Month: July 2021

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

As the summer doldrums drag on, precious metals bulls are eying potential support levels for a seasonal bottom.

The gold market found support at the $1,750 level last month and has since been trading with a slight upside bias. Although the price action hasn’t been especially exciting, base building in these summer months can be a healthy technical process in the context of a larger bull market.

Gold prices currently come in at $1,808 an ounce, down 0.6% for the week.

Turning to silver, the poor man’s gold has been underperforming this month but did catch some buying interest mid-week just under the $25 level. As of this Friday recording, silver trades at $25.21 an ounce to register a weekly decline of 2.1%.

Platinum is off 3.6% since last Friday’s close to trade at $1,076. And finally, the palladium market is putting together a 3.2% rally this week to check in at $2,747 per ounce.

Meanwhile, investors are weighing troubling developments on the inflation front. Price increases are hitting consumers every time they shop, and that trend shows no signs of letting up.

Appliance makers including Whirlpool are announcing price increases of as much as 12% as a result of higher labor and material costs.

Unilever, which owns some of the leading brands on grocery store shelves, warned Thursday that rising costs were eating into profitability. Everything from ingredients to packaging to transportation is becoming more expensive – and that, of course, will ultimately have to be passed on to consumers.

They can expect to pay more for Cheerios and Tide laundry detergent. Packaged goods giants General Mills and Proctor & Gamble recently implemented price increases. Some of those increases may be disguised by reductions in unit sizes on certain products – a phenomenon that has been dubbed “shrinkflation.”

But savvy shoppers won’t be fooled. They know that price isn’t the same thing as value. What matters is the cost per ounce of a box of cereal or bottle of detergent. The best value in terms of cost per ounce is usually found in larger sized products.

That is also true to a significant extent when it comes to bullion products. Fractional sized coins of less than one-ounce tend to cost more than full ounce or larger coins when calculating the costs per ounce. Large bullion bars often provide the best value in terms of metal content.

But there are exceptions to be aware of. Sometimes premiums on pre-1965 silver coins or scratched and dented gold coins are among the lowest available.

And sometimes buyers find utility in fractional sized items or aesthetic value in coins that arrive in mint condition.

Bargain hunters at the grocery store will often opt for generic or store-branded products. In many cases, they have exactly the same ingredients as pricier counterparts next to them on the shelf that are put out by more recognized name brands.

This principle also applies to bullion shopping. A popular name brand such as the U.S. Mint’s American Eagle will carry a sizeable premium over a round issued by a private mint that is less well known.

A Walking Liberty Silver Round produced by Money Metals Exchange has the same .999 purity as a Silver Eagle. If they were both melted down, they would look exactly the same, have exactly the same physical properties, and be worth exactly the same amount. But silver stackers who opt for the Walking Liberty will save a few bucks per ounce compared to the American Eagle, which is manufactured by the poorly run U.S. Mint.

At some point, upward price pressures will again exert themselves on precious metals markets. When they move, they can be expected to move much more dramatically than cereal and soap.

Consumers who are looking to protect themselves from rising shopping bills would be wise to consider buying bullion products while they can still be had at bargain prices.

The underlying drivers of rising inflation aren’t going to abate anytime soon, despite the insistence of Federal Reserve officials and President Joe Biden that the inflation problem is just temporary.

The White House Budget Office had forecast inflation of 2.1% for 2021 in its recent budget proposal. Inflation is running at more than double that rate. It’s running at 5.4% according to the latest Consumer Price Index reading – and higher still according to other measures that may be more accurate.

The Wall Street Journal recently reported that M2 money supply has been growing at an annualized rate of 23.9% since March 2020.

It typically takes several months for a flood of new currency to work its way through the financial system and producer supply chains before finally showing up in retail prices. So, the monetary inflation currently being pumped out will have consequences well into next year.

Where the next inflation hot spots will emerge is difficult to predict. But it’s a pretty safe bet that gold and silver markets won’t be exempt from the price consequences of the inflation that is already here as well as the inflation that is yet to come.

