Rebecca Romijn’s Charlie Dolly Jewelry

Rebecca Romijn has a jewelry line called Charlie Dolly. There are lots of celebrities that have created jewelry lines, and some of them are interesting, […]

Rebecca Romijn has a jewelry line called Charlie Dolly. There are lots of celebrities that have created jewelry lines, and some of them are interesting, […]

You’ve done all the work finding the perfect engagement ring, now you just need to find the perfect destination to propose!

COT Silver Report – August 19, 2022 Positions as of16 August, 2022. Silver COT Report Fri, 08/19/2022 – 15:35

Gold Silver Rate Today: Gold and silver prices fall; here’s what you pay The Indian Express Gold-Silver Price on Friday, 19 August 2022 In Maharashtra. Globe News […]

The Data Driven Investor/Olegs Jemeljanov/8-12-2022 “[T]he demand for gold persists due to the fact that during periods of instability and higher price volatility, the price […]

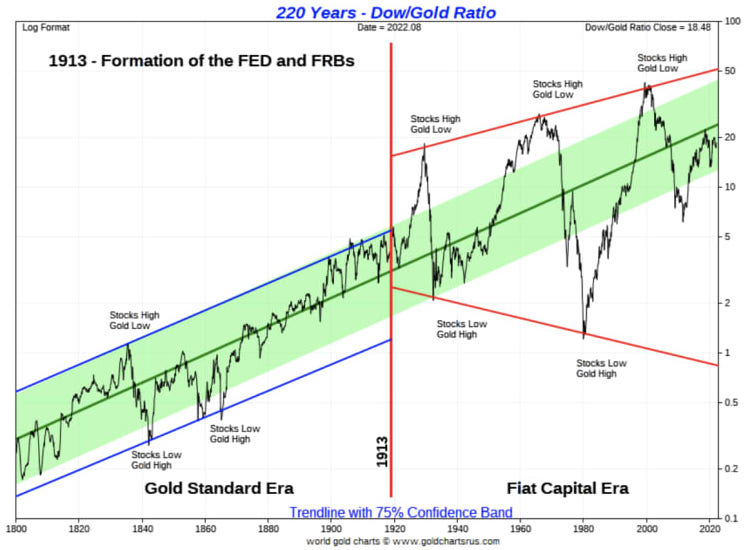

Money Week/Dominnic Frisby/8-12-20222 “Effectively, you are measuring stocks in money that hasn’t been debased. There are many who argue that the gold price is suppressed, […]

Gold miners’ Q2 2022 fundamentals – MINING.COM MINING.com

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Precious metals markets are giving up ground this week as investors react to the latest […]

It was a relatively slow news week in the financial realm. For once, the Fed didn’t do anything particularly noteworthy. So, Friday Gold Wrap Host […]

It’s hard to see how borrowers that are already under financial pressure could prioritize paying off a mortgage they couldn’t afford in the first place […]

Copyright © 2026 | WordPress Theme by MH Themes