Author: Gold News Club

Silver has experienced strong price momentum this year, but so far the white metal hasn’t been able to break through the key $30 per ounce level.

For David H. Smith, senior analyst at the Morgan Report and a contributor to Money Metals, it’s only a matter of time before that happens, and investors should make sure their portfolios are ready.

“The resistance level is around $30, and whether that happens within the next week or two, or it takes a month, (it’s) hard to say,” he told the Investing News Network. “Once it gets a couple of closes above $30, I think everybody is going to be jumping on board — the big funds and everything.”

In his view, market participants should be cautious about trading in and out of silver right now. He anticipates that the precious metal will keep running quickly after it moves through $30, and ultimately there may not be time to get back in.

“When this thing really gets underway and decides to challenge the high $30s and into the $40s, I don’t think it’s going to take any prisoners,” Smith explained.

Looking at what’s been driving silver this year, Smith identified factors related to both supply and demand. On the supply side, he mentioned that silver was in its fourth year of declining production even before COVID-19 hit. Meanwhile, demand has been high enough that it’s been hard to get physical metal.

Smith emphasized that the important thing for investors to do is be prepared.

“I do think it’s the chance of a lifetime for investors now. And it’s an asymmetric chance of a lifetime — you don’t need to mortgage the house to do well, you can buy a modest position of physical, and a few good mining stocks and hold on. You may be shocked at what you see in just a few years in terms of the appreciation on both of those metrics,” he said.

Watch the video here…

Simply Buy $1,000 in Silver and Receive a Free Buffalo Round (And Your Order Ships Free, Too!)

MONEY METALS EXCHANGE – Silver prices are on the move, and yet silver remains historically very low in relation to gold.

PLUS, you still have time to swap some of your overvalued stocks or cash for precious metals – PROVIDED you act before Wall Street’s inevitable next ‘correction.’

Wise investors are taking immediate action to protect themselves. In recent months, Money Metals’ order volume has been as high as five times normal as we work late and add staff to serve savvy precious metals investors.

Take advantage of our Free Silver Offer and add to your savings with free shipping. Remember, only Money Metals Exchange gives you:

- Super competitive pricing on all your metals purchases

- Top-notch, “white glove” service that shames our competitors

- Friendly, no-pressure expert support all the time

- Total privacy and reliability for your peace of mind

Take advantage of today’s bargain silver prices and get your FREE 1/2 oz Buffalo Silver Round and FREE SHIPPING! Order online or call our in-house experts at 1-800-800-1865.

Don’t Miss Out! Order $1,000 or more in silver coins, rounds, or bars before October 11, and we’ll throw in a FREE 1/2 oz Buffalo Silver Round (along with free shipping)

- 29 2020 American Silver Eagles, OR

- 32 Walking Liberty 1 Oz Silver Rounds, OR

- 7 5-Oz Silver Bars, OR

- $45 Face Value, 90% Silver Quarters or Silver Dimes; Pre-1965 Junk Silver Coins <<< MOST SILVER FOR YOUR MONEY, OR

- ANY combination of silver we offer totaling $1,000 or more! (Only Vault Silver is excluded.)

- KA-CHING!!! Your FREE 1/2 oz Buffalo Silver Round will automatically appear in your shopping cart once your total silver purchase meets or exceeds $1,000!

- Suggested choices are merely minimums to qualify for FREE SILVER… buy as many coins, rounds, or bars as you wish a low Money Metals prices!

Calibre Delivers 149.4 g/t Gold

Source: Bob Moriarty for Streetwise Reports 09/16/2020

Bob Moriarty of 321gold explains why he believes this company is on its way to mid-tier producer status.

I don’t think most investors understand the extent that the well-led resource companies have cashed up in anticipation of far higher prices for gold and a renewed interest in mining by the general public. The actions of the Federal Reserve and all central banks pouring bales of $100 bills onto a bonfire pretty much guarantee the end of fiat currencies, higher gold and even potential hyperinflation.

Eleven months ago I covered the potential for Calibre Mining Corp. (CXB:TSX; CXBMF:OTCQX) that had just done a deal with B2 Gold to take over two existing gold mines in Nicaragua. While gold is up a lot at the time their shares were $0.75. Fast forward to today and those same shares are up about 300%.

Everyone in the junior resource space is going to benefit but the sweet spot of risk vs. reward is going to be in actual producers. Management at Calibre has done a bang up job of hitting the ground running. They cashed up as soon as they could and have been dumping money into drilling and expanding the resource ever since.

Calibre is in the midst of a gigantic 80,000-meter drill program covering infill resource drilling, expansion drilling and some raw exploration. It is a giant success with results just out showing as high as 149.4 g/t gold over 4.8 meters leading the pack. The company has 14 drill rigs active on various projects and has 12,000 meters a month planned for the remainder of 2020. To date a mere 10% of assays have been received.

