Month: March 2022

Source: The Critical Investor 03/15/2022

As the dust settles after an intense proxy battle, the Critical Investor looks into this junior explorer’s new direction and a rare opportunity.

Fancamp Exploration Ltd. (FNC:TSX.V) currently has a very extensive exploration project and royalty portfolio, a huge cash and liquid equity position of CA$25 million, and a high-quality core investor base, and is at a pretty attractive entry point as it is trading at just a CA$17.5 million market capitalization. Because of this, Fancamp seems to be one of the better risk/reward exploration plays in the sector.

Not often do you see the rare opportunity coming by of a junior explorer with close to 90 exploration projects, numerous royalties, and a titanium recovery technology, combined with a treasury that is larger than its market cap. Fancamp Exploration unites all these remarkable features in one company, and is looking to unlock the value of all assets after having endured an intense proxy battle involving the multimillion dollar question of which strategy to follow for unlocking that value. As the share price had been side ranging basically since 2013, a growing number of people involved in the company became convinced last year that a change of course was necessary, with precious and base metal prices printing all-time highs or close to this.

Share price 10-year timeframe (Source: tmxmoney.com)

A first attempt at merging with ScoZinc, a company with a zinc mine in care and maintenance, was the catalyst for the proxy battle as lots of shareholders didn’t see sufficient value in this deal. After the dust has settled since the proxy outcome on Oct.r 6, 2021, with the ScoZinc deal off the table, investors were curious about the new direction Fancamp would take. This wasn’t an easy task, as a rigorous selection process was needed for downsizing the extensive asset portfolio. This resulted in the following initial strategy:

- Sifting through all exploration properties, in order to hold onto and advance about five to eight selected properties, and market all other properties for optioning out, JV, sale and/or creation of royalties with the goal of building a significant royalty portfolio.

- Doing strategic investments and acquiring advanced/development projects with potential for either monetization or near-term cash flow generation.

- Monetizing titanium technology by developing and patenting the in-house proprietary technology, following a trajectory of forming a strategic partnership with an industry player, obtaining funding for a pilot plant, and spinning off the complete package in a separate listed company.

There are 176.52 million shares outstanding (fully diluted 189.6 million), and 13.1 million options and warrants. Fancamp has a current market capitalization of CA$16.77 million based on the March 2, 2022, share price of CA$0.095 to CA$0.10 . The current cash and equity position of Fancamp is approximately CA$25 million, and consists of over CA$6.0 million in cash and about CA$18.5 million worth of Champion Iron Ore (CIA.TO) shares (3.1 million shares at CA$5.98). Management and Board holds no less than 22% of the current shares outstanding (Director Ashwath Mehra holds more than 18%), several close strategic holders own approximately 30%, and there are a few institutions holding an estimated 5%.

Management Includes Heavy Hitters

President and Chief Executive Officer Rajesh Sharma has more than 25 years of global experience in the mining and metals industry with a track record of advancing exploration and mining projects and executing investments, M&A and JV deals internationally. He is the former CEO of Tata Steel Minerals Canada, and was an executive in residence at one of the largest investment funds in Canada (Investissement Quebec).

Vice President of Exploration Francois Auclair is a professional geologist with more than 25 years of experience both in Canada and globally, has led mining exploration programs for several companies, including Algold, Nimini Gold, Diabras (Sierra Metals), Axmin, Rio Narcea Gold Mines, Ashanti Goldfields, and Aur Resources.

Mehra is actively involved with Fancamp strategy and financings, and is a successful investor and advisor to venture capital firms in real estate, mining, tech, and bio-tech. He was cofounder of GT Gold, which was sold to Newmont in 2021 for CA$393 million.

Director Mark Billings has been an investment banker, having raised hundreds of millions of dollars for small-cap companies, including several junior mining companies.

Close to 90 Exploration Projects

Fancamp owns close to 90 exploration projects (precious metals, base metals, and strategic metals). But as part of their new strategy, Fancamp already divested several projects, made several strategic investments (NeoTerrex, Vision Lithium, and EDM Resources), and arranged drill programs for the Clinton and Harvey Hill copper projects in Quebec, with a 2,000 meter program for Clinton already underway. These two projects in northern Quebec have seen historic production with remaining, demonstrated mineral potential, including a noncompliant historic bulk sample of 114 tons at Clinton that returned 2.6% Cu, 2.5% Zn, 0.41g/t Au and 31g/t Ag, and a small noncompliant historic resource that contains 1.5Mt @ 2.02% Cu and 1.54% Zn. Fancamp completed drilling in the past, with best intercepts returning 1.79% Cu over 6.19 meters within a 14.58 meter wide zone of 1.09% Cu; 1.27% Cu, 1.14% Zn, and 11 g/t Ag over 11 meters, and finally 2.78% Cu and 16.9 g/t Ag over 24.7 meters.

