Month: June 2021

- Affidavit: FBI Feared Pennsylvania Would Seize Fabled Gold 90.5 WESA

- FBI feared Pennsylvania would seize fabled gold, court docs show NBC News

- Lost Civil War gold seems to have given everyone, including the FBI, gold fever The Philadelphia Inquirer

- FBI Feared Pennsylvania Would Seize Fabled Civil War Gold: Affidavit HuffPost

- FBI fears Pennsylvania seizes legendary gold – NBC10 Philadelphia Pennsylvanianewstoday.com

- View Full Coverage on Google News

- Gold prices fall, but hold onto week-to-date gain MarketWatch

- Gold dips as mixed Fed outlook put investors on edge CNBC

- PRECIOUS-Gold dips as mixed Fed outlook put investors on edge Reuters

- Gold Price Forecast: Gold Grasps at Fibo Support but Sellers Vigilant DailyFX

- PRECIOUS-Gold holds steady as traders seek direction from U.S. data Nasdaq

- View Full Coverage on Google News

Bubbles Galore

Is the entire financial system currently in a massive bubble? That is the question that astute investors may now be asking.

According to Nouriel Roubini, CEO of Roubini Macro Associates and professor at NYU Stern School of Business, now is the time to be overweight gold as more bubbles pop up.

Stocks, bonds, crypto, tech, real estate, whatever sector you want to focus on – these all appear to now be building into or rapidly falling from bubble territory.

The higher these markets do ascend, the greater the eventual fall may be.

That fall could be arriving sooner rather than later and may catch many unsuspecting investors off-guard.

Stocks are now valued at levels that have not been seen in some time, if ever before. Real estate is booming, with price advances well into double digits in many regions. The risk of a major correction across many asset classes continues to rise.

Based on the total stock market capitalization to GDP ratio, the market is now 100% overvalued on a historical basis. To put that figure into perspective, the height of the tech bubble saw stocks become overvalued by some 49%.

The adjusted price/earnings ratio known as CAPE was developed by Yale economist Robert Schiller. This metric is favored by many of the sharpest minds in the market as a gauge on whether stocks are under or overvalued.

As recently as early April, the CAPE registered a reading of 36.8. The measure has only risen that high once before in the 139 years it has been tracked… immediately before the 1929 crash, the CAPE reading peaked at 33.

When CAPE reached extreme levels in the past, the market tumbled rapidly and lost a significant portion of its value – well into double digit declines. Do current readings suggest a similar outcome?

It is impossible to say when the freefall may get going. Stocks have shown a strong tendency to become overbought and eventually become wildly overbought in a process that can take weeks, months, and even years.

The day of reckoning will come, at some point, however, and those who are unprepared will get bloodied.

Of course, it’s not only stocks that have become severely overbought.

Numerous asset classes from housing to cryptocurrencies have zoomed to unprecedented heights in recent months.

Although speculative investments may provide investors with significant upside potential in the near-term, too much exposure to assets in bubble territory carries tremendous risks.

For example, Dogecoin exploded in price this spring on social media hype and Elon Musk cheerleading. But it has since crashed by more than 65%.

Careful, disciplined investors keep their focus on long-term value rather than short-term upside. Gold and silver bullion offer intrinsic value and – now in particular – relative value compared to most asset classes.

Once a bubble pops, the implosion can occur swiftly and there may be few places for investors to hide.

Against the current backdrop of low interest rates, massive quantitative easing, and rising sovereign debt levels, there may be no better place for investors to turn to than physical precious metals.

Many people involved with the monetary metals may be eagerly awaiting Monday, when the “Basel 3” regulations on unallocated gold held by bullion banks take effect in the European Union, supposedly making the unallocated business prohibitively expensive.

Of course, there are great hopes that implementation of the rules will begin to explode the fraud of “paper gold” by which gold’s price long has been suppressed with the assistance of central banks.

But Monday doesn’t seem likely to be the day of deliverance.

In the first place, most of the banks transacting in unallocated gold are in London and not subject to the European Banking Authority, which is to enforce the Basel 3 rules in the EU. The Bank of England well may adopt the Basel 3 rules for the United Kingdom, but no official decision has been made yet.

Secondly, wherever the Basel 3 rules on unallocated gold take effect, any bullion banks subject to them would not be getting out of the unallocated gold business abruptly on one day.

The banks would be diminishing their unallocated gold trade gradually, and perhaps already have been engaged in that. Whatever the effects of such diminished trading are, they likely will be gradual as well.

Third, who can ensure that the new rules will actually be enforced and that governments will not provide a secret exemption if they consider essential to national security the camouflage bullion bank trading in unallocated gold provides to government gold suppression policy?

