SEC doubles the size of its crypto fraud unit

Kitco News (Kitco News) – The U.S. Securities and Exchange Commission (SEC) is adding 20 more positions to its Crypto Assets and Cyber Unit, nearly […]

Kitco News (Kitco News) – The U.S. Securities and Exchange Commission (SEC) is adding 20 more positions to its Crypto Assets and Cyber Unit, nearly […]

Kitco News (Kitco News) – China’s Zijin Mining Group announced today that it has agreed to acquire an asset bundle consisting of four assets in […]

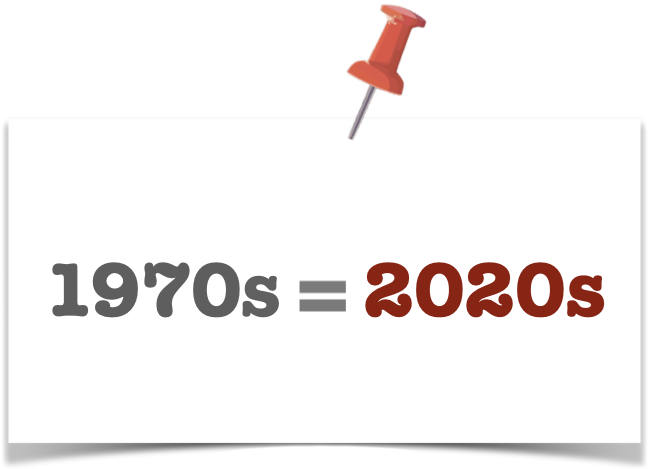

Kitco News (Kitco News) – The Federal Reserve is on the cusp of embarking on its most aggressive tightening cycle in 28 years. The central […]

Santacruz Silver Mining Reports Fourth Quarter/Year-End 2021 Financial Results Junior Mining Network

Financial Times/Valentina Roma and Alan Smith/5-1-2022 “The prospect of stagflation’s return strikes fear into policymakers because there are few monetary tools to address it. Raising […]

The New York Sun/Editorial/4-28-2022 “The headline this morning atop the Drudge Report — ‘Dollar is King / Best Month in Decade‘ — certainly got our […]

In the Wake of Coup, Gold Mining Boom Is Ravaging Myanmar Yale Environment 360

Gold prices gain following a pull-back in yields, dollar Reuters Gold prices slide 2% as yields, dollar gain ahead of Fed meet CNBC Gold price near 3-month […]

U.S. Mint sees gold demand drop 43% in April, silver demand drops 23% Kitco NEWS

Last week’s release of first quarter GDP data was a disappointment, as GDP sank by 1.4%. Analyst expectations were calling for a rise of 1%. […]

Copyright © 2026 | WordPress Theme by MH Themes