Fancamp owns close to 90 exploration projects (precious metals, base metals, and strategic metals). But as part of their new strategy, Fancamp already divested several projects, made several strategic investments (NeoTerrex, Vision Lithium, and EDM Resources), and arranged drill programs for the Clinton and Harvey Hill copper projects in Quebec, with a 2,000 meter program for Clinton already underway. These two projects in northern Quebec have seen historic production with remaining, demonstrated mineral potential, including a noncompliant historic bulk sample of 114 tons at Clinton that returned 2.6% Cu, 2.5% Zn, 0.41g/t Au and 31g/t Ag, and a small noncompliant historic resource that contains 1.5Mt @ 2.02% Cu and 1.54% Zn. Fancamp completed drilling in the past, with best intercepts returning 1.79% Cu over 6.19 meters within a 14.58 meter wide zone of 1.09% Cu; 1.27% Cu, 1.14% Zn, and 11 g/t Ag over 11 meters, and finally 2.78% Cu and 16.9 g/t Ag over 24.7 meters.

Regarding the exploration assets, the most advanced asset seems to be the 50% interest in the Koper Lake project (KWG Resources owns the balance). A large chromite project in the Ring of Fire, Koper Lake has a 85.9Mt @ 34.5% Cr2O3 (chromite) 2015 Inferred resource, which is NI43-101 compliant. To give you an idea of value, the price for 42% Basis CIF China is about US$200/ton at the moment, so with some concentrating the in-situ metal value would quickly surpass US$4 billion, which is comparable to a 1 billion pound copper deposit or 2Moz gold deposit.

The property is surrounded by Noront ground, which was the focus of the very recent bidding war between BHP and Wyloo, resulting in a buyout price of CA$616.9 million. Although the Ring of Fire has been waiting for substantial infrastructure investments for a long time now, Wyloo seems convinced it can singlehandedly kickstart these investments. This is not unrealistic as Wyloo is backed by one of the richest men in Australia, billionaire Andrew Forrest, founder and major shareholder of Fortesque Metals Group, one of the largest iron ore producers worldwide, who mentioned building out the Ring of Fire as one of his focus points for the near future.

Some Key Points

- Fancamp Exploration is in the process of revitalizing itself, by selecting just five to eight projects from the very extensive asset portfolio holding about 90 projects and royalties, and market all other properties.

- The company has an impressive treasury, holding over CA$6.0 million in cash. Besides this, Fancamp also holds 3.1 million shares in Champion Iron Ore, worth CA$18.5 million at the moment, causing the stock to trade at a market cap of 0.7 times cash and equity, which is very rare. At a current daily average volume of 627,000 shares per day, the Champion Iron Ore position is easy to divest when needed.

- The three-pronged strategy doesn’t only downsize and optimize the extensive project portfolio, but also involves doing strategic investments/acquiring advanced projects, and the monetization of their titanium technology.

- Fancamp arranged drill programs for the Clinton and Harvey Hill copper projects, with a 2,000 meter program for Clinton already underway.

- Fancamp owns 50% of a substantial Ring of Fire asset, a region which became instantly more attractive after powerful Wyloo recently acquired Noront.

- Fancamp management is very much aligned with shareholders, as Director Mehra owns over 18% of outstanding shares.

- A wildcard for Fancamp are its investments in NeoTerrex, Vision Lithium and EDM Resources, which could provide lots of cash in case of exploration/development success.

Conclusion

Although Fancamp has started a process of selective downsizing of their asset portfolio, it is still a remarkable and versatile combination of a huge pile of cash and equity, lots of good exploration projects, a growing royalty portfolio, numerous future JVs, several strategic investments, and a proprietary titanium technology. I expect this process to take another nine to 12 months, and after this, Fancamp should be well on its way creating substantial value for shareholders. Stay tuned!

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. Dollars, unless stated otherwise.

Please note: The views, opinions, estimates, forecasts or predictions are those of the author alone and do not represent views, opinions, estimates, forecasts, or predictions of Fancamp Exploration or Fancamp Exploration’s management. Fancamp Exploration has not in any way endorsed the views, opinions, estimates, forecasts, or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: FNC:TSX.V,

)

Source: Streetwise Reports 03/15/2022

Hycroft Mining Holding Corp. shares traded 14% higher after the silver and gold mining company reported it received a $56 million equity investment from famed precious metals investor Eric Sprott and movie chain operator AMC Entertainment.

Precious metals development company Hycroft Mining Holding Corp. (HYMC:NASDAQ), which owns and operates the Hycroft Mine located approximately 54 miles west of Winnemucca, Nev., today announced “a $56 million equity private placement with precious metals investor Eric Sprott and AMC Entertainment Holdings Inc. (AMC:NYSE).”

Hycroft Mining Holding’s President, CEO and Acting Chairman Diane Garrett remarked, “We couldn’t be more pleased to announce this transformational investment in the future of Hycroft, anchored by Eric Sprott, one of the world’s leading precious metals investors, and AMC Entertainment Holdings, which has proven its expertise and ability to address liquidity challenges and to raise capital to optimize the value of significant underlying assets. Collectively, their investment dramatically improves Hycroft’s liquidity position and provides years of financial runway.”

