Source: Rick Mills for Streetwise Reports 03/08/2021

Rick Mills of Ahead of the Herd delves into the investment metrics of the silver market and explains why he thinks Dolly Varden’s prospect is a good bet.

“Native silver,” found in the Earth’s crust on its own, is relatively rare. More commonly, it is mined alongside gold, or as a byproduct of zinc-lead ore. There are currently only 75 “pure play” silver companies, most of whom have projects in Chile, Argentina, Mexico and Peru.

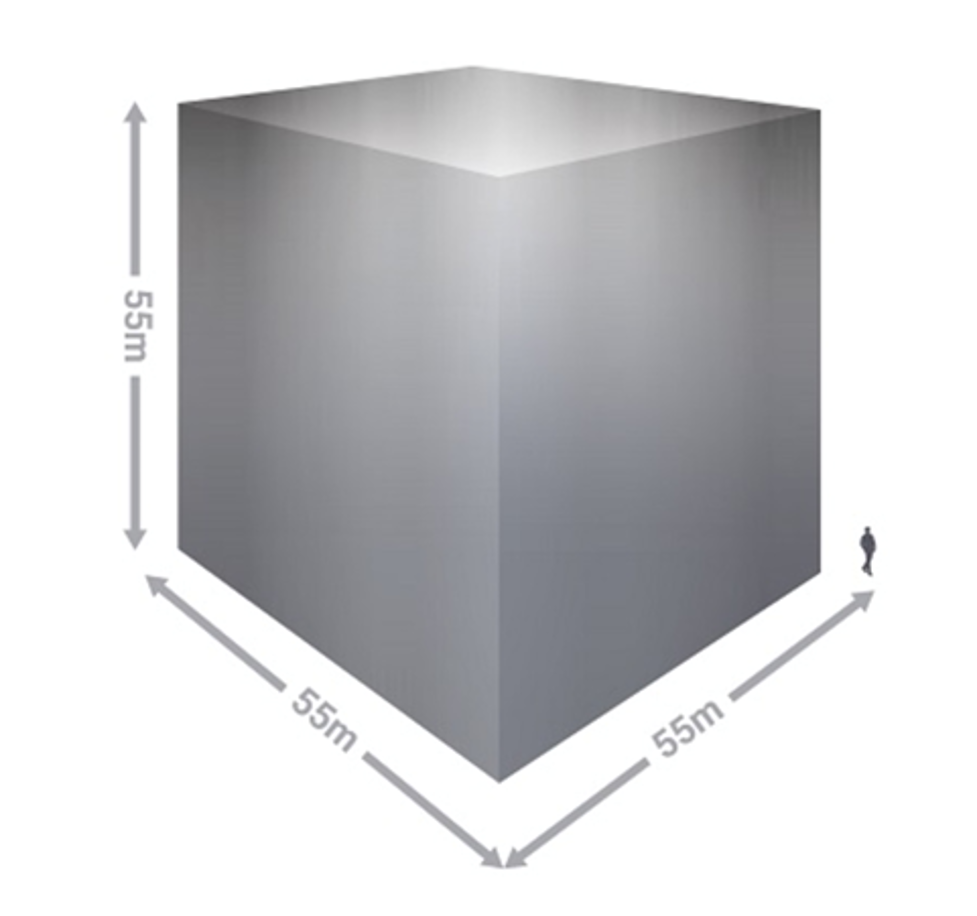

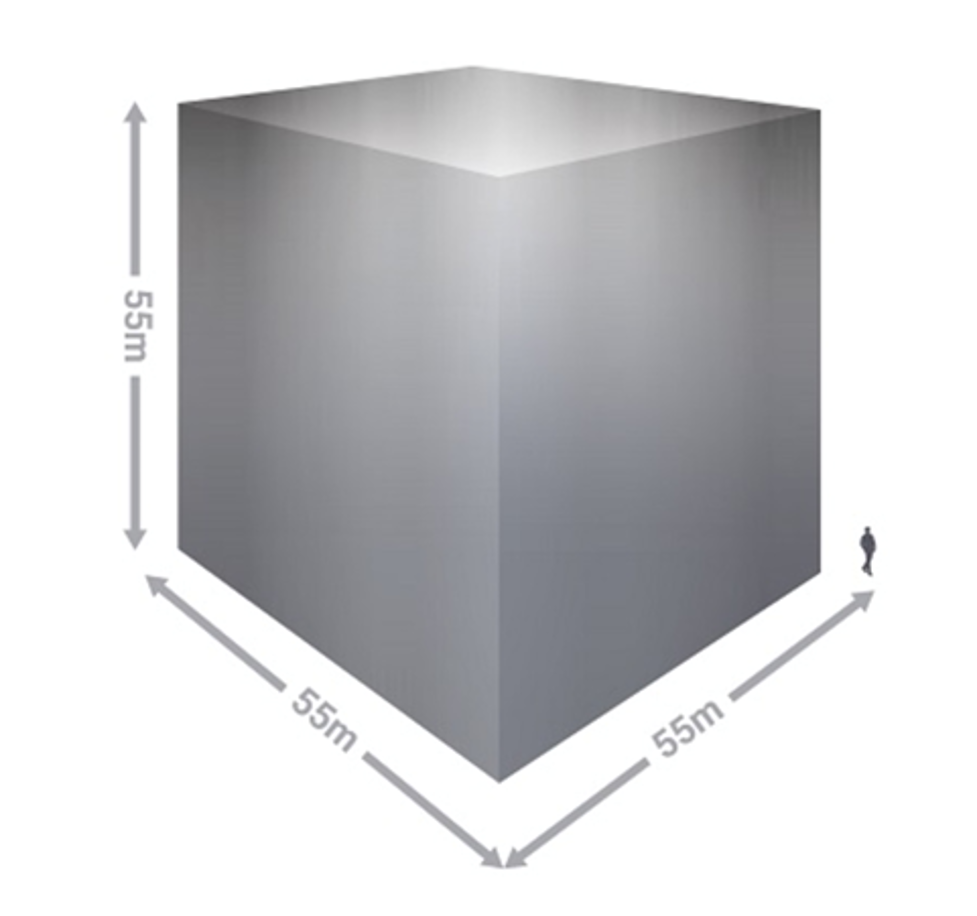

The rarity of silver and gold becomes apparent when we consider how little of both have been mined throughout history—just 190,000 tonnes of gold and 1.6 million tonnes of silver. Or, in ounce (oz) terms, 6.1 billion oz of gold and 51.3 billion oz of silver. All the gold ever mined in the world could fit into a cube 21.6 meters on each side, and all the above-ground silver could fit into a 55m cube.

