Month: May 2021

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up we’ll hear part 2 of a recent interview Money Metals President Stefan Gleason gave with Palisades Gold Radio. Stefan discusses dealer and investor harassment laws maintained by certain states, talks additional sound money initiatives at the state and federal level, including legislation requiring a true audit of America’s gold. So, stick around for the conclusion of this fantastic interview, coming up after this week’s market update.

In this special Thursday release of our weekly podcast, we’ll go over the inflation bombshell that hit markets on Wednesday.

The Labor Department reported yesterday that the Consumer Price Index jumped 4.2% from the prior year. Although a big rise in the CPI had been expected, the actual number came in even higher than economists had forecast.

According to the CPI data, inflation in April accelerated at its fastest pace in more than 12 years. Higher prices showed up in everything from used cars to lumber to energy to food.

If April’s rate of price increases were to persist for another 11 months, the annual CPI growth rate would be 10.3%. And that wouldn’t even account for items that the CPI excludes or understates.

Jerome Powell and other Federal Reserve officials have repeatedly insisted than any rise in inflation this year will be “transitory.” They cite base effects from last year’s economic lockdown and supply bottlenecks they expect to be temporary.

But investors appear to be concerned that inflation is now becoming a much bigger problem than the Fed acknowledges.

Emergency government benefits pumped into pocketbooks and a record-high budget deficit that shows no signs of narrowing will have lasting effects. The cycle of spending, borrowing, and printing by the trillions looks to be more of a permanent than a transitory practice in Washington.

Stocks, bonds, and even precious metals got hit with selling following the CPI report. However, gold did show relative strength versus the S&P 500, which lost 4% for the week through Wednesday’s close. Gold was down a mere 0.5% over that period.

The monetary metal continues to hold above its $1,800 breakout level and currently comes in at $1,830 an ounce.

The silver market also succumbed to some modest selling pressure through Wednesday – though it, too, held up better than the stock market. Silver prices now trade at $27.05 per ounce, off a little less than 2% since last Friday’s close as of this Thursday morning recording.

Naturally, many precious metals bulls were disappointed that gold and silver didn’t scream higher on the inflation news. The reason they didn’t has a lot to do with interest rates. Bond yields moved up and futures markets began pricing in higher probabilities for a Fed rate hike by the end of the year.

When it becomes clear that central bankers won’t get out in front of inflation with a sufficient number of rate hikes anytime soon, that’s when precious metals markets can be expected to take off. Gold and silver thrive during periods of negative-trending real interest rates – and that includes rate-hiking cycles where the Fed is almost always behind the curve.

Although bullion buying has been strong in 2021, precious metals markets have continued to be overshadowed by the cryptocurrency craze. Bitcoin and more recently Dogecoin have been all the rage among digital speculators.

Last weekend, billionaire Tesla CEO and cryptocurrency aficionado Elon Musk hosted Saturday Night Live. During the “Weekend Update” segment, Musk’s character was repeatedly asked to explain what Dogecoin is. He retorted that it’s just as real as the U.S. dollar, which isn’t far from the truth.

SNL Weekend Update Anchor #1: So, what is Dogecoin?

Elon Musk: Yeah, like I said, it’s a digital currency.

SNL Weekend Update Anchor #1: Like, okay, for instance, this is a dollar, right? It’s real. See?

Elon Musk: Sort of. Sort of real. Yeah.

SNL Weekend Update Anchor #1: So, what is Dogecoin?

Elon Musk: About as real as that dollar.

SNL Weekend Update Anchor #1: Now Colin, are you making any sense of this?

SNL Weekend Update Anchor #2: I’ve actually been reading a lot about it, yeah. I’m trying to diversify my investment portfolio. My question is what is Dogecoin?

Elon Musk: I’m glad you asked.

SNL Weekend Update Anchor #1: It’s a good question.

Elon Musk: Well, it’s the future of currency. It’s an unstoppable financial vehicle that’s going to take over the world.

SNL Weekend Update Anchor #1: I get that, but what is it, man?

Elon Musk: I keep telling you. It’s a cryptocurrency you can trade for conventional money.

SNL Weekend Update Anchor #1: Oh, so it’s a hustle.

Elon Musk: Yeah, it’s a hustle.

Musk has been accused of using his platforms to manipulate crypto markets. Some say he single-handedly caused the recent price explosion in Dogecoin with his constant tweeting about it. But after confessing on SNL that it’s a “hustle,” the cryptocurrency promptly sold off.

Dogecoin began as a joke based on an internet meme and it may well have peaked as a result of jokes made by Elon Musk.

Bitcoin is regarded as a more serious cryptocurrency by way of gaining wider acceptance by the public and businesses.

But Musk shocked Bitcoin enthusiasts on Wednesday when he announced that Tesla would no longer accept the cryptocurrency as payment. He cited Bitcoin’s hefty energy use as being environmentally unfriendly.

Bitcoin prices plunged as much as 17% on the news.

Pressure from social activists and government regulators who have long opposed cryptocurrency could force other major corporations and financial institutions to blacklist Bitcoin.

All this goes to show that despite their massive run-ups to market capitalizations that rival top blue-chip stocks, cryptocurrencies remain fragile. They rest entirely on confidence that can erode in an instant.

By contrast, precious metals don’t derive their value from any celebrity’s comments and don’t depend on the approval of big corporations.

Gold and silver are valuable based on their history, their aesthetic properties, their scarcity, and their utility. These fundamentals will never go away regardless of where precious metals ultimately fit in the universe of alternative currencies.

Well now, without further delay, let’s get right to part 2 of Stefan’s recent interview with Palisades Gold Radio, and we start with his response to a question about laws that are in place in many jurisdictions to harass local coin dealers and invade the privacy of precious metals buyers.

Stefan Gleason: It has a lot to do with second-hand dealer laws and these laws that police think that, “We could solve every crime if we made everybody report everything they bought that anyone would ever want to steal.”

And so, the idea is that a local coin shop, when they buy something from the public, so let’s say they buy jewelry. You go in and you sell a gold brooch. Well, maybe it was stolen. Maybe it’s being fenced. A lot of states and localities have passed ordinances and laws that require the dealer, who makes the purchase, to hold it for at least seven days or 14 days, don’t resell it, don’t melt it, take photos of it, upload those photos nightly to the county sheriff’s office along with the ID of the person who sold it to you.

And so basically, they want all of these transactions to be reported when a dealer buys something from the public. And so, that’s probably the main concept around that. Now, I’m not going to argue on the… I mean, I have ideological problems with that for anything, but jewelry, okay, maybe there’s some uniqueness. Theoretically, it’s some unique brooch, grandma’s brooch. There’s only one like it, whatever. But a gold bar, a Gold Eagle. It’s ridiculous. These are all fungible. There’s no, no rationale to say that that could be identifiable, even if you thought it was a good idea, which I don’t.

