Month: July 2021

Source: Clive Maund for Streetwise Reports 07/28/2021

Technical analyst Clive Maund explains why he is bullish on gold and precious metals.

Despite the looming threat of massive inflation, or at least stagflation in the event that markets collapse, many appear to have given up on gold at the worst possible time, perhaps due to the mistaken belief that it will be perpetually suppressed by market manipulators.

The key point to grasp with gold, which has always been the same, is that since it is “real money” with intrinsic value it will always retain its value, and this has never been more the case than in situations where a currency is rapidly losing its purchasing power, as is set to happen with the dollar—and is already happening—and with almost all currencies around the world. With the purchasing power of fiat money everywhere set to be vaporized by inflation/hyperinflation, gold’s (and silver’s) appeal as a store of value has never been greater.

It is crucial to understand that even if markets crash, and take gold and silver prices down with them, their prices should drop at a lower rate than most other assets, and thus they should retain or increases their purchasing power so you will be able to buy more—just ask the people of Venezuela what they would prefer to have owned before their country was destroyed by hyperinflation, their local currency or gold—by end of it gold would buy wagonloads of the currency. So, at a time like this, there are no asset better for retain value than gold and silver.

Whilst it is obviously ideal to have at least a portion of one’s precious metal holdings in physical gold and silver, all gold and silver based assets should do well going forward, such as futures of course but also ETFs and the better precious metal stocks.

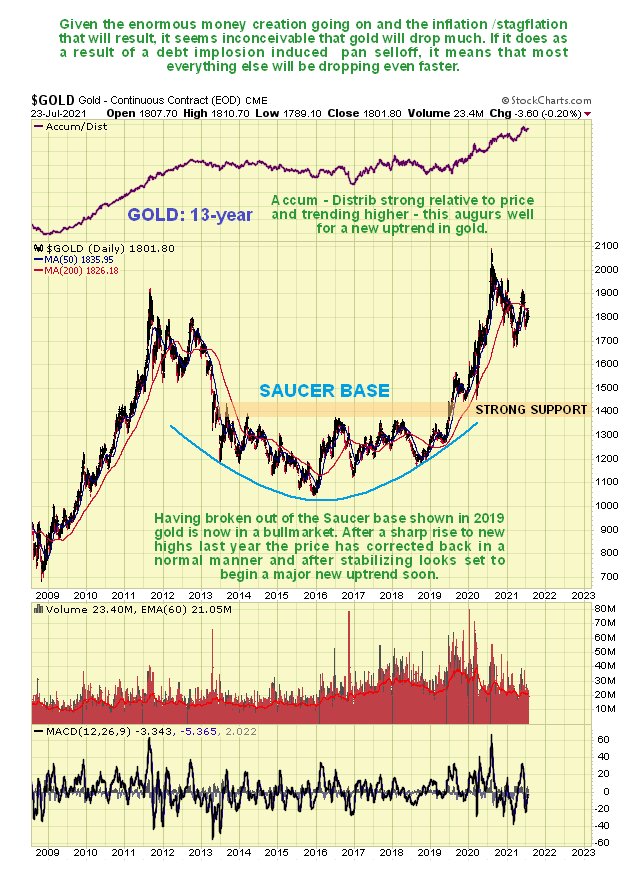

The reason that many investors have lost interest in gold is because it has been a dull market for a long time, having drifted lower for many months from its peak in August of last year. On the 18-month chart we can see that gold’s reactive downtrend ended when it arrived at strong support in March, since which time it has made a clear breakout from this downtrend before backing off again to support at the top of the downtrend channel. What appears to be going on is that gold is floundering around marking out a large base pattern that will lead to renewed advance. It looks like a potential Head-and-Shoulders base pattern has been completing and if so gold is at a good buy spot here close to the Right Shoulder low of the suspected pattern. The strong Accumulation line supports this interpretation.