All of the above-ground silver could fit into a 55-meter cube.

While most of the world’s mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated that 60% of silver is utilized in industrial applications, leaving only 40% for investing. Of the 60% used for industrial applications, almost 80% ends up in landfills.

Despite silver being about 17.5 times more plentiful than gold in the Earth’s crust, silver and gold have roughly the same amount, ~2.5 billion ounces, available for investment purposes. However, since very little gold is used by industry, it trades as an investment commodity—prices moving up and down in relation to factors like the U.S. dollar, inflation, interest rates and sovereign bond yields.

In comparison, silver commands a relatively small amount for investment, just 40% of supply. Because over half of supply is needed for industrial applications, silver trades more like an industrial metal than an investment commodity.

This also explains silver’s volatility. Because the investment market for silver is so small (60% is locked up in industrial uses) prices swing up and down wildly, at relatively low volumes. For this reason, investors nicknamed silver “the devil’s metal.”

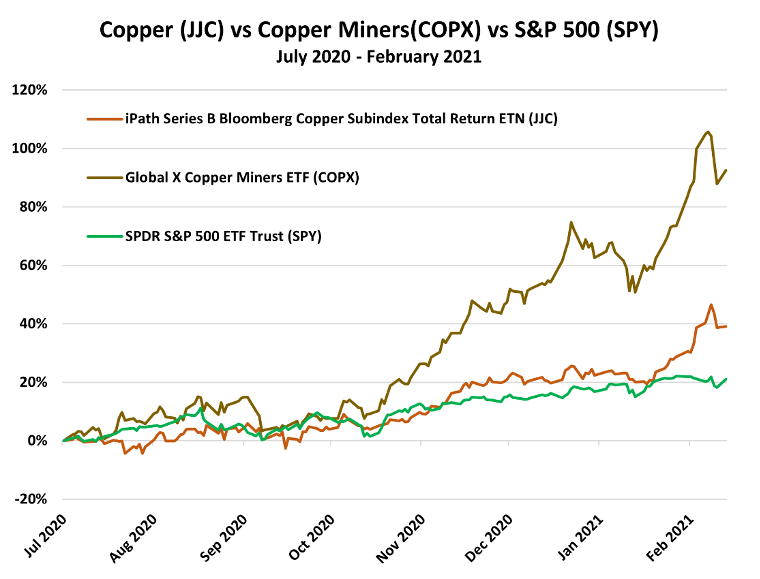

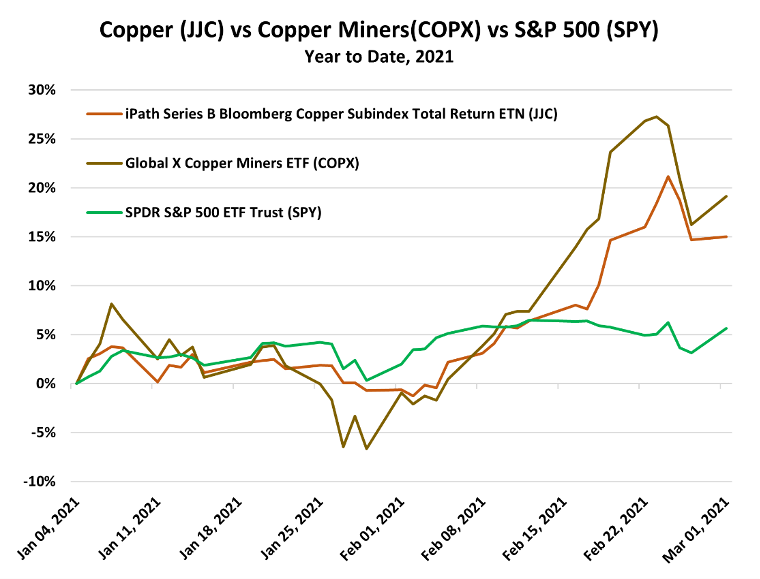

Silver prices

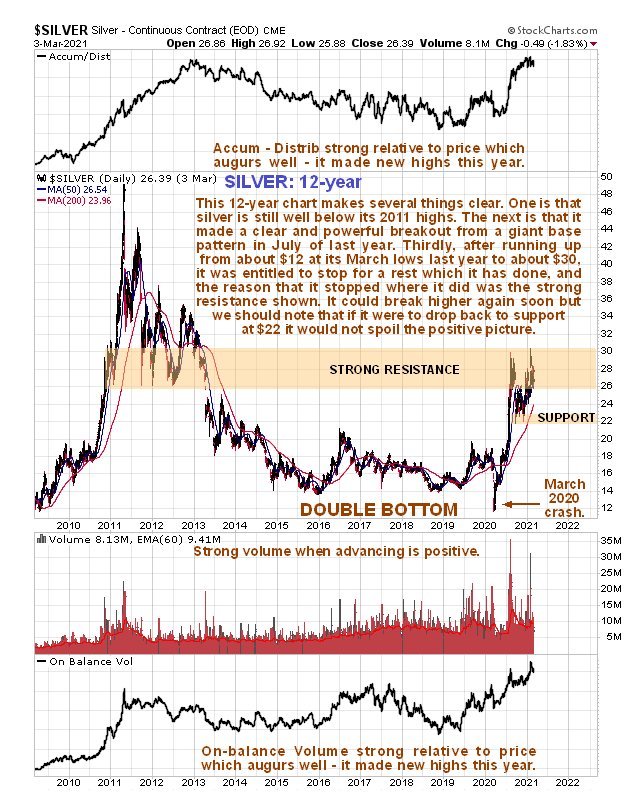

Silver last summer gained an astonishing 35%, as investors sought shelter from pandemic turmoil and low interest rates, while industrial demand for the metal recovered in some parts of the world. Its July performance, seen in the 1-year chart below, made silver the darling of the commodities complex.

The story behind its success—we were among the first to predict the potential for a silver breakout—was one of two demands, reflecting silver’s role as both a monetary and an industrial metal. There was also a supply narrative to silver’s rise, with respect to COVID-related output reductions at silver mines in Peru and Mexico, from which 40% of the world’s silver is produced.

Silver jumped to $28.32/ounce in August 2020, its best performance in seven years, and though prices retreated last fall, silver bounced higher in December, finishing the year up an impressive 46%, more than doubling gold’s 22% gain.

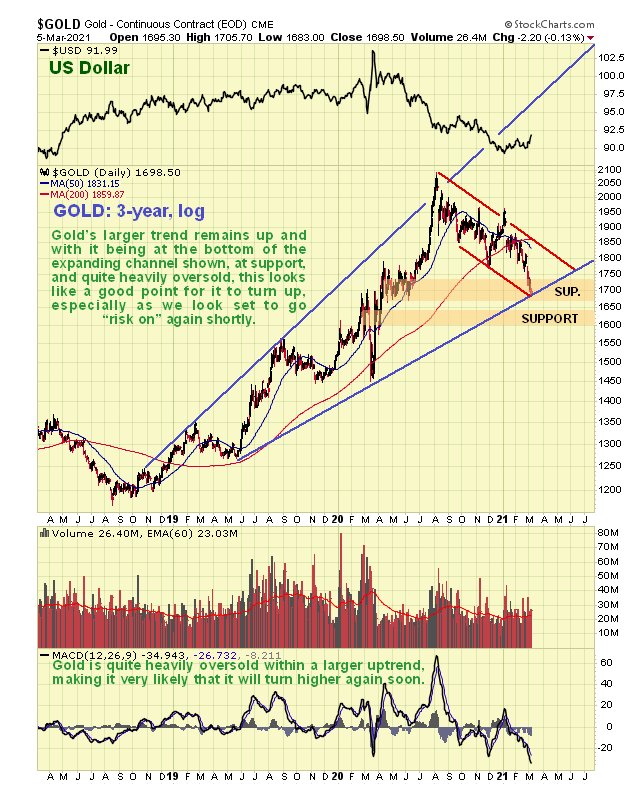

Despite pulling back in January and February, due mostly to expectations of better economic conditions and the recent rise in sovereign bond yields (ie. US Treasuries), silver and gold prices are expected to recover.

We know from previous articles that certain metals have done very well under government-mandated COVID restrictions. In countries where the virus got into the mining workforce, mines were shut down temporarily, impacting 2020 production. This happened in South America, including top copper producers Chile and Peru, and the number 1 silver mining country, Mexico. When combined with robust demand from China, the top metals consumer, the prices of copper, silver, zinc and nickel, just to name a few, had nowhere to go but up.

The silver outlook is extremely positive due to tight supply, combined with strong monetary and industrial demand drivers.

Hey Big Spender

The American government has already spent $4.5 trillion on COVID, not including the $1.9 trillion aid package currently before Congress, and the Federal Reserve has added around $7 trillion to its balance sheet.

To pay for these expenditures, the Fed printed so much money that the M2 money supply increased the most since 1943—when the U.S. was at war with Nazi Germany and tripled its military spending.

The national debt is $28 billion and clearly going higher, with most of the spending promises not yet put into action.

President Biden’s economic recovery package, expected to be unveiled this month, has as its centerpiece the biggest infrastructure spending commitments since Roosevelt’s New Deal. It includes roads, bridges and broadband internet access, with progressive Democrats eyeing much more, ie., an expansion of Obamacare and a public sector jobs program.

When campaigning for president, Biden proposed $2 trillion for economic rebuilding, so we expect the infrastructure bill to contain at least that much.

Then there’s his Clean Energy Plan, another $2 trillion program, to decarbonize U.S. electricity in 15 years, and create a net zero-emissions economy by 2050.