A lot of states are dealers who buy from the public are forced to hold those bullion bars and coins for long periods of time before they can sell them, take tremendous amounts of information from the people that sell them to them, upload that to the police, which probably sits in some database they never look at.

Tom Bodrovics: I can’t imagine how inefficient that system could be, even if you had bars with serial numbers on them.

Stefan Gleason: Right. It’s ridiculous. But it’s basically a huge cost to those dealers because for one, I mean, when you’re in the bullion business with tiny margins, you can’t necessarily tie something up for two to three weeks. What if somebody comes in the next day and says, “I want to buy 10 ounces of gold.” Well, you might have huge amounts of gold, but you can’t sell any of it because you bought it all from somebody in the last 14 days. And then you have more in your coin shop safe. I’ve talked to dealers who have been robbed at gunpoint. There’s more metal probably on their premises as a result of these kinds of laws.

Now, in Arizona, it goes even further, and it literally, makes it illegal to use cash to buy precious metals. So, you have to make an electronic transaction, but I have never heard something where it’s illegal to use a five dollar bill to buy a certain type of good, but in Arizona, the statute says you cannot use cash, you have to do an electronic transfer, it has to be an electronic documented transaction.

It’s literally a ban on cash for one type of purpose. And so, all of these things, we call dealer and investor harassment laws. Investor harassment, because the privacy intrusion, dealer harassment, because of tying up capital, becoming more susceptible to thefts, having a huge administrative burden, and then just the idea that you can’t even use cash is just beyond the pale. But there are a couple dozen states that have these kinds of things on the books, and there’s many cities.

Our main business is in Idaho. So, Idaho doesn’t have such a law, but several of the cities around the city we’re in has such a law or ordinance. So, we’ve been documenting that and added that to the index last year, because I thought it was important to put that on the radar. We have not introduced any bills yet to address those, but we’re looking for opportunities.

Tom Bodrovics: So Stefan, you were telling me, before we hit record here, that your highest real score on the index is about 61, 62%. How does that provide, basically, an incentive for these states to keep getting better?

Stefan Gleason: I had a political background before I launched Money Metals. About 12 years ago, I was in public policy and we learned over many years that you got to be careful about giving out a lot of credit when you’re dealing with politicians, because sometimes that’s used against you. If we were to say certain states are the best states by far on these things. They have a 90%, 100%. There’s very little incentive to… To the extent people are looking at the Sound Money Index and saying, “We like this state. Is there anything more to do on the state?” We don’t want to give the impression that there isn’t anything more to do.

I mean, Wyoming is number one on the index, and they have a 61%. So the top 10, go down. Nevada is number 10, has a 40%. So, there’s a long way to go. They may have no income tax on precious metals. They may have no sales tax on precious metals. They may have a lower income tax rate, which we score, than the average state. They may own gold in a pension fund like Texas, but there’s many things they haven’t done. They may have dealer harassment laws. They may not have a depository. They may not have protection for gold clause contracts, which is the idea that if somebody has an arrangement with some other person to be paid in gold over time, which used to be common, and back when the money was gold, essentially, and silver, every contract was essentially a gold clause contract because when you were being paid and in dollar bills, you were being paid in silver.

And that’s an important idea for long-term protection, so both parties know what they’re getting paid in the future. Right now, if you have an agreement to receive dollars over the next 20 years, what are you getting? You don’t know. It’s probably going to go down in value. Your wealth is being transferred to the other person over time.

So, the idea of a gold clause contract, I think, can come back in a way that people can opt out of the dollar-based or Federal Reserve Note-based system and say, “We’re going to have a contract that’s denominated in silver ounces, or Gold Eagles, or whatever.” And so, that idea of a gold clause contract is… There aren’t many of them out there.

There’s a paper by Edwin Vieira, which we could, if somebody wants to contact us, we can send to you, that talks about how these can be used. But the idea is that a state could… If you have a dispute under a contract, and you go to the court and say, “Enforce this contract,” we don’t want the judge to say, “Well, he doesn’t have gold, so he can pay you in dollars.” And that would be what would happen if you don’t have greater protections for gold clause contract enforcement. And so, and it’s kind of a sort of a narrow issue, maybe, to the listeners, but it’s something that we think is important enough to put on the indexes. Does the state have special, or I should say, strict enforcement of these contracts, where you cannot substitute Federal Reserve Notes for gold, if that’s what the contract requires? There are states considering legislation on that.

Tom Bodrovics: Excellent. So, are there, or what kind of progress can you share with us that’s happening at the federal level?

Stefan Gleason: So, the federal level… most of it’s negative, as people know. I mean, you’ve got debt expanding dramatically, you have Federal Reserve bailouts in the trillions of dollars, even this year. And you have a Gold and Silver Eagle program. They mint Gold and Silver Eagles, they can’t mint enough. That’s another issue. It’s one of the reasons premiums are so high right now. But there are some things that are on the radar. Obviously, there was the Audit the Fed bill, which Rand Paul had and, it even passed one of the houses a few years ago. That’s kind of going back and forth as an issue that would be valuable, more transparency in the Federal Reserve System.

Of course, the real problem is the Federal Reserve system itself, which should be eliminated. But some feel that auditing the Fed would kind of be a step in that direction, because then you’d realize, “Oh, here’s what they’re doing behind closed doors. This is all manipulation. This whole system is rotten. Let’s get rid of the Fed.”

Congressman Mooney has two bills that we’re working with him on, and one is the one I mentioned earlier, which is the Monetary Metals Tax Neutrality Act that would end gold and silver as something that can be taxed under the income tax. And then, the other is the Gold Reserves Transparency Act, and that’s the audit the gold bill. That’s kind of what we’re calling it. The idea that United States, theoretically, has large, I think, 8,000 tons of gold, somewhere in that neighborhood, on the books, but it has not been audited for 70, almost 70 years. And even that audit was not a complete audit, or wasn’t a complete inventory.

So, there has been no serious review of US gold reserves for almost 70 years. And Congressman Ron Paul had a bill along these lines seven or eight years ago, and it was not complete. It was good. There was actually a little hearing on it, didn’t pass. The Treasury came in and said, “Hey, we do check. Here’s some of the things we’re doing to make sure.” But the issue with US gold reserves is not just whether it’s all physically there. Obviously, that’s important. Is it all physically there, where is it, how much of it is Good Delivery bars, how much of it is melt, stuff that was collected back in 1933, coins and things that maybe are not pure, and that kind of stuff. But are all the ounces there and are they properly secured? That’s one layer of what should be audited and inventoried and then assay.

So, this bill by Mooney would do those things but it also goes a step further, and this is the part, I think, of the bill that is even more important, and that is a full review of any encumbrances that have been placed against the United States gold. So, just because it’s in Fort Knox, or in the New York Fed building, or at West Point, does not mean that it’s, somebody else doesn’t think they own it. I mean, it could have been pledged. It could have been pledged to the International Monetary Fund as part of a gold swap arrangement. It could have been leased. It could belong to China.

