Tax Day Is Almost Here. Here’s What Experts Are Saying We Should Expect This Year.

No matter what your goals are, I believe that preparation is key to finding success. For our clients, it means we provide them with exclusive […]

No matter what your goals are, I believe that preparation is key to finding success. For our clients, it means we provide them with exclusive […]

“Central banks…have been buying physical gold for years. They’ve never owned so much gold as they do right now.” — Precious Metals Advisor Tim Murphy […]

Kitco News (Kitco News) – A weaponized U.S. dollar as Russia’s war with Ukraine enters its fifth week could create more opportunities for gold, according […]

Kitco News (Kitco News) – The recent developments in the crypto space have even Ethereum’s co-founder worried about the future. The post Ethereum co-founder warns […]

Kitco News (Kitco News) – Gold and silver prices are sharply higher in midday U.S. trading Thursday, as safe-haven demand is featured amid marketplace risk […]

“”silver price”” – Google News Calico Silver Project 2022 Drill Program Update: Drill Rig Mobilization to Commence March 29, 2022 GlobeNewswire The post Calico Silver Project […]

Kitco News (Kitco News) – The gold market is holding on to solid gains just below critical resistance at $1,950 an ounce and new momentum […]

Fortuna Silver Mines (FSM) Q4 2021 Earnings Call Transcript The Motley Fool Fortuna Silver Mines Inc. (FSM) CEO Jorge Alberto Ganoza on Q4 2021 Results – […]

Silver Price Analysis: XAG/USD rallies towards $26.00 despite higher dollar/yields amid geopolitical woes FXStreet The silver price needs to overcome this intraday resistance Kitco NEWS Silver Price: […]

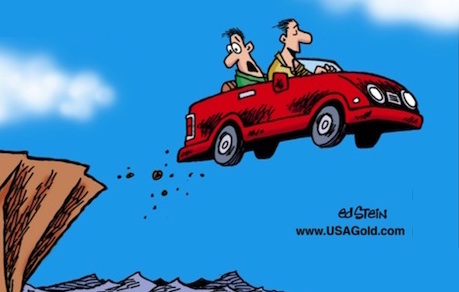

Eurasia Review/Claudio Grass/3-23-2022 “Now, while these are the sort of arguments I would usually bring up in conversations about ‘how high is too high’ when […]

Copyright © 2026 | WordPress Theme by MH Themes