AbraPlata Reso…

Mon, 03/08/2021 – 09:10

Month: March 2021

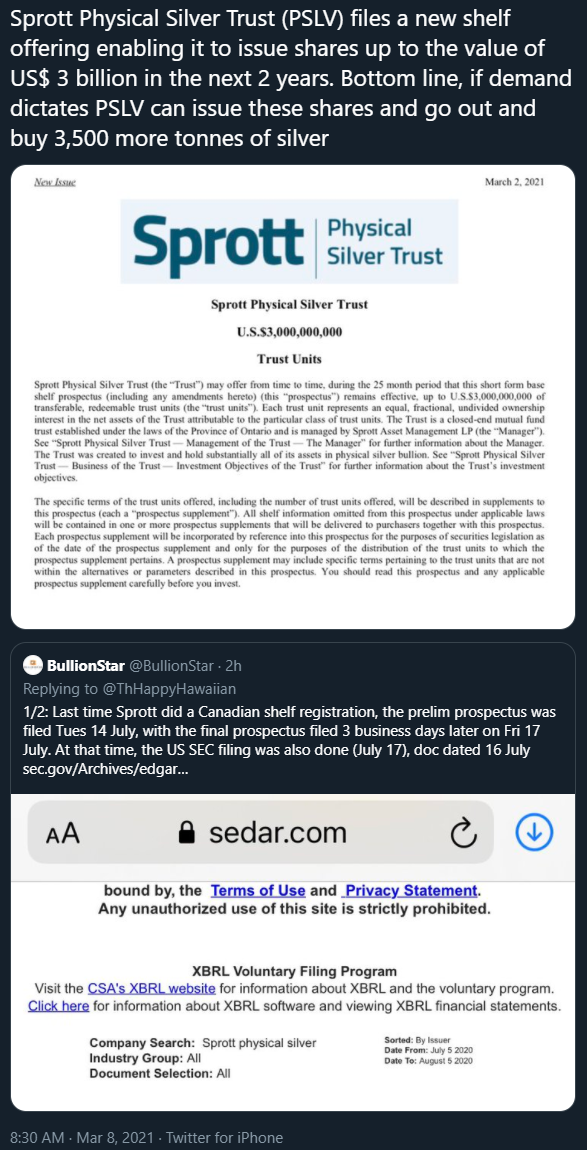

Sprott Physical Silver Trust (PSLV) files a new shelf offering enabling it to issue shares up to the value of US$ 3 billion in the next 2 years. Bottom line, if demand dictates PSLV can issue these shares and go out and buy 3,500 more tonnes of silver https://t.co/qAfgfO07Ly pic.twitter.com/2iYUWh6nKx

— BullionStar (@BullionStar) March 8, 2021

SilverSeek.com

Mon, 03/08/2021 – 04:35

Financial Times/Colby Smith/3-8-2021

“Investors are bracing themselves for a trio of large US government debt auctions this week, after a recent sale of seven-year notes flopped and set off a bout of frenetic trading.”

“Investors are bracing themselves for a trio of large US government debt auctions this week, after a recent sale of seven-year notes flopped and set off a bout of frenetic trading.”

USAGOLD note: From all appearances, the Fed has stepped out of the batter’s box for the moment, but that could change in a heartbeat. FT says these auctions are scheduled at a “tenuous time for bond markets.” Another poorly bid auction could release the trap door under the bond market.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

NewsMaxFinance/Thomson-Reuters/3-5-2021

“The U.S. federal debt burden will double over the next 30 years, reaching 202% of economic output in 2051, as deficits grow and interest rates eventually rise, the Congressional Budget Office said on Thursday in its latest long-term budget projections.”

USAGOLD note: This projection from the Congressional Budget Office has a troubling aspect. We post charts regularly here that show the relationship between ceaseless growth in the national debt and the rising price of gold over the longer run. Since the current ratio is 127% as of the third quarter last year, the latest CBO numbers tell us that the deficit and debt problem will be with us for a very long time to come. Since economists consider anything over 100% excessive, questions about the sustainability of the current financial system naturally arise ……

Sources: St. Louis Federal Reserve, Office of Management and Budget

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.