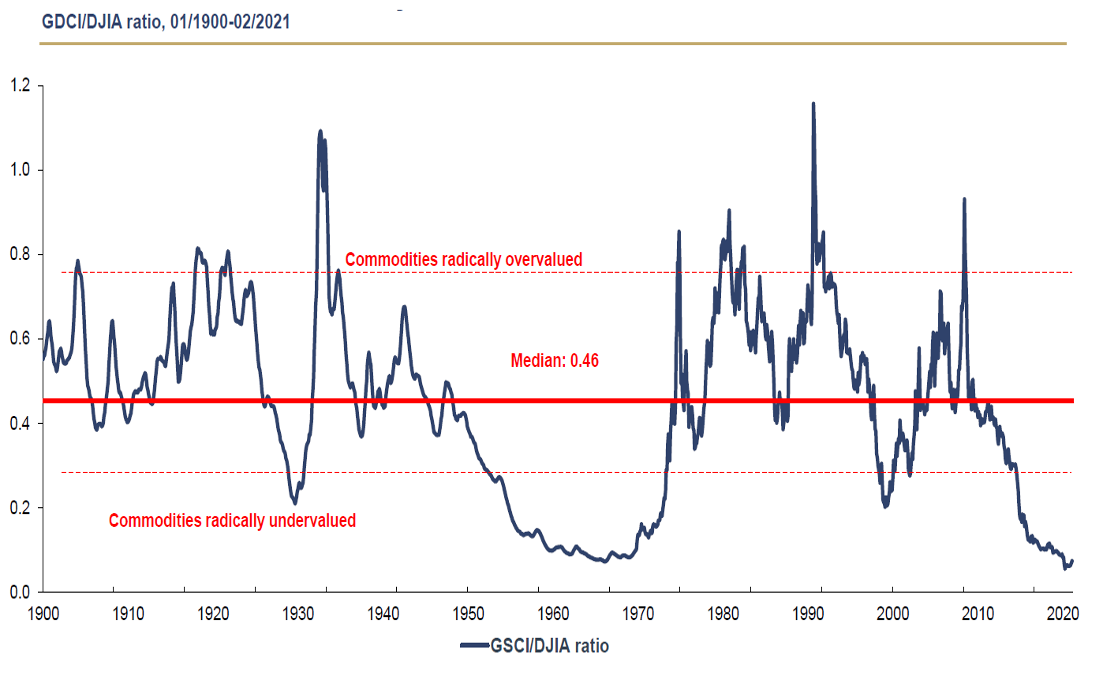

This big-spending environment is bound to be good for gold and silver prices. Not only is it inflationary, on the scale of historical spending imperatives like the New Deal of the 1930s or the Second World War, but the kind of spending we are talking about will increase the debt-to-GDP (gross domestic product) ratio, and lower the U.S. dollar (in an earlier article, we showed the close relationship between debt-to-GDP ratios and gold).

Supply Deficit

The two waves of COVID-19 that hit Latin America last year, impacted some of the biggest silver mines in the world.

In Peru, among the companies affected were Trevali Mining Corp. (TV:TSX; TV:BVL; TREVF:OTCQX) and its Santander silver mine, Hochschild Mining Plc’s (HOC:LSE) Inmaculada, and Fortuna Silver Mines Inc.’s (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) Caylloma.

Investment projects such as Anglo American Plc’s (AAUK:NASDAQ) $5 billion Quellaveco, Minsur’s $1.6 billion Mina Justa and Chinalco Mining Peru’s $1.5 billion Toromocho expansion were delayed.

In Mexico, the world’s largest silver producer, a surge of COVID-19 cases last March led to the suspension of non-essential services. Among the companies forced to temporarily halt their operations, were Newmont Corp. (NEM:NYSE), Argonaut Gold Inc. (AR:TSX), Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ), Sierra Metals Inc. (SMT:TSX), Excellon Resources Inc. (EXN:TSX; EXLLF:OTCPK) and Alamos Gold Inc. (AGI:TSX; AGI:NYSE).

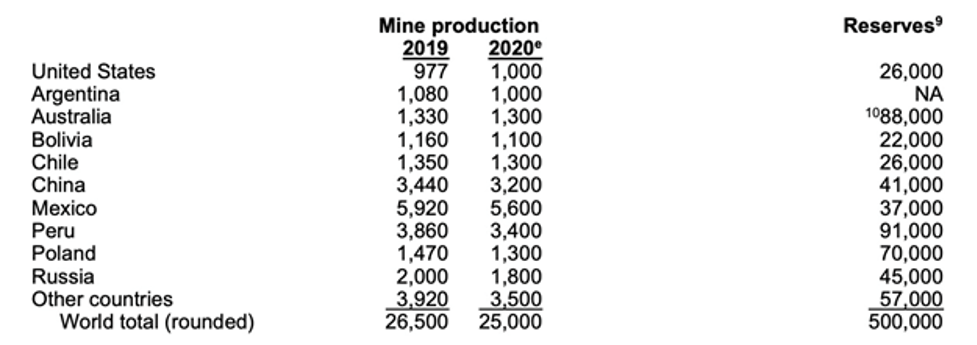

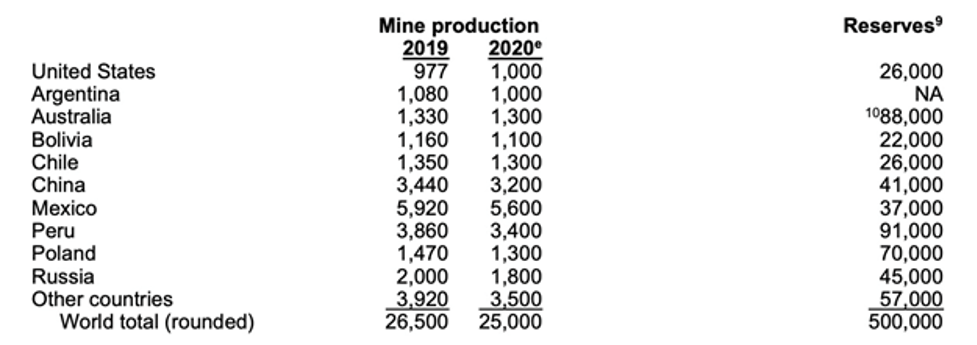

As a result of COVID, the Silver Institute predicted a 13% decline in silver production from Latin America in 2020—equivalent to 67 million fewer ounces. The global tally amounted to 6% fewer ounces mined last year compared to 2019, according to the U.S. Geological Survey (25,000 tonnes vs 26,500 tonnes).

Source: USGS

Given supply and demand factors, Capital Economics estimates the silver market will remain in a small deficit, right through to 2022.

Industrial Demand Drivers

When gold prices approach or retake highs reached last summer, silver prices will likely follow; the white metal’s dual-demand drivers, being both a monetary and an industrial metal, has some analysts predicting it will outperform gold in 2021.