Just because the gold is actually there, it doesn’t mean that it belongs to the United States, and doesn’t mean that other people don’t think they own it. Now, I guess if you’re the United States, and China says, “Hey, we want your gold,” or maybe that’s not a good example. Germany says, “We want your gold,” and they did say that, and it took them seven years to get it. I think they may have gotten it a little bit faster, but theoretically, the US could say, “Well, too bad. It’s in our country. You can’t come and get it. It’s our gold now.” Of course, maybe that’s what they fall back on.

But there needs to be a full examination of all of these transactions that may have occurred involving the United States taxpayers’ gold. And so, Mooney’s bill does all of the physical stuff, but then it looks at this accounting stuff, which could be the most revealing part of any audit that’s done. And so, he introduced that bill last year for the first time, and then in the last session, I should say, and then that’s going to be reintroduced in the next month or so.

So, beyond that, I mean, there’s commissions to have a study going back on a gold standard. That’s been discussed. There’s some things that can be done at the US Treasury, too. I think I mentioned earlier that there’s no statutory basis for this 28% income tax. So, the US Mint mints gold legal tender coins and silver legal tender coins. It could itself, the US Treasury, could say, “These are not going to be taxed.” They could do that without legislation. There were some groups that we were working with and talking to that were pressing the Secretary of the Treasury in the last administration to do that.

But I think it’s a pretty bad scenario right now. I think in a crisis, some of these things could come very quickly to the forefront, but at the current time with the Biden administration, not that this is a partisan issue, but they need this system to perpetuate money printing and the Fed stepping in and monetizing the debt. So, I don’t think we have much chance of doing anything at the federal level. That doesn’t mean we shouldn’t keep pushing.

But I’m very optimistic at the state level, because we have had progress there. We’ve only gone, and other than the loss in Ohio, which I mentioned, we’ve really only gone in one direction, and that is towards more protection for sound money and lower taxes or elimination of taxes on gold and silver.

Tom Bodrovics: Absolutely, Stefan. That’s… It’s very interesting, the way that all those things are developing. And I just had a discussion with Chris Powell of GATA, and talking about how many times the, let’s say, the US’ gold could possibly be rehypothecated. It’s just crazy to think about.

Stefan Gleason: And they do a very good job there at GATA. I really appreciate them and I think they’re doing a tremendous service to the entire gold ownership community.

Tom Bodrovics: So Stefan, I want to be respectful of your time. Why don’t you tell us quick about one interesting program that you have, and it is the contribution every month to, basically, a savings account.

Stefan Gleason: Oh, okay. Thank you for asking about that. I didn’t realize you’d seen that. So, this has been something we’ve had in place since the very beginning at Money Metals, is a monthly savings plan. And it’s very popular. We have about five or 6,000 people currently in the plan, and these are folks that have basically enrolled to have a scheduled monthly purchase of a certain amount or a certain number of ounces, and this is a way to put it on autopilot to stop sort of the guesswork around timing the market, just get into a disciplined program that just happens automatically.

It’s sort of like taxes. So, one of the big problems with the income tax is that a lot of people don’t realize how much they’re paying, unless you’re a small business owner and you have to write a check, because it comes right out of your paycheck before you even see the money. And so, at the end of the year, people get excited. They, “Oh, I got a $2,000 tax refund. I beat the system,” They loaned money interest-free to the government throughout the year and got a little bit of it back.

So, but the idea of this is harnessing that principle of automation and default. And so, the default with the monthly plan is, every month, regardless of what happens with gold and silver prices, regardless of what you’re doing, unless you pull out of the program, you have an automatic purchase that just happens, and then we, typically people will have us ship it to them every three months, or they will store it in the depository.

And most people have us automatically debit their bank account. No charge for that, it just happens automatically. We send you the invoice, your bank account is debited, and then you’ve acquired another $300 worth of gold at whatever price it was, or $300 worth of silver. The minimum is $100 a month. And you can change products. You can switch that around. You can have both a gold and silver plan at the same time. You can have us store it, you can have us ship it. And most of the products that we have, at least all of the popular products, are available in our monthly savings plan.

Tom Bodrovics: Yeah, I think that’s a great way to, like you say, automate it and kind of take it out of your own hands and it provides a great way to dollar cost average, as well. I encourage all of our listeners to go check out your website. You have the Sound Money Index on there, the modern Money Metals Insider quarterly report, the savings account. Why don’t you tell us what it is and where we can find more about you and the company, Stefan?

Stefan Gleason: Thanks again. I appreciate the opportunity to talk about the public policy stuff because it’s not something that… I haven’t heard it covered on your podcast and it’s an important aspect, so I really appreciate the opportunity. Money Metals, we’re one of the largest dealers in the country. Moneymetals.com is our website and there’s lots of content on the site. We’re also a publisher, if you will. We have a free print newsletter that goes out quarterly to all of our customers. We send out content almost daily, news articles, or certain topical articles about the precious metals markets, about the public policy stuff, about any topic related to precious metals and gold ownership. So, we’re also a pretty good sized publisher in our space, if you will.

So, we’re not just about selling. We’re about educating, guiding people on pitfalls. One of the things I should mention, one of the early things about our company, was we were founded in part because of these rare coin dealers that were doing the bait and switch, and I was in publishing before I launched Money Metals, I had a publishing company for a short period. And the only advertisers that could afford to publish or advertise in our publication were the rare coin dealers that had 50% markups and generally, the people you see on TV with their celebrity spokespeople, Charlton Heston, or, and he’s not around anymore, but folks like that.

So, they’re still a major force in our industry. Unfortunately, a lot of folks are being taken for a ride, paying huge markups, finding out they lost half their money on day one because of the premium. And so, we’ve always been focused on education. And so, one of the early things we focused on was, hey, here’s why this is bad. Here’s how you avoid the pitfalls. Here are some of the phony stories they tell you to try to get you to buy their overpriced, rare coins. And no knock on collectors. There are true rarities out there, if you know what you’re doing, but for the vast majority of people, they’re not trying to buy a piece of artwork. They’re trying to buy a piece of gold. And, focusing on melt value and things like that are what you want to do.

So, we’ve always had an educational component, and then we also have a depository. We have a program you can borrow against your gold for business purposes, like a line of credit, like a home equity loan. And we have the monthly plan. So, and we work with IRA companies and that kind of thing. We love to help people on any of those fronts, and you can go to our website, moneymetals.com, get on our free email newsletter, and if you become a customer, you’ll start getting the print newsletter. We’d love to help anyone, especially in these times. One thing that we’ve noticed is a lot of our competitors are having trouble with inventory, not that it’s easy. We’re not flush with inventory on a lot of stuff, but we pretty much have every popular item in stock for gold and silver and I think that differentiates us also. It seems that we’re doing really well on the sourcing side. You can find probably what you want at Money Metals, right now.

Tom Bodrovics: Excellent, Stefan, and I appreciate you bringing up the, let’s say, the taxation issue and that index, I will agree it’s not necessarily the sexiest topic, but it is something that we haven’t covered yet on the podcast. Stefan, I really appreciate your time and hopefully we’ll hear more from you in the future.