“Additionally, their confidence underscores the world-class nature of Hycroft’s gold and silver deposit and our potential to unlock value at a pivotal moment in its development. We look forward to working alongside our new investors to advance Hycroft up the value chain,” Garrett added.

The company advised that the private placement is expected to close on or around March 15, 2022. Under the terms of the investment agreement, Mr. Sprott and AMC will both make a cash investment of $27.9 million in the company and in return will each receive 23,408,240 units, whereby each unit includes one Hycroft common share and one common share purchase warrant. The firm listed that the units are priced at $1.193 and the purchase warrants will be valid for five years at an exercise price of $1.068 per share.

The firm indicated that when the transaction is finalized Mr. Sprott and AMC will each own about 21.8% of Hycroft’s outstanding common shares which will make them the second largest stockholders in the company. The company stated that under the terms of the investment AMC will be given the right to a appoint a representative to serve on Hycroft Mining’s Board of Directors.

The company said that it plans to use the new capital raised for general corporate purposes for items such as working capital, debt restructuring, investments, capex, additional exploration and perhaps to advance the Initial Assessment in the Hycroft Mine’s 2022 Technical Report Summary to a pre-feasibility and/or feasibility study.

In addition to the private placement the firm stated that it has taken steps to recapitalize its balance sheet which will provide it with greater flexibility going forward. The company reported that “it reached an agreement in principle with its primary lending partner, Sprott Private Resource Lending II (Collector), LP (Sprott), acting as Facility Agent, to extend all principal debt repayments to one bullet payment in May 2027, from current maturity date of May 2025, subject to $50 million of new equity, and upon payment of a $3.3 million lender interest adjustment which will be capitalized and added to the principal due upon maturity.” The company pointed out the that the arrangement to extend the maturity date will include certain loan coverage conditions and covenants.

Hycroft advised that “it also reached an agreement with its other second lien holders whereby, subject to $50 million of new equity, they will extend the life of the loan by two years to December 2027 with continuing 10% annual payment-in-kind interest payments.”

Hycroft Mining Holding Corp. is a U.S. gold and silver development firm that owns, explores, develops and operates the Hycroft Mine in Northern Nevada. The property encompasses approximately 72,000 acres and is located about 50 miles west of Winnemucca, Nev. on the western flank of the Kamma Mountains. The Hycroft Mine hosts a Measured & Indicated Resource of 446.0 Moz Ag and 9.65 Moz Au and an Inferred Resource of 150.4 Moz Ag and 5.0 Moz Au.

Hycroft Mining started the day with a market cap of around $84.0 million with approximately 60.41 million shares outstanding. HYMC shares opened nearly 95% higher today at $2.71 (+$1.32, +94.96%) over yesterday’s $1.39 closing price. The stock has traded today between $1.53 and $2.72 per share and is currently trading at $1.58 (+$0.19, +13.67%).

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: AMC. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: HYMC:NASDAQ,

)

Tocvan Ventures Finding Gold in Sonora

Source: Bob Moriarty 03/15/2022

Bob Moriarty of 321 Gold recommends this “low-cost, high-opportunity” Mexican explorer to today’s investor.

I wrote a piece a week ago about how to use the DSI to predict market turns. I listed 13 different commodities and their DSI. All 13 turned. The DSI is the only signal I know of that can be that handy. Gold and silver are not down for the count, they are only correcting.

Indeed the future for both is bright due to the incredible stupidity of the sanctions laid on Russia. It’s important when using any weapon that you don’t do more damage to yourself than to your enemy of the day.

Investors need to be looking for low cost, high opportunity companies to invest in.

I am going to write about one today named Tocvan Ventures Corp. (TCVNF.OTC).

Tocvan has two important gold projects in Sonora province in Mexico. The projects are surrounded by operating important gold mines in the Sonora Mega shear.

The first project is the Pilar low sulfidation gold project located to the Southeast of the La Colorada gold mine in Sonora. To get 51% of Pilar Tocvan has spent $750,000 in cash and exploration and issued two million shares. They still must pay $225,000 and spend $1.4 million in exploration and issue another two million shares. Once they have picked up the 51% they have six months where they can purchase the remaining 49% for $2 million with a 2% NSR or form a joint venture with the vendor.

Prior to now, Pilar has had 22,700 meters of drilling to date with results as high as 94.6 meters of 1.6 g/t Au and 16.5 meters of 53.5 g/t Au with 53 g/t Ag. The company is in the midst of a phase III drill program with 1,200 meters completed so far with results estimated to be released in the next two weeks.

Nine months ago Tocvan signed a deal with Millrock to pick up the El Picacho Gold project for total payments of $1.989 million USD over a five year period to pick up 100% ownership subject to a 2% NSR. El Picacho has had no drilling but has had extensive surface samples taken.