Analysts at Capital Economics think silver prices should gain momentum on the back of ongoing fiscal stimulus in China, and greater industrial activity which drives around half of annual silver consumption. They point out the latter will be helped by governments investing in green energy, including solar panels which contain silver paste.

The solar power industry currently accounts for 13% of silver’s industrial demand.

More and more silver will be demanded for its use in solar photovoltaic (PV) cells, as countries move further toward adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute predicts 100 gigawattas of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

All that solar will be a major boon for silver.

CRU expects PV manufacturers to consume 888 million ounces of silver between now and 2030. That’s 51.5 million oz more than the combined output from all the world’s silver mines in 2019.

5G technology is set to become another big new driver of silver demand.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of Things (IoT)-enabled devices.

The Silver Institute (SI) expects silver demanded by 5G to more than double, from its current ~7.5 million ounces (Moz), to around 16 Moz by 2025 and as much as 23 Moz by 2030, which would represent a 206% increase from current levels.

A third major industrial demand driver for silver is the automotive industry. While copper and battery metals are usually thought of as the main beneficiaries of electrification, it appears the white metal will get swept up in the EV growth story. SI anticipates that, due to the evolution of hybrid and battery electric vehicles, the auto industry is expected to absorb 90 million ounces of silver by 2025, rivaling silver consumption in photovoltaics, currently the largest application of global industrial silver demand at 98 Moz this year. Automotive demand in 2021 is projected at 61 Moz.

A recent Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity. Charging points and charging stations are also expected to demand a lot more silver.