Well, that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a weekend everybody.

Source: Maurice Jackson for Streetwise Reports 07/22/2021

Dan Weir, the CEO of Copper Bullet Mines, talks with Maurice Jackson of Proven and Probable about his company’s plans during what may be a “golden age for copper.”

Maurice Jackson: Joining us for a conversation is Dan Weir, the CEO of Copper Bullet Mines.

It is a pleasure to be speaking with you today to discuss the opportunity before us in Copper Bullet Mines. Before we delve into company specifics, Mr. Weir, please introduce Copper Bullet Mines and the opportunity the company presents to shareholders.

Dan Weir: Copper Bullet Mines is a new company we plan to take it public in the next 12 months. It’s run by a bunch of experienced mining guys. We have currently three geologists involved in the company. We have multiple engineers, mining engineers, metallurgical engineers, process engineers, guys that know how to mine. We have decided to focus on the Western United States.

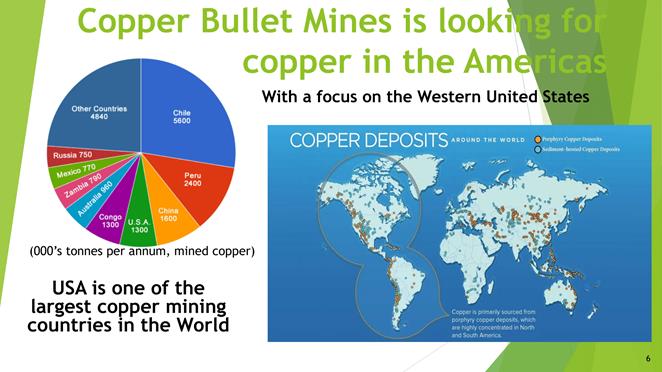

Maurice Jackson: This may very well be the “Golden Age for Copper,” as many believe that copper is the new oil. Mr. Weir, please provide us with an overview of the supply and demand of copper.

Dan Weir: Yes, it’s very interesting. You’ve got Goldman Sachs and several companies have come out; Goldman Sachs uses the term “copper is the new oil.” If you look at a comparison, a combustible gasoline or diesel-burning vehicle has about 48 pounds of copper in it, but a Tesla or an electric vehicle has 183 pounds of copper in it. So, you can see here that it can be four, five times as much copper in an electric vehicle. So that’s just one aspect of it. Let alone the fact that we have to go across all over around the world building stations to recharge our electric vehicles, and our houses are all wired with copper wiring. More and more people are putting solar panels on their house. That means more wires, more copper is needed for that. Again, I look at Africa and only about 50% of Africa has electricity to people’s homes. That’s being built out as we move along. Other people call this is the “golden age for copper,” and I agree 100%.

Maurice Jackson: The value proposition of copper is quite compelling. Now, it’s early days for Copper Bullet Mines as the company’s currently private looking to go public. How does Copper Bullet Mines plan to meet the global demand for copper?

Dan Weir: We plan to focus on the western region of the United States. Currently, we are in what we call the copper triangle, which is in Arizona. Last month we purchased our first project the Copper Springs Project, which took about six months to put it all together. And that first project has historical resources, but we’re also looking for other assets. We are currently right now bidding on some producing assets. I can’t get into any details on those right now because we’re under confidentiality agreements, but we are looking for those types of assets, near-term type producing assets or producing assets, or something that has historical resources that we can bring up to a new resource by twinning holes. So, our focus and what we really would want to do is buy producing assets.

