Click here to get this article in PDF

Source: Michael Ballanger 12/19/2024

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and, upon request, his list of tax-loss purchase candidates.

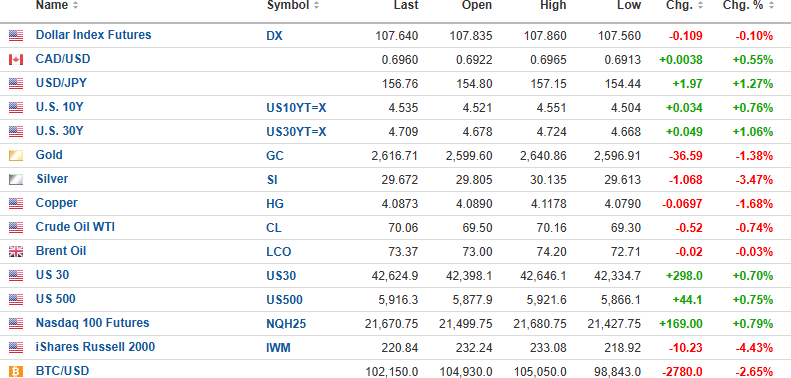

The USD Index futures are down 0.10% to 107.640 with the 10-year yield up 0.76% to 4.535% and the 30-year yield up 1.06% to 4.709%.

Gold (-0.10%) is lower but silver (+0.55%) and copper (+1.27%) are higher.

Oil (-0.74%) is lower by $0.52 to $70.06/bbl. Stock index futures are bouncing after yesterday’s post-FOMC crash which is to be expected but not to be trusted.

Stocks

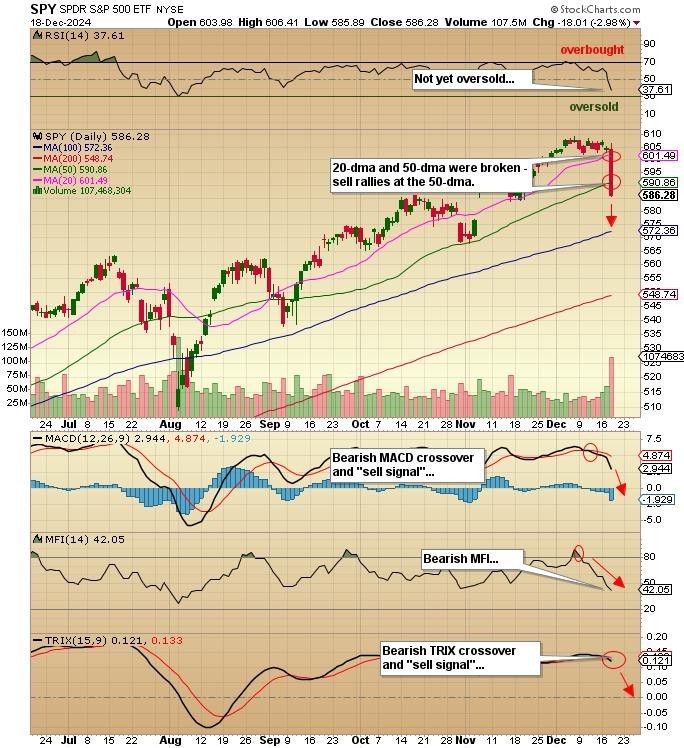

As can be seen clearly from the chart posted below, the SPDR S&P 500 (SPY:US) went out below both 20-dma and 50-dma lines, and although pre-market futures indicate that it will reclaim the 50-dma on the opening, I am going to sell that rebound on the premise that a) end-of-year rebalancing is not yet over and b) when the Fed makes a pivot as it did yesterday, you have to sell.

That “pivot” was not exactly a move to tighten credit conditions, but what it told me was that Powell sees the Trump campaign promises as inflationary (which they are) and has decided to reduce the pace and amplitude of interest rate cuts.

You can see that in the 10-year and 30-year yields where the 10-year has just the 4.5% level with the 30-year a mere 30 bps from the ominous 5% level, a level from which major corrections have begun.

This morning, I will leave the markets alone until after all stocks have had a chance to open, but around 9:50–10:10 am, I will be executing the following trade:

- Buy 10 1,000 SDS:US at < $20.00

For the option traders:

- Buy 25 contracts SPY January $575 @ $5.00

I will set target prices later if filled.

Volatility

The VIX has backed off from over 27 to 21.18 with 30 minutes til the opening, which is totally in keeping with the desperate efforts the hedge funds will use to try to preserve their huge 2024 bonus pool that, after yesterday, has taken an enormous haircut. Nonetheless, the rebalancing they have been carrying out has to continue until all the portfolios are realigned back to 60% equities / 40% fixed income by December 30, so the pressure in stocks should continue.

Tomorrow, the all-important PCE will be released at 8:30 am, and that will give us clues to how the FED will respond in its policy guidance.

I am now comfortably long 40 contracts VIX January $10 calls at ACB $6.85 as well as 10,000 UVIX:US at $3.45 ACB, so while they will open below the after-hours peak of yesterday, there should be upward pressure as the day unfolds as managers move to lock in profits (and bonuses, of course) before year-end and before the next wave of selling slices even more from the bonus pool.

Tax Loss

I have been asked to provide Streetwise Reports with my list of tax-loss purchase candidates, and while Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) has been locked in a range of CA$0.10-0.22 for the entire calendar year, I still consider it my top end-of-year purchase that will be going out to a rather extensive audience.

Other companies that undoubtedly need some love include Adamera Minerals Corp. (ADZ:TSX.V), whose range has been CA$0.10-0.55 in 2024, making it a bonafide tax-loss candidate and a solid Buy as we speak.

Of the bigger names, Newmont Corp. (NEM:NYSE) is down from US$42.50 earlier in December to US$37.64, with a 2024 range of US$29.42-$58.72. It is getting pitched overboard with ferocity this week and will probably continue until December 30.

Also suffering the demise of the Senior Gold Miners is Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), whose range is US$13.76-$21.35 so at the current price of US$15.51, it too is getting pummelled by portfolio managers not too keen on having it show up in the January statements.

I am sure there are any more but those are few from which to pick.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Adamera Minerals Corp., and Barrick Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. and Adamera Minerals Corp. My company has a financial relationship with Getchell Gold Corp. and Adamera Minerals Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.