Pure Gold appoints new CEO and CFO as it transitions to ‘a culture of operational excellence’

Kitco News (Kitco News) – Pure Gold Mining (TSX-V: PGM) today announced appointments of new President & CEO, as well as CFO, effective as of […]

Kitco News (Kitco News) – Pure Gold Mining (TSX-V: PGM) today announced appointments of new President & CEO, as well as CFO, effective as of […]

Kitco News (Kitco News) – Gold and silver futures prices are higher in midday U.S. dealings Tuesday. Bulls are enjoying the near-term technical advantage as […]

Kitco News (Kitco News) – The company said that no cases of Covid-19 have been recorded for any employees or contractors who were present at […]

Yahoo! Finance: SI=F News Canaan announced partnerships with various crypto-leading mining companies in the country and the end of its first phase of expansion. The […]

Silver Price Daily Forecast – Resistance At $23.15 In Sight Nasdaq Silver Price Prediction – Prices Rebound on Softer JOLTS Report FX Empire Silver Price Analysis: XAG/USD […]

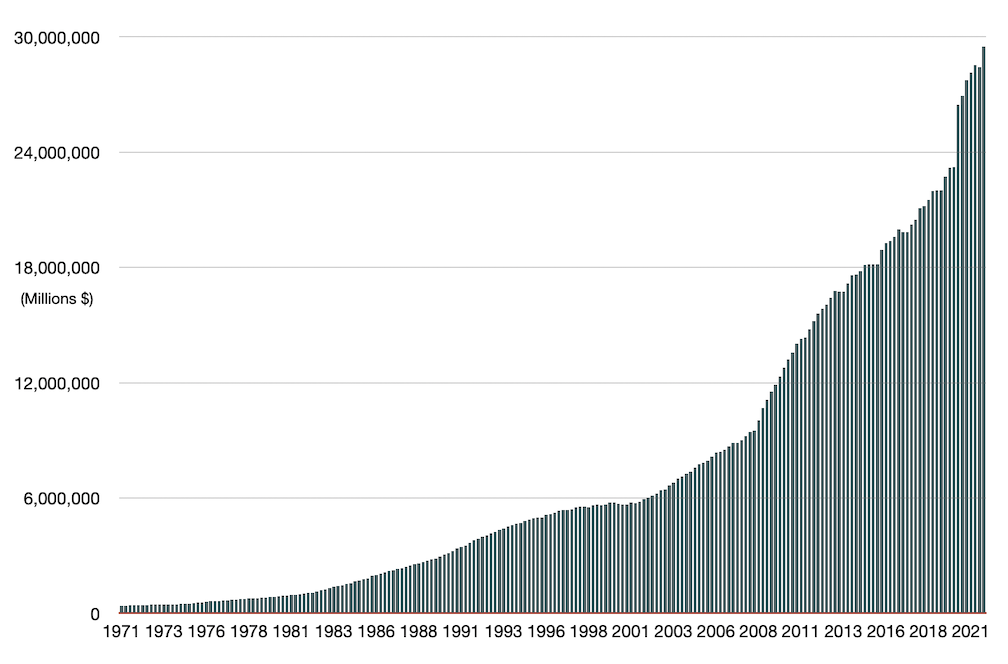

United States National Debt (1971-2021) Source: St. Louis Federal Reserve [FRED] Chart note: Quietly, the U.S. national debt is approaching the $30 trillion mark. It […]