Stefan Gleason: Thank you very much, Tom. I appreciate it, also.

Well, I hope you enjoyed the conclusion of that Palisades Gold Radio interview with our company’s president. And that’s a wrap for this week’s show. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.

Source: Peter Epstein for Streetwise Reports 05/12/2021

Marvel Discovery Corp. CEO Karim Rayani talks with Peter Epstein of Epstein Research about his company’s activities.

I remain quite surprised at the massive rebound in commodity prices from COVID-19 lows last year. For instance, lumber is up >500% and iron ore, crude oil, soybeans, tin and copper are up 285%, 170%, 150%, 130% and 125%, respectively. Gold at $1,840/oz (up +25%) might seem unimpressive by comparison.

However, in August as gold roared past $2,000/oz, reaching at an all-time [nominal] high of $2,067/oz, there was real excitement in the air. Hundreds of gold junior stocks soared.

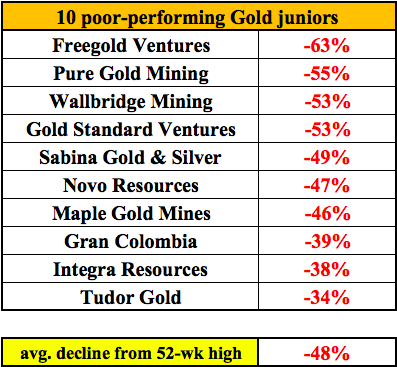

Today’s gold price is 11% below its high tick, yet many high-quality gold juniors are down three to five times as much. In the chart below are 10 well-known gold juniors down an average of 48% from 52-week highs.

To be fair, some gold junior valuations might have traded too high last summer, but the sell-off appears to be overdone, leaving some really good opportunities. Readers should note that $1,840/oz is a spectacular price.

In the seven-years from 2013–2019, the average of year-end closing prices was $1,245/oz. Most PEAs, PFS/DFS reports done in that period used a long-term gold price assumption of $1,200–$1,350/oz.

Therefore, even without a higher gold price, juniors with gold properties in safe, prolific jurisdictions like Canada, near highly respected producers or world-class projects, offer very compelling risk-reward propositions. And, if the gold price fights its way back above $2,000/oz, all bets are off on how high some juniors might fly.

With that in mind, one such company with tremendous blue-sky potential, albeit with commensurate high risk, is Marvel Discovery Corp. (MARV:TSX.V; IMTFF:OTCQB). Last week it spun out some REE and battery metal assets, leaving it with four gold properties and a few others, including a nickel, cobalt, copper project in Quebec.

It has four gold properties spread across Newfoundland and the Red Lake/Atikokan areas. To learn more about the re-focused Marvel Discovery, I spoke at length with its CEO and large shareholder Karim Rayani, who continues to be an active buyer of shares in the open market.

Peter Epstein: Please give readers the very latest snapshot of Marvel Discovery Corp.

Karim Rayani: This is a great time to be looking at Marvel Discovery. Over the past several months the company has undergone a management reorganization and rebranding. We have acquired a number of gold assets that have tremendous potential and are adjacent to multimillion ounce discoveries in both Newfoundland and northwestern Ontario.

We think that discovery potential is high across our gold portfolio. We’re adjacent to, or nearby, great producers like Agnico Eagle and Evolution Mining, and very well-respected juniors including New Found Gold, Great Bear Resources, Marathon Gold, Premier Gold Mines and Pure Gold Mining. Evolution is expanding in the district, having recently acquired Battle North Gold.

Peter Epstein: There’s been a lot of excitement in Newfoundland lately. Can you talk about that, and about Marvel’s properties in the province?

Karim Rayani: Newfoundland is one of the hottest areas for exploration these days. New Found Gold Corp. is achieving great exploration successes, its market cap has rocketed to C$1.4 billion. This has sparked a gold rush in the province. Marvel has been staking and acquiring new ground in key areas.

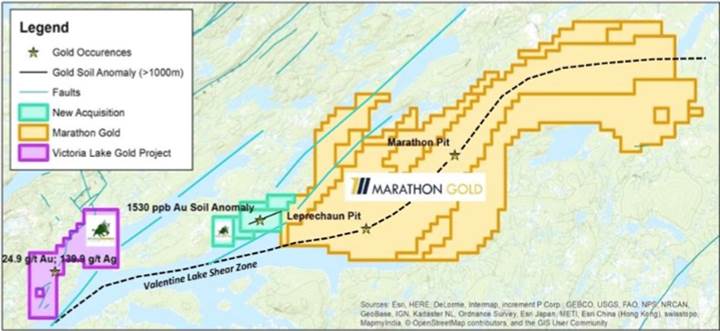

With our Victoria Lake and Slip gold properties, we’re now one of the larger landholders around New Found Gold, Exploits Gold and Marathon Gold—host of the North Atlantic’s largest gold deposit (aggressively drilling and looking to acquire more ground).

Victoria Lake shares structural settings with Marathon’s world-class Valentine Lake project. Historical grab samples at Victoria Lake returned up to 15.5 to 24.9 g/t gold plus 18 to 140 g/t silver. Slip has similar structural settings as New Found Gold’s Queensway project, and has historical surface samples as high as 44.5 g/t gold.

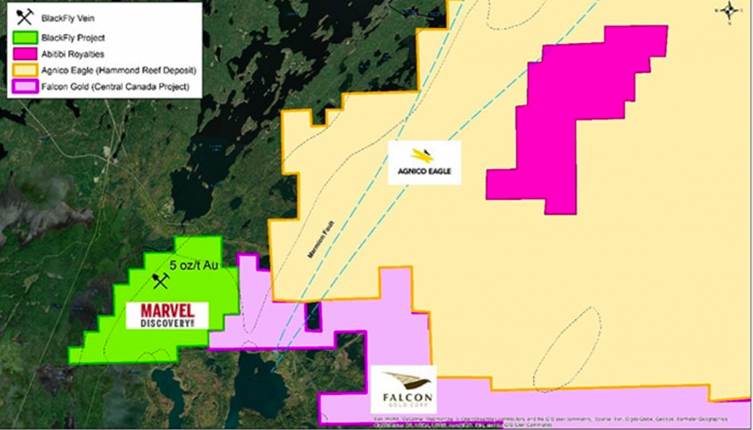

Peter Epstein: Please update us on the Blackfly Gold project.

Karim Rayani: Yes, Blackfly is very exciting. It’s in the up-and-coming Atikokan gold mining camp, ~13.6 km southwest along strike of Agnico Eagle’s 5.6 million ounce Hammond Reef Gold project. This year’s exploration program follows up on last year’s compilation of historical info and high-resolution airborne magnetics/time-domain EM data collection. Prospecting, bedrock mapping and rock sampling are underway.