El Picacho has five different high-grade gold advanced targets with two dozen samples showing between 2.4 and 32 g/t Au.

Tocvan is in the process of closing a $600,000 private placement. I have participated and am very interested in seeing a drill program started on the El Picacho project. The company is very cheap with a $23 million market cap and two excellent gold projects in a mining friendly country.

Tocvan is an advertiser. I have participated in their PP so naturally I am biased. This is an interesting story but you need to do your own due diligence.

Tocvan Ventures

TOC-C $.74 (Mar. 15, 2022)

TCVNF OTCQB 32 million shares

Tocvan Ventures website

Bob Moriarty

President: 321gold

Archives

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Tocvan Ventures Corp. Tocvan Ventures Corp. is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: TCVNF.OTC,

)

Source: Adrian Day 03/15/2022

Adrian Day discusses financials from three resource companies that released earnings last week; all reported record years.

You could do far worse that simply buy and hold these three royalty companies, each with diversified portfolios, each with a strong balance sheet, and each with top management which thinks counter-cyclically.

Record revenue for Franco, on higher key asset and oil

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) (FNV.NY, 158.05) reported a strong fourth quarter on the back of higher production at Cobre Panama, its largest stream, and record oil and gas revenue. Overall for the year, there was record revenue of $1.3 billion, up 27%, coming in at the high end of its guidance. There were records on several other metrics as well.

Franco expects a small decline in overall gold-equivalent ounces (GEOs) this year, though another record in oil. Lower GEOs comes from expected lower grades at two large streams, Antamina and Antapaccay, and lower production at Guadalupe. Based on forecast metals prices, precious metals account will for about 75% of 2022 revenue, while energy will contribute almost 20%, with iron ore the bulk of the remainder. Obviously this could change if any new producing assets are acquired or to the extent realized prices differ from Franco’s price assumptions.

After 2022, however, in its five-year guidance, Franco is forecasting between 765,000 and 825,000 GEOs by 2026, based on Cobre Panama expanding its throughput (by the end of next year), an expansion at Tasiast, and on several new mines commencing production. It has started including oil & gas in its “GEO” calculations.

Franco ended the quarter with $539 million in cash, no debt, and $1.1 billion available on its credit facilities. G&A is less than 3% of revenue. It increased its dividend again, by nearly 7%, for the 15th consecutive dividend increase.

Asset diversification separates Franco from other gold royalty companies

Franco has a lower percentage of gold and silver than other large royalty and streaming companies, which diversification it now calls a distinguishing advantage. It is probably a feature that makes the company attractive to generalist investors. The company is also well diversified in terms of its assets (with Cobre Panama the largest single asset at 18% of revenue, and no other asset over 10%); operators (again, First Quantum, owner of Cobre Panama, at 18% is the largest); and geographically. It has more exploration projects in its portfolio than other companies, some of which will eventually produce.

Franco sees the pipeline quite strong across a variety of financing needs. Its current focus for new investments continues to be on precious metals, but it is open to other resources. For these, it is driven by the quality of the asset rather than the commodity.

Franco-Nevada continues to be one of our core investments. Royalty and streaming companies have far lower exposure to operating cost inflation than miners, and also less exposure to potentially increasing taxes. So they remain attractive investments for the current environment. Because of the strong recent rally–-it was $127 at the end of January–-we are holding and looking for a pullback to buy.

Wheaton also sees $1 billion revenue

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) (WPM.NY, 48.10) reported record revenue and earnings for the fourth quarter, though it missed analyst forecasts by a small amount. For the year, revenue was $1.2 billion. Due to high cobalt prices, the company reversed a previous impairment on the Vale cobalt stream; it does not, however, seem to have an appetite for any additional such streams, focusing on gold and silver (currently 94% of revenues). The Salobo expansion (Salobo III), which is part of the project that represents Wheaton’s largest single asset, was delayed because of landslide; it had been 85% complete at year-end. Vale is conducting a thorough review of the project, which should be complete sometime in the second quarter. At present, the expansion is considered still on track for a year-end start up.

Wheaton has a solid balance sheet, with available liquidity now up to $2.2 billion. With cash, a strong credit facility and anticipate strong cash flows in coming years, CEO Randy Smallwood said he did not think the company would ever have to issue another share. Unlike his peers, he is not debt-averse, particularly when rates have been so low; “we are glad we haven’t diluted shareholders.” Wheaton focuses on assets with low costs, with 85% of its assets in the lower half of the cost curve, and reserves with over 30 years of life. Wheaton is forecasting an average of 20% growth over the next 10 years, with GEOs averaging 910,000 ounces per year over that period, up from 750K last year.

But he added that it was becoming “more and more difficult to find projects to put money into,” indicating that the dividend may increase further in coming years. Already, Wheaton (whose current yield is 1.3%) has been included in the S&P Canadian Dividend Aristocrats Index. Wheaton is a core holding for us, but given the 25% plus run up since the end of January, we are holding and looking for a pullback to buy.

