It’s ‘permanent’ not ‘temporary’, won’t bounce back

______________________________________________________________

Wolf Street/Wolf Richter/6-10-2021

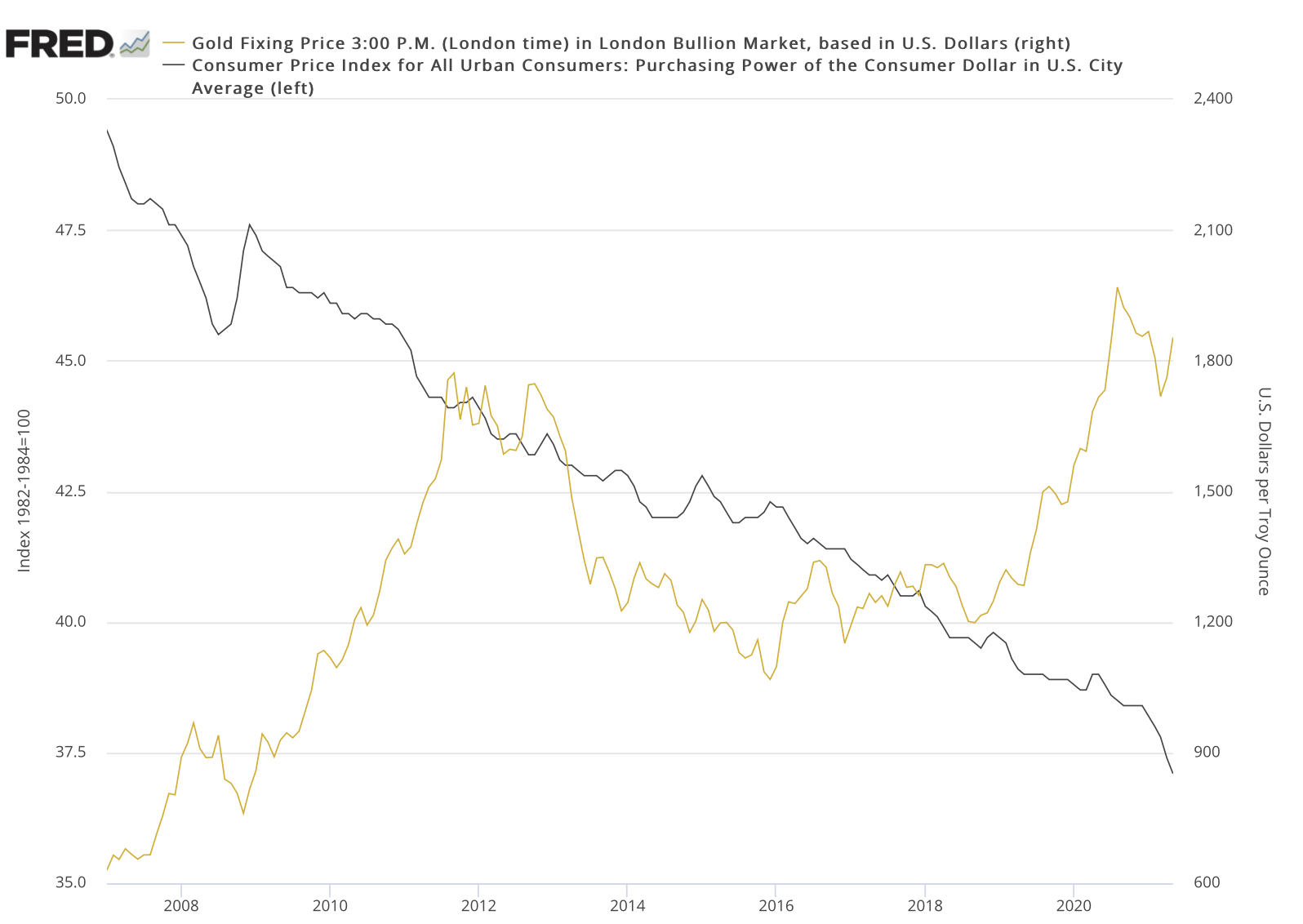

“Yup, the current plunge in purchasing power is permanent. And the plunge in purchasing power in the future is also permanent. The only thing that might make a small portion of it ‘temporary’ is if there is a period of consumer price deflation, which has happened for only a few quarters in my entire life, for example in the last few months of 2008, which is indicated in the chart below. So I’m not getting my hopes up. The rest of the time, we’ve had lots of decline in purchasing power. And that has proven to be rock-solid ‘permanent,’ and we never got that lost purchasing power back.”

USAGOLD note: We included the price of gold in the chart referenced by Richter in order to emphasize gold’s functionality as a hedge against currency deterioration and a long term store of value.

Gold and the purchasing power of the dollar

(monthly, 2007 to present)

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.