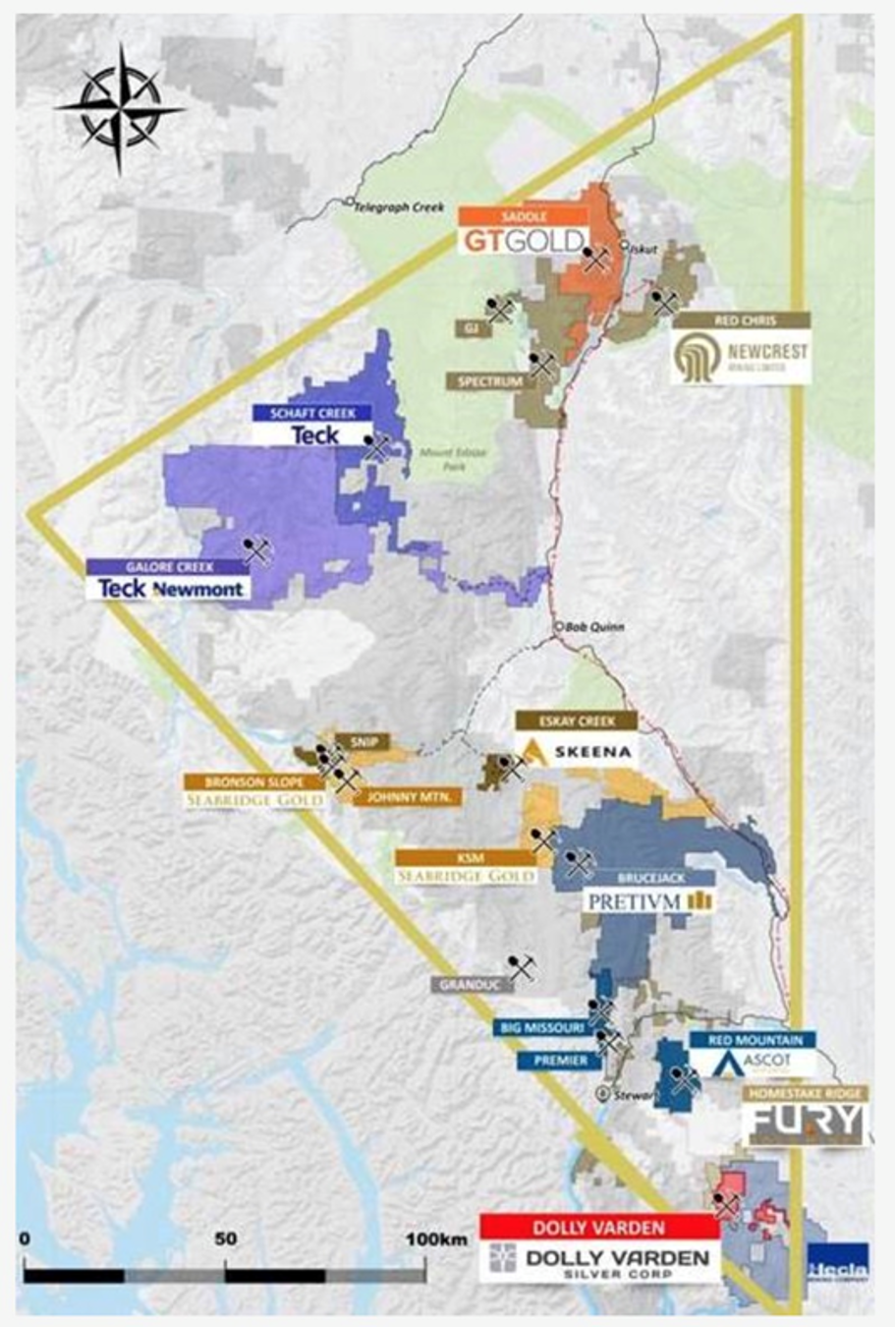

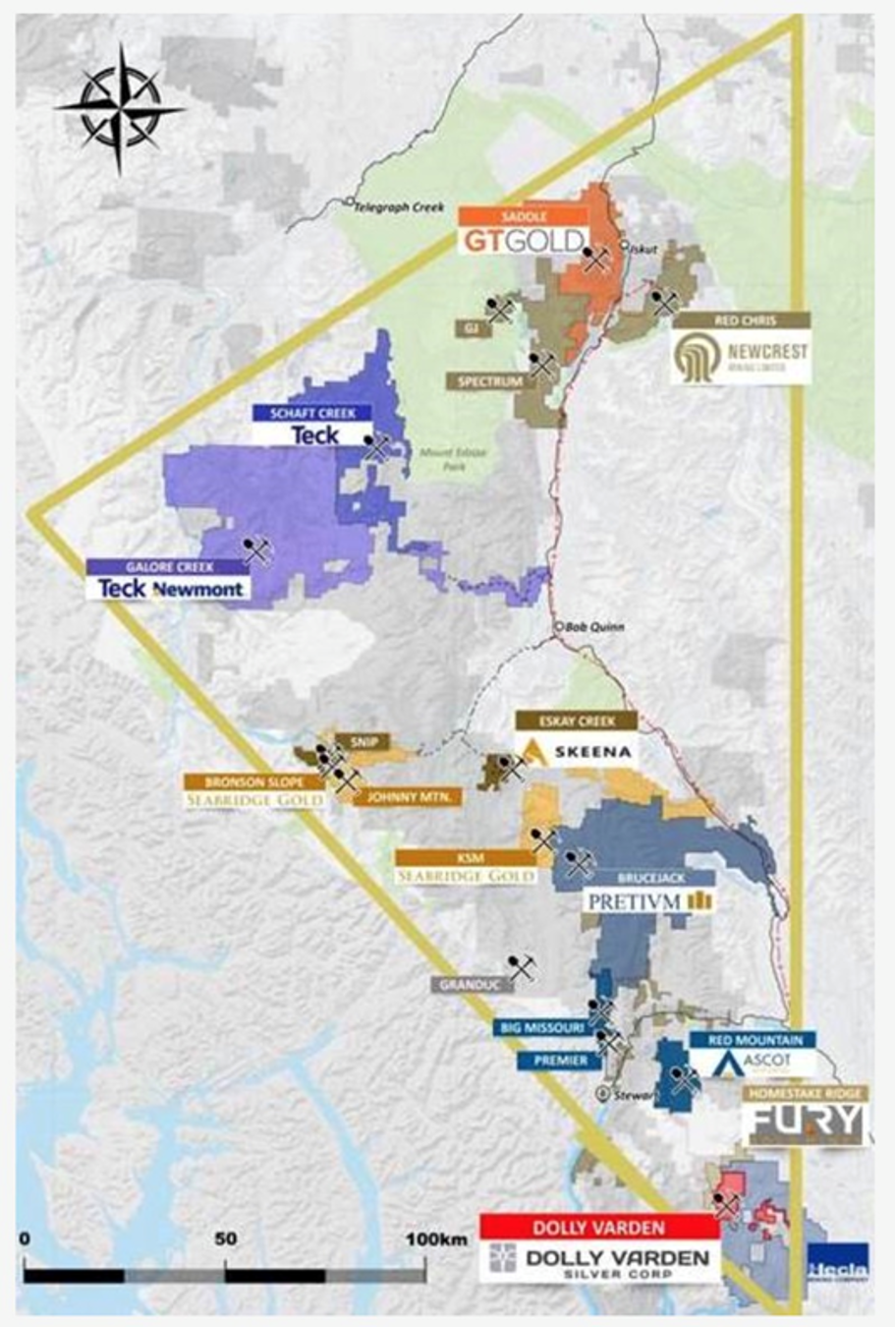

Golden Triangle

While most of the world’s silver (Ag) is mined in Latin America and China, British Columbia should not be overlooked as a past and future Ag producer. The province is endowed with one of the richest mineralized regions on the planet, in the Golden Triangle of northwestern BC.

With over a century of mining history, the triangle has been the site of three gold rushes and some of Canada’s greatest mines, including Premier, Snip and Eskay Creek. Other significant and well-known deposits include Brucejack, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc and Red Chris.

The Golden Triangle takes its name from a 500-kilometer belt of mineralization that stretches from the British Columbia-Yukon border in the north, to the town of Kitsault, just southeast of the port of Stewart, BC. The Kitsault area is historically associated with molybdenum and silver production.

When production started at Eskay Creek in 1994, it was the highest-grade gold mine in the world. The operation produced over 3 million ounces of gold at an average grade of 45 grams per tonne (g/t), and 160 million ounces of silver, at 2.2 g/t, before shutting down in 2008. However, the ore that has been left is valuable. A recent PEA (preliminary economic assessment) shows a 4 Moz gold-equivalent resource grading 4.4 g/t, which is quite high grade for an open pit.