While I personally like investing in the real penny dreadfuls with ten-bagger potential, CXB is an easy ten-bagger from when I wrote about them in October and perfectly positioned for several hundred percent higher move from their price today. They are selling for a market cap of about $650 million today but are a dead easy call for them to crack into the billions.

As an investor you have to consider both risk and reward. CXB has a mix of the two that I consider perfect. They will be a mid-tier producer one day soon and with that the market will value them a lot higher per ounce of production.

Go to their website and view their presentation. They do a great job of telling their story.

Calibre is an advertiser and I did participate in their last PP. As such that makes me biased so do your own due diligence. I share in neither your gains nor your losses so your decisions are yours alone.

Calibre Mining

CXB-T $1.95 Sept 15, 2020

CXBMF OTCQX 330 million shares

Calibre Mining website

Bob Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Calibre Mining. Calibre Mining is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Are the Gold Stocks Overvalued Today?

Source: Adrian Day for Streetwise Reports 09/16/2020

Money manager Adrian Day takes a look at the gold stocks—the senior miners, in particular—and discusses whether they remain undervalued or whether they have moved too far, too fast.

We discussed recently how the policies of the Federal Reserve and other global central banks were extremely bullish for gold. If the various quantitative easings (QEs) after 2008 took gold on a five-year bull market that saw the price of gold almost triple, while the major mining index (XAU) went up over 3.5 times, and many juniors far more, today’s even more extreme “policy,” dubbed “QE Infinity,” could have an even longer and greater impact on the price of gold.

Yet despite increased interest in gold and gold stocks—despite the XAU having more than doubled since March—the gold stocks remain undervalued. This is true of pretty much every subsector of the gold space, other than the major royalty companies. (We still like these companies, for reason we have discussed many times, but they are not, as a group, particularly undervalued today.) There are individual stocks—among the producers, developers and exploration—that are not cheap, of course, but as a group, they are very undervalued today, including the major mining companies.

One factor that contributes to whether gold stocks are cheap or not, of course, is the price of gold itself. If the price of gold were to move up significantly from here, then we would expect the gold stocks generally to move up as well. Conversely, a major drop in the gold price would see the gold stocks drop. (That is not the only factor, of course, and the relationship between the gold stocks on the one hand, and the gold price and the broad market on the other, is a complex one.)

Is gold due for a correction?

Is gold due for a correction? Certainly it has moved above its longer-term trend, though the drop in early August and sideways movement since has brought gold back to its trend line since the end of March.

Typically, of course, we would expect a decline below the trend after a move above it, (such as we saw in the second half of July and into August). Inflows into gold seems to have leveled off; in August, inflows into global gold exchange-traded funds (ETFs) were the lowest since January, and only just over a quarter the monthly average this year. That would lead to concern about a reversal, and thence a price decline.

However, though there were some days at the end of August that saw net outflows, overall for the month, inflows on an historical basis were still strong, while the last 12 days have seen inflows every day, albeit still as a lower price than the last several months.

Technically, gold is at a critical level, very close to its 50-day moving average (MA), and just above support that has held since the early August drop. Should gold break below either support or the MA (and it would likely be both), then it could drop to the next support level, which is also around the 100-day moving average, in the $1,800–$1,820/ounce level. Though a drop like that would by no means break the longer-term trend, it would shake the gold stocks.

In short, the possibility of a $100–150 decline is real; gold has been very resilient, quickly reversing any intra-day declines. And should we see a pullback, I suspect it will be both shallow and brief. There is simply too much buying on the sidelines waiting for a pullback.

Large gold miners well below highs

First, the gold stocks have been lagging bullion since 2011, and the gap continues to be wide. In fact, the gap between gold and gold stocks is wider today than it ever has been. If you are bullish on gold, you should be even more bullish on gold stocks.

Second, the gold stocks remain considerable cheaper than they were in 2010–2012. Despite the big run-up in gold stocks this year—and they are up 350% since early 2016—they are still significantly less expensive than they were at the previous peak. The XAU index would have to rise more than 50% from here to equal the level of those years.

But we should bear in mind that leading components of the index are the royalty companies, which generally performed very well over the past decade. Remove those stocks, and the miners generally would have to double from here to get back to the levels they were a decade ago, the last time gold was at the same price as today.

Gold stocks remain well below average valuation levels

More important than mere price is value. If we look at valuations, the story is even more compelling. On every valuation metric, the gold stocks today, despite record gold prices, are in the lowest quartile on a historical basis.

On a price-to-book value, the gold stocks over the past five years have traded at the lowest multiples ever. As stock prices have gone up, so too have the book values of mining companies. At 1.3 times book, the major miners are trading at a better than a 40% discount to their trading range from the early 1980s to 2013.

