As children, we often have elaborate dreams about our wedding day… We dream about a picturesque wedding scape, a dreamy partner, and a wedding dress that could stop traffic in Times Square.

As children, we often have elaborate dreams about our wedding day… We dream about a picturesque wedding scape, a dreamy partner, and a wedding dress that could stop traffic in Times Square.

Every year, I make sure that my kids, my husband, and I all get our checkups at the doctor. It’s not about worrying that something may be wrong—it’s about making sure we’re on the right track and avoiding any surprises. For instance, maybe we learn that it’s time to rebalance our diet, or perhaps a bad allergy season is on the way and we need to figure out the best way to prepare.

The same is true for our finances. Setting time aside for a close examination of where we’re at and where we’d like to be by the end of the year and beyond can help put our minds at ease. Plus, just as we would want to know whether we should expect a bad allergy season, we should make sure we’re aware of any economic changes that may be on the horizon.

For example, a June 14, 2021, article by Fox Business states that according to a recent survey by the Federal Reserve Bank of New York, “Inflation expectations for the next year climbed for a seventh straight month in May to a record high…the highest since the New York Fed’s Survey of Consumer Expectations began.” And according to a June 15, 2021, article by Fox Business, “Producer prices rose in May by the most on record…since recordkeeping began in November 2010.”

Prices are increasing, and many are wondering what that may mean for their bank accounts. With these things in mind, let’s take a look at your mid-year financial checkup.

Revisiting your financial plans is one of the most important things you can do for your financial health. According to Northwestern Mutual’s 2021 Planning & Progress Study released on June 23, 2021, “83% of those surveyed say they were prompted to either create, revisit, or adjust their financial plan over the past 16 months.”

It’s incredibly helpful to have an idea of how much money is coming and going each month. If inflation or consumer goods prices increase, the amount you spend each month could increase without your realizing it.

If you feel like you’ve never had the time to create a budget or haven’t felt the need, you should know that there are many benefits to be found by getting a handle on the basics. Try to keep track of your receipts for one month and then separate those expenses into categories like entertainment, groceries, utilities, etc. You might be surprised by what you find, and if you keep it up, you’ll have a helpful indicator of where prices may be slowly increasing because of inflation.

If you already have a budget created, take a look and see how you’ve done over the last six months. The Wall Street Journal reported on June 15, 2021, that U.S. retail spending fell 1.3% in May as consumers spent more money going out to restaurants and patronizing other businesses that were shut down or operated with restrictions over the last year. Perhaps this applies to you as well, and you’ve been going out to eat more often. If you plan on going out more, make sure it’s included in your budget and adjust as necessary.

Having a strong handle on your personal budget may be extremely helpful if the economy experiences a spike in inflation. Plus, it’s just good common sense to know where your money is going each month.

As members of society and members of our respective communities, we should be looking out for one another. I honestly believe that it’s our duty. One of the personal philosophies I hold most dear is that you get back what you put into the world. This can also be extended to our finances—the government even allows certain charitable organizations to receive tax-deductible donations.

As you continue your mid-year financial checkup, you may feel encouraged to look into charitable organizations that support causes you believe in so you can either make tax-deductible donations now or plan donations you want to make before the end of the year. By doing so, you not only help yourself, but you also help others, which is even more important.

According to the IRS, if you plan on taking the standard deduction on your tax return, you’re eligible for up to $300 (or $600 for those filing jointly) in additional deductions for cash donations to 501(c)(3) nonprofit organizations. But that limit expands significantly if you itemize your deductions. It’s a great way to save on taxes while also helping those in need.

Now is also a great time to help yourself by examining your retirement contributions. In 2021, employer-sponsored 401(k) contributions are capped at $19,500, with an extra $6,500 allowed for those over 50. Traditional and Roth IRAs have a combined contribution limit of $6,000, or $7,000 for those over 50.

When the summer comes, I like to use the opportunity to see where my finances are at and consider adjusting how much I put into retirement each month. I want to make sure that I’m as comfortable as possible, but I also need to make sure I have enough liquid funds on hand for bills, emergencies, or any number of unexpected issues that can come up.

