Month: March 2022

Perfect Storm Brews for Higher Helium Prices

Source: Peter Epstein 03/16/2022

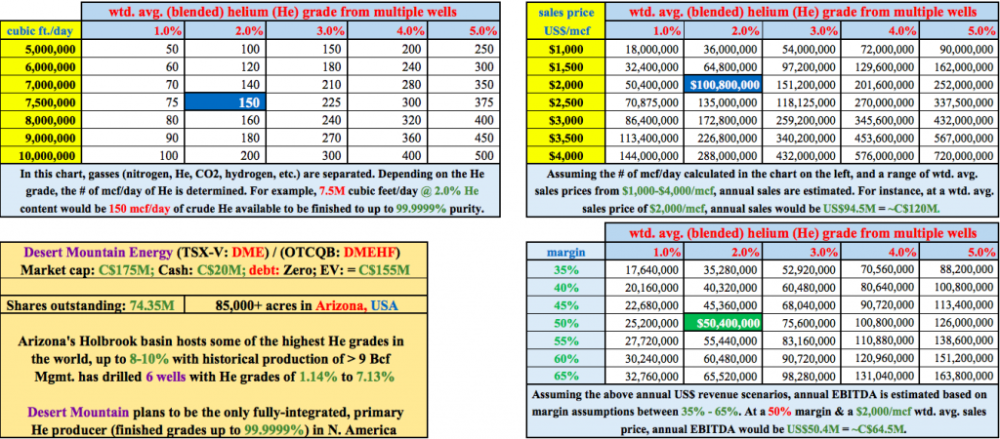

Helium gas is one of the hottest commodities on the planet, but few investors are tracking its price because prices are quite opaque. But by first quarter 2023, margins should be very high and run-rate annual revenue could exceed CA$100M.

Front page news about inflation and ongoing upheavals across Europe are driving commodity prices a lot higher, and it’s not just the energy complex, and precious metals.

Nickel, lithium, steelmaking coal, copper, and wheat (and probably a few others) hit all-time highs this month. Most pundits believe, and I agree, that events unfolding in Europe will have far-reaching consequences for years — not just weeks or months.

Nickel, lithium, steelmaking coal, copper, and wheat (and probably a few others) hit all-time highs this month. Most pundits believe, and I agree, that events unfolding in Europe will have far-reaching consequences for years — not just weeks or months.

Reverberations from Europe will lead to a comprehensive rethinking of security of supply, and ESG initiatives. End users will push for raw materials and finished goods to be sourced regionally. This will significantly reduce the time, cost, and logistics of transportation (addressing security of supply), while cutting emissions.

Helium Market As Tight As Any Industrial Commodity

Moreover, the source of critical materials needs to be carefully considered. Countries in the West can no longer rely on supplies originating from Russia and China (or countries they influence/control). This is nothing new, but to say this issue is taking on a new urgency would be an understatement.

