Chris Marchese

Mon, 03/15/2021 – 12:24

Month: March 2021

What’s the real price of gold?

Daily Reckoning/James Rickards/3-2-2021

“I’m looking at a trading screen right now, and it displays a price of $1,733.80 per ounce. That price may change a bit by the time you read this, but it would only take a fresh glance at the screen to get the new price. Case closed. … If only things were that simple. They’re not. In fact, establishing prices for gold and silver is far more difficult than it sounds. Further, the different prices on offer and the reasons for those differences can tell us a lot about what’s going on right now in precious metals markets.”

“I’m looking at a trading screen right now, and it displays a price of $1,733.80 per ounce. That price may change a bit by the time you read this, but it would only take a fresh glance at the screen to get the new price. Case closed. … If only things were that simple. They’re not. In fact, establishing prices for gold and silver is far more difficult than it sounds. Further, the different prices on offer and the reasons for those differences can tell us a lot about what’s going on right now in precious metals markets.”

USAGOLD note: At times like these when demand for physical metal is running through the roof and the price remains ring-fenced, investors wonder why the price isn’t flying wingman to demand. Rickards explains why in this analysis that will be particular interest to newcomers to the gold and silver markets. “The cost of owning bullion coins or bars you can hold in your hand,” he says, “is materially higher than the official “prices” you see listed on the exchanges. That tells you that actual bullion is considerably more scarce than paper bullion.”

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Let the facts speak

Credit Bubble Bulletin/Doug Noland/3-12-2021

“I received a friendly email a few weeks back from a reader inquiring whether my analysis is Fact or opinion. Well, it’s my opinion that the world is in the ‘Terminal Phase’ of history’s greatest Credit Bubble. It is opinion that U.S. and global equities markets are historic speculative Bubbles, fueled by runaway Monetary Inflation and Acute Monetary Disorder. It’s my opinion that markets in U.S. stocks, cryptocurrencies, corporate Credit and derivatives have evolved into full-fledged manias. It’s certainly my opinion that this all ends very badly.

“I received a friendly email a few weeks back from a reader inquiring whether my analysis is Fact or opinion. Well, it’s my opinion that the world is in the ‘Terminal Phase’ of history’s greatest Credit Bubble. It is opinion that U.S. and global equities markets are historic speculative Bubbles, fueled by runaway Monetary Inflation and Acute Monetary Disorder. It’s my opinion that markets in U.S. stocks, cryptocurrencies, corporate Credit and derivatives have evolved into full-fledged manias. It’s certainly my opinion that this all ends very badly.

But this week’s CBB is about Facts rather than opinion. History informs us that money and Credit are critically important – ignore their disorder at your own peril (policymakers at all our peril). That’s a Fact. The Fed’s Z.1 “flow of funds” report is our quarterly glimpse at Credit and financial developments – where “the rubber meets the road”. As far as I’m concerned, the Facts Speak for themselves. It was another quarter that corroborates Bubble Analysis. Facts provide the foundation for my analysis and opinions, and Z.1 data reflect monetary inflation spiraling out of control.”

USAGOLD note: Noland visits the facts behind the opinion (stated above) – an opinion, by the way, with which a good many of our readers would agree.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Many investors sense that the country, and the world, has drifted into uncharted territory.

The last year has been extraordinary. There have been COVID lockdowns, a disputed presidential election, and multi-trillion-dollar federal deficits and bailouts. The Federal Reserve has injected more money into markets than ever before.

This insanity showed up in the physical gold and silver markets.

Bullion dealers have spent much of the past year fighting to get inventory, because investment demand for coins, bars, and rounds has never been higher.

The frustration, for both seasoned metals investors and a whole lot of newcomers, is the demand hasn’t been fully reflected in the price. Yes, silver prices have showed strength. But silver has underperformed commodities such as lumber.

The disconnect between physical demand and the spot market price of metals has never been more obvious than over the past month. The COMEX inventory of “registered” silver bars continues to fall. Yet the spot price remains capped.

Last year’s finale in criminal prosecution of JPMorgan Chase, and the billion-dollar fine, apparently changed nothing. The bullion banks and other big-money players seem to have been given carte-blanche to cheat and swindle those still daring enough to speculate in the futures markets.

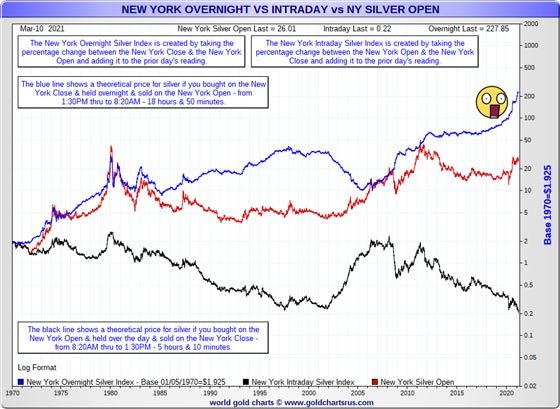

Below is a picture that tells a remarkable story of price suppression over several decades. It’s worth 1000 words to anyone except for CFTC bureaucrats hoping for a high paying job on Wall Street.

As shown by the blue line, a theoretical investor who bought at the close of trading in New York, held overnight, and sold at the New York opening price would have enjoyed tremendous gains relative to anyone who simply bought and held.

Doing the opposite is shown by the black line. Owning silver only while the New York trading markets are open would have been financially disastrous.

This sort of price behavior would seem impossible in any free, or fair, market. The fundamentals behind precious metals aren’t reflected in a futures market that is dominated by banks who create paper silver supply during prime market hours and absorb much of the demand.

This swindle will continue until a critical mass of people trading in futures realize they likely can’t get delivery of actual metal. That day remains somewhere in the future.

Despite the diminishing stockpiles and the scores of claims against each ounce of silver available, most contract holders still think that bit of paper they hold is a reasonable proxy for the metal itself.

When that day finally arrives, we can foresee a couple of possible outcomes. The price of paper metal may be allowed to explode high enough to balance physical supply and demand.

Or investors will recognize the futures market is a rigged casino and abandon it altogether. If this happens, the price of metal promised on a contract in which few people have any confidence, will be increasingly irrelevant.

The real price of gold and silver will ultimately be set in physical markets.

Just five months into fiscal 2021, the US government has already run a budget deficit of over $1 trillion. In a year of massive deficits, the US federal government charted its biggest monthly shortfall of fiscal year 2021 in February. According to the Monthly Treasury Statement, the February deficit came in at $310.92 billion, pushing […]

The post Blog first appeared on SchiffGold.