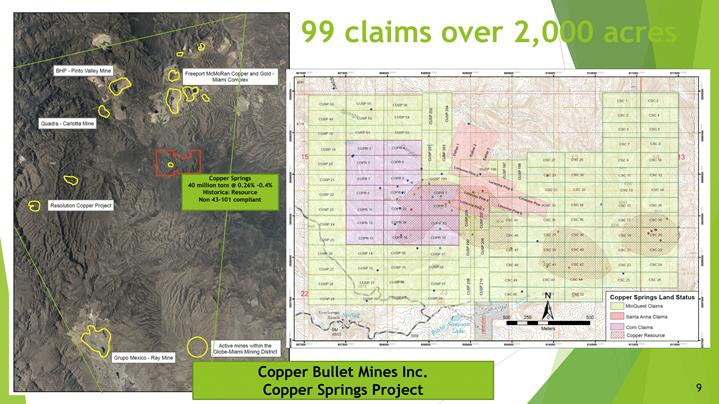

Maurice Jackson: Let’s go on site and find out more. Sir, take us to the “Copper Triangle” of Arizona and get us acquainted with the Copper Springs Project along with some of your neighbors.

Dan Weir: The Copper Springs Project is in the Copper Triangle, which is about one hour east of Phoenix. Some our neighbors in the Copper Triangle are the largest mining companies in the world, such as Rio Tinto, BHP, KGHM, Capstone and Asarco, which is owned by Grupo Mexico, and Freeport-McMoRan. We are surrounded by some of the largest mining companies in the world with mines in this area or are building a mine. And what I mean by building a mine, as an example, Rio Tinto and BHP, are spending billions of dollars to build the Resolution Mine. It will be one of the largest copper mines in North America when it’s completed. The Copper Springs Project is less than 12 kilometers away from the Resolution Mine.

Just to the north of us is Freeport-McMoRan. It has a copper smelter. There are only currently three, well, sort of three large copper smelters in the United States and one smaller one. Two of them just happened to be in the Copper Triangle, one with Freeport, just north of us, and the second at the bottom of the triangle owned by Asarco, and it’s called the Hayden Smelter. That smelter is being shut down. In the near future, the United States, is only going to have two full-sized copper smelters. One here, one up at Bingham Canyon in Utah, and then a small one in the Texas area. The Copper Triangle is probably the premier place in all of North America where you’re seeing copper production. And guess what? We’re right in the heart of the Copper Triangle.

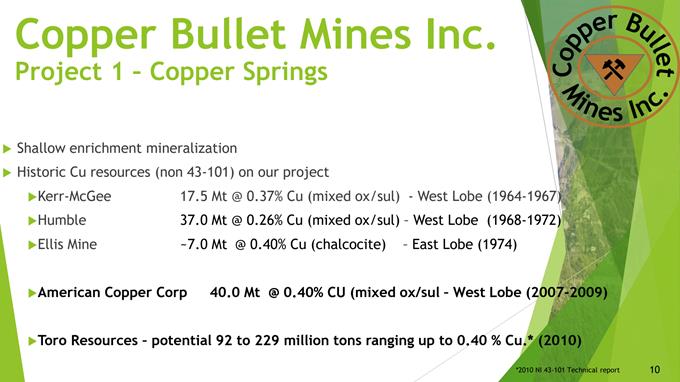

Maurice Jackson: The Copper Springs is a shallow enrichment mineralization project with the historical resource, which is currently non-compliant to 43-101 standards. Provide us with some context and what is the plan moving forward to become 43-101 compliant?

Dan Weir: Over the last 50 to 60 years, there have been many different groups who have owned this project or optioned this project and have gone in and drilled at calculated resources on the Copper Springs Project. Companies like Kerr-McGee, Humble, American Copper, and most recently in around 2010, there was a small junior company called Toro Resources that had the project. And I must add to that, they had parts of the project. It wasn’t until I was able to come in here and put all of the claims together in this area. There were three groups that I had to work with. The groups had the claims. They had a package of eight claims that sat right in the middle of the claim block, and they have owned these claims since 1924. Their great grandfather had staked them, owned them in the family all that time. And this is the first time since the ’50s that this project has all been put together with all these claim packages under one option.