On the long-term 13-year we can see that it is perfectly reasonable for gold to have reacted back as it has since last August, given the magnitude of the advance following its breakout from a giant Saucer base in the middle of 2019. This chart suggests that after reacting back, gold is readying for renewed advance in another major upleg.

As for precious metal stocks, we see that although the 6-month chart for GDX looks rather grim, with a weak accumulation line and bearishly aligned moving averages, the long-term 13-year chart shows that it has reacted back close to strong support at the top of the giant base pattern that it broke out of last year. This therefore looks like a very good time to accumulate the better stocks across the sector.

Originally posted on CliveMaund.com at 2.45 pm EDT on 25th July 2021.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Source: Maurice Jackson for Streetwise Reports 07/28/2021

Greg Johnson, CEO of Metallic Minerals, sits down with Maurice Jackson of Proven and Probable to discuss his company’s exploration programs at its projects in the Yukon and Colorado, as well as its royalty portfolio.

Maurice Jackson: Joining us for a conversation is Greg Johnson, the CEO of Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCMKTS).

Sir, we are thrilled to have you back as Metallic Minerals has several exciting developments to provide shareholders. Before we begin, Mr. Johnson, please introduce us to Metallic Minerals and the opportunity the company presents to shareholders.

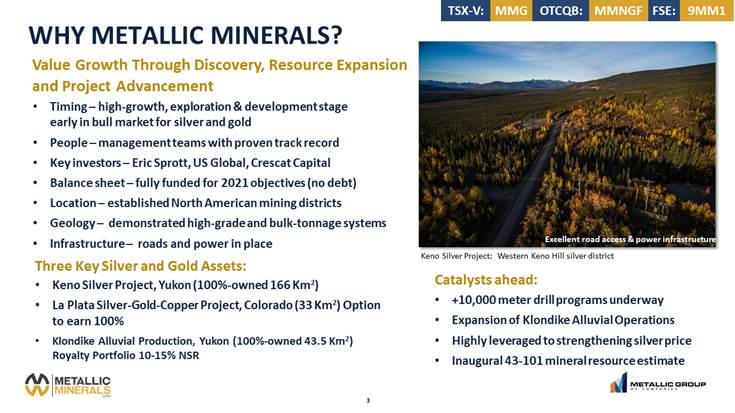

Greg Johnson: Metallic Minerals is a silver-focused exploration and development stage company. We are a member of the Metallic Group of Companies. Many of us were part of the original founding of NovaGold. The group is backed by renowned resource investors, such as Eric Sprott. We started putting together the Metallic Group at the bottom of the metal price cycle. Our focus was on brownfields, past-producing, high-potential districts with MMG being focused on silver. Over the past five years, we’ve acquired and explored three exceptional assets, including our flagship Keno Silver Project, the La Plata Project and our Klondike Royalty Portfolio.