When you go to the doctor for a checkup, you may receive a suggestion to take certain vitamins or exercise more—in other words, to add an extra “something” to your lifestyle to increase your overall physical health. In the same way, this mid-year financial checkup is a great time to consider whether there’s an extra “something” you could add to your portfolio to increase your overall financial health. Perhaps that “something” is precious metals.

Every day, it feels like we hear more and more worry over inflation. Gold and other precious metals have historically been used as a hedge against inflation and other economic factors. Your mid-year checkup is the perfect time to consider adding precious metals to the mix. You may even consider a self-directed precious metals IRA to help bolster your retirement savings.

Whether it’s for your health or for your finances, it’s a good idea to routinely check in and make sure you’re on the right path. With just a little work, you may make significant progress in attaining overall success. In both cases, you’ll be helping yourself live a longer, healthier, more comfortable life.

The post Here’s Your Mid-Year Financial Checkup appeared first on U.S. Money Reserve.

“Two years ago, we had hundreds of coins in our vault. Last week, we were lucky to have 24 Gold Eagles. We’re seeing the silver squeeze and the gold squeeze firsthand.”— John Karow, Scottsdale Bullion & Coin precious metals advisor

In just 4 days, Basel III could change the gold and silver markets forever. How do we know this for sure? We don’t. Here’s what we do know:

Call it the perfect setup for higher gold and silver prices. Call it the long overdue reckoning for big bullion banks. Call it what you will, but Basel III is about to force serious accountability into the paper gold and silver markets in just 4 days. The countdown to Basel III is on.

When gold and silver paper contracts have to be backed 1-to-1, demand for gold and demand for silver could surge, and so too could gold prices and silver prices. See more on the impact of Basel III on the price of gold and silver from Scottsdale Bullion & Coin’s Founder Eric Sepanek and precious metals advisor John Karow. Watch the video now.

What does all of this mean for you? Real gold and silver prices could be coming in 4 days, making now the opportune time to buy. The only question left then is, which gold and silver products to buy. Get the answer in your FREE Precious Metals Investment Guide.

Kitco News

(Kitco News) – The increase in export of metalliferous ores to China, Australia’s largest trading partner, was once again driven by iron ore, up $2,087m (20%) to $12,666m.

![]()

The post Australia’s iron ore export to China sets another record in May – report appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Last week’s surprisingly hawkish tone from the Federal Reserve may have driven the speculative hot money out of the market. Still, the CEO of one of the largest precious metals firms in the world said that gold’s long-term potential remains firmly intact.

![]()

The post Gold’s fear-driven selloff should be bought – Sprott’s Grosskopf appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Bitcoin price to set new record by year-end, institutional money will flood in once this happens

![]()

The post Bitcoin price to set new record by year-end, institutional money will flood in once this happens – Jason Urban appeared first on WorldSilverNews.

Kitco News

(Kitco News) – A proposed draft bill would authorize the Central Bank of Bolivia (BCB) to purchase the country’s domestically-produced gold to strengthen its international reserves, according to Bolivia’s President Luis Arce.

![]()

The post Bolivia to buy more gold to strengthen reserves as prices set to rise – Bolivia’s president appeared first on WorldSilverNews.

Kitco News

(Kitco News) – StatCan said that the real GDP of the mineral and mining subsector (+5.1%) rose for the third consecutive quarter as production increased following rising prices.

![]()

The post Canada’s mining industry grows for the third consecutive quarter – StatCan appeared first on WorldSilverNews.

MarketWatch/William Watts/6-21-2021

“Dalio, speaking in a conversation with economist and former Treasury Secretary Lawrence Summers at the Qatar Economic Forum, warned that it will be difficult to avoid an overheating of ‘monetary inflation’ due to a flood of bond issuance.”