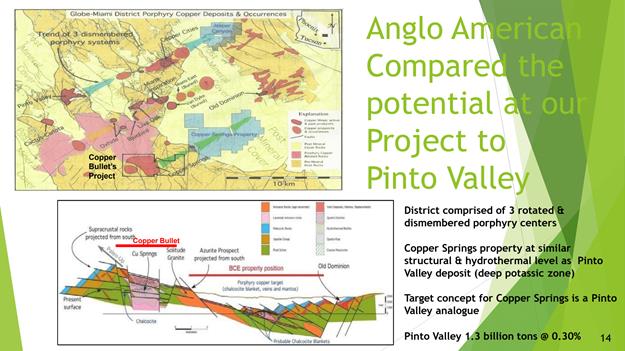

I’m not trying to pat myself on the back too much, but it was a lot of work, and it’s been a great experience putting this whole package together. Thus we now have a claim package of 126 claims over 2,600 acres. Our claim package that has had worked done over the years by some very large companies. Anglo-America recently visited the project in the last number of years. They say that this thing has huge potential, that we could be looking at similar to some of the others in the Copper Triangle, like Pinto Valley.

I’m not saying that that’s what we’re going to get. I believe from the data that we’ve looked at that we have a historical resource now, with 40 million tonnes grading around the 0.4% range. I’ve read several reports. Again, I can’t guarantee this, that there is potential here to be sort of 100 to 200 million tons. Let’s put that in some perspective. Even if we have 40 million tonnes and we have success twinning the historical holes, 40 million tonnes grading 0.4% is about 320 million pounds of copper.

The price of copper recently went up to the $4.60, $4.70 range. It’s pulled back in a little bit, but let’s use $4. It’s currently trading I think today at $4.25. Let’s call it $4. Multiply $4 times 320 million pounds of copper, you’re somewhere around $1.2 to $1.3 billion worth of copper sitting on this property right now. Now, again, there’s a lot of work to do. We’ll have to figure out recovery rates. We’ll have to figure out all sorts of things that go along with that. But I’m just throwing some big numbers out here because it does have some historical resources on here, and we believe that those historical resources are good. Again, until we do the drilling on here and twinned a bunch of these holes and bring it up to 43-101 standards, and do wish to be responsible with my words, these are just hypotheticals at the present.

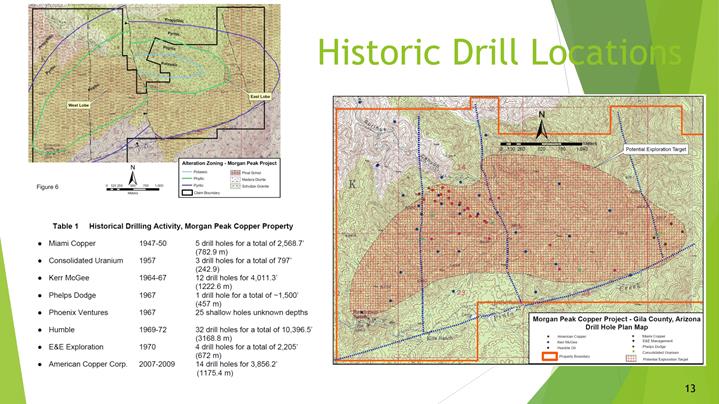

Maurice Jackson: Sticking with the historical resource, please walk us through some of the historical drill locations.

Dan Weir: As I mentioned, several different groups drilled over time, including Kerr-McGee, Phelps Dodge, some different groups have kind of come in and out of this project. Some people will look at a project and go, “Well, these guys drilled and they didn’t find anything.” Well, they did find a lot. You talk to certain geologists or people that had been around the mining industry for a long time and one discovers that to put a project into production, there may have been about five or six junior companies, maybe a couple of larger companies that have done all of the resource studies and looked at it at so many different ways, and then you’re likely going to have one or two guys before it goes into production.

It’s very typical of these types of projects that you have multiple different people over time that will pick up claims. They’ll do some drilling, maybe they ran out of money, maybe the copper price dropped, all sorts of things. But I can tell you that in this area, as I mentioned, I’m the first one since the 1950s that’s been able to put this whole package together, and we have a lot of the old data that we can go on model, go back and drill and build a resource on the back of that.