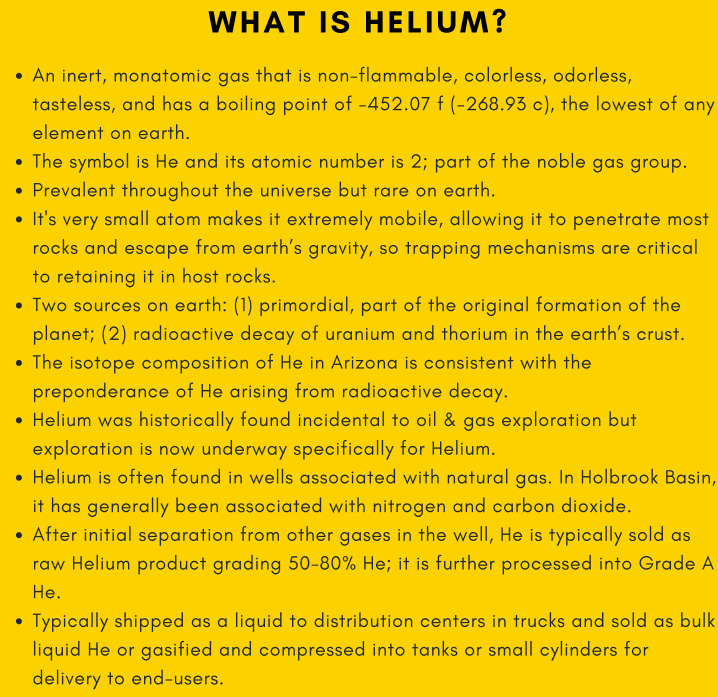

One industrial commodity that investors seem less familiar with is helium gas (“He”). It’s vital in a number of high tech applications. Helium is traded and consumed at grades ranging from ~90% to 99.999999% purity, but privately contracted prices are confidential.

In addition to its widespread use in MRI machines and other medical equipment, the gas is critically important in semiconductors, fiber optics, data centers, LCD displays, hard drives, quantum computing, small nuclear reactors, rocketry, lasers, and more.

Essentially, it is vitally important in public and private scientific, research and development, manufacturing, high tech, aerospace and military applications. The U.S. Departments of Defense (DoD), Energy (DoE), and NASA increasingly use He.

The past several months have been a perfect storm for higher He prices. To be clear, I’m not happy with a major reason WHY the price is rising (Russia’s war on Ukraine), I’m just reporting the facts.

Before the recent hostilities, a major new source of He supply (the Amur Complex) was supposed to come online in Russia’s Far East. Amur was slated to ramp up in phases reaching roughly a quarter of global supply by 2030.

When Will Investors Notice Desert Mountain Energy?

Unfortunately, fires and an explosion (or two) occurred during the commissioning of Phase 1, setting everything back nine to 12 months. Now, with severe sanctions in place, a major economic downturn is underway in Russia. Experts think He supply out of Russia will be largely cut off for years.

In Texas, the Federal Helium Reserve operated by the BLM has been out of service since July 1, 2021, due to serious safety issues. No one knows how much He remains in storage as there have been leaks. And, there’s no telling when He will flow again or at what rate.

Industry participants report that end-users are experiencing force majeures and/or cutbacks of contracted volumes. Many are desperate to replace lost supplies.

As a result, prices are soaring. In late January, I was quoted a range of $1,000 to $3,000/mcf for Desert Mountain Energy Corp.’s (DME:TSX.V) anticipated top grades (99.9999% purity). Today that range is reportedly $2,000 to $5,000/mcf.

Readers should note that none other than natural resources legend Robert Friedland is onboard the helium train as his company Ivanhoe Mines just invested in Australian-listed developer Renergen Ltd. Friedland is hugely successful, famous for his longtime very bullish views on copper, cobalt, palladium and now helium.

Readers should note that none other than natural resources legend Robert Friedland is onboard the helium train as his company Ivanhoe Mines just invested in Australian-listed developer Renergen Ltd. Friedland is hugely successful, famous for his longtime very bullish views on copper, cobalt, palladium and now helium.

A few months ago there was strong interest from three dozen prospective customers in DME’s upcoming production. Today the interest level is off the charts, it’s becoming a frenzy. This is a company that has been impressively de-risked and management is sitting on ~$20 million in cash — more than enough to reach positive free cash flow.

Desert Mountain Energy Has Competitive Advantages

Chief Executive Officer Robert Rohlfing received about 50 calls last week alone from companies looking for supply. Importantly, he believes the calls he’s getting are from end users who could take most or all of DME’s entire output in 2023 to 2024.

Production by North American juniors couldn’t possibly come at a better time. DME’s prospects have improved by leaps a bounds, but its share price is down about 10% since mid-January.

