Tiffany Solitaire Ring – Where to Buy a Similar Ring For Less

When the Tiffany setting was first introduced in 1886, it quickly revolutionized the industry and became the most popular engagement ring design that consumers buy. […]

When the Tiffany setting was first introduced in 1886, it quickly revolutionized the industry and became the most popular engagement ring design that consumers buy. […]

What is a ‘Trellis’ setting? A trellis setting provides a framework and support for gemstones, typically found in engagement ring designs. Some trellis settings overlap, […]

“It’s a great time to be looking at gold for a hedge.” – Joe Elkjer, Precious Metals Advisor The endless barrage of soaring inflation, skyrocketing […]

Make the silver mining town of Wallace a summer dining destination Inlander

Silver and platinum: two precious metals that will be screaming buys when the dollar turns https://moneyweek.com/investments/commodities/silver-and-other-precious… SilverSeek Thu, 07/14/2022 – 11:31

Gold, silver see strong price declines amid another hot U.S. inflation report Kitco NEWS

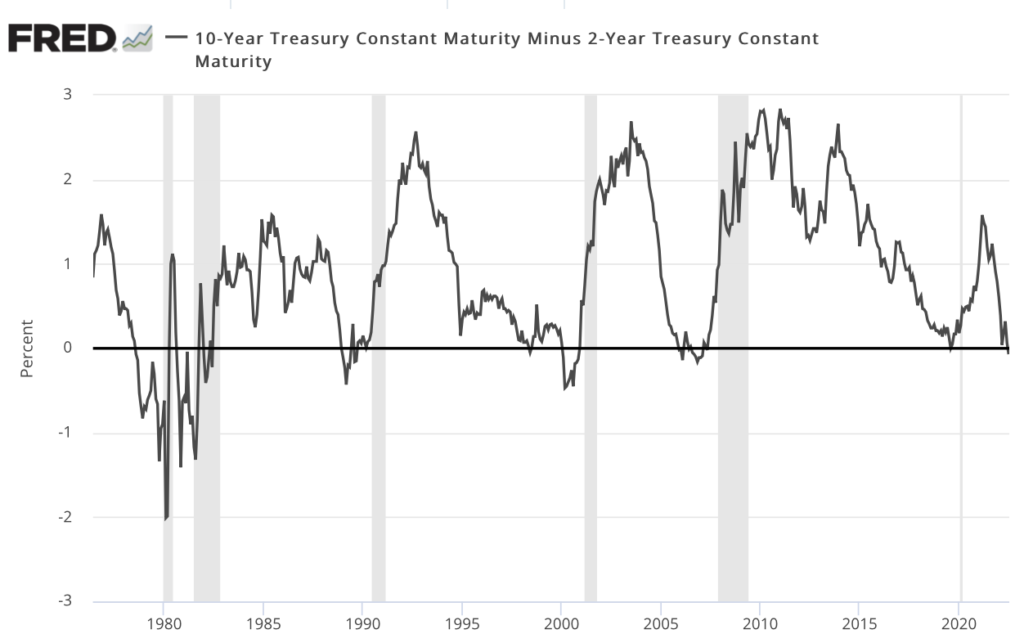

YahooFinance-Bloomberg/Michael Mackenzie and Elizabeth Stanton/7-12-2022 “So-called inversions of the yield curve — in which longer-term rates fall below those on shorter-dated maturities — are regarded […]

MarketWatch/Barbara Kollmeyer/7-12-2022 “I think this buy-the-dip mentality has just been so deeply ingrained, I think by the time this bear market has run its course, […]

Gold Drops as Nervous Traders Again Seek Haven in the Dollar Bloomberg Gold prices settle at more than 15-month low as U.S. dollar soars MarketWatch Gold rebounds […]

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels Kitco NEWS

Copyright © 2026 | WordPress Theme by MH Themes