Seabridge Gold Inc.’s (SEA:TSX; SA:NYSE.MKT) KSM is considered the world’s largest undeveloped gold-copper porphyry deposit. It hosts 38.8 million ounces of gold and 10.2 billion pounds of copper in reserves, with an initial 44-year mine life production plan. The project spans four deposits: Kerr, Sulphurets, Mitchell and Iron Cap.

The Brucejack Mine commenced production in 2017 and, at 16.1 g/t, is one of the highest-grade gold mines to have opened in recent years. The underground gold and silver mine has estimated reserves of 4.2 million gold ounces, and a mine life of 13 years.

Other large deposits/mines worth mentioning include Schaft Creek, a joint venture between Teck Resources Ltd. (TCK:TSX; TCK:NYSE) and Copper Fox Metals Inc. (CUU:TSX.V) that hosts Proven and Probable reserves of 5.6 billion pounds of copper, 6 Moz of gold and 52 Moz of silver; and Red Chris, an open pit mine developed by Imperial Metals Corp. (III:TSX). Imperial opened the mine in 2015 and sold it four years later to Australian gold miner Newcrest Mining Ltd. (NCM:ASX), for $804 million. According to Imperial, Red Chris produced 71.9 million pounds of copper in 2019, 36,741 ounces of gold, and 133,879 oz of silver in 2019, and will keep producing until at least 2043.

