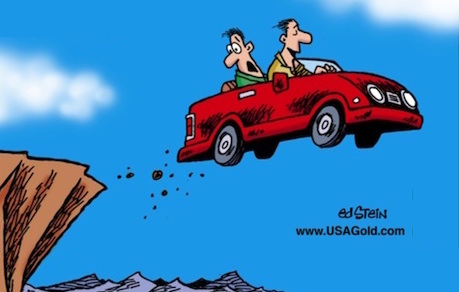

Commodities at risk of reversing massive gains with ‘wild run’ similar to 2008, gold price to take on $2k – Bloomberg Intelligence

Kitco News (Kitco News) – The commodity market is at risk of a reversal that will be a volatile ride similar to 2008, according to […]