Gold price today rises for second day in a row, silver rates edge higher – Mint

Gold price today rises for second day in a row, silver rates edge higher Mint

Gold price today rises for second day in a row, silver rates edge higher Mint

How high can gold & silver go in 2022? Rates to rise, here’s the impact on markets – Gary Wagner Kitco NEWS

Endeavour Silver: Weaker Silver Price Continues To Weigh On Margins Seeking Alpha

Bullion Star/Ronan Manly/12-13-2021 “Each of these central bank decision making bodies also knows that they are now in unchartered territory and that they have painted […]

Wall Street Journal/Kevin Warsh/12-12-2021 USAGOLD note: Former Fed governor Kevin Warsh says inflation is a choice and it is the road the Fed has taken […]

Investors looking to save for retirement by buying precious metals should be looking at self-directed IRAs. In contrast to traditional IRAs, which allow investment in […]

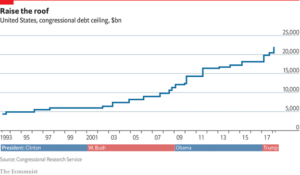

In October, the US government will be unable to pay it bills if Congress does not raise the debt ceiling. The debt ceiling is the […]

September 8, 2021 The Honorable Nancy Pelosi Speaker U.S. House of Representatives Washington, DC 20515 Dear Madam Speaker: I am writing to follow up on […]

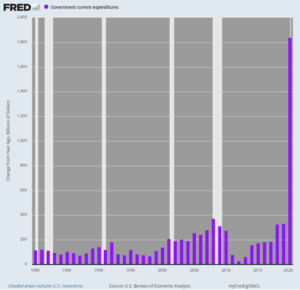

Government current expenditures Explosive growth of Fed’s balance sheet, 1980-2021 Year-over-year change in gross public debt (billions), 1980-2020

Digging Into 2021 Gold Miners Index Performance Seeking Alpha

Copyright © 2026 | WordPress Theme by MH Themes