Click here to get this article in PDF

Source: Michael Ballanger for Streetwise Reports 01/13/2020

Sector expert Michael Ballanger offers his insights into the precious metals markets as 2020 begins.

It was one of those days that all sexagenarians loathe; you have to go to the doctor, and whether it’s the GP (general practitioner) or the dentist or the proctologist, nothing reminds you more rapidly of your advancing age than going to the optometrist.

Now, many of you would say that your annual prostate exam or a root canal or bloodwork would be the dreaded of all medical dreads, but for me, it is having the 50-something eye lady remind me that two years ago (when I last mustered up the courage to see her), my long vision was great and my reading vision required only 150-magnification “cheaters.” Smiling at me as if I just ran the New York Marathon, she then proceeds to tell me that I now require “progressive lenses” and 325-mag reading glasses.

Staring at her with slack-jawed miasma, I tell her that I can “manage just fine” and that since I am constantly losing my Dollar Store reading glasses, I really don’t feel an overwhelming desire to walk around with $900 glasses that will make me feel “like a new and younger man!” I won’t feel very young if I find them in a snowbank after running over them with the Toro Supercharger that does zero-to-thirty in less than sixty seconds and blows snow fifty feet in the air.

Then off I went to the dentist for the afternoon ordeal, only to have this millennial mouth-breather dental technician constantly scold me for “not flossing enough” as she takes her Black & Decker plaque remover to my gums.

Then the Generation X Chinese dentist looks into my mouth with his forehead lamp blinding me and tells me that an “old filling” (from the 1900s, he is sure) has come loose and he will need to clean it up. So, driving home to the site of lovely Lake Scugog, I was astonished that a policeman (who shaves once a month) didn’t pull me over and yank my license for the “unsafe operation of a vehicle” because I can’t read the bottom line of the eye chart or because my root canal from 1937 is failing.

All in all, this was just “one of those days.”

However, this week has played out exactly as I predicted, instructed and rued, as the precious metals succumbed to the weight brought to bear by three events:

· A rampaging stock market

· Severely overbought conditions in gold and silver, and

· 90% bullish consensus for the metals

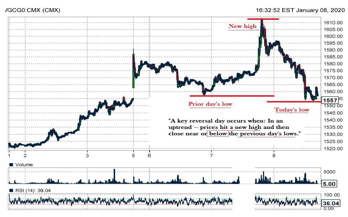

Now, I was fearful, albeit briefly, that the assassination of Iranian General Qasem Soleimani by a U.S. drone strike might have kicked the precious metals into the same short squeeze moonshot—as we had back in June where we stayed overbought for most of the month. But alas, as I said on Monday, geopolitical events always get faded (sold), and just as stocks failed to follow through to the downside after the Sunday evening massacre, gold reacted identically and closed the week out about $66 off the wee-hours peak of US$1,613/ounce from last Monday morning.

I raised 30% cash in the portfolio at or near the highs seen Friday and Monday, and have advised all subscribers to refrain from buying any of the names in the GGMA portfolio until things settle down, probably next week, but surely by month-end.

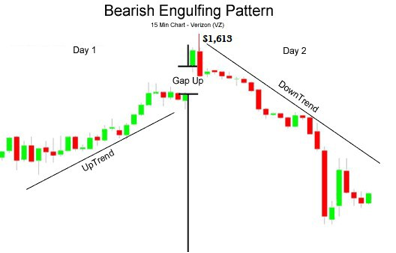

The daily gold chart for the past month shows a really ugly “bearish engulfing” candle that surely, albeit in retrospect, serves as the apex for the latest advance. While it is certainly a formidable short-term top, it by no means has changed my 2020 forecast for substantially higher prices for gold and silver.

The key to outperformance, for me at least, seems to lie in “fading blind optimism” and “buying despair” and, of course, looking under my desk to see if Fido is content. If, God forbid, he is to be found under the tool shed or off his food, then surely a bullion bank takedown is either pending or upon us.

Needless to say, Fido is not a happy puppy as he appears to be getting totally intolerant of the constant shenanigans in our precious metals markets, and also of the absurdity of this constant Twitter “cheerleading” by “the Donald.”

The moves I made to raise cash in the two miner exchange-traded funds, GDX and GDXJ, in addition to taking off all the leveraged positions (futures, options, ETFs) allows me to begin to target a re-entry point for those same positions. The danger lies in trying to get “too cute” trading these things, because in a true bull market such as this one, you make one false move and suddenly they are 3% higher and you are unable to get back on board. I cannot tell you all how many times that has happened to me, so to avoid this, I scale in and I scale out, taking 25–50% initial positions and then adding as they go the right way.