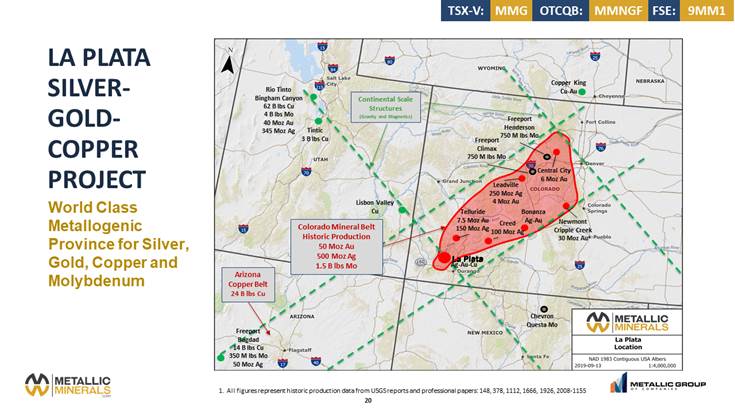

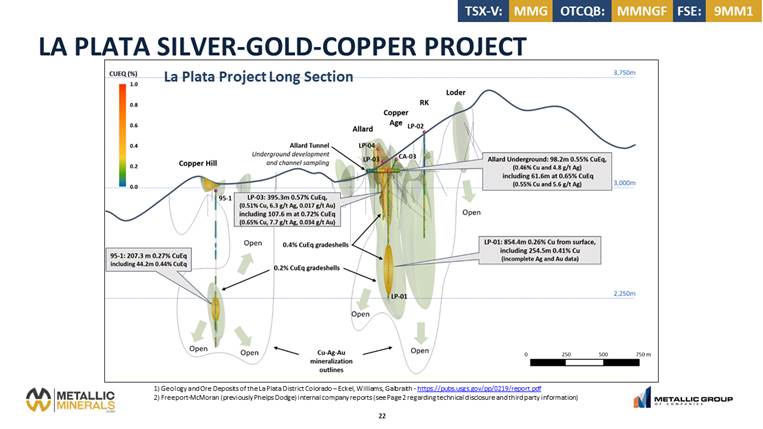

Maurice Jackson: Speaking of Colorado, sir, take us onsite to the La Plata Silver-Gold-Copper Project located just outside of Durango, as Metallic Minerals has just announced the commencement of its initial drill campaign on the La Plata, which is the first significant exploration in over 50 years in the historical high-grade La Plata Mining District. Before we get into the press release, Mr. Johnson, please acquaint us more with the La Plata Project and the value proposition before us.

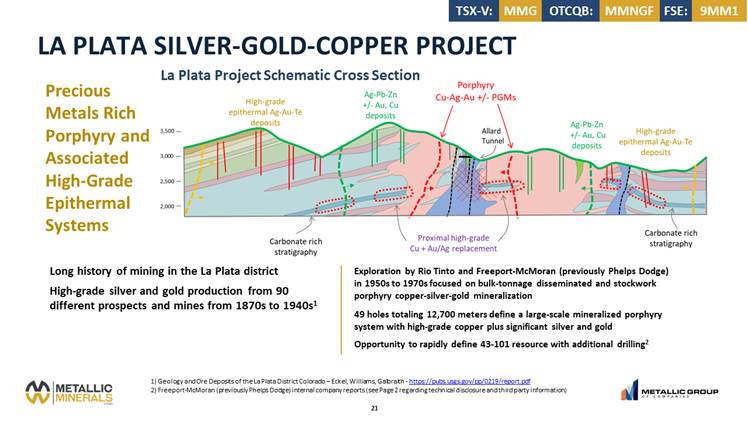

Greg Johnson: So we’re pretty excited about this. We see this as an amazing opportunity. The La Plata Project is a high-grade silver and gold district originally discovered in the 1700s with over 90 different mines and prospects that were developed from the 1800s to about the 1940s, all of these producing bonanza-grade silver and gold. Major miners, such as Rio Tinto and Freeport, have come into the district in the 1950s, recognizing the bulk-tonnage potential in the central part of this precious metals–rich porphyry system. This system is a lot like the Galore Creek Project that was operated by NovaGold—and our team was part of driving the success—that was recently sold to Teck and Newmont. Our team is particularly excited about applying our new modern toolkit to this opportunity in this historical high-grade district.

Maurice Jackson: Metallic Minerals is embarking on phase one of your 2021 drill program on the La Plata, which will be 2,000 meters of diamond drilling on the central porphyry, which hosts the historical resource. What is the goal for this campaign? And can you talk about the historical resource and what it looks like?

Greg Johnson: This is the first drill campaign on this project in, as you said, nearly 50 years. It’s designed to confirm the historical drill work on the project, which is only in the central porphyry system, and particularly the precious metal values, which were historically under-sampled. With 54 historical drill holes comprising nearly 15,000 meters of drilling, we see the potential here at La Plata to rapidly advance the system to a modern 43-101 resource. That historical resource indicates that we have the potential for a multi-billion-pound copper system with tens of millions of ounces of silver. And that historical resource doesn’t include any of the work surrounding the area in the high-grade epithermal silver-gold structures that were the focus of historical mining.

