This won’t be another Chernobyl, expert reassures

Lightbridge Firm chief executive officer Seth Grae states Europe's largest nuclear reactor recently taken by Russian military has 'contemporary, very strong' foundation. #FOXBusiness Sign Up […]

Lightbridge Firm chief executive officer Seth Grae states Europe's largest nuclear reactor recently taken by Russian military has 'contemporary, very strong' foundation. #FOXBusiness Sign Up […]

Former Performing DHS Assistant Chad Wolf responds to Colorado Rep. Lauren Boebert's remarks during Head of state Biden's State of the Union address. #FoxBusiness Sign […]

Afghanistan battle expert and bronze star recipient responds to a Russian general being eliminated in Ukraine on 'Kennedy.' #FoxBusiness Sign Up For Fox Organization! See […]

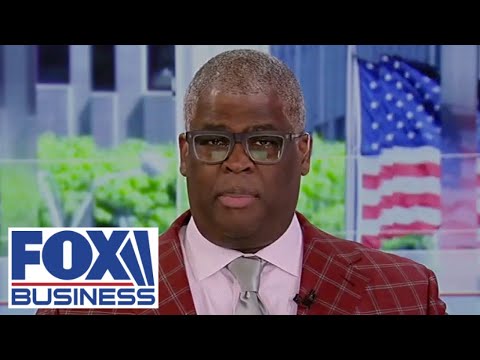

FOX Service host gives his take on the future tasks report on 'Generating income.' #FoxBusiness Subscribe to Fox Organization! See a lot more Fox Organization […]

'Americas Newsroom' anchor Expense Hemmer has the current on the Russian press into southerly Ukraine on 'Kennedy.'. Subscribe to Fox Company! Enjoy more Fox Service […]

This year, spring will officially start on Sunday, March 20, 2022. Spring is a time of year that symbolizes rebirth and new beginnings. For many […]

“Now, governments have the ability to bail-in banks using the depositors’ money. We’re no longer depositors. We’re now unsecured creditors when we put money in […]

Kitco News (Kitco News) – Gold prices have pushed solidly higher in the last few weeks as investors look for safe-haven assets to protect against […]

Kitco News (Kitco News) – Sibanye-Stillwater reported Thursday that its revenue for 2021 increased by 35% year-on-year to a record R172.2 billion (US$11.6 billion) on […]

Kitco News (Kitco News) – Having just raised C$5.6 million in a bought deal financing, Gold Terra Resource (TSXV: YGT) plans to drill 30,000-40,000m this […]

Copyright © 2026 | WordPress Theme by MH Themes