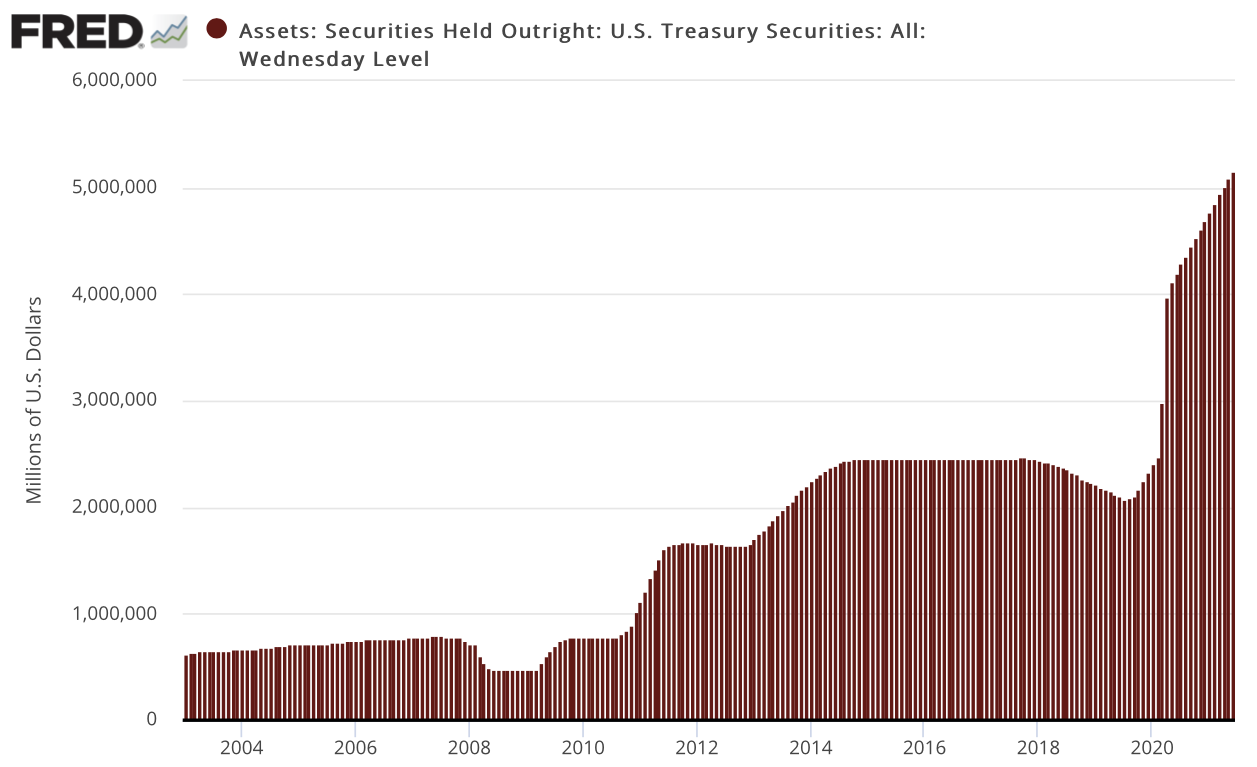

USAGOLD note: The Fed is behind the proverbial rock and hard place with more jawboning probably its best option. For its part, the Biden administration looks to have situated itself to the left of the Carter administration when it comes to fiscal policy. To say the Washington mix is volatile might be to understate the situation. The chart below shows in the aggregate the amount of federal debt monetized by the Federal Reserve. It stands at a little over $5 trillion and a level not even remotely associated with anything assumed previously. Capital, Dalio suggests, might flow in the direction of China and other markets.

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

BusinessInsider/Harry Robertson/6-15-2021

“Several of the factors pushing up inflation recently are likely to fade in coming months, including energy prices. We agree with the [US Federal Reserve] that elevated inflation pressures will prove short-lived,” he said. “We do not expect a more sustained disruption to equity markets.” – Mark Haefele, chief investment officer at UBS Wealth Management

“Several of the factors pushing up inflation recently are likely to fade in coming months, including energy prices. We agree with the [US Federal Reserve] that elevated inflation pressures will prove short-lived,” he said. “We do not expect a more sustained disruption to equity markets.” – Mark Haefele, chief investment officer at UBS Wealth Management

USAGOLD note: This is probably one of the reasons the gold rally stalled at just over the $1900 mark, i.e., 70% of fund managers buying into the Fed’s opinion that any inflation we get will be transitory. Though Business Insider waters down the fact that 64% of respondents to the survey expect higher inflation over the next 12 months (as opposed to 83% a month earlier), it is still a very high number.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.