Maurice Jackson: How will Metallic Minerals measure success for this drill program and when can the market expect results?

Greg Johnson: What we’re looking for here is to confirm the past work, which was done by really high-quality players like Rio Tinto and Freeport, with the potential to be able to not only show what they did, but to build on that and show significant expansion. We should start to see results coming out over the next couple of months with continued 3D modeling going into the fall with an objective, ultimately, of delivering an inaugural 43-101 resource on this project.

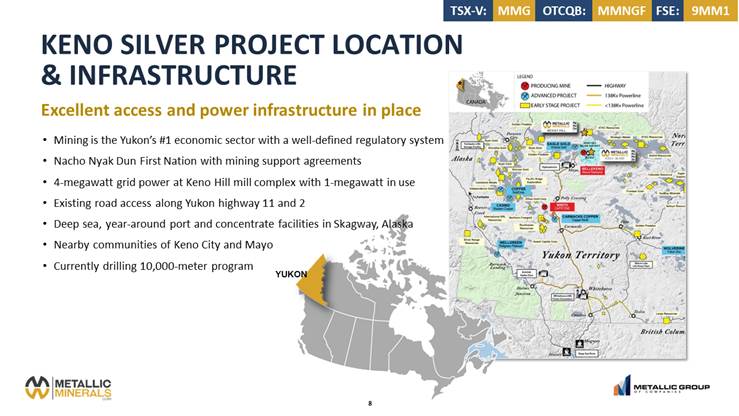

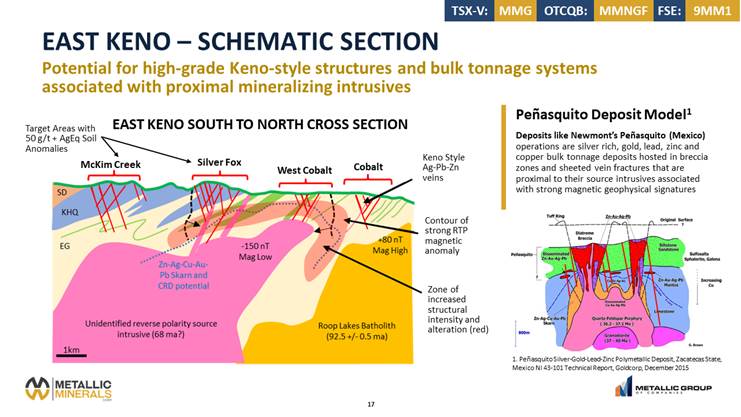

Maurice Jackson: Leaving Colorado, let’s visit Metallic Minerals’ flagship Keno Silver Project, which is adjacent to Alexco Resources, located in the historical silver-rich Keno Silver District of the Yukon in Canada. Back in April, Metallic Minerals announced a high-grade silver intersect with 4.1 meters resulting in 2,536 grams per tonne silver equivalent. That has now been followed up with a 10,000-meter drill program. How are things coming along and are there any updates that you can pass along to us?

Greg Johnson: This is an exciting program. Our exploration program kicked off this year in June with the first drill. We’re looking to add a second here. This is going to be one of our largest programs to date on the Keno Silver Project with 10,000 meters planned on multiple targets and following up on the success from last year. In addition, we’re running a deep IP geophysical survey across the large targets on the eastern part of the district, which could start to give us a sense of scale and potential on those discoveries from last year’s program.

That historical resource indicates that we have the potential for a multi-billion pound copper system with tens of millions of ounces of silver. And that historic resource doesn’t include any of the work surrounding the area in the high-grade epithermal silver-gold structures that were the focus of historical mining.

Maurice Jackson: When can we expect results from the drill program and what will determine success?