Even more compelling is price-to-cash flow: Other than the last quarter of 2018, the gold stocks have never been cheaper! For most of the past 35 years, gold stocks have traded at two to three times the current valuations. And when the gold price is strong, multiples tend to expand, so it would be usual were valuations above average today.

Today’s situation does not make any sense. Today we have record gold prices and an extremely bullish outlook. We have arguably better, more disciplined mining companies, with better managements and better balance sheets for the most part, yet prices and valuations far less than in 2011–2013.

There have been changes in miner management

The disastrous management decisions in 2001–2013—most notably overpaying for marginal deposits—and the 80%-plus decline in the XAU, soured generalist investors on the sector. Managements were wholesale sacked and replaced, while corporate “visions” of “growth at all costs” were replaced by “profitable ounces.” Despite this, generalists who do not follow the industry in great detail are reluctant and slow—understandably—to return to the sector.

But over time, as gold continues to move up, they will return to the sector. Indeed, we are already beginning to see this.

It is unusual that after gold itself has moved so much (over 30% this year; 50% in the past year), the major companies are still inexpensive. Investors are in a very unusual and advantageous position now that, with gold strong and the outlook even stronger, the largest and best companies remain inexpensive. One does not have to go “down market” to the juniors and exploration stocks, where the potential, but also the risk, is far higher.

The major miners as a group are also more “certain” to move as gold moves higher. Gold stocks remain about the most idiosyncratic of any sector; one company can be a disaster even while the sector is strong. So selection remains critical. But this is unquestionably the time to take advantage of this anomaly in prices and valuations of the largest mining companies.

Which are the “best” gold companies?

I am often asked, which are your top gold stocks? There is no easy answer because the question lacks precision. Top for greatest short-term potential? Top for lowest risk? Top for long-term holdings? Or certainty of moving up with gold? And so on. “Top” can mean a lot of different things, and it usually does to different investors.

What to buy for newcomers?

For someone completely new to the gold sector, we shall answer this question: If I were to buy four gold and silver companies today, to hold for the next three or more years, what would be those companies be? In framing the question thus, I assume the investor wants stocks with reasonable certitude to rise if the gold price rises; he wants low risk; and he doesn’t want to be figuring out every week if he should continue to own. In this list, I am less concerned about a stock’s price today; we are buying companies rather than stocks. On that basis, here are my “top “gold stocks.

First, Franco-Nevada Corp. (FNV:TSX; FNV:NYSE, US$144.93) the largest of the royalty companies. We favor it over Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) because it has a strong balance sheet, a more diversified revenue base and a deeper pipeline.

Second, Barrick Gold Corp. (ABX:TSX; GOLD:NYSE, US$29.76). I favor Barrick, the world’s second-largest gold miner, over Newmont Corp. (NEM:NYSE) (#1) because of better management, a stronger balance sheet and higher free-cash flow.

Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE, US$82.18), along with Barrick, is my favorite of the big cap miners. With a focus on Canada, it has first-rate management, solid balance sheet, a good pipeline and spends money on exploration and alliances with exploration companies.

Lastly, Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ, US$34.46), the largest of the silver producers outside of Mexico, has a diversified asset base, strong balance sheet and two high-potential assets (acquired from troubled companies), either one of which could add significantly to the company’s production and net asset value (NAV).

The best, and add some spice

Now, as an investor or trader, we would not necessarily buy each of these at today’s price. You know this from our recent comments on Franco, for example. But, if you want to buy four great companies and hold for the next few years, this basket represents the best of the best.

And if you want to add a few of smaller companies with high potential, we would pick Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE, US$6.92), a growing gold and silver company, very undervalued relative to other silver miners; Midland Exploration Inc. (MD:TSX.V, 1.03) for its strong management, solid balance sheet and diversified portfolio of exploration projects, many in joint venture with seniors; and Orogen Royalties (OGN:TSX.V, 0.39), again for its strong management, solid balance sheet, and two key royalties, one near term and one further out, both on projects being developed by other companies.

A portfolio, such as the our list of “Current Holdings,” is accumulated over time and quirks arise. One can buy a particularly depressed stock at one point and continuing holding because the long-term prospects look attractive. It may not be one’s favorite in the sector, but at the time, the favorite was expensive, and instead one bought a very depressed stock for a turnaround. Or one can buy Stock “A,” which gets taken over; hence we hold Newmont (which acquired Goldcorp, which got onto our list after it bought the Eleonore deposit from Virginia, the stock we originally purchased). In a future letter, we shall examine our portfolio as a whole, and make some changes.

Originally posted on Sept. 12, 2020.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Franco-Nevada, Barrick, Pan American Silver, Agnico Eagle, Fortuna Silver Mines, Midland Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fortuna Silver, Agnico Eagle, Midland Exploration, Orogen and Franco-Nevada, companies mentioned in this article.