The supposedly prohibitive expense the new rules would impose on bullion banks trading in unallocated gold – a vast increase in offsetting capital – might be covered by governments themselves and not reported.

Fourth, governments seeking to suppress the gold price could find other intermediaries for camouflage – brokerages or banks outside jurisdictions enforcing Basel 3 rules.

And fifth, governments seeking to continue controlling the gold price could simply do it in the open again, as they used to do it in the days of the gold standard and the London Gold Pool. They could try to tax gold transactions prohibitively.

This might not be terribly effective, since not all governments would cooperate with it and two systems of gold pricing would be publicized. But it would be a mistake to underestimate government’s capacity for totalitarianism even in the nominally democratic West.

If there is to be a big change in gold pricing, it likely will have the same sort of cause as the cause of the last big change, the collapse of the London Gold Pool – that is, the exhaustion of the supply of real metal that the price-suppressing governments are prepared to lose.

The change also probably will be made in a way that makes central banks seem to be sponsoring and controlling it, and probably will put gold into a framework in which central banks can sustain another 50 years or so of gold price control, if at a higher price whose maintenance causes less strain and political conflict in the world financial system.

Of course, given government’s power to create infinite money and deploy it in secret, and financial journalism’s corruption, cowardice, and uselessness to the public interest, Basel 3 rules may come to seem to have had no impact at all. But something almost surely is happening with Basel 3 and gold. For if Basel 3 had no meaning for gold, the London Bullion Market Association and the World Gold Council would not have issued such a desperate protest against it six weeks ago, proclaiming that Basel 3 threatens to put the bullion banks out of business.

That kind of thing had never happened before.

Indeed, many things lately have been happening with gold that have never happened before, or not for a long time, even as two principles will remain eternal – that gold is the ultimate money, money without counterparty risk, money everywhere at all times, money independent of government, and thus a prerequisite of individual liberty, and that government finds it very difficult to abide individual liberty.

Source: Maurice Jackson for Streetwise Reports 06/23/2021

Maurice Jackson of Proven and Probable speaks to Dr. Roger Moss, CEO of Labrador Gold, about his company’s highest grade drill results to date.

Maurice Jackson: Joining us for our conversation is Dr. Roger Moss, the CEO of Labrador Gold Corp. (LAB:TSX; NKOSF:OTCQX), with some very encouraging news to provide shareholders regarding more high-grade gold intercepts from the flagship Kingsway Gold project.

Before we begin, Dr. Moss, please introduce us to Labrador Gold and the opportunity the company presents to shareholders.

Roger Moss: Labrador Gold is a junior gold explorer. And as the name suggests, we have a couple of projects in Labrador and those projects are still active, at Ashuanipi and Hopedale. They’re both district-scale gold projects. Both are pretty green fields still, but coming along nicely.

Last year Labrador Gold picked up the Kingsway project and that’s been the focus for us over the last year to 18 months. And it’s been quite a ride. As you know, we’re in the middle of a gold rush here in Newfoundland and it’s a very exciting time to be exploring for gold in central Newfoundland.

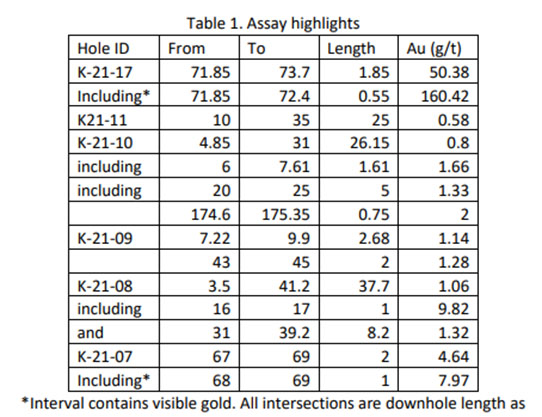

Maurice Jackson: The company is currently embarked on a 50,000-meter drill program. Let’s go onsite, as earlier today Labrador Gold released yet another impressive press release regarding more high-grade gold intercepts from the flagship Kingsway Gold project. Dr. Moss, what can you share with us?

Roger Moss: We had two holes that had visible gold in them that was still outstanding. The assays were in the lab, and all the samples were in the lab. We were waiting for the assays, and they came back and they were pretty good. Earlier today we released six holes from the Big Vein target. And two of them were holes that contained the visible gold.

