Why Silver Is an Oak-Solid Investment

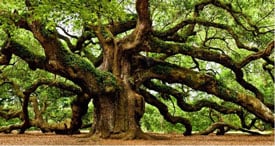

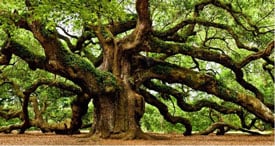

Imagine what an oak tree’s underground root ball looks like, with supportive tendrils spreading out in all directions, not unlike what the limbs of this […]

Imagine what an oak tree’s underground root ball looks like, with supportive tendrils spreading out in all directions, not unlike what the limbs of this […]

This silver miner is on a rapid pace to restart production at its Bunker Hill Mine in the historic Coeur d’Alene Silver District in Idaho. […]

January saw another record trade deficit. The $89.7 billion deficit shattered the $82 billion record set in December by 9.4%! Before March 2021, the Trade […]

Not too long ago, the national debt pushed above $30 trillion. Today, Uncle Sam is $30.26 trillion in the red. And he’s on the fast […]

Gold pushed above $2,000 an ounce on Tuesday and made a run at the all-time record high. The yellow metal was up $54 on the […]

There will be a run on physical precious metal, and only those who… To paraphrase Lenin, decades will go by with not much happening and […]

It is the US that is using fossil fuels as weapons against other nations, including its own, not Putin who continues the flows to Europe… […]

Counter party risk continues to grow the longer… by Jason Burack of Wall St For Main St But the counter party risk for large European […]

Put on the space helmets! All that’s needed to deal with these swings is… by Stewart Thomson of Graceland Updates 1. It’s rare that I suggest […]

However, what is wrong with silver at less than thirty stinkin’ bucks? (by Half Dollar) Everybody and their brother are coming out of the woodwork […]

Copyright © 2026 | WordPress Theme by MH Themes