Greg Johnson: Results should start coming out any time and continue over the next several months and well into the fall. What we’re hoping to do here is to build and expand on the areas we’ve already identified mineralization, both in terms of the high-grade systems and the bulk tonnage, and to continue to build towards that inaugural resource estimate for the project.

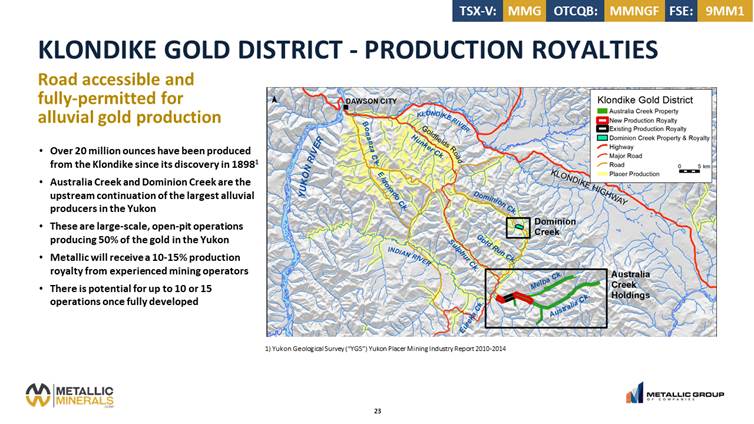

Maurice Jackson: Finally, let’s discuss the highly innovative Klondike alluvial gold properties in the Yukon. Do you have any updates there?

Greg Johnson: We were pleased actually to see significant progress on the Alluvial Gold Portfolio. This is in the historical Klondike Gold Fields, which produced over 20 million ounces historically. And today that production is from these large-scale, modern open-pit operations. We’ve had major drill campaigns completed by a couple of our operators this spring and going into the summer. The next steps here are the initiation of bulk-sample processing, which is like test mining of the ground. And from that work, we could potentially see two or three of the blocks advance quickly to commercial gold production, including the potential for the first significant production royalties to Metallic Minerals this year from gold produced on those projects.

Maurice Jackson: Oh, that sounds exciting. All right. Leaving the project sites, what is the next significant milestone for Metallic Minerals?

Greg Johnson: With three active programs, we’ve got a lot of activity that I would expect to see strong news flow coming from each of the projects. Each one of them has kind of its milestones, but drilling, geophysical results, and then, ultimately, culminating in initial resource estimates and potentially gold production from the Alluvial Portfolio.

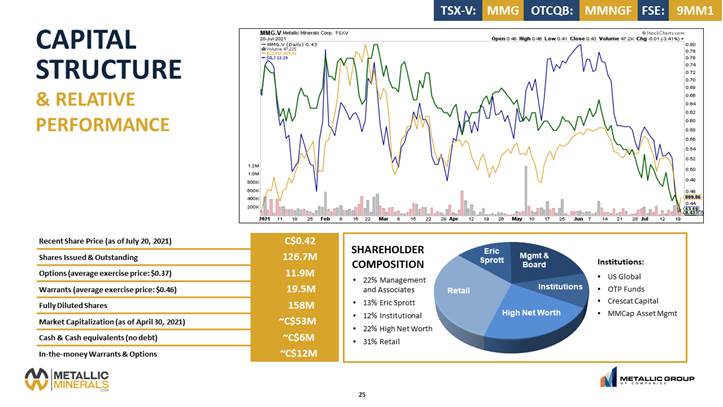

Maurice Jackson: Let’s look at some numbers. Sir, please provide us the capital structure for Metallic Minerals.

Greg Johnson: The company is well structured. 126 million shares outstanding. No debt. Got about $6 million in cash and significant in-the-money warrants that could bring in as much as another $12 million for the next year. We’re well positioned to carry out this year’s program and we’re well positioned into 2022 for follow-up programs.

Maurice Jackson: In closing, Mr. Johnson, what would you like to say to shareholders?