Lately there has been a resurgence of interest in the Golden Triangle, with the excitement driven by:

- New road, power and port infrastructure built by the BC government

- Receding glaciers revealing fresh mineralization

- Improved relationships between mining/exploration companies, the BC government and the region’s two First Nations groups

- New technologies allowing geologists to gain a better understanding of the Golden Triangle’s complex geology

The rocks underlying the triangle host a variety of mineral deposits, including gold, silver, copper and molybdenum. Situated within the Sulphurets Hydrothermal System, known to host one of the world’s largest concentrations of metals, the Golden Triangle contains an estimated 188 million ounces of gold reserves, including 47.5 million in the highly certain proven and probable category; 1.2 billion ounces of silver with 214 Moz proven and probable; and 55 billion pounds of copper of which 10B is proven and probable.

Geologists believe most of the mineralization was formed because of volcanism during the Late Triassic and Early Jurassic periods. Importantly, all the mineral deposits have one characteristic in common: they are all found near surface, at depths no greater than 2,500 meters. This allows for relatively easy access, especially with the help of receding glacial ice cover.

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCMKTS)

The story of Dolly Varden Silver’s involvement in the Golden Triangle, particularly the area south of Stewart, began in 1910, when the Dolly Varden Mine was discovered by prospectors of Scandinavian descent.

Its namesake project is a volcanogenic massive sulfide (VMS) and epithermal-style pure silver deposit, with a small amount of lead and zinc.

The Dolly Varden properties, consisting of two past-producing silver deposits, became part of British Columbia’s mining lore, featuring assays as high as 2,200 ounces (over 72 kg) silver per ton, with historical production of 20 million ounces Ag, between 1919 and 1959.

In fact, the Dolly Varden/North Star Mine was among the richest silver mines in the British Empire, producing 1.3 Moz at an average grade of 1,109 g/t Ag between 1919 and 1921. An interesting historical tidbit: The mine was opened by mining engineer Herbert Hoover, who would go on to become U.S. President.

In 1956, the Torbrit Mine was the third largest silver producer in Canada, outputting 18 Moz at 466.3 g/t Ag, plus base metal credits, between 1949 and 1959, when the mine closed. A large part of the Torbrit deposit was left intact due to silver prices falling below $0.85/ton.

Dolly Varden’s goal is to try and extend Torbrit through some step-out drill holes, and to get into the high-grade, 500g to 1kg material. There are early indications of other Torbrit “look-alikes” along a 4.5-km trend. Through drilling, Dolly Varden wants to prove up another Torbrit and drastically increase the size of the resource, which in all categories is about 44 Moz at an average grade of 300 g/t.

A key part of the exploration thesis is the fact that the rocks hosting the mineralization on the property are the same age as some of the other large deposits found in the Golden Triangle including Eskay Creek.

“The exciting thing about the Dolly Varden project is that it is hosted in the Hazelton formation, a Jurassic package of volcanic rocks that went through the same expansion or release of pressure called the Eskay Rift period,” says head geologist Rob van Egmond, in a recent AOTH video interview. “That was the time frame when a lot of the metallogenic deposits throughout the whole Golden Triangle were emplaced, such as Eskay Creek. After that rifting there was a compressional period which formed a lot of the structures that host the epithermal veins. And a lot of those epithermal veins were probably active to form the deposits that were on the seafloor, VMS-style.”

CEO Shawn Khunkhun likes to compare Dolly Varden Silver to Skeena Resources Ltd. (SKE:TSX.V), which has seen a significant re-rating commensurate with its success so far in developing the historical Eskay Creek Mine.

“Our story is very similar,” he says. “They’re awakening Eskay Creek, we’re re-awaking the Dolly Varden silver mine. It’s got a rich history, it’s one of the richest silver mines in the world, it’s produced 20 million ounces of high-grade silver, and we’re endowed with 44 million ounces in a cornerstone high-grade pure silver resource, and we’ve got a technical team that has the ability to unlock further discoveries in this trend.”

Last year the company raised $27 million through two tranches ($2.5M from Hecla Canada, a major shareholder with 11% ownership.) Eric Sprott soaked up CA$2.3 million of a $0.33 financing, the billionaire resource investor upping his stake in Dolly Varden (DV) to 19.9%. Institutional investors have come into DV in a big way—they own 50% of the 129.9 million shares outstanding (144.4 million fully diluted) and include Frank Holmes’ US Global Investors and Sprott Asset Management.

It’s unusual for a junior Dolly Varden’s size to be so tightly held by institutional and notable shareholders. In fact, when all is said and done, retail only owns 12%.

Emerging Silver District?

The Dolly Varden project comprises 8,800 hectares (88 square km) in the Stewart Complex of northwestern BC, which hosts base and precious metals deposits. The property has four historically active mines—Dolly Varden, Torbrit, North Star and Wolf.

On the map below, note that Dolly Varden’s project is in the bottom corner of the Golden Triangle. It lies to the west of Hecla Mining’s (HL:NYSE) Kinskuch project, and borders Fury Gold Mines’ (FURY:TSX) Homestake Ridge, where a PEA envisions a 13-year mine with peak annual production of just over 88,000 gold-equivalent ounces. More than 275 holes totaling over 90,000 meters have been completed on the Dolly Varden? or Homestake? property.

Hecla’s Kinskuch is an early-stage project with the potential for discovery of epithermal silver-gold, gold-rich porphyry and VMS deposits.

According to Dolly Varden Silver, only 3% of the Dolly Varden property has been explored in detail, leaving tons of upside for shareholders.