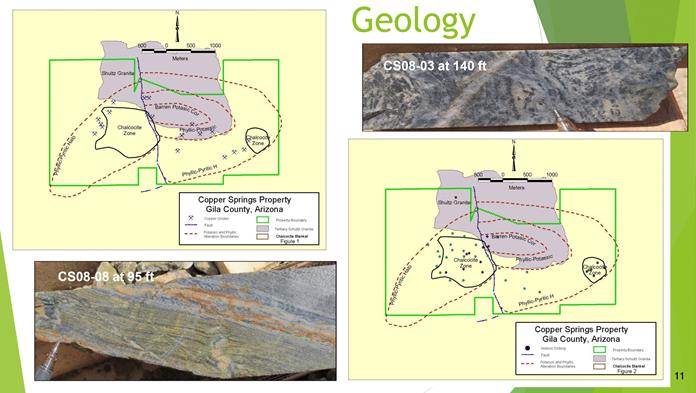

Maurice Jackson: What can you tell us about the genetic and the exploration model?

Dan Weir: Another great thing is around 2011, several people went out and mapped the Copper Springs Project. We have talked to the geologists and some of them are PhD-type geologists who have gone out and done a lot of mapping on this project. Most of the work has been done in one area. There’s a massive area sort of on the east side of the deposit that has huge potential. And these guys have gone out and done a bunch of the mapping and again agree that there’s massive potential. And there has been very little activity on the east side of the deposit. The non-compliant historical was produced mainly from the west region of the deposit of 40 million tonnes grading about 0.4%, but there’s been very little work done on three-quarters of the project. We are confident that these is a much larger potential before on the Copper Spring Project. And again, I can’t guarantee this. I do believe that we can get too much higher numbers than 40 million tonnes.

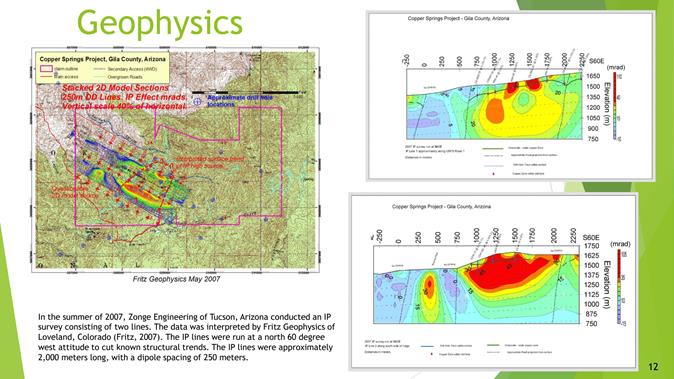

Maurice Jackson: To coincide with mapping, I see that a geophysics study was completed in 2007. Now, will this suffice for a drill targeting, or is there a plan to conduct another survey, or do you plan to twin the historical holes?

Dan Weir: Yes we will twin some of the holes. We will do a lot more geophysics over the property. You can see from some of the maps, it was only done in the one area where they did most of the drilling. We do want to go back in here and want to do a lot more geophysics over that. Geophysics is a cheap way to do exploration. Remember that drilling is very expensive, so anything that you can do to pinpoint where you want to put those drills helps the geologists pinpoint exactly where we want to put the drill in the ground.

Maurice Jackson: Let’s discuss some important topics germane to your project. Are you fully permitted?

Dan Weir: The simple answer is no. There’s a lot of work to do over the next couple of years on here. We have to go out and get permits from the BLM [Bureau of Land Management] and the Forest Service to begin our drill program of twinning the holes. That should take to get the drill permits about six months. But as we’re applying for those permits, we can be doing a lot of the mapping work, IP work, as we decide exactly where we want to drill those holes. There’s lots of work to do here.