Greg Johnson: I think it’s worth talking about the current markets for precious metals and particularly how it fits in with the historical seasonality for the sector. We believe that a major bottom in the commodity and precious metal sector was put in in that 2016 to 2020 period and that we’re now in the very early stages of a multi-year commodity cycle. I believe it has the potential to eclipse the last cycle that ran from 2001 to 2011. Typically, during these decade-long cycles, we’re going to get extended, healthy consolidations that can take significant periods to resolve. Gold and silver equities have been consolidating since August of last year. On top of that, we’re currently in what’s typically the weakest seasonal period for silver and gold with the strongest period generally starting in the fall.

The next steps here are the initiation of bulk-sample processing, which is like test mining of the ground. And from that work, we could potentially see two or three of the blocks advance quickly to commercial gold production, including the potential for the first significant production royalties to Metallic Minerals this year from gold produced on those projects.

Greg Johnson: I think this presents an opportunity for astute investors to be picking up shares of high-quality, precious metal companies at terrific values. With such long recent consolidations, but such very bullish fundamentals, I think we’re winding the spring here for a very bullish period ahead with likely another five to ten years of bull markets still to come. I should mention that with over 30,000 meters of drilling underway in the three Metallic Group of Companies, this gives investors exceptional exposure to silver, battery metals and copper in what is looking to be an exceptional time in the marketplace for people to be picking up value in our group.

Maurice Jackson: Mr. Johnson, last question and that is, what did I forget to ask?

Greg Johnson: I think this has been an amazingly comprehensive coverage and interview. I would recommend that if investors have questions that they go to our website, which is mmgsilver.com, or give us a call at the numbers listed on that website. We’re happy always to talk with investors and to answer questions.

Maurice Jackson: Mr. Johnson, it has been a pleasure speaking with you. Wishing you and Metallic Minerals the absolute best, sir.

Greg Johnson: Thanks a lot. Been a pleasure to be back with you.

Maurice Jackson: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

- Magna Gold Corp.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Metallic Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Metallic Minerals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Metallic Minerals. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metallic Minerals, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: MMG:TSX.V; MMNGF:OTCMKTS,

)

Source: Streetwise Reports 07/28/2021

On this episode of Streetwise Live! gold and metals expert Matt Badiali and Alex Klenman, CEO and director of Cross River Ventures, discuss why they think this gold explorer has it all: size, scalability and an all-star team at the helm.

The Streetwise Live! Broadcast on July 28, 2021, featured natural resource investing expert Matt Badiali, who outlined why he thinks Cross River Ventures Corp. (CRVC:CSE; CSRVF:OTC; C6R:FWB) should be in every speculative investor’s portfolio. Also on the panel was Cross River CEO Alex Klenman, who described the company’s flagship project and explained why investors should start following this Canadian explorer now.

Host Cyndi Edwards introduced Cross River Ventures as a young company that says it “is sitting on top of high grade gold.” It recently received permits to drill its 12,000 hectare McVicar gold project in northwestern Ontario and is quickly moving forward. She asked Cross River CEO why investors should keep an eye on Cross River.

Cross River has the attributes that smart investors are looking for, Klenman said. They are size, scalability, location, newness (the initial public offering was just last year), low capital structure and an experienced and highly successful technical team.

“You can’t argue with those metrics,” he said.

Matt Badiali, a natural resource investing expert and technical adviser to Cross River, added that the company, with its a $5 million market cap, is low risk but offers high reward.

“It’s a really, really small company, but it’s like a lottery ticket,” he described.

That high reward would come from the company’s sizable flagship McVicar project, a consolidation of numerous small claims throughout and covering Ontario’s Lang Lake Greenstone Belt.

According to Badiali, McVicar sits between two other greenstone belts, the Abitibi containing 200 million ounces (Moz) of gold and the Red Lake encompassing about 30 Moz of gold. In fact, a past-producing mine on the property, Golden Patricia, produced 0.5 Moz of gold at an average grade of 18 grams per ton.

