

“As we head into 2021, there is a large consensus that the massive monetary interventions in 2020 will lead to an explosion of economic growth, inflation, and higher interest rates. We suspect that the outcome of more debt-driven spending will lead to a disappointment in growth and disinflation instead.”

“As we head into 2021, there is a large consensus that the massive monetary interventions in 2020 will lead to an explosion of economic growth, inflation, and higher interest rates. We suspect that the outcome of more debt-driven spending will lead to a disappointment in growth and disinflation instead.”

USAGOLD note: When the history is written on this era, the Fed’s inability to spur borrowing and inflation on Main Street likely will be recorded as its greatest failure. It is not enough to print money that goes no further than Wall Street, and its stock and bond markets. The Fed is well aware of this shortcoming, but at a total loss as to what should be done about it. “We fear,” writes Roberts, “the ongoing policies will continue to lead to further social instability and populism. Such has been the result in every other country which has run such programs of unbridled debts and deficits.” In short, the same old same old ……

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.