One thing I’m going to add here, Maurice, I mentioned earlier that we’re looking at buying some other properties, producing mines, one of them in Arizona. If we’re able to buy one of those mines, it’s close enough that we think we can just truck the ore from this property over to the operating mine, and utilize a lot of the infrastructure there. And it’s fully permitted and is in production. If we can take some of the ore from here and move it over to a producing mine, it should expedite the permitting process from the Forest Service to start mining because you’re not having to worry so much about leach pads and other things. Again, I can’t guarantee that that’s exactly what’s going to happen, but it is one model that we’ve been looking at.

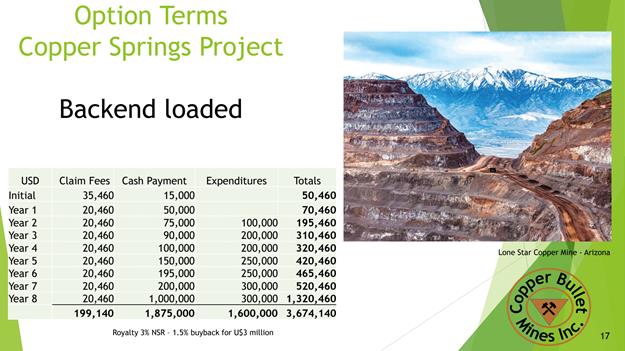

Maurice Jackson: Is the Copper Springs Project 100% owned?

Dan Weir: We have optioned the project. It is an eight-year option process in which we have annual full cash payments, which most of the financing is backend loaded. So, from the first number of years, they are not onerous. And we have to do a certain amount of exploration work on the project. It is a great deal for us to move forward on this.

Maurice Jackson: What are the company’s goals and what strategy will the company use to accomplish its stated goals?

Dan Weir: I used to work for a brokerage firm on Bay Street or Wall Street for several years. I spent 12 years working at one of the top brokerage firms in all of Canada. When I left that firm, I spent another three years running the institutional sales desk for another firm. I have experience working on Bay Street or Wall Street and have been involved in financing mining companies.

One of the companies that we did a lot of work with, and I can remember doing the IPO for it in 2004, was a company called Quadra. When Quadra started, they bought one mine in Nevada called the Robinson Mine. They then took some of the cash flow that they were doing from that mine and then expanded out and started buying all sorts of other mines, not only the U.S. and into Chile. Then they went and bought another full company called FNX Mining. Maybe many of the people that will read this will remember Quadra or FNX. Ultimately, they sold it to a Polish company called KGHM for $2.5 billion. I’m not saying that we can do that, but that’s the type of model that we want to work on for this company.

I would love to be able to buy an operating mine. Again, as I said, we are bidding on several assets that are currently in operations, or that mines are in operation. If we can take that cash flow and everything else from that and start to build a company out, that’s really what I want to do. My chairman of the board is a gentleman named Daryl Hodges. He is a geologist. He worked all over the world for Falconbridge, including places like Norilsk in Russia looking for nickel, copper. He understands and gets that he and I are aligned; that’s what we want to build in this company. We want to buy assets that are in production or close to production. We also want to have some exploration plays like Copper Springs, the first one that we bought here, and grow and build a company. That is exactly what we want to do.

Maurice Jackson: We’ve discussed the good. Let’s address the bad. What can go wrong and what are your action plans to mitigate that wrong?

Dan Weir: We all know, anybody in the mining business, that mining is very cyclical. There can be ups and downs. I believe that the copper cycle here is going to be here for quite a while. Number one, because as we start to electrify more and more of the world, you’re going to see the demand for copper continue to increase. As we buy and drive more and more electric vehicles, you’re going to see big copper demand increase. In a lot of places in the world, Chile, as well as others, the copper grades continue to fall off at most of the mines around the world. Us focusing on places like Arizona to mitigate some of the risks, even Chile that produces most of the copper in the world is considering increasing some of its royalty rates. You’ve got Peru. They’re going through an election cycle here right now. We don’t know exactly what’s going to happen.

