Gold Prices Today: Gold, Silver Futures Rise On Global Cues – NDTV Profit

Gold Prices Today: Gold, Silver Futures Rise On Global Cues NDTV Profit Gold rate today falls, struggles near 2-month lows; silver prices drop Mint Gold Bullion and […]

Gold Prices Today: Gold, Silver Futures Rise On Global Cues NDTV Profit Gold rate today falls, struggles near 2-month lows; silver prices drop Mint Gold Bullion and […]

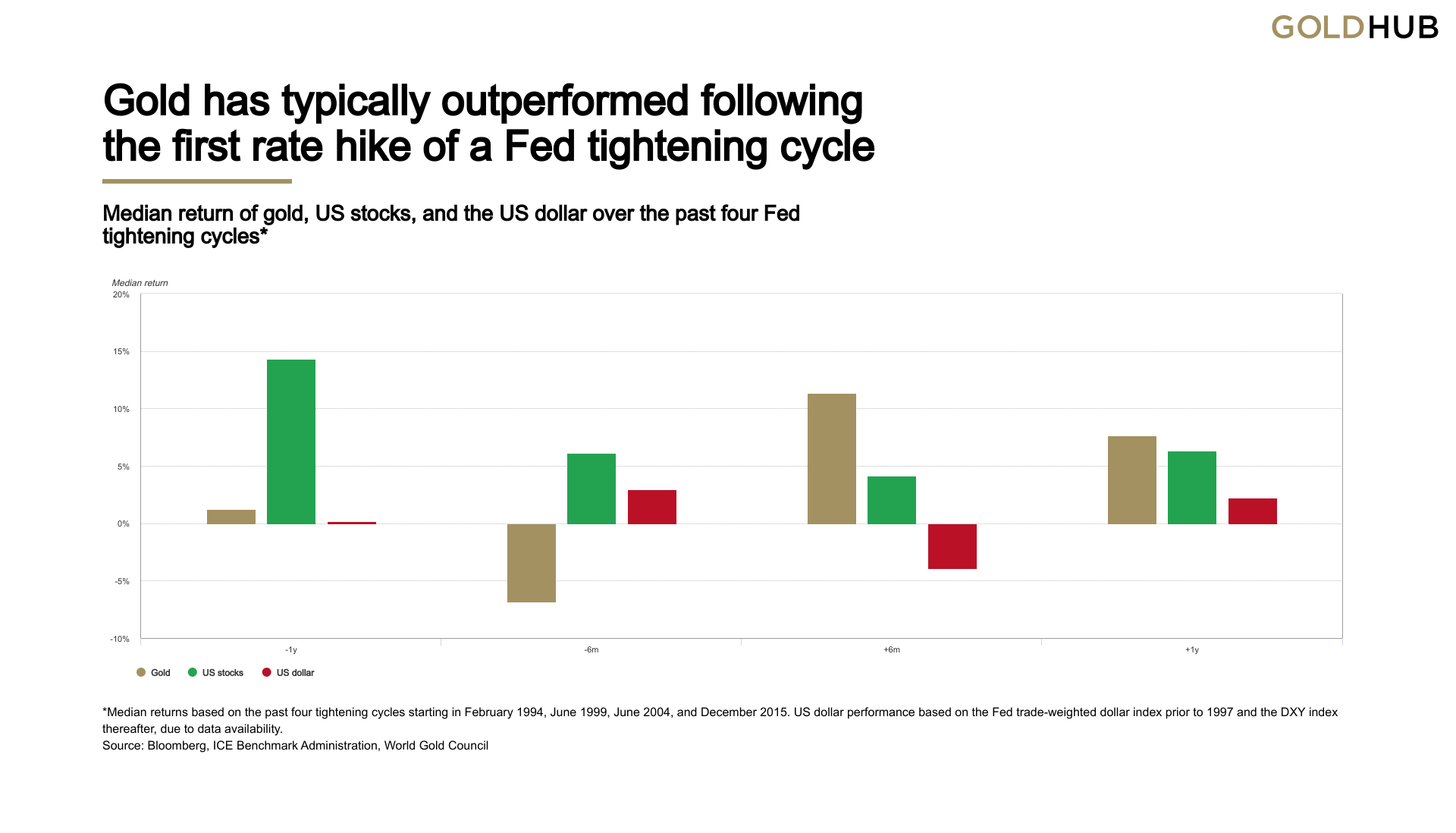

Gold Hub/Staff/1-13-2022 “Dot-plot projections suggest that year-ahead Fed expectations have significantly exceeded actual target rates. More importantly though, financial market expectations of future monetary policy […]

Over the past year, the Federal Reserve Note “dollar” has been losing value at an alarming pace as reflected by broad price level increases. Last […]

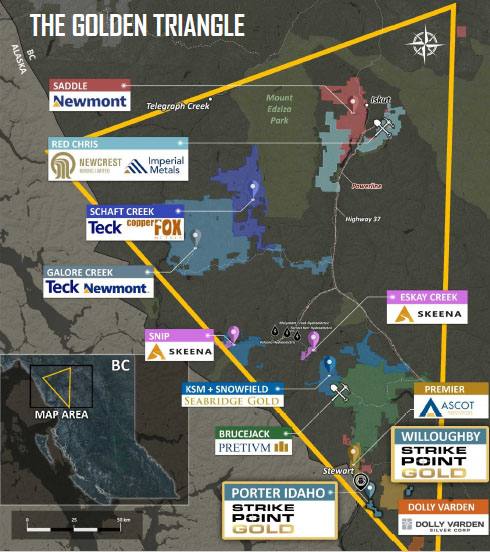

Source: Streetwise Reports 01/15/2022 If your neighbors sell their house, the sale price will tell you a lot about the value of your home. In […]

Elizabeth Warren and others are running around blaming inflation on greedy corporations’ “price gouging.” Of course, this narrative falls apart when you realize producer prices […]

With 2021 now in the rear-view mirror, I believe that future financial historians may regard it as the year of peak speculation. While the history […]

Serious inflation initially fuels record-high stock markets, which stunt gold investment demand. But festering inflation increasingly… by Adam Hamilton of Zeal LLC Gold is lagging […]

Systemically, the US is undergoing socio-economic collapse, which means that individually, we all have to… Charles Hugh Smith from Of Two Minds with Paul “Half […]

Bubble activities cannot sustain themselves without support from central bank monetary pumping… by Frank Shostak via Mises Most experts tend to assess the strength of […]

For the win! A guaranteed win? (by Half Dollar) I’m not sure why I feel like writing about this in mid-January? Perhaps it is because […]

Copyright © 2026 | WordPress Theme by MH Themes