Smaller Altius see several growth prospects

Altius Minerals Corp. (ALS:TSX.V) (ALS, To., 23.91) reported records on most financial metrics, with revenue for the year at $82 million, up from $60 million in 2020. With an 80% margin (including business development costs), earnings more than doubled from 36 cents per share to 77 cents. After a small paydown on debt, Altius currently has $117 million outstanding on its credit facility, and $37 million in cash (excluding the cash at Altius Renewables, which is consolidated on its balance sheet). In addition, it has $108 million in shares of Labrador Iron Ore Royalty Corp., about $56 million in its project generation and junior portfolio, and shares in Altius Renewables (59% ownership) valued at year end at $190 million. So the balance sheet is very strong.

A time to sow, a time to reap

During the weak years for commodities after 2012, Altius undertook several acquisitions and accumulated a large land bank. Now, Altius––among the top counter-cyclical investors in the sector––looks at this as a period of harvesting. Ten years of under-investment mean the sector is now seeking new assets. It is focusing on growth of its organic assets rather than new M&A opportunities, though “we are always looking.”

Thus Altius has cash flow available to return to shareholders. It paid almost $10 million in dividends in 2021, and hiked in the last quarter. It also continued to buy back shares, last year buying about 2% of its shares), seeing its own shares as better value than what else is available.

Altius has many potential growth opportunities

In our last article, we reviewed some of the growth opportunities inside Altius’ portfolio, so we won’t repeat now. Suffice to say that there is a lot of growth ahead in potash (shortage and higher prices leading to perhaps a 50% increase in revenues), expansion at Voisey’s Bay nickel-copper-cobalt, a new discovery at the copper-gold Chapada, and the Kami iron-ore deposit potentially moving towards production.

We discussed last time the emerging gold district near Beaty in Nevada, controlled by Anglo, over which Altius holds a 1.5% royalty, plus, through its 16% interest in Orogen, another 1% over a part of the district. The 3.4 million resource is just the beginning. Altius CEO Brian Dalton said that, given Altius is not a gold company, it could try to achieve more value for the royalties perhaps selling to a gold royalty company (or exchanging for non-gold royalties), or even spin out the royalty, which Dalton is clearly excited about. However, he commented that there was a lot of time before doing something as he wanted to let the area expand first.

In sum, Altius has been achieving strong results, has a solid balance sheet, and multiple high-growth potential ahead of it. It also has some of the smartest management in the business. I repeat what I wrote last time: if you do not own it, Altius is still a good buy for long-term investors.

TOP BUYS NOW, in addition to those discussed above, include Ares Capital Corp. (ARCC:NASDAQ) (ARCC, Nasdaq, 20.33), Midland Exploration Inc. (MD:TSX.V) (MD, To., 0.47), and Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) (FSM.NY 4.27). Some can be bought as long-term holdings if you do not already own, including those above and Nestle SA (NESN:VX; NSRGY:OTC) (NESN, Switzerland, 112.98).

Originally published on March 12, 2022.

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Franco-Nevada, Ares, Midland Exploration, Fortuna Silver, Nestle, Orogen, and Altius Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada, Wheaton Precious Metals, Midland Exploration, Fortuna Silver, Orogen Royalties, and Altius Minerals, companies mentioned in this article.

Adrian Day’s Disclosures: Adrian Day’s Global Analyst is distributed by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. ©2022. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.

( Companies Mentioned: ALS:TSX.V,

FNV:TSX; FNV:NYSE,

WPM:TSX; WPM:NYSE,

)

Source: Marin Katusa 03/15/2022

One analyst says commodity prices are soaring as tensions between superpowers escalate, setting up the U.S. dollar to continue to dominate the world as a reserve currency.

Commodity and stock futures have maximum allowable limits for price appreciation or deprecation. It is an attempt to avoid catastrophic blowups to investors who are on the wrong side of the trade.

Only under the most volatile of market conditions do we ever see “melt-up” or “meltdown” scenarios. We are seeing these scenarios in real time right now.

Commodity prices are soaring as tensions between superpowers escalate because of the Russia vs. Ukraine situation, setting up the U.S. dollar to continue to dominate the world as a reserve currency.

Where is the true safe haven? You aren’t seeing people rush to rubles, yen, or euros. They are rushing into the dollar and gold, both of which have appreciated sharply since the conflict began.

This is a world I’ve described many times before where we can have both a strong US dollar and strong gold prices.