“Despite the long production history and exploration history we’re still making new discoveries,” says van Egmond. “We’ve done structural re-interpretation of the whole project, and we’ve drilled across faults and found offsets to the main Torbrit deposit, within 50m of the old drilling from the ’50s. So, there’s still a lot of exploration upside near deposit, as well as all the way up the trend to the northern end of the property, we have four and a half kilometers of these Hazelton rocks with a strong potassic alteration signature, as well as sodium depletion, so that’s indicative of VMS heat cells working within that alteration, so we look forward to exploring up the rest of that belt.”

Map of BC’s Golden Triangle region, with Dolly Varden’s property in the

bottom corner.

An updated NI 43-101 resource estimate completed by Dolly Varden in 2019 revealed 32.9 Moz silver in Indicated resources and 11.477 Moz Inferred, adjacent to the historical deposits. Drilling and underground work that went into the resource estimation confirmed that the mineralization occurs as two styles: bedding-parallel VMS, similar to that mined at Eskay Creek, as well as cross-cutting epithermal mineralization similar to that being developed at Pretium Resources Inc.’s (PVG:TSX; PVG:NYSE) Valley of the Kings deposit (Brucejack Mine).

According to DV, both the Eskay Creek and Valley of the Kings deposits are located on the same structural trend to the north of Dolly Varden’s ground. Dolly Varden represents the silver end of these styles of mineralization and includes the base metals lead and zinc.

Could Dolly Varden represent the southern end of a silver district that extends northward? It seems likely and further exploration may prove it.

2020 Drill Results

Over the past three years, structural re-interpretation and aggressive drill testing have yielded new discoveries of high-grade silver mineralization proximal to areas with 100 years of exploration history. Since 2017, Dolly Varden has drilled over 66,000 meters in 213 holes.

Last October, Dolly Varden published results from 2020 exploration, which included step-out drilling at the Torbrit Mine, and infill drilling to expand the high-grade zones within the deposit. The step-out highlights were 351 g/t over 12.75m, including a higher-grade 1,083 g/t Ag intercept over 2.7m; and 135 g/t Ag over 37.5m, including 906 g/t over 1m. The best infill drill hole featured 302 g/t Ag over 31.95m, including 642 g/t Ag over 4m.

A total of 11,397 meters in 40 drill holes were completed in 2020, 19 of which were in the Torbrit area. The rest were reconnaissance and exploration drill holes, testing multiple areas on the property.

In February, the rest of the assays came in, with highlights that included 310 g/t over 6 meters, a standout 304 g/t over 45.82m, and 306 g/t over 5.10m. Higher-grade core within those intercepts featured 648 g/t over 6.06m, 1,595 g/t over 1.06m, and 1,290 g/t over 0.6m.

“We are seeing consistent intervals of high-grade silver mineralization at the Torbrit Silver deposit that has the potential to support economically attractive underground bulk-mining technics, while at the same time each successive drill programs continues to demonstrate that the deposit is open for expansion,” states CEO Shawn Khunkhun, in the Feb. 16 news release.

He adds that the company “cannot rule out a gold discovery consistent with the plus million-ounce resource at the adjacent Homestake property in addition to the potential for another Torbrit like silver discovery,” given encouraging geological and geochemical results for gold and copper mineralization from the four-kilometer-long trend to the northwest of the silver deposits.

Conclusion

Dolly Varden is conducting exploration in the Golden Triangle at the perfect time for the silver market, which, as mentioned, is supporting higher prices, and a renewed sense of purpose, as an essential metal for the modern economy.

Unlike its sister precious metal, gold, silver has both a monetary and an industrial function, meaning that prices can move on demand drivers that mesh with the prevailing trends of the modern industrialized world. For silver, that means the growth of solar power (photovoltaics), electric vehicles, and 5G.

As the prospects for economic growth continue to brighten, as vaccine rollouts accelerate, we expect silver prices to catch a bid on strengthened industrial demand. And with trillions of dollars in new government spending related to economic stimulus and recovery, about to be unleashed in the United States alone, precious metals will surely react to inflationary concerns, especially considering that the Federal Reserve is severely restricted in how high it can raise interest rates to cool the economy. The Fed has already stated it will let inflation run higher to accelerate growth and bring down record-high unemployment, and expects to keep interest rates close to zero for the next two years—both policies are good for precious metals.

Dolly Varden is a tightly held stock—85% of the outstanding shares are with insiders, Hecla Mining, Eric Sprott and institutional investors—that is well financed and comes with a strong management and technical team. The company finds itself in the rare position of being a pure-play silver explorer, in a space where most silver production comes from lead-zinc deposits or is a by-product of gold mining.

This makes Dolly Varden the perfect vehicle for rising silver prices.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

CA$0.69/share, 2021.03.01

Shares Outstanding 126,022861M

Market cap CA$89.6M

DV website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Richard (Rick) Mills, AheadoftheHerd.com, lives on a 160-acre farm in northern British Columbia. Richard’s articles have been published on over 400 websites, including: Wall Street Journal, USA Today, National Post, Lewrockwell, Montreal Gazette, Vancouver Sun, CBSnews, Huffington Post, Beforeitsnews, Londonthenews, Wealthwire, Calgary Herald, Forbes, Dallas News, SGT report, Vantagewire, India Times, Ninemsn, Ib times, Businessweek, Hong Kong Herald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Rick Mills: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Dolly Varden Silver is an advertiser on Ahead of the Herd. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Dolly Varden Silver, Seabridge Gold and Pretium Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fortuna Silver and Pretium Gold, companies mentioned in this article.

Charts and graphics provided by the author.

Legal Notice / Disclaimer: Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH. Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of Dolly Varden Silver Corp (TSX.V:DV). DV is a paid advertiser on his site aheadoftheherd.com.

( Companies Mentioned: DV:TSX.V; DOLLF:OTCMKTS,

)