Congress has a stake in the dollar’s integrity

Wall Street Journal/Judy Shelton/5-17-2022 USAGOLD note: In this editorial, Judy Shelton explores two interrelated questions. First, who is responsible for a sound dollar, Congress or […]

Wall Street Journal/Judy Shelton/5-17-2022 USAGOLD note: In this editorial, Judy Shelton explores two interrelated questions. First, who is responsible for a sound dollar, Congress or […]

Bloomberg/Ruth Carson and Amelia Pollard/5-18-2022 “Through that agreement which France, Japan, the UK, US and West Germany agreed to weaken the dollar — a stance […]

Bloomberg/Lu Wang and Liz McCormick/5-13-2022 “Another stormy week has left investors groping when it comes to the direction of stocks and bonds. Expecting to be […]

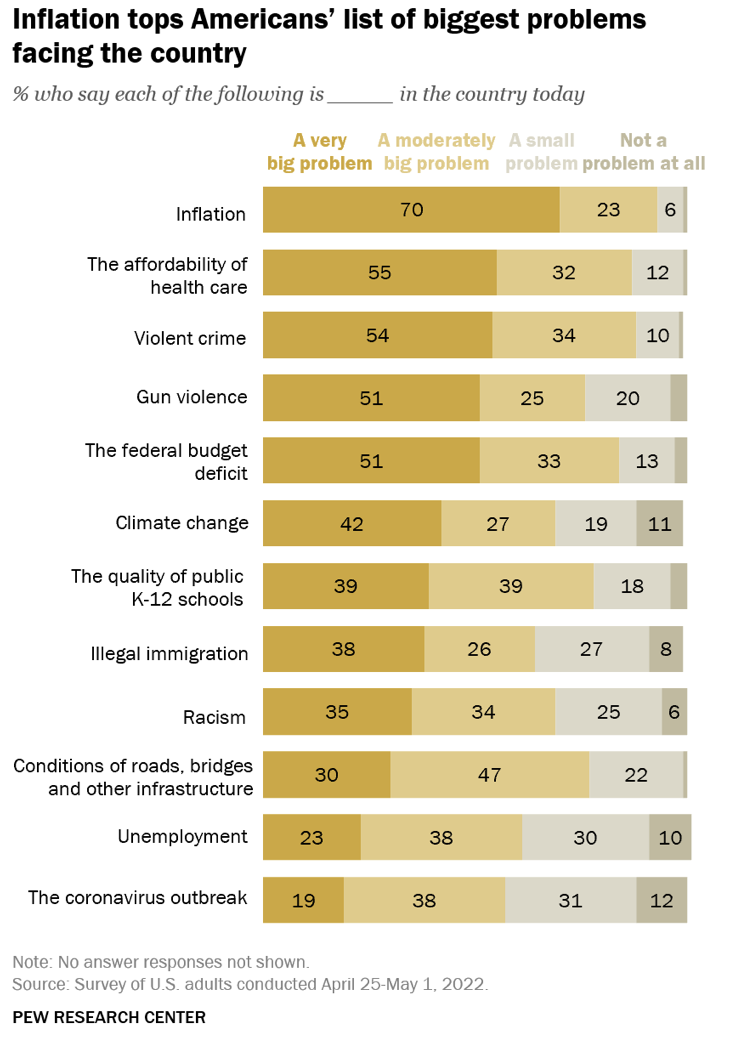

Pew Research Center/Carrol Doherty and Vianney Gomex/5-13-2022 “The public views inflation as the top problem facing the United States – and no other concern comes […]

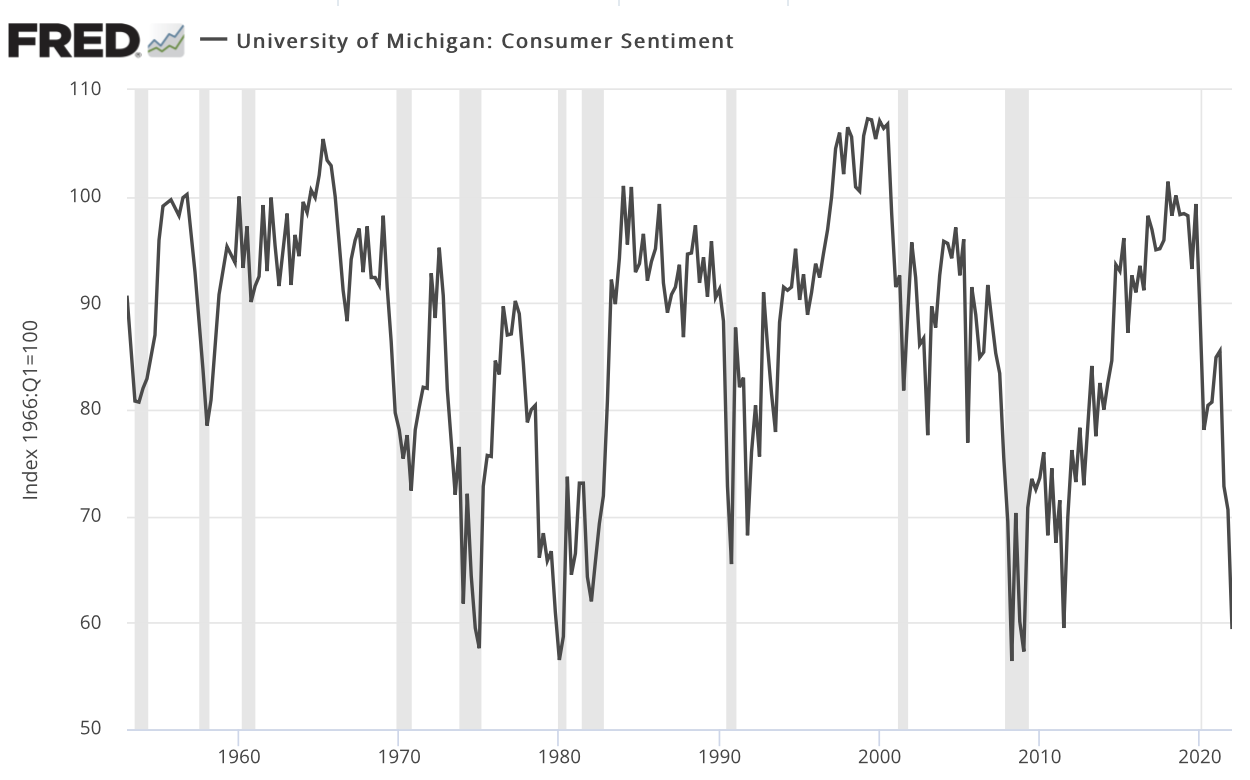

MarketWatch/Xavier Fontdegloria/5-13-2022 “The deterioration in consumer sentiment reverses the improvement registered in April, which came after three consecutive months of drops as inflation has weighed […]

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. The converging forces of price inflation and economic contraction continue to weigh on asset markets. […]

This analysis focuses on gold and silver physical delivery on the Comex. See the article What is the Comex for more detail. Silver: Recent Delivery Month Silver […]

There is a lot of spin out there when it comes to economic news. You get spin from the corporate media, You get spin from […]

Over the last decade, we’ve seen a rapid acceleration in the consolidation of “Big Tech”, resulting in… by Claudio Grass via Claudiograss.ch Interview with Bernd Rodler Those […]

The final act in the illustrative monetary career of the nickel is expected to be extinction, as with the penny, as inflation… by Mark Thornton […]

Copyright © 2026 | WordPress Theme by MH Themes