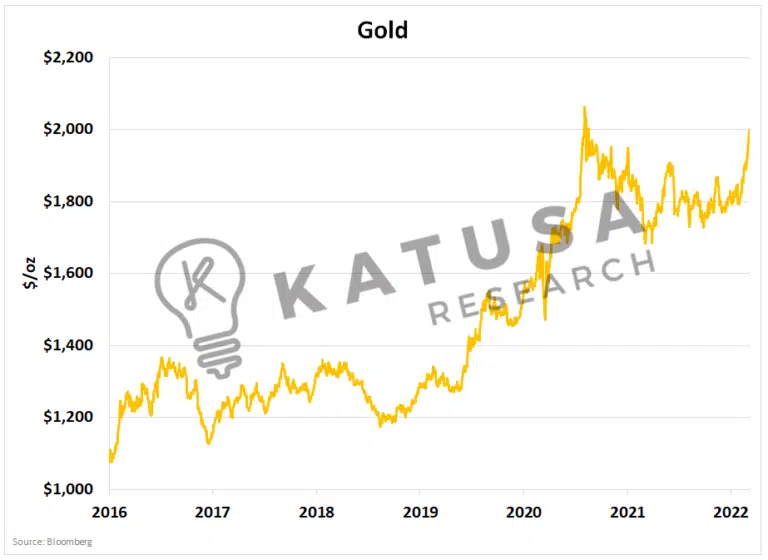

Gold has spiked higher up close to $250 over the last two weeks and has hit as high as $2,067 per ounce. We are paying close attention, and have loaded up on the best gold stocks in Katusa’s Resource Opportunities portfolio.

Global Energy Prices Soar

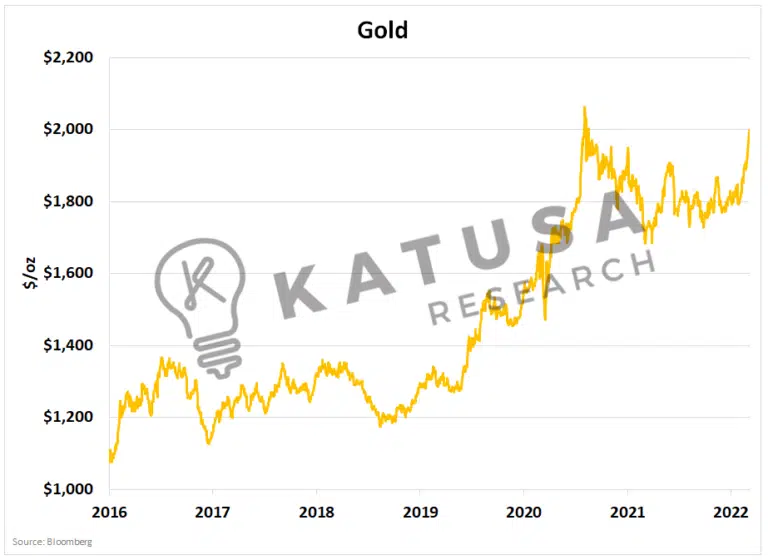

Oil has ripped nearly 60% higher this year. Brent crude, which is a key European benchmark oil price, has now taken out most of its previous resistances.

It is within striking distance of its all-time high set back in August 2008.

It’s soaring right now because Russia is one of the world’s largest oil producers and exporters. If Russian companies are for the vast majority shut out of swift banking facilities, it effectively reduces to zero any oil that would normally be routed to western countries.

This represents millions of barrels of oil in an already tight market.

The U.S. has banned all oil, natural gas, and coal coming from Russia. President Joe Biden has urged all other nations to do the same but acknowledges that many cannot do so (like Germany) without some time to secure alternative sources.

Uranium was not included in the import ban.

I know this will sound absurd, but the U.S. has already given sanction waivers to Rosatom (Russia’s largest uranium company, which owns Uranium One).

The Big Wild Card

Elsewhere in the energy market, uranium has caught a bid. It broke $50 per pound for the first time since 2012. As I have written about many times, the former Soviet Union produces half the world’s uranium.

As utility companies look to avoid doing business with Russia, this is going to spike spot prices.

Just like with avoiding Russian oil, new uranium can’t just be created out of thin air and this has and will continue to spike prices. This is the big wild card. Nations will start voluntarily rejecting Russian nuclear fuel, the way Sweden has.

Sweden only has six operating reactors, but that alone has taken the spot price from $43 to $47 in three days. More nations will be pressured by their citizens to follow Sweden’s lead of voluntarily avoiding Russian uranium and commodities. This will have upward price pressure on the uranium spot and long-term price.

One would think that if Russia continues its advance and increases its land grab, the energy flow would be a sacrifice that the European Union would have to make once it secures alternative sources (which could take as long as a year).

Keep an eye on uranium as the mainstream narrative continues to shift towards this carbon-neutral fuel.

Bullish For Carbon Credits

Because the flow of Russian natural gas could be slowed significantly, the switch to coal (to make up for the difference) will replace natural gas for electricity generation.

Coal emits much more carbon dioxide than natural gas, meaning the utilities will have to offset those emissions. The transition to green and non-Russian fossil fuels is years away.

We are very early to the carbon bull market. If you want to follow carbon prices and breaking news, this is a free resource with live price feeds.