Peru and Chile produce the majority of the world’s copper. Therefore, we are focusing on places like Nevada and Arizona. Now, could things change in the United States? Could it get more difficult to get permits? That is always a risk. But I believe, and even if you look at the Fraser Institute, they rate the top two jurisdictions in the world to look at mining are Nevada and Arizona. And that is exactly where we want to focus, right in the heart of the Copper Triangle in Arizona. One hour outside Phoenix with infrastructure, with people that know mining, understand mining, and we can work and get highly skilled people. It’s a huge opportunity for us. But again, you’ve got to look at cycles, and mining can be very cyclical so that can cause big problems.

Maurice Jackson: Speaking of high-skilled people, Mr. Weir, please introduce us to your board of directors and management team, and what skill sets do they bring to Copper Bullet Mines?

Dan Weir: I mentioned earlier, Mr. Daryl Hodges. I mentioned earlier, too, that we have three geologists working with us; Daryl, we have another advisor to us, a gentleman named Herb Deurr. Herb is involved in some other junior publicly traded companies here in Canada. He lives in Reno. He is a prospector and a geologist and a brilliant guy. He has claims all over the United States, and even Puerto Rico. He’s been developing a project there as well. I’ve got engineers, like Keith Minty is a guy that built up North American Palladium, which now has been bought by Impala. We have Rich Warner as an advisor. He lives in Zurich. He’s Canadian, but lives in Zurich, works for some very high-end companies over in the Zurich area, and knows the mining industry, has worked in the mining industry all his life.

And again, our board right now, we have Doug Harris. He’s an accountant. He’s also the CFO of three other junior mining companies. So, we have the people. We also recently picked up another geologist who was the chief geologist of a mine in the Globe Miami area, right in the heart of the Copper Triangle. We have been talking to several permit experts that will likely come on board with this as we move forward here, too. We have been able to put together an absolutely amazing team who understand copper, who know copper, who have built mines, who have built processing plants, are PhD-type guys in metallurgy and metallurgical engineering. We have an amazing group of people that know how to do this.

Maurice Jackson: Who is Dan Weir and what makes them qualified for the task at hand?

Dan Weir: Again, as I mentioned, I spent several years working on Bay Street/Wall Street. I’ve spent the last 10 years working for mining companies. I’ve been on the board of directors of zinc and copper companies. I’ve been around the mining industry. I know the mining industry, but I also know that I’ve got to bring the right people with me. So, I see myself more of as a conductor of an orchestra in bringing all the right people together. I’m not a geologist, but I know a little bit about geology. But I know that I’ve got to bring the right people around me, the engineers, and everybody else to put this all together. So, we have a bunch of guys that are very hardworking, willing to roll up their sleeves, and have a lot of experience in the mining industry. And I consider myself one of those people as well.

It’s going to be interesting over the next couple of months as we go through the bidding process on some of these production assets, but right now we want to raise a million dollars as the seed round and then we will likely raise money at much higher prices.

Maurice Jackson: Mr. Weir, for readers who want to get more information on Copper Bullet Mines, please share the contact details.

Dan Weir: I may be reached at 416-720-0754. Or you can email me anytime at danweir@bulletmines.com.

Maurice Jackson: Last question, sir, what did I forget to ask?

Dan Weir: Well, Maurice, in some of the last projects that you and I have worked on together, you’ve traveled down to see some of the deposits. I think the next thing for you to do is come on down to Arizona and let’s go see the property because I’m sure you’re going to be very, very impressed with the property and the area inside the Copper Triangle. Seeing some of those smelters and some of the producing mines in the area, I think you’ll be very, very impressed. So, you know what? Ask me to get you on an airplane and get you down there, and over the next month or so, we will do that.

Maurice Jackson: Mr. Weir, it’s been a pleasure speaking with you today. Wishing you and Copper Bullet Mines the absolute best, sir.

And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRA’s. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide: Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

- Magna Gold Corp.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Copper Bullet Mines is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned:

)

Source: Streetwise Reports 07/22/2021

This newest financing of Troilus Gold is discussed in a Laurentian Bank Securities report.