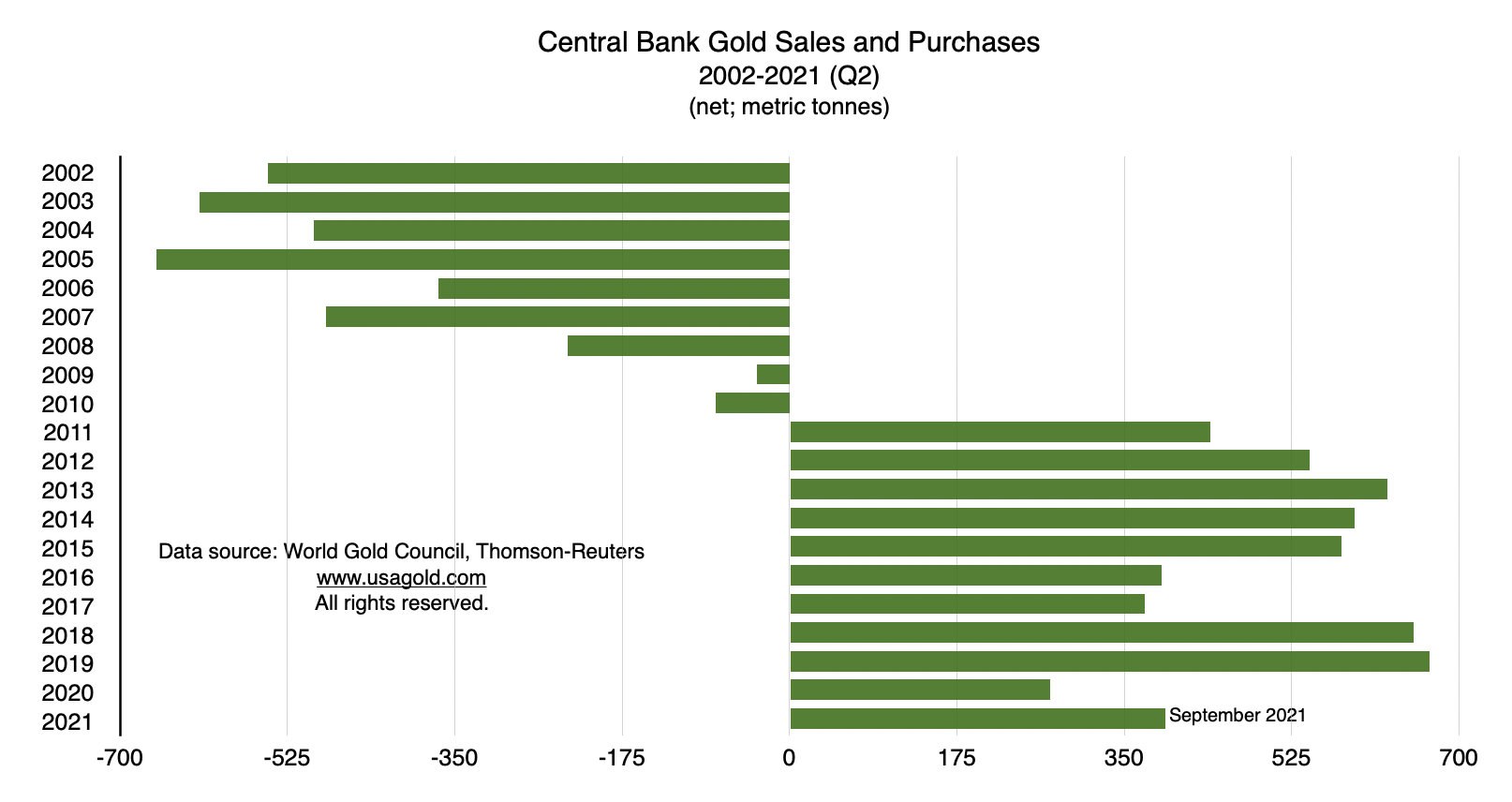

NikkeiAsia/Haruki Kitagawa/12-29-2021 “Central banks around the world are increasing the gold they hold in foreign exchange reserves, bringing the total to a 31-year high in […]

Financial Times/Patrick Jenkins/12-19-2021 Cartoon courtesy of MichaelPRamirez.com “Today, close to 90 percent of the world’s central banks are classed as independent. But, as finance ministers […]

Bloomberg/Iain Rogers/ 12-25-2021 “[Fund CEO] Tangen said the ‘biggest potential problem’ for the fund — the world’s biggest owner of publicly traded stocks — is […]

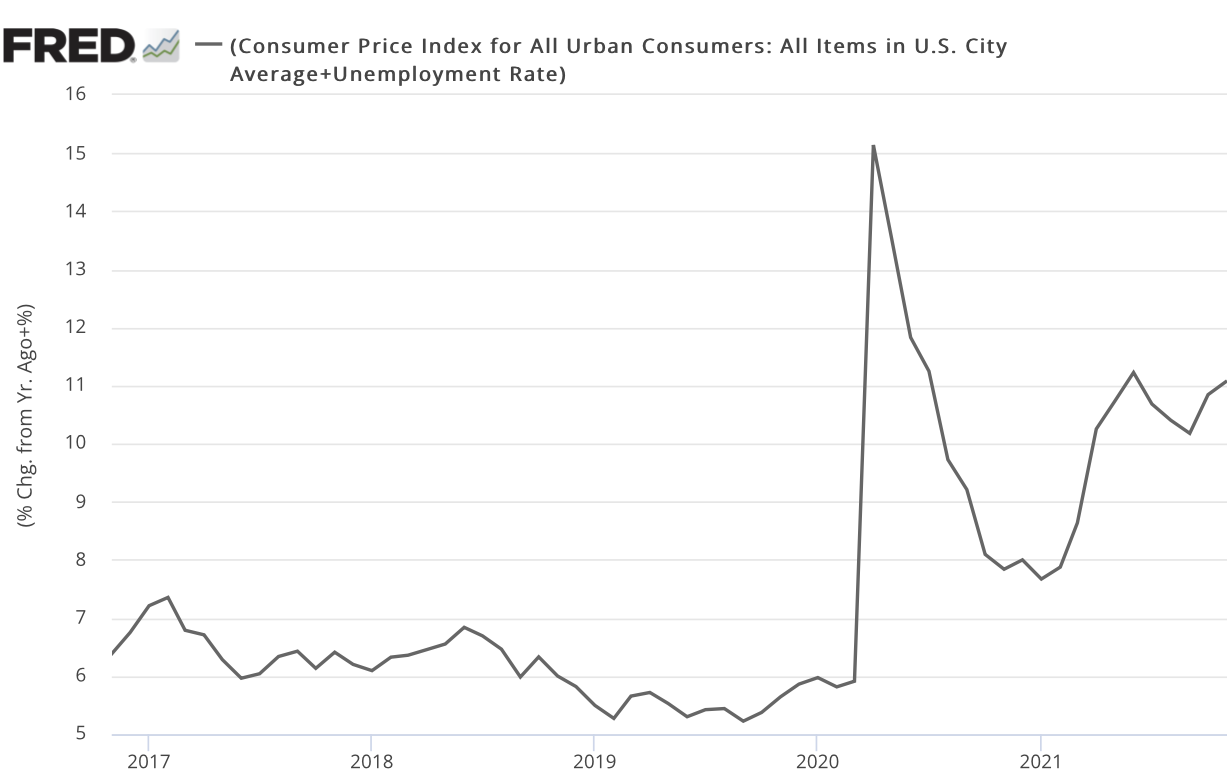

MoneyWeek/John Stepek/21-20-2021 “Stagflation is a messy old business and something everyone will want to avoid. But unless Omicron turns out to be a flash in […]

Copyright © 2026 | WordPress Theme by MH Themes