Jewels Of The Week: April 2022

Each Friday on the PriceScope Facebook page we celebrate the Jewel of the Week from Show Me the Bling!, one recently posted jewelry piece belonging […]

Each Friday on the PriceScope Facebook page we celebrate the Jewel of the Week from Show Me the Bling!, one recently posted jewelry piece belonging […]

Kitco News (Kitco News) – It hasn’t been a good week for gold as prices dropped below $1,900 an ounce, falling roughly 5% after it […]

Kitco News (Kitco News) – Russia is currently in discussions to peg the ruble to gold, according to the Kremlin. But the idea was dismissed […]

Kitco News (Kitco News) – Agnico Eagle CEO Ammar Al-Joundi is confident the company will meet this year’s guidance. The post ‘Strong quarter by any […]

Kitco News (Kitco News) – Impala Platinum (JSE: IMP, Implats), a leading producer of platinum group metals (PGM), announced Friday that its concentrate production declined […]

Kitco News (Kitco News) – Chaarat (AIM: CGH) said today that in Q1 2022, the company produced 15,266 gold equivalent ounces at its Kapan polymetallic […]

Canadian company’s plan for a Down East silver mine runs into opposition from locals Bangor Daily News

COT Silver Report – April 29, 2022 Positions as of 26 April, 2022. Silver COT Report Fri, 04/29/2022 – 15:35

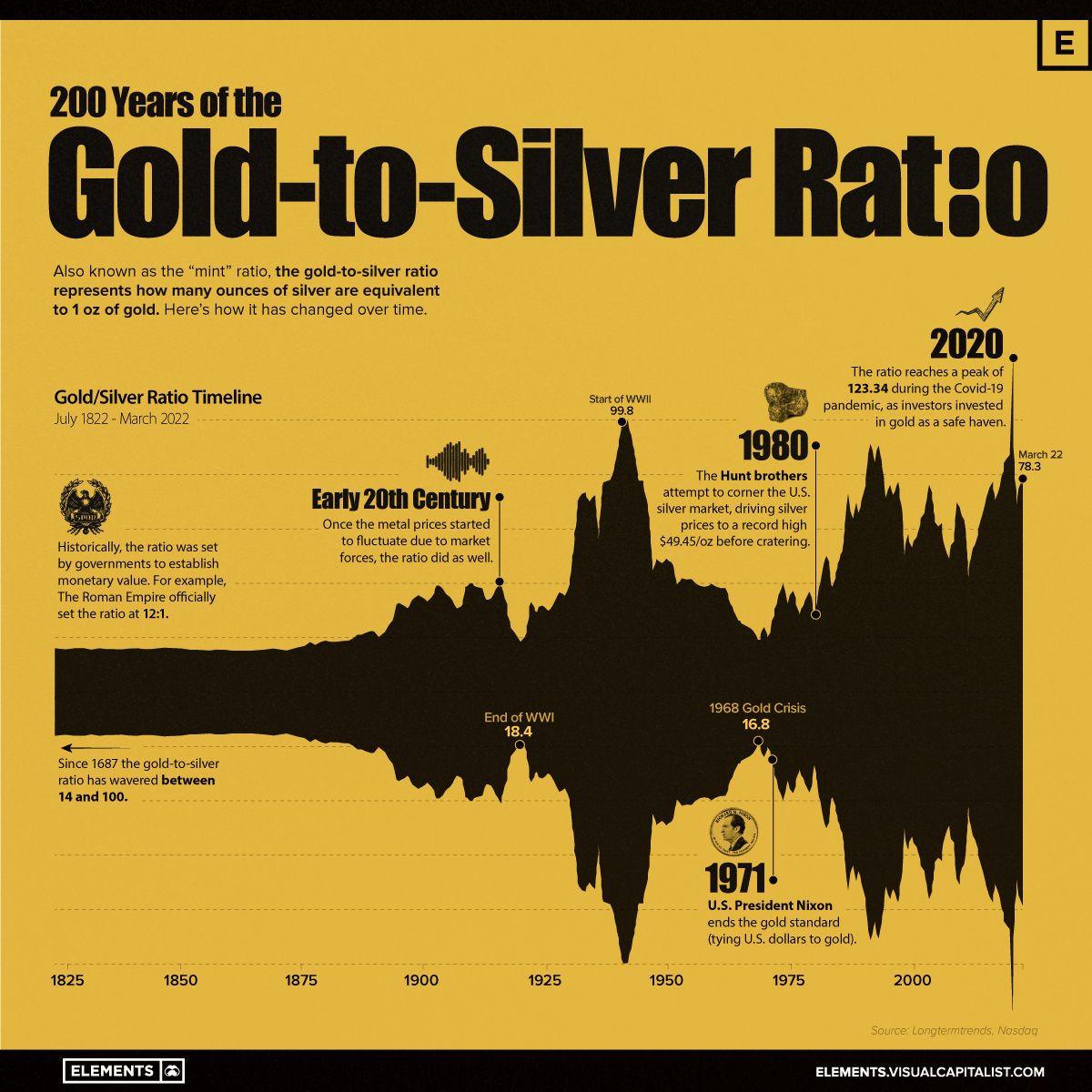

Visual Capitalist/Niccolo Conte/4-27-2022 (Click to enlarge) “Gold and silver have been precious and monetary metals for millennia, with the gold-to-silver ratio having been measured since […]