On Friday morning Jan. 10, we are getting a nice precious metal rebound off the lows thanks to a disappointing non-farm-payroll report (the “unemployment” report), where the weak number plus negative revisions were shrugged off by the rampaging equities bull.

The chart of the NASDAQ shown above is a screaming “sell” with RSI (relative strength index) in the high 70s and at a level where it has topped out numerous times in the last three years. However, we are in an election year and I am so cynical of the collusion and intervention and manipulation that I just cannot find the courage to short this massively overvalued market. It is like the Ontario housing market; people keep leveraging up to own million-dollar houses on 90-foot lots with 1,500 square feet of living space that went for $200,000 ten years ago. It’s just another bank-created bubble, and part of this enormous global wave of credit that benefits only the financial crowd and those who have learned to game the system.

Trust me when I tell you that it will not end well, but also keep in mind that these cretins have kept the charade intact for infinitely longer than I (or Ray Dalio or Stanley Druckenmiller or Jeffrey Gundlach) might ever have dreamed. I hate to use this well-worn phrase but it is certainly true that “markets can remain irrational much longer than you or I can remain solvent.” This is the reason I use stop-losses and cut-losses quickly, no matter whether my reasoning is sound or not. Rigged markets do that to you, so never forget it.

Here are a few charts to give you an idea of where my head is at in terms of buying back or initiating positions in the various names in the Forecast Issue. (Not all but a few. . .)

My inbox is now chock-full o’ queries as to whether last week’s rally constitutes a bottom for the Gold Miner ETF’s and the answer is categorically “NO!” When you get an outside reversal day like we had on Monday, you don’t usually have a tradeable bottom until at least a couple of weeks later. You can see from the chart shown below how it unfolded.

Here is the textbook definition of what grabbed gold by the throat on Monday. It is a powerful technical signal and while of course there is no certainty that we are entering a prolonged downtrend, I include it here as a way of accentuating the need for patience.

Since many of you are new subscribers, I want you to accumulate the GGMA portfolio (should that be your intention) at optimum prices and hopefully into oversold (as opposed to overbought) conditions, with RSI sub-30.

COT Report

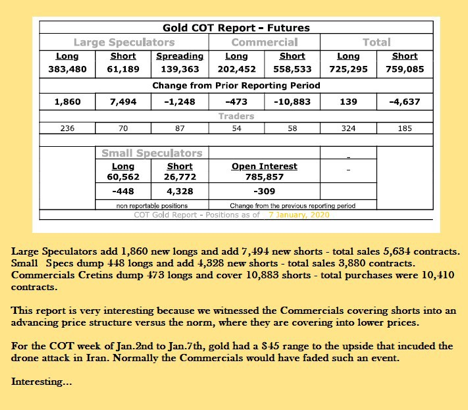

The COT, or Commitment of Traders, report covers activity on the Crimex futures exchange and the interplay between “Commercials” (large bullion banks acting for miners and metal fabricators, as well as their own prop accounts), “Large Speculators” (large commodity funds run by CTAs [commodity trading advisors], hedge funds, and locals), and “Small Speculators” (small retail investors usually on the wrong end of most major trends). It covers a Tuesday-to-Tuesday reporting period and is released on Friday afternoons at around 3:30 p.m. It is far more predictive during bear market periods, as liquidity is sparse and the big banks can move the market wherever they wish.

The Commercials are the arm of the U.S. Treasury and the major central banks, and for this reason, you must be very attentive to their positioning. However, the period of June to September had the Commercials heavily short during the entire rise of US$250 per ounce. Selling or getting short metals and miners alongside the Commercials proved a faulty strategy for more than a few investors. (Even I lightened up on the leveraged ETFs prematurely.)

The COT report for the week ended Jan. 7 means very little, but suffice it to say that, at an aggregate short position of 356,081 contracts held by Commercial traders, it coincides with major tops in past years. It is one reason why I am “cautious,” not “bearish,” on the metals and miners going into this first few weeks of the New Year. Another week of sideways to down action and I will probably begin to accumulate.

So now I’m going to put some eyedrops in my eyes and some oil of cloves on my loose filling, guzzle some Metamucil, pop a few anti-arthritis pills and try to make it to Monday when I’m sure some poor defenseless fool will remind me of just how really ancient I have become.

Billy clubs and hobnail boots are great, ain’t they?

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver. My company has a financial relationship with the following companies referred to in this article: Aftermath Silver. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aftermath Silver. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Aftermath.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, a company mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: AAG:TSX.V,

)