“The potential for high grade quantities of gold exist on the [McVicar] project,” Badiali said. “We have what I consider to be a lot of exploration upside.”

Edwards then showed a map of McVicar to viewers, and Klenman pointed out the areas of interest on it. They included Golden Patricia, the various smaller deposits to the south and the numerous known gold occurrences on the property. He commented that the map conveys the McVicar property’s scale.

Right now, Badiali said, for an early-stage explorer like Cross River, a good technical team is critical, and the company has a stellar one led by Dr. Rob Carpenter. When Carpenter was Kaminak Gold Corp.’s CEO, that company discovered the Coffee deposit that it wound up selling for $1.5 billion.

“You want these experienced people who’ve made discoveries before to really help set up the exploration, figure out where the potential lies and then direct the drilling and exploration,” said Badiali.

As for where Cross River currently stands with McVicar, Klenman noted that the company now is conducting groundwork there in preparation for drilling slated to commence in late Q3/21 or early Q4/21.

Finally, the broadcast ended with Badiali saying this about Cross River: “This is early, early stage, but there’s a lot of smoke here with really good people going out to look and see if they can find fire. Chances are, I think, pretty good.”

View the entire broadcast here:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Cross River Ventures. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cross River Ventures, a company mentioned in this article.

Streetsmart Live Disclosures:

- This broadcast does not constitute investment advice. Each viewer is encouraged to consult with his or her individual financial professional and any action a viewer takes as a result of information presented here is his or her own responsibility. This broadcast is not a solicitation for investment. Streetwise Live! does not render general or specific investment advice and the information should not be considered a recommendation to buy or sell any security. Streetwise Live! does not endorse or recommend the business, products, services or securities of any company mentioned here.

- Statements and opinions expressed are the opinions of the presenters and not of Streetwise Live! or its officers. The presenters are wholly responsible for the validity of the statements. The presenter was not paid by Streetwise Live! for this broadcast. Streetwise Live! requires presenters to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Live! relies upon the authors to accurately provide this information and Streetwise Live! has no means of verifying its accuracy.

- The following companies discussed in this broadcast have paid a $10,000 fee to participate: Cross River Ventures Corp.

- From time to time, Streetwise Live! and its directors, officers, employees or members of their families, as well as persons interviewed for broadcasts and interviews on the site, may have a long or short position in securities mentioned. As of the date of this broadcast, officers and/or employees of Streetwise Live! (including members of their household) own securities of the following companies discussed in this broadcast: Cross River Ventures Corp. Cross River Ventures Corp. has a consulting relationship with an affiliate of Streetwise Live! (description available at https://www.streetwisereports.com/disclaimer/html#consulting). Cross River Ventures Corp. is not a billboard sponsor of Streetwise Reports, an affiliate of Streetwise Live! (description available at https://www.streetwisereports.com/disclaimer/).

- Alex Klenman – CEO, Director owns securities of the company.

- Matt Badiali is a paid Technical Consultant for Cross River Ventures Corp. and own securities in the company.

- Disclosures for: Cyndi Edwards, Host. I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: None. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: None.

( Companies Mentioned: CRVC:CSE; CSRVF:OTC; C6R:FWB,

)

The Federal Reserve insists inflation is “transitory” and the economy is making “progress.” Yet, it continues with the extraordinary monetary policy it launched at the onset of the COVID-19 pandemic. Meanwhile, we’re seeing all kinds of data hinting that the economy may not be as great as advertised. Despite this, and even as prices continue […]

The post Blog first appeared on SchiffGold.

The Federal Reserve wrapped up its July meeting on Wednesday. Once again, there was a whole lot of talk and no action. The Fed kept interest rates at zero. The Fed kept its quantitative easing program rolling. The Fed didn’t do anything. But the Fed had plenty to say. Peter Schiff summed it up this […]

The post Blog first appeared on SchiffGold.