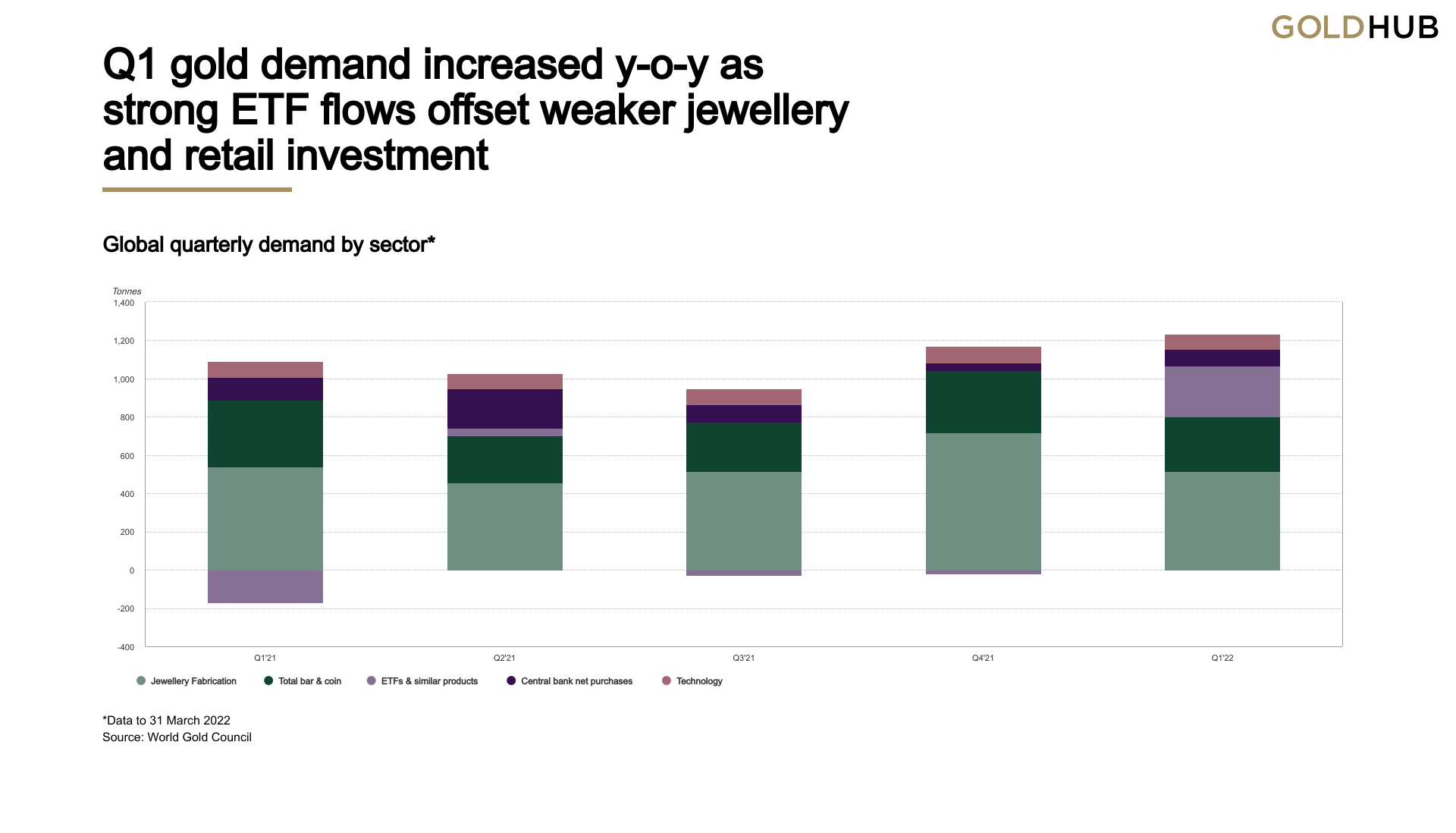

World Gold Council/Staff/4-28-2022 “ETF inflows came flooding back in Q1 on safe-haven demand and inflation concerns; bar and coin investment, although healthy, failed to match […]

Copyright © 2026 | WordPress Theme by MH Themes