Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

After several brutal weeks of selling in precious metals markets, bulls are seeking a catalyst for a potential turning point. They may have gotten one via currency markets.

On Thursday, the European Central Bank raised its benchmark interest rate for the first time in 11 years. The ECB’s larger than expected 50 basis point rate hike came amid spiking inflation and a plummeting euro exchange rate.

After European central bankers finally took steps to tighten, currency traders pushed the euro higher against the U.S. dollar.

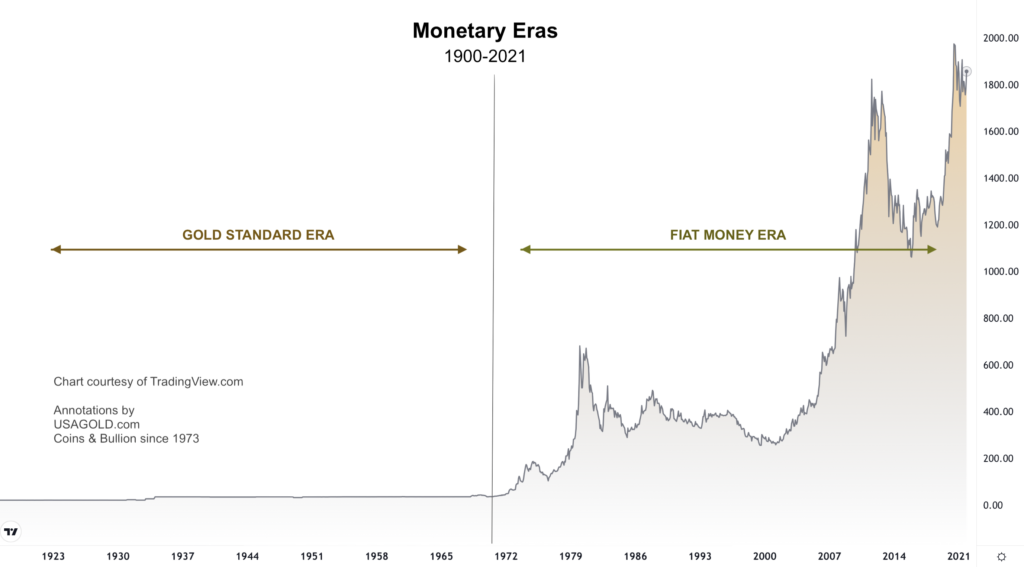

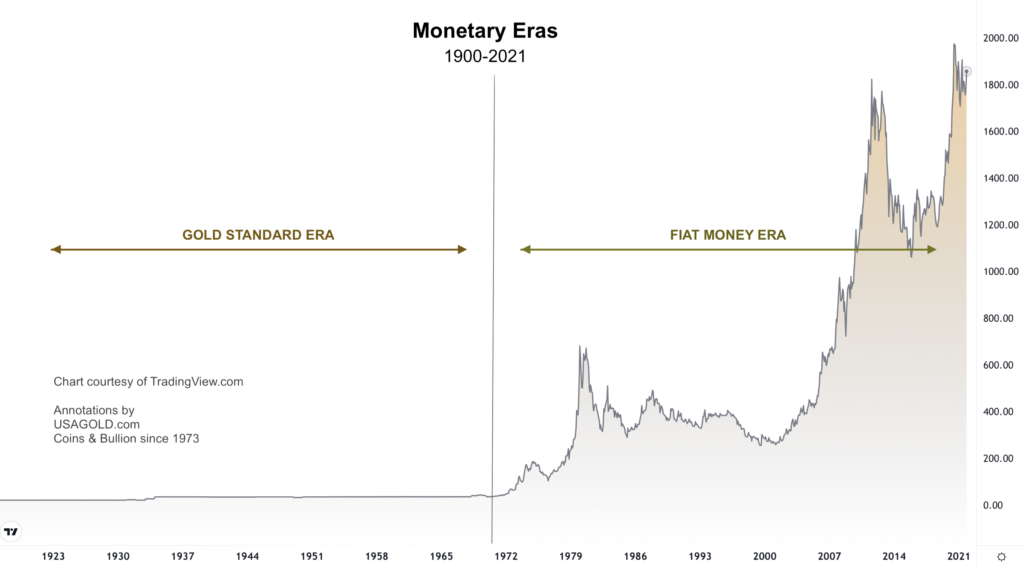

The trends in the euro and other fiat currencies that trade against the dollar have little to do with the fundamentals for precious metals. But futures market speculators often take a rise in the U.S. Dollar Index as a signal to sell gold.

Relentless dollar strength on foreign currency markets this year has certainly been a major headwind for gold and silver prices.

Of course, the Greenback has been rapidly declining, not strengthening, in terms of its purchasing power.

Cumulative inflation has yet to be reflected in gold and silver prices. That will change eventually. And a possible top in the Dollar Index here could coincide with a bottom in precious metals markets.

As of this Friday recording, spot gold prices are up 1.2% for the week to trade at $1,737 an ounce. Silver, meanwhile, is unchanged on the week to come in at $18.96. Platinum is higher by 2.8% to trade $893. And finally, palladium is having a big day here today and has added 9.2% since last Friday’s close to command $2,085 per ounce.

Depressed precious metals prices have deterred trend traders from going long these markets. Futures speculators have on net continued to add to their short positions on the way down.

But commercial traders who consist of industrial users and institutional hedgers have done the opposite. They have become increasingly bullish over the past couple weeks. This smart money indicator suggests the selling is overdone. The shorts could soon get squeezed.

Meanwhile, bargain hunters who aim to accumulate ounces for the long term are taking advantage of discounted pricing.

Bullion investors have plenty of great options when it comes to beautiful products that sell for minimal premiums above spot prices. The best values are typically found in privately minted bars and rounds.

Certain types of historic coins that lack numismatic value can also often be obtained at bargain prices. For example, pre-1965 90% silver dimes and quarters are a staple for silver stackers who buy them by the bag.

These previously circulated coins are often heavily worn. But they are still worth their weight in silver and are convenient for use in barter transactions.

In a sounder monetary era, silver circulated as coinage. One of the most beloved designs was the Mercury dime, issued by the U.S. Mint from 1916 to 1945. It features Lady Liberty wearing a winged cap.

Investors can now get investment grade silver featuring this iconic design. Money Metals is proud to offer full-ounce Mercury silver rounds as a stunning a tribute to these no longer minted dimes.

Unlike the Mercury dime which contained 90% silver and 10% copper, one-ounce Mercury rounds are made of 99.9% pure silver.

Pure silver rounds come in many other styles. Some are inspired directly by the classic designs of official coins. Others are completely unique.

Aesthetic value is certainly a relevant consideration for many bullion investors. But for the most part, design features will have no bearing on a silver round’s current or future market value.

Privately minted bullion products tend to trade closely in line with spot prices. Government-minted coins, such as American Eagles, carry higher premiums above spot.

It’s up to each individual precious metals buyer to decide whether it’s worth it to pay a bit more for official coins. Some want particular coins from particular mints that are stamped with particular dates.

Others only care about acquiring ounces. They may be perfectly happy to buy plain bullion bars that lack any historic value, aesthetic qualities, or official mint prestige.

At the end of the day, acquiring gold and silver bullion in any form represents an investment in sound money. And with so much unsoundness in our monetary system today, precious metals play a vital role for investors that no other asset class can replicate.

Well, that will do it for this week. Be sure to check back next Friday for our next Weekly Market Wrap Podcast. Until then this has been Mike Gleason with Money Metals Exchange, thanks for listening and have a great weekend everybody.