The War on Gold Ensures the Dollar’s Downfall

Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order […]

Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order […]

Tax revenues have been on the rise for about 18 months. As speculated previously, if this windfall was temporary, it would have shown up with […]

Americans are feeling the pinch of inflation. Wages are up but consumers are worse off. Average hourly earnings have risen by 5.5% over the last […]

The March Consumer Price Index (CPI) was 8.5% annually, the highest since December 1981. But the mainstream narrative was that inflation had probably peaked because […]

How is the most recent rate hike tanking the markets and putting pressure on gold & silver? Gary Wagner with Patrick V. on Silver Bullion […]

The emergence of deflation is always good news, since it is in response to… by Frank Shostak via Mises For most experts, deflation is bad […]

Regardless of how unpleasant the past few weeks have been, events are mostly playing out as forecast, and in reality, silver is acting just as […]

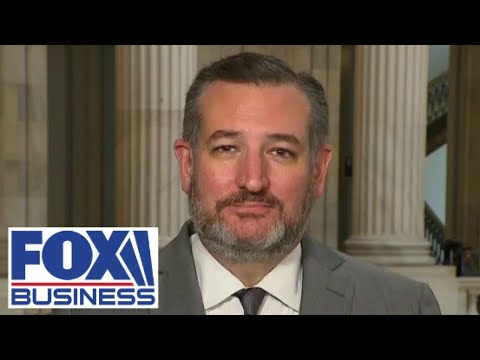

Texas Republican offers his take on the possible rescind of Roe v. Wade and also the state of the American economic climate on 'Kudlow.' #FoxBusiness […]

Louisiana Rep. Mike Johnson and also and Stifel chief economic expert Lindsey Piezga weigh in on President Biden's growing inflation on 'The Evening Edit.' #FoxBusiness […]

White House press secretary Jen Psaki holds an instruction. #FoxBusiness Sign Up For Fox Company! See a lot more Fox Service Video Clip: View Fox […]

Copyright © 2026 | WordPress Theme by MH Themes