We recently received a work permit allowing for trenching, line cutting and drilling. Diamond drilling of 16 holes is planned for the summer. Historical intervals include 1.1 meters at 15 g/t gold and 2 meters at 11 g/t gold.

Geological mapping indicates alteration/mineralization for up to 5 km. Grab samples at the historical shaft area include 85.6 and 167 g/t gold. With the work we’ve done this year and last, we’re zeroing in on high priority targets.

Peter Epstein: You recently spun out two properties into a new entity. Where does that leave Marvel Discovery in terms of ongoing involvement in the assets that were spun out?

Karim Rayani: Good question, thank you. We’re very excited to have spun out the Pecors and Wicheeda projects into a new entity named Power One Resources. This leaves Marvel as a more focused entity. However, Marvel retained ~25%–30% of the new entity. The remainder will be distributed to shareholders as a special dividend.

We plan on implementing the arrangement on or about May 13, 2021. Holders of Marvel shares as of the close on May 7th will get a common share of Power One for every five shares held in Marvel. Power One will also issue 5 million Power One Shares to Marvel.

Moving forward, Marvel and Power One will be sister companies with common goals. In fact, we recently picked up additional ground contiguous with Power One’s Wicheeda REE property. To the extent that Power One advances Wicheeda and Pecors in coming years, shareholders of Marvel will benefit as well. Equally important, Marvel will be in a position to help Power One expand if/when they are successful.

We recently acquired a 100% interest of a 5,352-hectare property east of Elliot Lake, Ontario, that’s contiguous to Grid Metals Corp’s and Canadian Palladium’s East Bull Lake Intrusive (EBLI) palladium (Pd) projects.

The new property is also near New Age Metals’ River Valley deposit, which hosts a 4 million troy ounce Pd Eq. resource. Our EBLI property hosts a possible extension of palladium-platinum mineralization onto our property.

The Pecors property that we spun off, west of the newly acquired Marvel Discovery ground, has been recognized as a large (25 km long x 6 km wide) magnetic anomaly. A regional magnetic feature between the Pecors anomaly, and the EBLI to the east, suggests these intrusive suites may be connected. This possible connector and the southeast extension of the Pecors anomaly is hosted within the Marvel Discovery claims.

Peter Epstein: Can you tell us about your Camping Lake property in Red Lake?

Karim Rayani: In the Red Lake district we’re earning into a 51% interest in the Camping Lake project. Camping Lake is within 20 km of Great Bear Resources’ blockbuster Dixie Gold project. Historical exploration on the property was done by Kinross Gold, Laurentian Goldfields and Anglo Gold, incl. drilling and (rock, soil and lake sediment) samples.

Peter Epstein: Finally, how significant is your Duhamel battery metals project in Quebec?

Karim Rayani: Our 2,300-hectare Duhamel property is prospective for nickel, copper and cobalt. As a frame of reference, the best drill intercept we had was in 2000. A 3.0 meter interval graded 1.27% nickel, 0.33% copper and 0.12% cobalt. So, yes, we think Duhamel could be significant.

Those grades might not sound too sexy, but given that copper is at an all-time nominal high, and nickel and cobalt have significantly bounced off of last year’s lows, that 3-meter intercept equates to ~5 g/t gold equivalent, and the mineralization is near surface.

Peter Epstein: Thank you, Karim. As always, a great update. I look forward to seeing progress on your gold prospects this year.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Marvel Discovery, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Marvel Discovery are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Marvel Discovery was an advertiser on [ER] and Peter Epstein owned shares and warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: MARV:TSX.V; IMTFF:OTCQB,

)

Source: Streetwise Reports 05/12/2021

The deal will make Agnico Eagle Barsele Minerals’ largest shareholder.

Barsele Minerals Corp. (BME:TSX.V) just announced that it has signed a nonbinding letter of intent to acquire Agnico Eagle’s 55% indirect share of the Barsele project located in northern Sweden. Barsele already controls 45% of the project.

The project is located at the western end of the Proterozoic Skellefte Trend, a volcanogenic massive sulphide deposit belt, that host polymetallic and orogenic gold deposits.

“The opportunity to acquire a 100% controlling interest in the Barsele Project represents a tremendous milestone for Barsele,” said Gary Cope, president, CEO and a director of Barsele, commented. “We plan to significantly increase the drilling activity on the project with the goal of growing the current mineral resource estimates. We are excited to start a new chapter in the development of the Barsele Project and are thankful to our joint venture partner Agnico Eagle for the work we have completed together. We now look forward to having Agnico Eagle as our largest shareholder.”

Through the terms of the agreement, Barsele will acquire Agnico Eagle’s 55% indirect interest in Gunnarn Mining AB, which holds the Barsele Project, for a payment of US$45 million, the issuance of shares so that Agnico Eagle will hold 14.9% of Barsele’s common shares, warrants exercisable for 6 million Barsele common shares, a 2% net smelter returns (NSR) royalty, and a contingent value right (CRV) on “future gold mineral reserves and mineral resources identified at the Barsele Project.” Barsele can purchase 1% of the NSR royalty for US$15 million.

The company noted that there is an “existing 2.0% net smelter return royalty on the Barsele Project pursuant to an agreement dated June 11, 2015 between Orex Minerals Inc., Gunnarn Mining AB, Agnico Eagle Sweden AB and Agnico Eagle, which includes a repurchase right for US$5,000,000. The LOI anticipates that the Existing NSR, including the repurchase right, will be assigned and assumed by Barsele at closing of the Proposed Transaction.”

The warrants will have a term of five years and an exercise price of CA$1.25 a share, or a 20% premium to the 20-day volume weighted average of Barsele common shares, or the conversion price of convertible debt if Barsele issues convertible debt as part of the financing of the cash amount of the sale.

On the contingent value right, Barsele agrees to pay Agnico Eagle US$2.5 million for each additional 1 million ounces of gold mineral reserves and resources identified at the project above the current reserves and reserves, capped at a maximum of US$20 million. These funds won’t be payable until there is a construction decision at Barsele, change of control or the tenth anniversary of the closing of the transaction. Barsele “may satisfy the first US$5,000,000 of any future CVR payments by applying such amount to the repurchase of the Existing NSR rather than payment of the CVR,” the release stated.

Agnico Eagle will also be granted a participation right in certain future financings so that it can maintain its pro rata or 14.9% interest in Barsele.

Barsele stated that it intends to fund either all or a part of the cash amount of the transaction through issuing debt or equity.

The companies have established an exclusivity period that ends July 30, 2021, “with a view to settling the definitive documentation for the Proposed Transaction by such date.”

“We see Barsele’s consolidation of the Barsele Project as a positive outcome for all stakeholders,” stated Sean Boyd, Agnico Eagle’s CEO. “The monetization of our interest in the Barsele Project will allow Agnico Eagle to focus on the most advanced projects in our exploration and development pipeline, while retaining an interest in the Barsele Project as a significant equity investor and royalty holder. We wish Barsele success as they undertake the next phase of exploration at the project and are confident that they have the required skill set to continue to advance the project.”