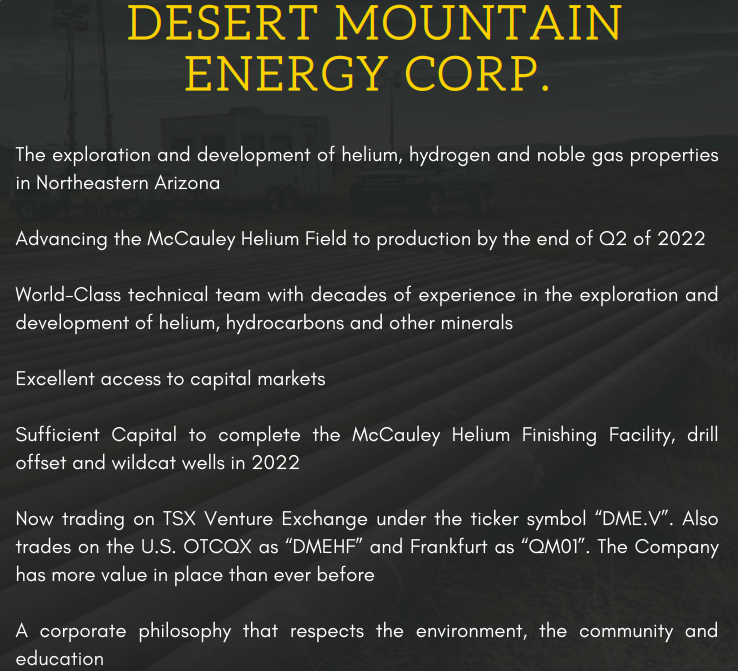

Of about a dozen juniors with market caps greater than CA$3 million, nine are pure-play He companies. Some have lower market caps than my favorite, Desert Mountain. However, the differences between DME and its peers are substantial.

Most others are planning to produce crude He and sell it (without upgrading) to major industrial gasses/chemical companies like Linde plc & L’Air Liquide. (Note: Total Helium just announced initial production of He in the midwestern state of Kansas, they’re selling it for $212/mcf.)

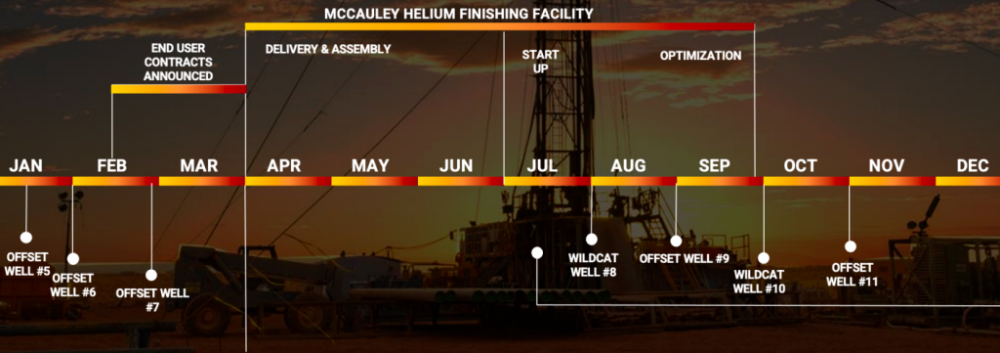

By contrast, management expects to have its 10.5 mcdff/day McCauley Finishing Facility built by June 30, commissioned in the third quarter and ramping up in the fourth quarter. That makes DME head and shoulders above the rest as they will start selling grades of up to 99.9999% this year.

Both stronger prices and a larger portion of the sales mix coming from higher-margin He sales could drive DME’s blended average price to $2,000-plus/mcf. In that scenario, the EBITDA margin would be spectacular. Still, readers are reminded that risks remain considerable, especially the timing of starting operations.

By the fourth quarter, if DME’s first refining facility has been successfully commissioned and is on its way to processing thousands of mcf/day, the company’s valuation should move up, possibly by a lot.

With underlying fundamentals so strong for (at least) several more years, DME could comfortably generate CA$10’s of millions in EBITDA/year from refinery #1 (the McCauley Finishing Facility) alone, before doubling production with the addition of refinery #2 (probably in 2H 2023 or 1H 2024).

