New Jersey to Consider Ending Taxes on Precious Metals

(Trenton, NJ, USA – January 14, 2022) – Legislators from New Jersey are trying to restore sound money in the Garden State. Originally introduced in 2021 by […]

(Trenton, NJ, USA – January 14, 2022) – Legislators from New Jersey are trying to restore sound money in the Garden State. Originally introduced in 2021 by […]

(Charleston, WV, USA – January 13, 2022) – In 2019, the Sound Money Defense League teamed up with lawmakers and in-state supporters to eliminate the sales […]

(Olympia, Washington, USA – January 14, 2022) – Washington State removed sales taxes against sound money decades ago, but a lawmaker hopes to take it a […]

Source: Michael Sheikh 01/13/2022 Michael Sheikh explains what makes Guanajuato Silver Co. a unique opportunity and takes a look at five other companies that caught […]

The Quick Take Zacks Small-Cap Research has a $2.03 per share target price on World Copper. Zacks SCR initiated coverage on World Copper in light […]

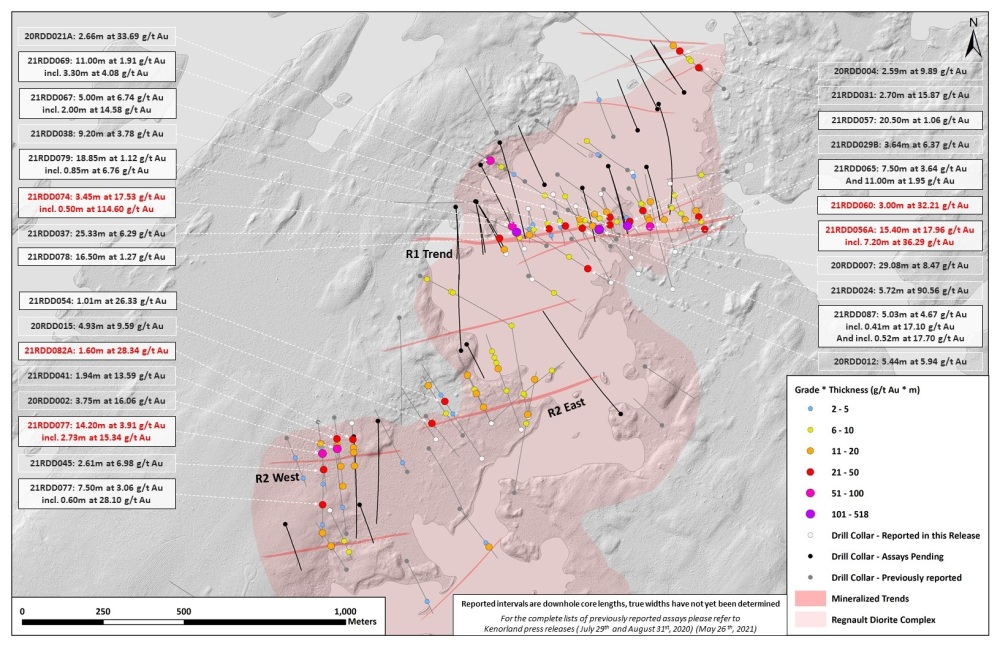

Source: The Critical Investor 01/13/2022 After Kenorland Minerals announced its latest batch of drill results, the Critical Investor took the opportunity to do an extensive […]

December gave us another big jump in consumer prices. But despite a lot of talk about an inflation war, accommodative monetary policy remains in play. […]

In the calendar year 2021, federal tax revenues surged by an incredible 25% compared to 2020 and were up 22.8% over 2019 (pre-COVID). But the […]

It will be the trigger for mass financial destruction… by Bix Weir of Road to Roota Shorting an asset is the most RISKY endeavor in […]

We clearly need to add “outliving our savings” to the ever-lengthening list of future risks. Gold Bugs, that means turbocharge your… by John Rubino of […]

Copyright © 2026 | WordPress Theme by MH Themes