Hole 7 ran 7.9 grams per tonne (g/t) over a meter. But that was overshadowed by Hole 17 which was the highest grade that we’ve drilled yet on the project. And that was 160 grams per ton, over 0.55 meters within a larger interval of 1.85 grading 50.4 grams per ton. These are some pretty nice intercepts. And like I said, the largest, highest-grade that we’ve seen yet from Big Vein.

Maurice Jackson: You must be a master chess player or poker player because I like how you’re containing your composure here.

Roger Moss: It is pretty exciting. I must admit. There’s a lot of excitement around the core shack these days and people are always waiting to open the core boxes. Yeah, I think people are pretty happy.

Maurice Jackson: Sir, this is another great demonstration of Labradors Gold’s proof of concept. What is the significance of these results?

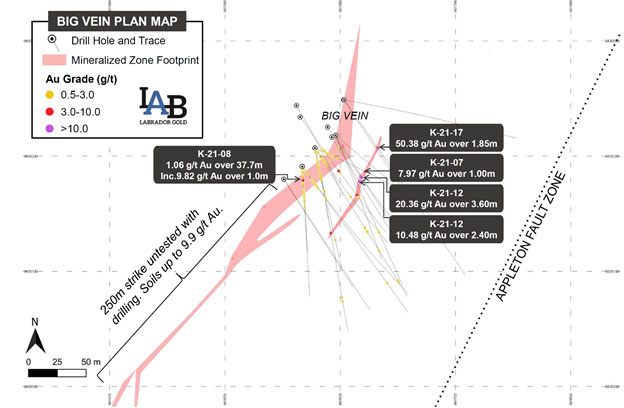

Roger Moss: Well, I think it shows again that the Big Vein target is a very prospective target. This is probably the third high-grade results that we’ve had, the highest yet. And this was a 30 meter step out to the northeast from the previous interval. That’s a pretty significant step up when we’re doing these very tight space drill holes of 10 to 12.5 meters from one another. So, 30 meters step-out, that’s good.

We’re starting to get a bit of a handle on the plunge of the mineralization. And that’s key. We think we’re going to be able to target these higher-grade intervals better going forward. And the more of these intervals we see the more refined that our targeting will be. The high-grade interval is now over about 40 meters or so, or at least the strike length is over 40 meters or so. And it’s still open in both directions and lots of drilling to follow that up.

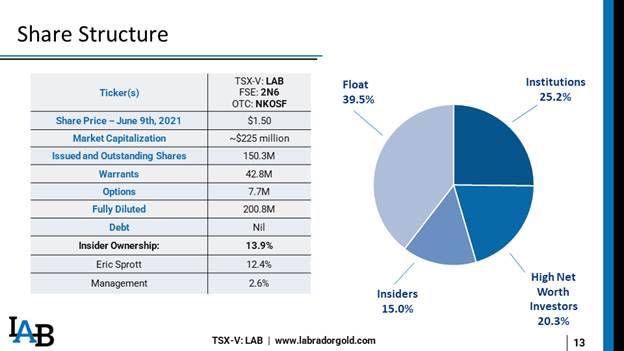

Maurice Jackson: Sir, please provide us with the capital structure for Labrador Gold.

Roger Moss: We have 150 million shares outstanding, about 43 million warrants, all of which are in the money right now, and about 8 million options again, all in the money. We have about 200 million shares on a fully diluted basis.

Maurice Jackson: In closing, Dr. Moss, what would you like to convey to shareholders?

Roger Moss: This is like a baseball game. We’re in the first innings. And I think we managed to reach first base. We’ve seen a lot of pitches. We’ve got a man on, nobody out and the more pitches we see, the better the chance we will hit a home run/s.

I think we’re still swinging and one of these days we’re going to hit it out of the park. And you know that doesn’t just go for Big Vein, which is where we’ve been focused most of our exploration, but we’ve also got a much wider quartz vein corridor along Big Vein, which we’re going to be drilling pretty soon. Once we’ve got targets lined up there, we’re developing targets all along that quartz vein corridor stretching for about seven and a half kilometers. And that is going to be interesting.

I had a conversation with our VP Exploration Matt Lapointe the other day, and he said, “Big Vein may not be the biggest occurrence that we get. It’s just the first one we’re looking at.” And so I like to think that some of the prospects that we’re developing north and south of Big Vein will turn into a string of pearls, all strung out along the Appleton fault zone.

I think that would be the ultimate discovery, it’s not just to have a discovery at Big Vein, but to be able to discover more occurrences all along the Appleton fault zone. I think that would be the ultimate.

Maurice Jackson: Dr. Moss, for readers who wish to learn more about Labrador Gold, please share the contact details.

