Click here to get this article in PDF

Bloomberg/Liz McCormick, Tracy Alloway and Stephen Spratt

Repost from 3-5-2021

“Bond traders have been saying for years that liquidity is there in the world’s biggest bond market, except when you really need it.”

“Bond traders have been saying for years that liquidity is there in the world’s biggest bond market, except when you really need it.”

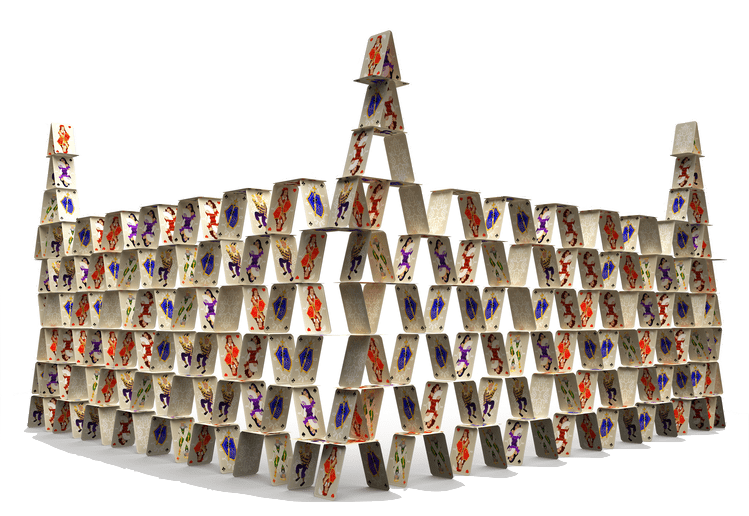

USAGOLD note: It’s not like that need comes and goes. It is consistent – even ever-present. One wonders what liquidity would be like if the Fed were to suddenly withdraw its support. A full 54% of U.S. government-issued debt in 2020, according to Crescat Capital, was purchased by the Federal Reserve. Add to that the $1.9 trillion stimulus package and ……well, you get the picture. A house of cards, as we have said before, is still a house of cards no matter how elaborate.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.