In a July 16 research note, Laurentian Bank Securities analyst Jacques Wortman reported that Troilus Gold Corp. (TLG:TSX; CHXMF:OTCQX) generated about US$11.15 million from a now closed financing with the Quebec government and Fonds de solidarite des travailleurs du Quebec (FTQ).

“We view this investment as important as it: 1) further aligns the government of Quebec with the Troilus project, 2) follows extensive technical, financial and social due diligence, and 3) represents a de-risking milestone as [Investissement Quebec] and other Quebec-based institutional shareholders are defining and establishing project financing options as part of the process,” Wortman wrote. The Quebec government now owns an estimated 5.2% of Troilus Gold.

The analyst reviewed the terms of the non-brokered private placement. The financing was done with Investissement Quebec through Fonds Capital Ressources Naturelles et Energie, FTQ and Fonds regionaux de solidarite FTQ, S.E.C.

In this financing, the terms of which were the same as those of the recent bought deal financing, 10,136,359 units were purchased at US$1.10 apiece. Each unit consists of one common share and one-half of one common share purchase warrant. With each full warrant, for 24 months, the holder may purchase one common share for US$1.50.

Wortman noted that Troilus Gold plans to use the proceeds for engineering and feasibility study work on its namesake project, for working capital and for general corporate expenses.

Also, the financing dilutes the net asset value (NAV) Laurentian Bank has on the project and on Troilus Gold, Wortman indicated. However, the fact that it significantly de-risks the project warrants a reduced discount rate. The firm adjusted its model accordingly.

Laurentian has a Buy rating and a CA$3.30 per share target price on Troilus Gold. The stock is now trading at about CA$0.87 per share.

Read what other experts are saying about:

- Troilus Gold Corp.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Troilus Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Troilus Gold, a company mentioned in this article.

Disclosures from Laurentian Bank Securities, Troilus Gold Corp., July 16, 2021

Laurentian Bank Securities Inc. and/or its officers, directors, representatives, traders, analysts and members of their families may hold positions in the stocks mentioned in this document and may buy and/or sell these stocks on the market or otherwise.

The Research Analyst’s compensation is based on various performance and market criteria and is charged as an expense to certain departments of Laurentian Bank Securities (LBS), including investment banking.

Laurentian Bank Securities Inc. may, in exchange for remuneration, act as a financial advisor or tax consultant for, or participate in the financing of companies mentioned in this document.

The analyst(s) certify that (1) the views expressed in this report in connection with securities or issuers they analyze accurately reflect their personal views and (2) no part of their compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by them in this report. The Research Analyst’s compensation is based on various performance and market criteria and is charged as an expense to certain departments of Laurentian Bank Securities (LBS), including investment banking.

Within the last 24 months, LBS has undertaken an underwriting liability with respect to equity securities of, or has provided advice for a fee with respect to, this issuer.

The Analyst has visited material operations of this issuer.

This issuer paid a portion of the travel-related expenses incurred by the Analyst to visit material operations of this issuer.

To access Laurentian Bank Securities’ regulatory disclosures, please click here.

( Companies Mentioned: TLG:TSX; CHXMF:OTCQX,

)

Fun on Friday: With Friends Like This…

With friends like this, who needs enemies? Amanda Douglas, 27, stole gold and silver coins, along with other items from her friend’s home, including gold bars, 150 earrings, guns, ammunition, and a container holding a dog’s ashes. Yes. You read that correctly. Amanda stole her friend’s pet’s ashes. Nice girl. Amanda pleaded guilty to the […]

The post Blog first appeared on SchiffGold.

Pop some popcorn. It’s time for some political theater. Congress is gearing up for another debt ceiling fight. In this episode of the Friday Gold Wrap podcast, host Mike Maharey gives you a preview of the next big Washington DC blockbuster production, complete with some debt ceiling history and an explanation as to why we […]

The post Blog first appeared on SchiffGold.