2022 Bermuda Gold Cup cancelled >> Scuttlebutt Sailing News – Scuttlebutt Sailing News

2022 Bermuda Gold Cup cancelled >> Scuttlebutt Sailing News Scuttlebutt Sailing News

2022 Bermuda Gold Cup cancelled >> Scuttlebutt Sailing News Scuttlebutt Sailing News

Gold tallies a 4th straight session gain and highest finish in a month MarketWatch

Perseus Discovers More High-Grade Gold at Yaouré Mine GlobeNewswire

According to recent U.S. Mint production reports, demand for gold coins remains super strong. Rampant global inflation, the war in Ukraine, stock market volatility, and […]

(Richmond, Virginia – April 12, 2022) – By signing sound money legislation last night, Virginia Governor Glenn Youngkin has ended Virginia’s discriminatory practice of assessing […]

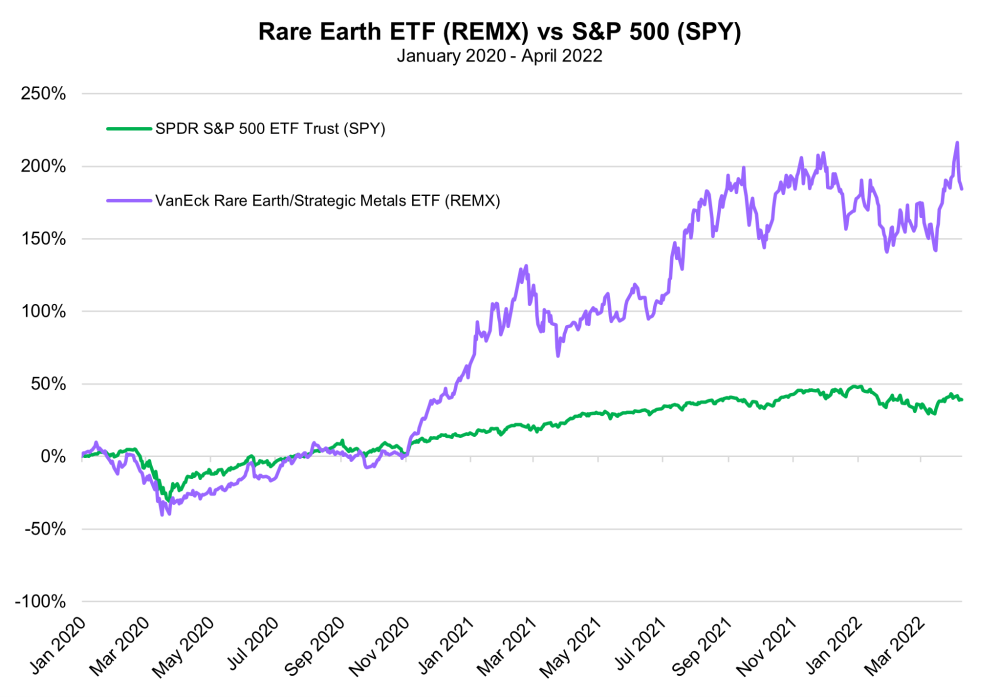

Source: McAlinden Research 04/12/2022 With geopolitical tensions rising, the US recently banned defense contractors from purchasing REE metals from China and will consequently attempt to […]

Source: Adrian Day 04/11/2022 Editor of Adrian Day’s Global Analyst, Adrian Day explains what he sees in the future for two gold companies and reveals […]

There was a little March Madness on Wall Street. In fact, the month turned into an old-fashioned blood bath. But you wouldn’t have found any […]

Global ETF gold holdings surged in March, charting the third straight month of inflows. Net inflows of gold into ETFs came in at 187.3 tons […]

Government can’t create gold out-of-thin-air to fund its expansion into every aspect of our lives. But change is… by Ron Paul of Ron Paul Liberty […]

Copyright © 2026 | WordPress Theme by MH Themes