Roger Moss: Please email rmoss@labradorgold.com. The website is www.labradorgold.com. And I always refer people to our Twitter account, which is @LabGoldCorp. We put a lot of content up there, short clips that just give you a behind-the-scenes look at what we’re doing here in Newfoundland.

Maurice Jackson: Dr. Moss, thank you for coming on the show on such short notice; it’s been a pleasure speaking with you. Wishing you and Labrador Gold the absolute best, sir.

Roger Moss: Thanks very much, Maurice. And I hope I managed to get through this one without smirking too much.

Maurice Jackson: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales; subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Labrador Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Labrador Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: LAB:TSX; NKOSF:OTCQX,

)

Source: Peter Epstein for Streetwise Reports 06/23/2021

Peter Epstein of Epstein Research discusses Marvel Discovery Corp.’s strategically located new claims in the “red hot Newfoundland gold play.”

Marvel Discovery Corp. (MARV:TSX.V; IMTFF:OTCQB) has a lot going for it. I’ve written several articles on this company, typically describing its cheap valuation relative to peers. Yet everything I’ve written came BEFORE Marvel set out to become a significant claims holder in the red hot Newfoundland gold play. Last week, Marvel staked an additional 274 claims totaling 6,850 hectares to its Gander South claim group, within the highly prospective Gander zone.

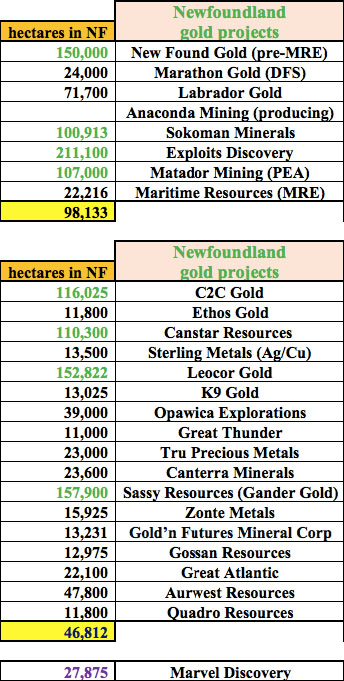

These new claims are ~10 km north of 10,250 hectares staked on June 8th. The company now has 17,100 hectares in the heart of the Central Newfoundland Gold Belt (CNGB), contiguous with New Found Gold’s [NFG] Queensway project. Gander South, and other Newfoundland holdings, position Marvel as an important gold junior in the province. While there are >50 publicly listed companies with properties in Newfoundland and Labrador, only a dozen have meaningful property holdings within an hour’s drive (70 km) of Ground Zero.

Will Marvel Discovery be the fastest growing Newfoundland gold junior of 2021?

Ground Zero is NFG’s Keats Zone, where a blockbuster discovery hole in late 2019 (19 m at 92.9 g/t gold), put the CNGB at the center of the high-grade gold exploration world. However, back then gold was around $1,475/oz. In the ensuing nine months, it hit an all-time high of $2,070/oz., sparking the ongoing, modern-day gold rush/claims-staking frenzy we see today.

Experts are increasingly noting similarities in geological setting and character of Newfoundland mineralization to that of both the Abitibi Greenstone Belt (AGB) of Ontario and Quebec, and the Bendigo-Fosterville goldfields in Australia. If these parallels prove to be informative, it would really bode well for growing Newfoundland stakeholders like Marvel Discovery. Since the early 1900s, the AGB has produced over 180 million ounces of gold and 15 billion tonnes of copper (+silver and zinc and other base metals).

A month ago, NFG shocked the world yet again with one of North America’s best gold assays of the century: 25.6 m @146.2 g/t gold = 3,743 gram-meters. That 3,743 figure is more than Great Bear Resources’ seven best holes combined. NFG’s Enterprise Value (EV) {market cap + debt – cash} has soared to ~$1.8 billion! (pre-maiden resource estimate).

Other significant Newfoundland juniors include Marathon Gold, Anaconda Mining, Sokoman Minerals, Exploits Discovery, Labrador Gold, Maritime Resources, Matador Mining and Sassy Resources. Marathon has a strong 5 Moz project entering production in 2023. Anaconda is in production (~18,000 oz/yr) at one of its three projects. Matador has a growing 1 Moz deposit and a preliminary economic assessment (PEA). Labrador Gold, Exploits and Sokoman already have high-grade discoveries under their belts, (but they’re still pre-maiden resource)—with an average EV of ~$163 million.

Ambitious goal to triple in size to ~100,000 hectares this summer

In a recent Proactive Investors interview, largest shareholder and CEO Karim Rayani stated that the company plans to grow its portfolio in Newfoundland from ~28,000 to as many as 100,000 hectares this summer. That would make Marvel a top-10 precious metal claims holder in the province.