A resource estimate released in February 2019 calculated the resource to be 324,000 ounces of gold in the Indicated category and 2.086 million ounces of gold in the Inferred category.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Barsele Minerals. Please click here for more information.

The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barsele Minerals, a company mentioned in this article.

( Companies Mentioned: BME:TSX.V,

)

Source: Adrian Day for Streetwise Reports 05/12/2021

Money manager Adrian Day looks at recent results for four companies with results he says are, for the most part, positive.

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE, US$23.92)reported gold production down slightly in the quarter, mostly because of various operational issues—planned and unplanned—at various mines, but nothing of deep and lasting significance. And the gold price was down for the quarter, even as input costs increased. The result was that costs—both cash costs and “all-in sustaining costs”—rose.

Copper production and prices increased (and copper production costs declined). Copper represented just over 20% of gold-equivalent ounces, up from 16% in 2020. Earnings overall fell from the last (blockbuster) quarter, though up nearly 80% from a year ago. Overall it was a neutral quarter, but follows a very strong one. The company reiterated its full-year guidance, saying that the second half was expected to be stronger than the first.

Mine disposals as other grow

The company continues to sell non-core mines. This year, it is paying a special $750 million return-of-capital distribution, doubling the payment, from the proceeds of previous sales. Net cash increased to over half-a-billion dollars, from just $33 million last quarter. This represents a dramatic turnaround on the balance sheet. There are no significant debt repayments until 2033.

There are several opportunities for large-scale increases in production over the next year or two, including the restart of the Porgera mine following an agreement with the government; a potential agreement with the government of the Democratic Republic of the Congo allowing repatriation of funds; the ramp-up of underground mining at Bulyanhulu; and the expansion at Pueblo Viejo. CEO Mark Bristow said that Nevada— which saw first gold pour at Goldrush in the last quarter—still is the “most prospective area” in the world with “the potential to increase production very strong.”

Barrick stock has underperformed peers since the sector peak last August—though it had outperformed for the six months prior—and remains one of the most undervalued of the senior miners. Although it has added $5 since the low at the end of February—and $1.70 in just the last two days—it remains a buy for those who do not own it.

Mixed Results at Royal

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX, US$119.95) had a mixed quarter, with revenue and net income down. Gold-equivalent sales were down almost 6% from the last quarter and 8% from the year-ago quarter, though revenue was up 5% from last year. Much of the quarter’s decline was attributable to a sharp drop in gold sales from Mt. Milligan, its largest asset. This was partly offset by an increase in gold inventories.

The good news was that Royal was able to pay off its debt completely ($50 million during quarter, and the remaining $150 million after the quarter); cash at the end of the quarter stood at $370 million. Its next major asset to start cash flowing, the Khoemacau copper mine in Botswana, is now over 90% complete, and expected to start production next quarter. With its final payment now made, Royal has a stream on 84% of the silver byproduct (on the initial 34 million ounces of silver, and half that thereafter). This asset represents about 9% of the company’s net asset value (NAV).

Khoemacau, in February 2019, was Royal’s last major deal, so now, with that mine almost complete and a nearly $1 billion undrawn credit facility, Royal is in a position to make a major purchase to reinvigorate its stock price. The stock has, indeed, moved since late March, when it was around $103, but has underperformed its major royalty peers in the recovery. We are holding.

Record Revenues for Wheaton

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE, US$43.74) reported record quarterly revenues for the first quarter of the year. Although its “gold equivalent” sales fell 1.9% from the previous quarter (though up 5.6% from a year ago), its attributable production was nearly 8% more than sales, due to delays in cobalt deliveries from the Salobo mine, the first quarter of cobalt deliveries.

Although the gold price fell in the quarter, the realized price of silver and palladium both increased, more than offsetting the gold price decline. Similarly, gold sales fell by 13% while silver sales jumped 45%. Overall, Wheaton’s revenues increased, by 13% relative to the prior quarter and by 27% compared with a year ago. The silver share of total revenues rose to 54%, while gold revenues fell from 57% to 42%.

New streams acquired, even as debt paid off

Wheaton’s cash position remains virtually unchanged, at $191 million. During the quarter Wheaton acquired a new gold stream on Capstone’s Santo Domingo, and repaid debt of nearly $200 million. Wheaton now is essentially debt free, with over $2 billion in available liquidity. Santo Domingo, a long-life copper mine in Chile, is expected to commence production in 2024, generating about 35,000 ounces per year for the first five years. This is the third small stream acquired by Wheaton over the past six months, for a total of $550 million.

The stock has rallied, up from under $36 in early March, though it has been a laggard since the sector peak last August. Compared with other major royalty companies, it is undervalued. On the price-to-cash-flow metric, only Royal Gold is less expensive, but on price-to-free-cash-flow, it is by far the lowest valuation: 24x, compared with 32x for Royal, 74x for Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) and 77x for Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). If you are underweighted in the sector, Wheaton would be the top buy now.

Ares Still Sports Safe 8%+ Yield

Ares Capital Corp. (ARCC:NASDAQ, 19.24) had strong results, with income of $0.43 a share, up from a year ago (though down from a spectacular fourth-quarter at $0.44), but well covering the dividend. The net asset value increased to $17.45, a new record, as the company saw no new portfolio companies on non-accrual, and upgrades outpacing downgrades by seven to one.

ARCC CEO Kipp deVeer said activity in the space was picking up, with a 14% increase in the number of transactions that Ares was reviewing. Two lending trends favor Ares, the largest BDC by far. First, there is a trend toward direct lenders, away from banks and other traditional lenders, because direct lenders offer more flexibility, greater certainty of closing and a long-term relationship.

In addition, larger companies are generally performing better than small ones as the economy exits from the year of COVID, but there is no risk premium for small companies. Ares is in a position to do the largest transactions out there. It has over $5 billion of available liquidity, with a reasonable leverage ratio (1.2x, at the high end of its leverage goal, but still very comfortable).

Dividend safe with excess cash

With net investment income exceeding the dividend for another quarter, Ares now has undistributed spillover cash of $1.04 per share, equivalent to two-and-a-half quarters of the regular dividend payment.

Trading at just over NAV—but with little danger of another equity raise to take advantage of the premium—and a yield of over 8%, with the potential for another special cash distribution—there were four in 2019 but none last year, as the company went into defense mode—Ares is a very strong holding. If you do not own, it can be bought as a long-term holding.

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE, US$6.45) moved off the post-deal announcement lows as the gold and silver prices jumped, demonstrating that the metals prices matter as much as company specifics. As discussed last time, we think there will be some selling from various disaffected shareholders on both sides of the transaction. But we also think the combination creates a first-class intermediate producer, undervalued relative to peers. We want to own it. If you do not already own it, you can look to buy now; for additional buys, there is no need to chase, but pick opportunities.

