Larry Kudlow: The Inflation Reduction Act is a pathetic piece of legislation

FOX Business host Larry Kudlow shreds Manchin as well as Schumer's reconciliation costs on 'Kudlow.' #FoxBusiness #kudlow Register For Fox Company! View much more Fox […]

FOX Business host Larry Kudlow shreds Manchin as well as Schumer's reconciliation costs on 'Kudlow.' #FoxBusiness #kudlow Register For Fox Company! View much more Fox […]

GR Silver Mining Announces Discovery of Wide, High-Grade Silver Zone – 101.6 m at 308 g/t Ag, Including Multiple Intervals >1000 g/t Ag Junior Mining Network

The Fed Is All Talk, and JPMorgan Trial EXPLAINED – Chris Marcus Chris Marcus from the YouTube channel Arcadia Economics joins us today to discuss […]

Finbold/Dino Kurbegovic/8-5-2022 “The limited production of gold vs. unlimited supply of fiat currency is a top reason the metal appreciates over time, and the extended […]

The Mises Institute/Ryan McMaken/8-2-2022 “In spite of the fact that real wages are going down, the cost of living is soaring, and new jobless claims […]

The federal criminal trial of JP Morgan executives Michael Nowak, Gregg Smith, and Jeffrey Ruffo began on July 8th. These senior bankers are accused of […]

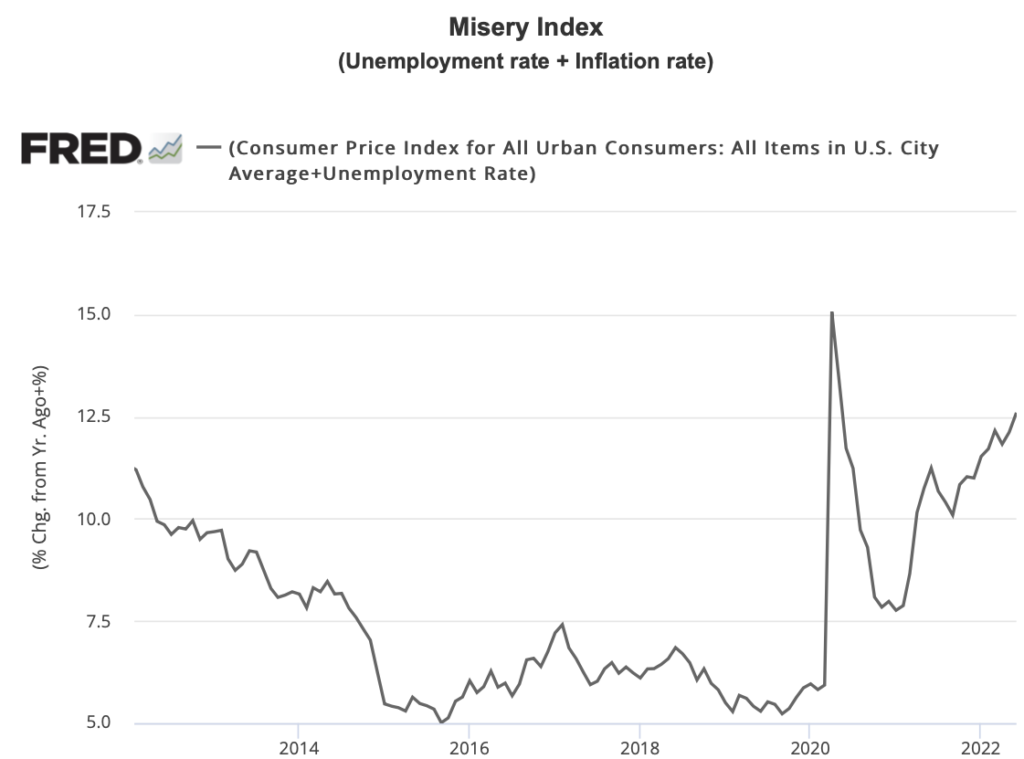

The July non-farm payroll report came out much stronger than anticipated. According to the Bureau of Labor Statistics, the economy added 528,000 jobs and the […]

Despite White House and media spin downplaying a recession, a lot of people aren’t buying. Fifty-seven percent of small business owners say a recession has […]

An interesting point that gets lost in the general noise is that the Federal Reserve has now… By Robert Lambourne via GATA So far this […]

Do we have a breakout? by Morris Hubbartt Here are today’s videos and charts. The videos are viewable on mobile phones as well as computers. […]

Copyright © 2026 | WordPress Theme by MH Themes