DME’s EBITDA Margin Could Be Well Above 50%

Even if/when prices deflate moderately (pun intended), Desert Mountain will still have had the opportunity to expand its McCauley Facility and build a second facility. At that point, margins would be lower, but production would be higher.

Assuming management can execute on its operational plans and continue to drill productive wells, an industrial gas or specialty chemical company should be willing to pay a substantial premium to partner with or acquire the Company.

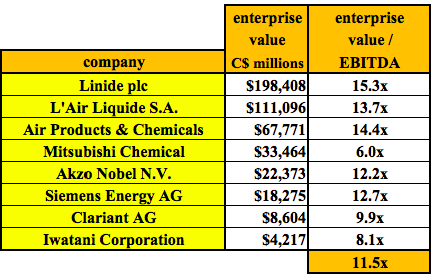

Potential acquirers include very profitable multi-billion dollar companies. In the chart below are some of the publicly-traded names.

Potential acquirers include very profitable multi-billion dollar companies. In the chart below are some of the publicly-traded names.

Rohlfing & President and Director Don Mosher are planning to drill and bring online 60 to 70 primary He wells over the next five years. With producing well lives of 12 to 16 years each, cash flow from DME’s existing 85,000-hectare footprint in the Holbrook basin of Arizona should be quite exciting.

As bullish as I’m on Desert Mountain Energy, other He juniors could also be successful. But most others are six to 12 months behind in terms of meaningful production, and a further 12 to 24 months (if ever) from designing, permitting, funding, building, commissioning, and operating a facility like the one that DME will start commissioning in July.

Compared to peers, DME has a more experienced management team, Board, and advisers, and is fully funded through positive free cash flow. The company expects toe one of the cleanest/greenest mining operations on earth by using an onsite solar farm plus its own produced hydrogen for backup power.

Another factor in favor of DME is that its wells have no wastewater to deal with. This saves on permitting, logistics/time, and operating expenses. The company believes it will be the only independent, fully integrated, and upgraded (refined) dry helium producer in the world.

Management Looks at Hydrogen

It should be noted that management is studying the feasibility of selling pure, clean hydrogen. A recent press release revealed the discovery of what could be a large hydrogen deposit, but this opportunity is a few years off.

According to the press release, “in three hydrogen bearing zones, the thickest is ~32 feet. of extremely high-quality hydrogen without sulfur or other elements which would create issues with production.” The hydrogen field is safely trapped underground, it’s not going anywhere — like money in the bank.

In summary, He demand is growing robustly but supply is not — in fact, it has declined. The He required in key industries cannot be substituted for other commodities. Helium is both finite and non-renewable.

Arizona is a growing high-tech industrial hub; home to semiconductor, EV, and Li-ion battery manufacturing, aerospace companies, and giant data centers. The demand for reliable, regional, 99.9999% He will be virtually insatiable for years to come.

Arizona is a growing high-tech industrial hub; home to semiconductor, EV, and Li-ion battery manufacturing, aerospace companies, and giant data centers. The demand for reliable, regional, 99.9999% He will be virtually insatiable for years to come.

Desert Mountain Energy is ideally positioned to meet soaring He demand in the U.S. It’s situated within a day by truck or rail of dozens of significant southwestern U.S. end-users. This is a key strategic advantage vs. peers near the U.S./Canadian border.

Every junior that crosses the finish line, delivering consistent He supply, will be rewarded. However, why not choose the one that’s vertically-integrated with an operating margin that will be far superior to peers not upgrading their produced helium?

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures / Disclaimers:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Desert Mountain Energy, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Desert Mountain Energy are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Desert Mountain Energy and the Company is a former advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosures:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the alidity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: DME:TSX.V,

)

Analyst coverage on Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) was recently initiated by Noble Capital Markets given the mining company’s potential to help supply rare earth elements (REEs) to the world, reported analyst Mark Reichman in a March 16 research note.

“Defense Metals is well-positioned to benefit from growing demand for rare earths (REs) for use in electric vehicle batteries, metal alloys and advanced technology applications,” Reichman purported. “We anticipate more activity in the rare earths and critical minerals space as capital flows to attractive opportunities, including growing demand for RE and critical minerals, limited supply sources and increasingly supportive government policies.”