Originally published May 9, 2021

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Franco-Nevada, Barrick Gold, Fortuna Silver Mines, Ares Capital and Royal Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Wheaton Precious Metals, Osisko Royalties, Franco-Nevada and Fortuna Silver Mines, companies mentioned in this article.

Adrian Day’s Disclosures: Adrian Day’s Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2020. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: ARCC:NASDAQ,

ABX:TSX; GOLD:NYSE,

FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE,

RGLD:NASDAQ; RGL:TSX,

WPM:TSX; WPM:NYSE,

)

Source: Michael Ballanger for Streetwise Reports 05/12/2021

Sector expert Michael Ballanger takes a look at recent developments in the uranium market, as well as in copper and the precious metals.

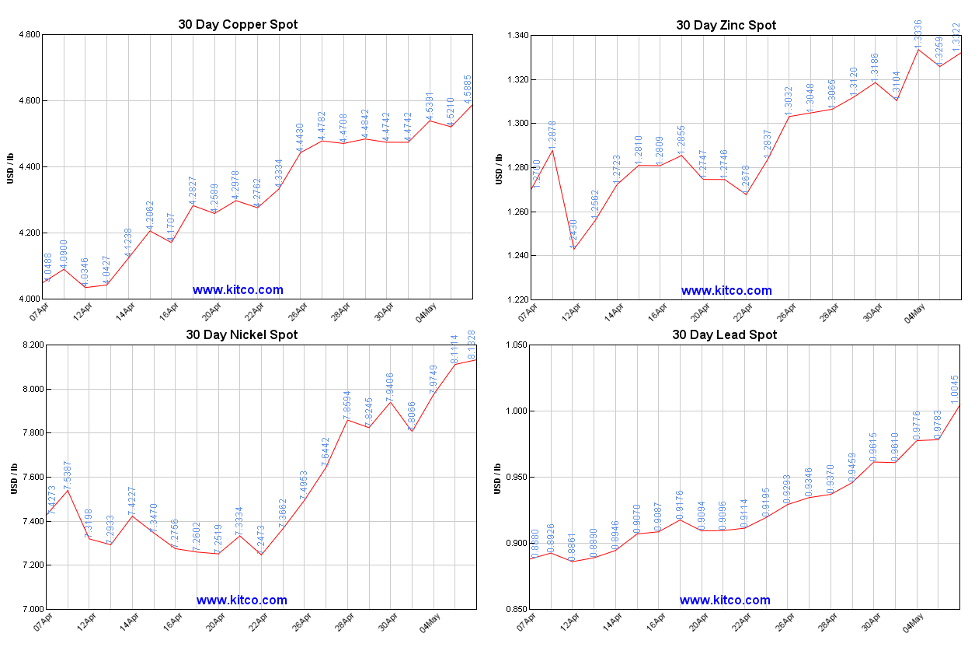

This past week was particularly enjoyable for a number of reasons, and while the action in the precious metals sector finally gave me something about which to cheer, prices for the base metals had terrific moves led by GGMA commodity favorite copper, which hit record highs above US$4.70/lb for the first time in the history of global currency debasement.

Notwithstanding the arrival of an “overbought” condition in this poster child for the electrification movement, copper’s performance is a testimonial to a surge in global demand and delayed supply shock brought on by mine closures and COVID-related issues. There exists a confluence of bullish factors in the copper market that supersedes an easier explanation, such as a “weak dollar” or “Chinese hoarding,” which includes changes in Chilean tax laws pertaining to mammoth copper production from their Andean cache.

However, it is not simply a copper story. Thirty-day charts for zinc, nickel and lead have all gone near-parabolic as vaccinated nations kickstart their economies back into operational normalcy. Whether or not this is investor perceptions “jumping the queue” ahead of actual physical demand remains a topic for another day. For now, we have entered a raging bull market in commodities, and that is good news for those of us that hold positions, which we do, in size.

Having been exposed to dozens of bloggers and newsletter writers and internet “gurus” taking victory laps this past week, the one bull market that has resumed after a very brief hiatus is uranium, with Cameco Corp. (CCO:TSX; CCJ:NYSE) hitting a 52-week high late week and dragging a number of junior developers along with it, including my only holding, Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) (CA$2.55/US$2.10). This Colorado-based owner of the Sunday Mine Complex has been a volatile component of my portfolio (which is currently dominated by gold, silver, and copper developers and explorers), having traded as low as CA$0.34 in June of last year, in the post-COVID-crash environment. But after we participated in an $0.80/unit financing in January, the stock price has been on a tear.

Thanks to the efforts of a few of my subscribers, I have been listening to a number of podcasts of interviews with stock pumpers and book-talkers, and while I usually just chalk it up to the usual tripe that infiltrates the blogosphere these days, there was one that really caught my attention. It featured a gentleman named Marcelo Lopez being interviewed by a young lady named Lyn Alden (interview). I have included the link because I learned more about the uranium business in 55 minutes than I would have in a four-month course at the University of Nuclear Knowledge.

More important, for anyone out there who needs a podcast template, this interview should be the acid test for all investment-related themes. No hype, all fact, but permeated by really well-executed excitement on what Mr. Lopez deems “the most asymmetric trade I’ve seen in my life.”

Now, one would normally think that after a 226.92% return, I would be eager to take my stock (and the full-warrant allowing us to buy more at CA$1.20/share) and ring the register, because the unit itself has CA$3.875/share of profit in it on a CA$0.80/share investment made in March.

However, after listening to that darn interview, what leaps off the page is the fact that Western Uranium & Vanadium has a 55-million-lb resource of uranium sitting underground at the SMC. At today’s price for U3O8, the in-situ metal value is US$1.58 billion for the uranium resource alone, and that does not consider the substantial vanadium resource present at the SMC.

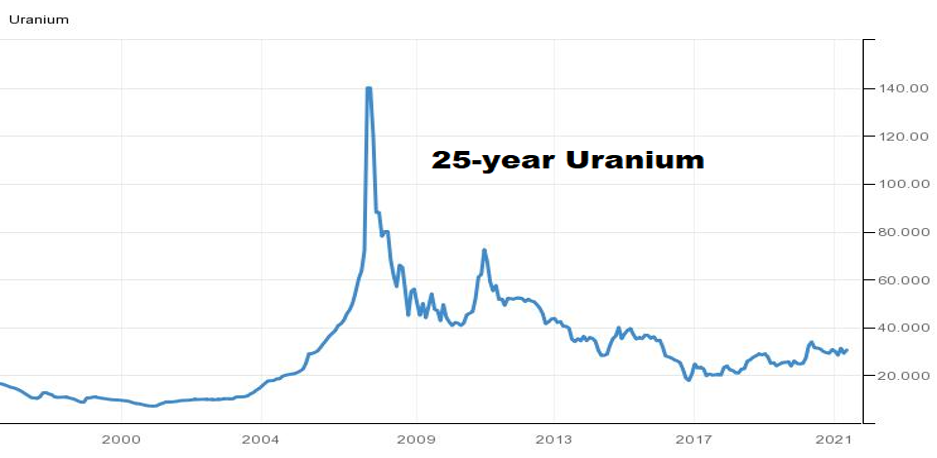

In the last big uranium cycle, prices moved to $140/lb from the current $28.85/lb level and, according to the narrative, uranium developer/explorer names had astronomical moves before crashing in 2008.