Metals Markets Rip Higher

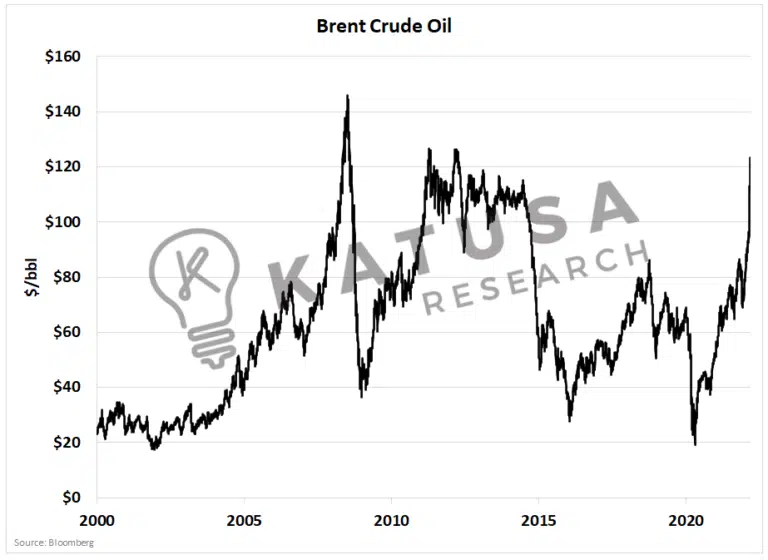

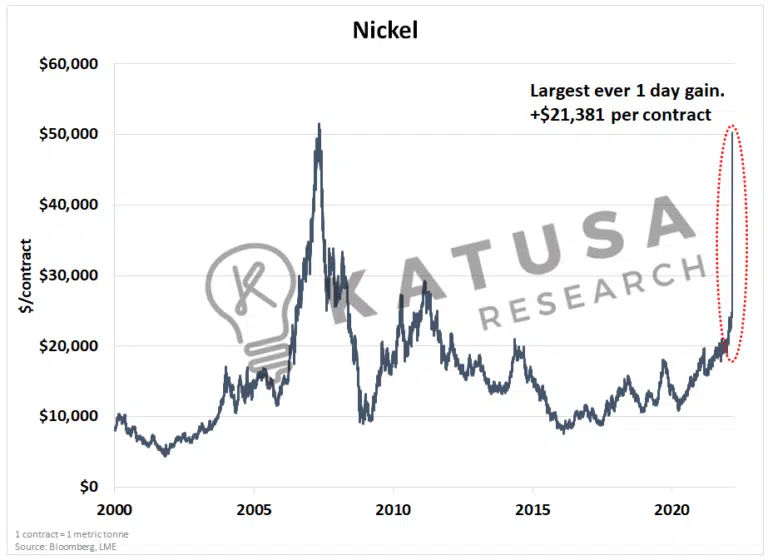

We are seeing this in the nickel market in an even more aggressive fashion. Russia is one of the largest nickel producers and on the fear of not being able to ship products, prices are soaring. In the most extreme move in nickel’s history, prices soared 90%, leading to the largest per-dollar gain ever.

This is going to have massive ripple effects on the steel industry, which utilizes 70% of the world’s nickel production every year.

Elon Musk and company won’t be happy either as nickel is a core ingredient in many of the EV batteries built today.

Right in the Breadbasket

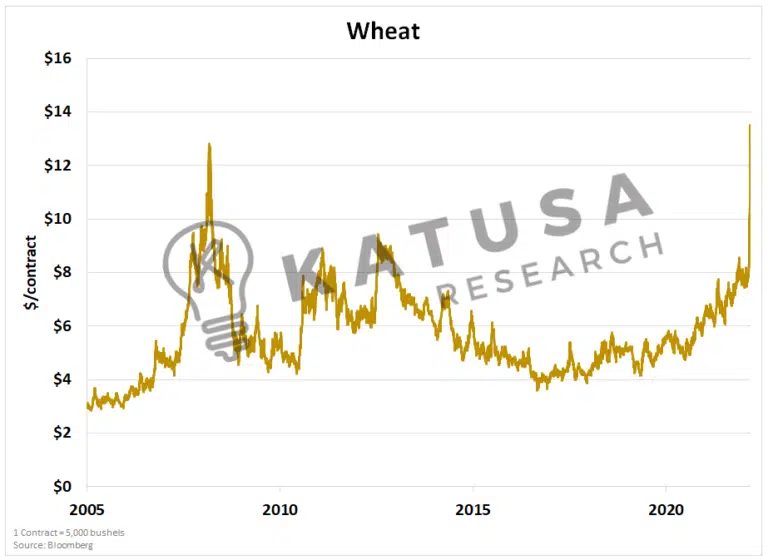

Even local markets are feeling the effects of the conflict. Wheat traded in Chicago’s Mercantile Exchange is up 70% and has gone “limit up” in six straight sessions.

Last week alone, wheat prices surged over 40%.

Wheat is just one of many “soft commodities” which are being bid up aggressively.