Why is size so important? The top eight Newfoundland-focused gold juniors have announced at least 421,000 meters of drilling for 2021 (in varying stages of completion). Two hundred thousand (200,000) meters is being done by NFG. Imagine how many exciting press releases this drilling might generate.

Depending on where management secures the land that takes them to 100,000 hectares, Marvel could soon have a top-6 holding [of property within 70 km] of Ground Zero, which would be a formidable footprint to show potential partners. I asked Mr. Rayani where he’s looking to expand, but he couldn’t tell me, except to say, “in desirable areas.”

Two of Marvel’s longer-held Newfoundland properties are Victoria Lake and Slip. Victoria Lake shares structural settings with Marathon’s world-class, 5 Moz Valentine Lake project. Historical grab samples at Victoria Lake returned up to 15.5 to 24.9 g/t gold. The Slip project has similar structural settings as NFG’s Queensway. Slip has historical surface samples grading as high as 44.5 g/t gold.

Marvel doing the right things at the right time in Newfoundland’s modern day gold rush

To be clear, even if Marvel’s team locks down 100,000 hectares, there can be no assurances that any of the prospective hectares will host interesting mineralization, not to mention economic grade. However, in any red hot area play the tried and true method is absolutely to grab as much land, in what appears to be the best places, as fast as possible.

Make no mistake, New Found Gold’s properties are going to become a mine. That means surrounding juniors (if they don’t develop mines themselves) will be prime takeover targets as satellite deposits to mining operations that spring to life later this decade.

Readers should recognize that most of the land scooped up by juniors will be uneconomic, but the call option value of well situated property is compelling. Consider that the Keats zone is ~50 hectares in size (open at depth and along strike), but could already contain millions of ounces of gold on just that small footprint. By far Labrador Gold’s most important property, Moosehead, comprises 7,700 hectares, yet that company’s EV is ~$250 million (pre-maiden resource estimate).

Rayani and other smart money investors, most notably Eric Sprott, are accumulating properties in this area play. Obviously, not every junior will make it big like NFG. In fact, most will never even climb to the ranks of Marathon, Labrador Gold, Anaconda or Sokoman. However, over the next 12–18 months, several companies with tiny market caps will enjoy substantial gains in market valuation; there’s a decent chance Marvel will be one of them.

The (potentially) high-grade Blackfly gold project in Ontario could be a company maker

Readers are reminded that Marvel Discovery is far from a one-trick pony. In prior articles I outlined how cheap the valuation was based on its portfolio of prospective properties. While the EV has increased, at $9 million it still appears undervalued. If Rayani can deliver 100,000 hectares in Newfoundland, the value of that land bank alone would easily be >$9 million (in my opinion).

Investors would be getting all the other assets for free. One “other” asset is the 1,296 hectare Blackfly Gold project in Ontario (~14 km southwest of Agnico’s Eagle’s 5.6 million ounce Hammond Reef project). Diamond drilling of 16 holes is expected to start next month. Historical intervals included 1.1 meters @ 15 g/t gold and 2.0 meters @ 11 g/t gold.

Earlier in June, assays from 78 surface samples at Blackfly were reported. Four graded >10 g/t gold, the highest was 24.3 g/t. These select samples (not necessarily representative of the entire deposit) included some visible gold, indicating the potential for both vein-hosted and broad disseminated/stringer mineralization. Assays on another 180 samples will be released in coming weeks.

Blackfly is very exciting. It’s in the up-and-coming Atikokan gold camp. This year’s exploration program follows up on last year’s compilation of historical info and high-resolution airborne magnetics/time-domain EM data collection. Geological mapping indicates alteration/mineralization for up to 5 km. Grab samples at the historical shaft area included grades of 85.6 and 167 g/t gold.

Blackfly’s drill program this summer could be a game-changer for that project. If drilling at Blackfly hits high grades over multiple meter widths, then that property alone could be worth more than the company’s entire EV of $9 million. In addition to Blackfly and the growing excitement in Newfoundland, Marvel also has promising Red Lake Ontario gold properties that could see exploration later this year.

Readers should consider watching Marvel Discovery (TSX-v: MARV) / (OTCQB: IMTFF) as multiple press releases are expected. News of securing properties, sample assays and drill results from Blackfly will keep shareholders busy well into the 4th quarter.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Marvel Discovery, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Marvel Discovery are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Marvel Discovery was an advertiser on [ER] and Peter Epstein owned shares & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: MARV:TSX.V; IMTFF:OTCQB,

)