Click here to get this article in PDF

Gold Eagle/Anna Sokolidou/6-21-2021

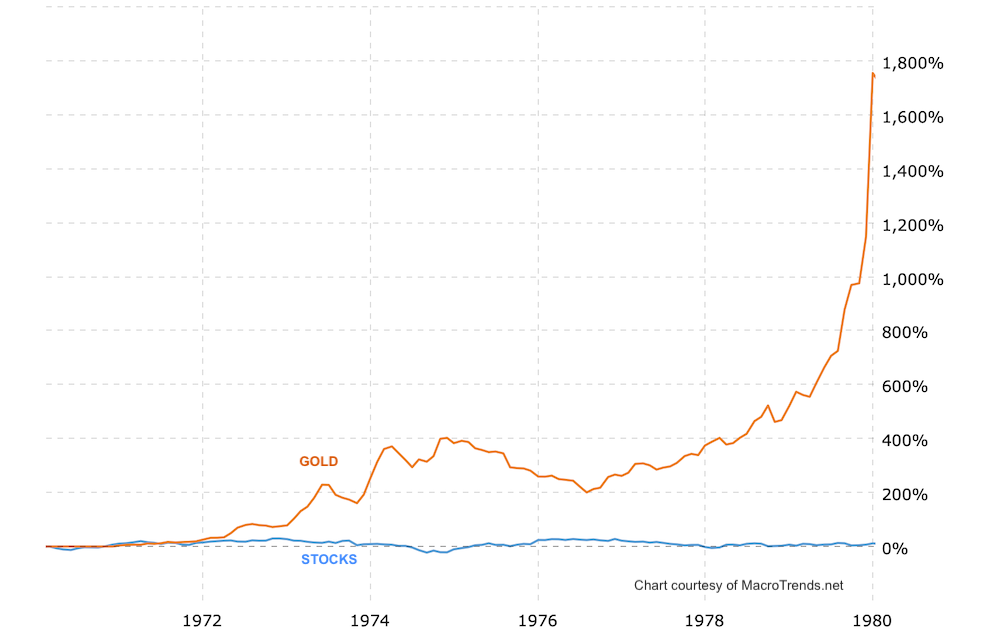

“History does not repeat itself, many people say. However, the lessons from the past should be learned. The prices of precious metals have recently fallen after the last Fed meeting. Briefly, investors are worried the Fed will hike the interest rates twice in 2023 due to the inflationary pressures. Here I will explain how inflation can get out of control by comparing the current situation to the 1970s Great Inflation in the US.”

USAGOLD note: Sokolidou returns the reader to the 1970s and delves into the many similarities between then and now, ending with the warning that “gold prices soared back then and they might rise substantially in the near future.” We have run the following chart a couple of times over the past few months as one analyst after another warns of a 1970s economic deja vu. Beware of carefully crafted arguments suggesting that stocks do well in periods of inflation. The historical support is spotty at best.

Gold and Stocks

(Performance 1970-1980, in percent)

Chart courtesy of MacroTrends.net

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.