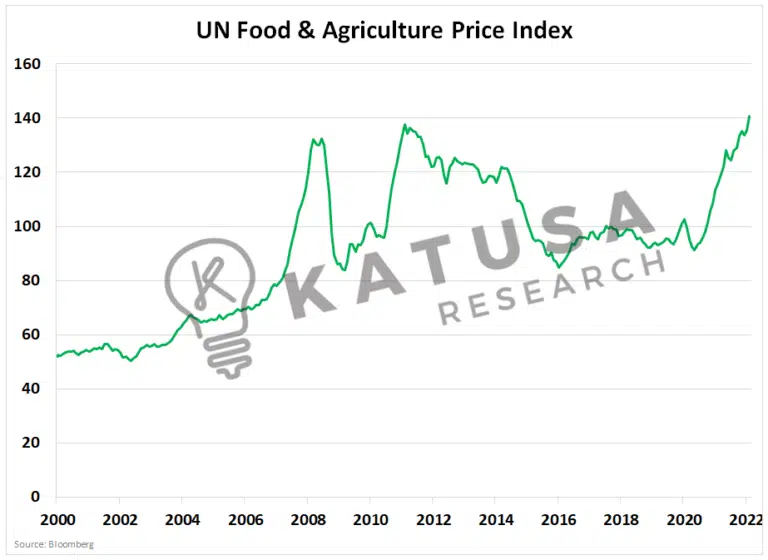

Russia and Ukraine are large suppliers of grains, vegetables, and fertilizers. Food prices around the world are already high and are likely heading even higher.

As food prices go higher and GDP growth slows due to this conflict, stagflationary concerns in Europe seem to be a scenario that is worth preparing for.

The Colder War

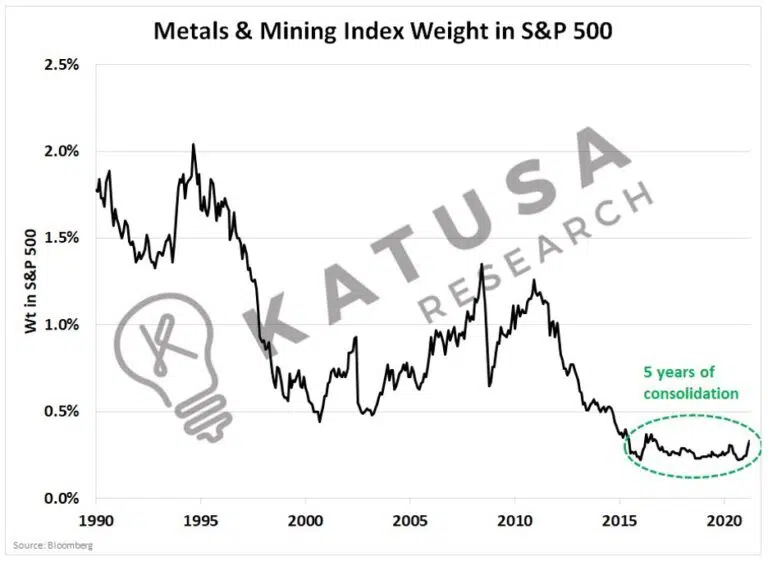

The number of mining companies in the S&P 500 will increase, which means an increase in the flow of capital into the sector. At the end of the Cold War, there were 20 mining companies in the S&P 500. Today there are two.

Expect this to change with The Colder War.

We are amidst truly ugly and challenging times. Russia appears to be committed and tensions are going to continue to escalate.

I play the cards I’m dealt, and there will be many generational opportunities in the coming months — if you have cash ready to put to work. You can follow along to see exactly what I’m doing, and what positions I hold. It’s all within the pages of Katusa’s Resource Opportunities.

Fortune favors the bold. Don’t get scared now.

Marin Katusa is the author of the New York Times bestseller, “The Colder War.” Over the last decade, he has become one of the most successful portfolio managers in the resource sector, such as his 2009 Fund Partnership (KC50 Fund, LLC) which has outperformed the comparable index, the TSX.V by over 500% post fees. Katusa has been involved in raising over $1 billion in financing for resource companies. He has visited over 400 resource projects in over 100 countries. Katusa publishes his thoughts and research at www.katusaresearch.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) Marina Katusa’s disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Marin Katusa’s Disclosures:

Please assume Marin Katusa, Katusa Research and its employees have a financial interest in all companies and sectors mentioned. The information provided is for informational purposes only and is not a recommendation to buy or sell any security. This is not financial advice.

Last week, I asked the question: is the US undermining the dollar’s credibility? It appears the answer is — yes. In another blow for dollar dominance, Saudi Arabia is reportedly considering pricing at least some of its Chinese oil sales in yuan. According to the Wall Street Journal, the move would “dent the US dollar’s […]

The post Blog first appeared on SchiffGold.

In another sign that the inflation train is far from running out of steam, producer prices were up big again in February. The Producer Price Index (PPI) for final demand surged 0.8% month on month. This was close to the expectation. The annual increase in producer prices came in at 10%, tying the all-time record. […]

The post Blog first appeared on SchiffGold.