Noble rated Defense Metals Outperform and assigned it a US$0.70 per share price target. In comparison, Defense Metals’ current share price is around US$0.25.

Reichman highlighted the compelling aspects of the Defense Metals story.

Notably, the RE explorer’s cornerstone project Wicheeda is well-advantaged and “has the potential to be a globally significant producer,” he wrote.

A preliminary economic assessment completed in January 2022 indicated the project is worth advancing “based on significant resource potential, favorable metallurgical recoveries and attractive return potential,” Reichman wrote.

Once commercial production is reached at Wicheeda, the project should yield about 25,400 tons of rare earth oxide each year, which equates to about 10% to 15% of the current global supply. Defense Metals is moving its project forward.

At this stage, Wicheeda has an existing resource. Current Indicated resources are 5,000,000 tons (5 Mt) averaging 2.95% total rare earth oxides (TREOs). Inferred resources amount to 29.5 Mt averaging 1.83% TREOs. By adding direct flotation to the recovery process, the company could increase its TREOs percentage to about 40 to 50.

These current Wicheeda resources do not include any 2021 drill results, which will add ounces. It only takes into account ounces from about 4,000 meters (4,000m) of previous drilling. This year, starting in May, Defense Metals intends to drill 5,300m at Wicheeda. Once completed, the company will incorporate the results of last and this year’s drilling into a preliminary feasibility study, expected in H1/23.

Also beneficial to Defense Metals, Reichman noted, is Wicheeda’s location. It is in the mining friendly jurisdiction of British Columbia and a place with ample infrastructure.

Another plus is the Defense Metals’ strong management and technical team, comprised of well-qualified and experienced people. CEO Craig Taylor has years of experience as a director or officer of mining explorers and developers. President Luisa Moreno, also a director, is a REEs expert. Each board member brings a different area of expertise to the group.

Lastly, Reichman pointed out, Defense Metals could be a potential takeout target by a larger REEs producer.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals. Click here for important disclosures about sponsor fees. An affiliate of Streetwise Reports is conducting a digital media marketing campaign on behalf of Defense Metals Corp. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals, a company mentioned in this article.

Disclosures and Disclaimers, Noble Capital Markets Inc., Defense Metals Corp., March 16, 2022

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc. (“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results.

Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES: This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures: The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

The Company in this report is a participant in the Company Sponsored Research Program (“CSRP”); Noble receives compensation from the Company for such participation. No part of the CSRP compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed by the analyst in this research report.

Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) within the next 3 months.

Noble is not a market maker in the Company.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE: Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis. Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.” FINRA licenses 7, 24, 63, 87.

CONTINUING COVERAGE: Unless otherwise noted through the dropping of coverage or change in analyst, the analyst who wrote this research report will provide continuing coverage on this company through the publishing of research available through Noble Capital Market’s distribution lists, website, third party distribution partners, and through Noble’s affiliated website, channelchek.com.

WARNING: This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc.

RESEARCH ANALYST CERTIFICATION: Independence Of View: All views expressed in this report accurately reflect my personal views about the subject securities or issuers. No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or research report.

Ownership and Material Conflicts of Interest: Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

( Companies Mentioned: DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE,

)

This May Be the Dumbest Thing You Read Today

This may be the dumbest thing you read today. Not my words, but this CNN article I’m about to tell you about. Americans are struggling under the weight of inflation. The official CPI for February came in at 7.9%. Measured honestly, CPI is above 15%. So, what’s the best way to help consumers deal with […]

The post Blog first appeared on SchiffGold.

The Federal Reserve wrapped up its March meeting, delivering a 25 basis-point interest rate hike in the face of a 7.9% CPI. Peter Schiff called it the most anticipated and probably the most meaningless rate hike in history. There was some speculation that the central bank would lift off with a 50 basis-point hike before […]

The post Blog first appeared on SchiffGold.