At $140/lb, the SMC holds US$7.7 billion of in-situ metal value, so even at today’s market cap of US$76.5 million, Western is valued at less than 1% of that figure. According to those who know a lot more about the uranium cycle than I do, conditions here in 2021 are far better than they were in 2004–2005, when the last bull market erupted. The end users (utility companies) are going to be caught in a supply-shock crisis that will dwarf conditions in 2007, and with electrification now dominating the mindsets of these new generations of investors, these required megawatts are going to come from the cleanest power source on earth, which is nuclear.

When you hear people like Rick Rule waxing so eloquently about the fortune he made in the last uranium boom (which he repeats 17 times in a nine-minute interview), I am forced to look at the price of Western in a wholly different perspective. Instead of thinking of ringing the register, I am going to do the opposite. The reason is this: Uranium is not correlated to the Fed, or to interest rates, or to oil prices, or to anything external. Pricing is purely and simply governed by supply and demand, and in a stock market that is correlated to all of those influences, uranium stocks will be a great place to “hide.” So “hide” it is, and I shall be adding to WUC/WSTRF in the very near term.

As for the precious metals, people who follow my Twitter feed know full well that I have been bullish on gold since prices touched the US$1,670 level twice in March (8th and 31st), prompting me to add to my precious metal holdings. I am going to add quite aggressively to my position in silver, now that the US$26.50 resistance level has been vanquished. The two-day-close rule would have worked beautifully if Treasury secretary and former Fed chairperson Janet Yellen had not come out with that ridiculous “I will increase interest rates if inflation shows up” statement. This, of course, allowed someone to cover their shorts in the metals before she was forced to walk back the statement the following day, after she was reminded that it is the Fed, not the Treasury, that sets the Fed funds rate.

Another issue that until recently has been a huge performer is Norseman Silver Ltd. (NOC:TSX.V), whose CA$0.76 print in February took it up 150% from the January funding level (CA$0.25/unit). In recent weeks, however, there has been considerable profit-taking, while insiders have been buying, leaving the price at less than half of the 52-week high.

Now, I own the stock for a number of reasons, but the primary reason is the letter of intent (LOI) Norseman signed on the Taquentren Project, located in the pro-mining province of Rio Negro in Patagonia. The man that put the package together is Daniel Bussandre, the prospector/geologist who assembled the mighty Navidad silver project bought in 2009 for over $600 million by Pan American. Work has already started on Taquentren, and while the Patagonian winter is a few weeks away, there should be some news arriving shortly that could provide clues as to the prospective nature of this potential behemoth.

Also active this month are the work crews in northern British Columbia (BC), where a number of silver-copper prospects are getting a look. Drill programs are intended on at least three of the prospects, and with the high-grade showings of copper and silver present, there could be some fireworks in the early summer to propel the share price back to the highs.

Another of the issues that is starting to get my attention is Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB), which has been stuck in idle for most of the past year. But I have learned that a new showing at the Kettle River project in British Columbia has caught the attention of project geologists. The area of interest is located on the west side of the Republic/Greenwood District of northern Washington State/southern BC, an area that has produced over 6 million ounces of gold.

The project is a short hop from Kelowna (1.5-hour drive; 130 kilometers) and sits at a modest 900-meter elevation, which means that it is accessible on a year-round basis. What has the rockhounds mumbling in their sleep is a trenching program that has revealed a highly-altered corridor of intensely silicified rock types spread over a large area that contain quartz textures and alteration minerals (like “aduaria”) common to low sulphidation epithermal systems. Surface samples from these “highly cooked” rocks (emanated from a major heat event) have contained highly anomalous gold values over a large area.

Obviously, the company was quite surprised by this discovery and has turned its focus from Nevada to BC in order to fully investigate what appears to be a potential game-changer for Goldcliff.

You will all recall the piece I wrote a few months ago entitled “Skin in the Game,” where I said that it is always encouraging when I invest in a company where management has a big personal stake in the company, hence the term “skin.” George Sanders controls over 35% of the issued capital of the company and participates in literally all financings, alongside outside investors. I like this in a deal, so with a market cap of only CA$6.2 million, GCN/GCFFF is a decent low-risk speculation on a possible new gold discovery in a region known for gold discoveries.

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) (CAD $0.48 / US$0.3959) will be resuming drilling on the Fondaway Canyon gold project in Nevada shortly, and after last season’s spectacular results, I am really looking forward to this accelerated program at Fondaway, as well as the Star Point copper-gold-silver project. With a fully diluted market cap of around US$45 million, it is valued at around US$42 per ounce of in-ground gold, but that was based on a 1,069,000-ounce resource calculated in 2017 using a 3.43 g/t Au cut-off grade and before the 2020 drill program discovered two new high-grade zones that have yet to be quantified.

I have stated that I fully expect Fondaway to hold a minimum 3-million-ounce resource, and if US$100/ounce is the benchmark for in-ground ounces in Nevada, then Getchell should be valued closer to US$300 million, not US$45 million. Markets may need to see more superb intercepts in the upcoming drill program before reassigning the new valuation, or they might decide to move sooner, but one thing is certain from where I sit: Once the current financing closes, the stock is going to all-time highs, because Fondaway is going to wind up as either a “Tier Two” or a “Tier One” asset, either of which will be highly coveted by the major miners in Nevada. It is also why Getchell continues to be my largest holding and my top pick for 2021–2022.

The UPS guy just got chased back into his truck by a large and very aggressive Rottweiler trying to guard us from intruders, so enough of my own book-talking. I must give the UPS driver back his right boot, dutifully removed and now in the jaws of Fido the Protector.

Originally published Saturday, May 8, 2021. All images provided by the author.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

- Goldcliff Resource Corp.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Western Uranium & Vanadium, Goldcliff Resource, Getchell Gold and Norseman Silver. My company has a financial relationship with the following companies referred to in this article: Western Uranium & Vanadium, Western Uranium and Vanadium, Getchell Gold and Norseman Silver. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Goldcliff Resource. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold, Western Uranium and Vanadium and Norseman Silver, companies mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: GTCH:CSE; GGLDF:OTCQB,

GCN:TSX.V; GCFFF:OTCBB,

NOC:TSX.V,

WUC:CSE; WSTRF:OTCQX,

)

Another Month, Another Huge Budget Deficit

The US government ran another huge budget deficit in April. The shortfall came in at $225.58 billion, running the total budget deficit through the first seven months of fiscal 2021 to a record $1.9 trillion, according to the Treasury Department’s Monthly Treasury Statement. That compares with a $1.5 trillion deficit through the first seven months […]

The post Blog first appeared on SchiffGold.