Click here to get this article in PDF

“If inflation’s taken off, why in the world isn’t gold at $5,000, $6,000, $7,000 per ounce?”— Scottsdale Bullion & Coin Founder Eric Sepanek

Because gold inflation is already a problem for the Fed, and it doesn’t want gold prices any higher than they already are.

Just compare the opening price of gold at the start of January 2020 to that of January 2021: $1,527.10/oz versus $1,943.20/oz. That’s a 27% jump.

Closing at $1,888.45/oz on May 19, 2021, the price of gold is still hovering below its 2011 high—the all-time high before gold prices hit $2,067/oz last August.[1]

Why is the Fed suppressing the price of gold?

Central Bank Gold Demand

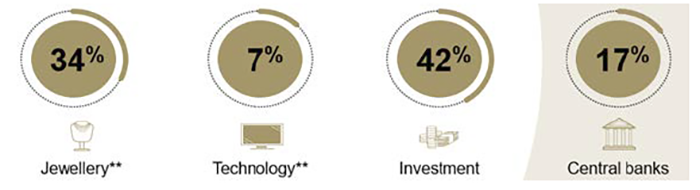

Figure 1: Gold’s demand is linked to investment and consumption

Composition of average annual net demand*

*Based on 10-year average annual net demand estimates ending in 2020. It excludes over-the-counter demand.

**Net jewellry and technology demand computed assuming 90% of annual recycling comes from jewellry and 10% from technology. Source: World Gold Council

Because central banks need to keep gold prices low, so they can keep buying gold—and central banks have bought a lot of gold.

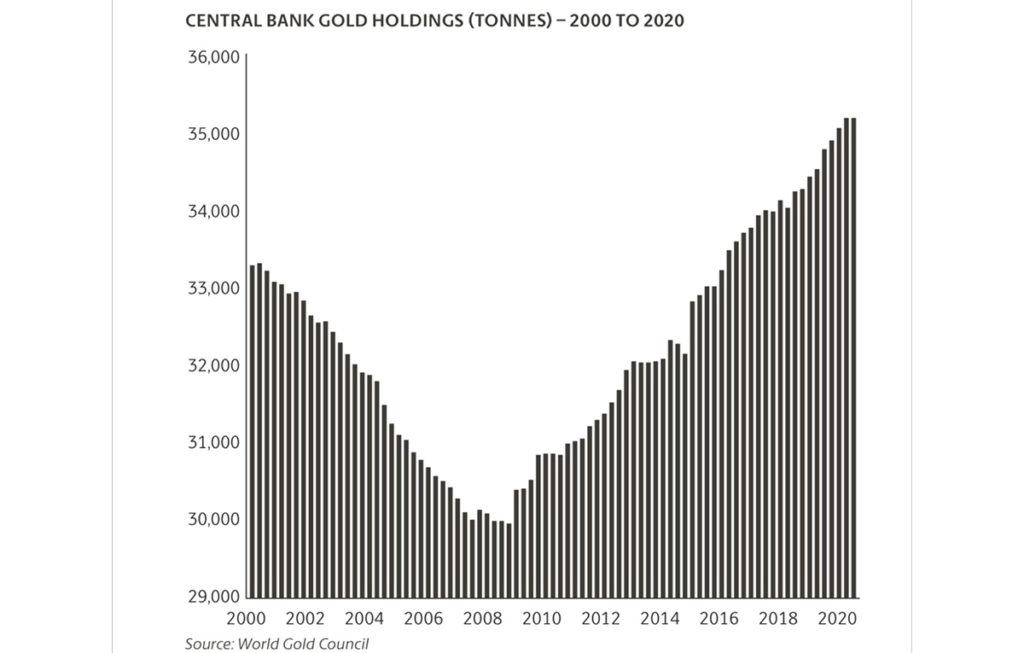

Central Bank Gold Holdings

Central bank gold holdings have soared 22% since the last financial crisis. They’ve bought gold almost as fast as they’ve printed money.

Coincidence? Not at all.

The Fed’s not just hedging against the very financial mess it created with gold; it’s keeping gold prices in check to mask America’s EVER-WEAKENING DOLLAR, explains Scottsdale Bullion & Coin Founder Eric Sepanek in the video above.

See Sepanek and precious metals advisor Steve Rand reveal the central bank COVER UP OF THE CENTURY in the video above. Watch Now.

Your Gold Inflation Hedge

How long can the Fed suppress gold inflation?

As long as it can KEEP THIS EXPERIMENT GOING.

That means now is the time to buy your gold inflation hedge. Before we see real gold prices.

Just don’t rush into bullion with the masses. Because that’s one market where you will be paying more for less…UPSIDE POTENTIAL…

…AND we both know you can do better. See how….

Get Your FREE COPY of our 2021 Precious Metals Investment Guide Today!

Just Fill Out This Form