Adrian Day’s Global Analyst disclosures: Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2020.

( Companies Mentioned: AEM:TSX; AEM:NYSE,

ABX:TSX; GOLD:NYSE,

FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE,

FNV:TSX; FNV:NYSE,

MD:TSX.V,

OGN:TSX.V,

PAAS:TSX; PAAS:NASDAQ,

)

Silver Bulls Will Be Handsomely Rewarded

Source: Peter Krauth for Streetwise Reports 09/15/2020

Peter Krauth outlines the reasons he believes the price of silver will continue to rise.

They say patience is a virtue.

Well, if anyone is virtuous these days, it has to be silver bulls.

They also say good things come to those who wait. I believe those good things will be coming…in spades.

Silver reached just shy of $50 back in April 2011. A decade later, we’re still just barely above half that level.

But that’s all about to change.

Since bottoming in March, gold has rocketed to a new all-time high near $2,070 in early August, up 40%.

But silver’s trough-to-peak gains have put gold’s to shame. The white metal bottomed in March near $12, then soared to a $29 peak, also in early August, for a blistering 140% gain in just 4½ months.

When silver really gets going, it can surprise even the most ardent of silver bulls. And odds are it’s going to go on several more runs like this in the future.

Here’s what’s making this metal tick, and why what lies ahead for silver is going to surprise us all.

Silver’s Monetary Side

It’s widely accepted that silver is both an industrial metal and a monetary metal. But now that precious metals are in a secular bull market, silver’s monetary side is likely to have an outsized impact.

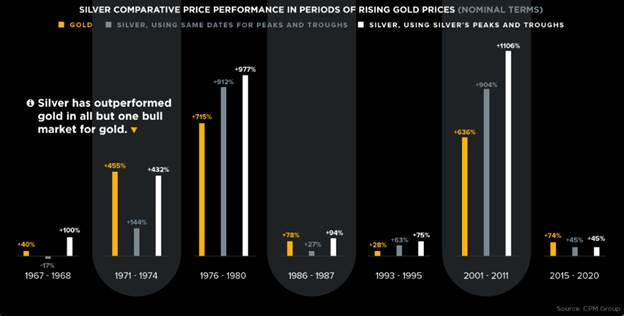

If we look at how silver compares to gold in bull runs, it turns out silver has outperformed five of the last six times.

Source: Visual Capitalist, CPM Group

That’s likely going to happen again this time, and the main driver will be investment demand.

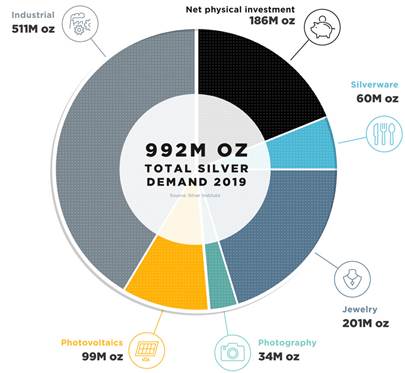

According to the Silver Institute’s Annual World Silver Survey, silver investment demand was up 12% in 2019 over the previous year. The Institute recently reported that in the first half of 2020, investors hoarded 10% more silver than in H1 2019, mostly through buying silver-backed exchange-traded products (ETPs). As a result, ETPs have been setting successive record high levels of holdings this year.

Source: Visual Capitalist, Silver Institute

What’s more, it’s estimated that just 6% of all above-ground silver is in investment form like coins or bars. The rest is almost evenly split between industrial uses and jewelry/decorative uses.

Challenged Silver Supply

Besides rapidly growing investment demand, one of the biggest drivers of higher silver is going to be limited new supply.

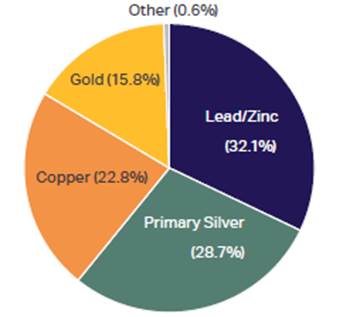

Just 28.7% of new silver supply comes from primary silver mines. 71% of newly mined silver is only produced as a by-product of other metals like gold, copper, lead and zinc.

Source: Metals Focus, Via Silver Institute World Silver Survey 2020

In a recent Kitco News interview (Kitco.com) E.B. Tucker, director at Metalla Royalty & Streaming (NYSE:MTA; TSXV:MTA), said, “Silver’s got some catching up to do. One of the things about silver that people need to understand is that the supply of silver is not elastic, and what that means is if the price goes higher, the mines can’t just turn it on. Only about a quarter of the supply comes from actual direct silver mining, the rest of it comes from by-products, and recycling.”

Even once silver prices soar, mines that produce silver cannot just ramp up silver production. And silver is often a small portion of their revenues, so there’s little incentive to produce more.

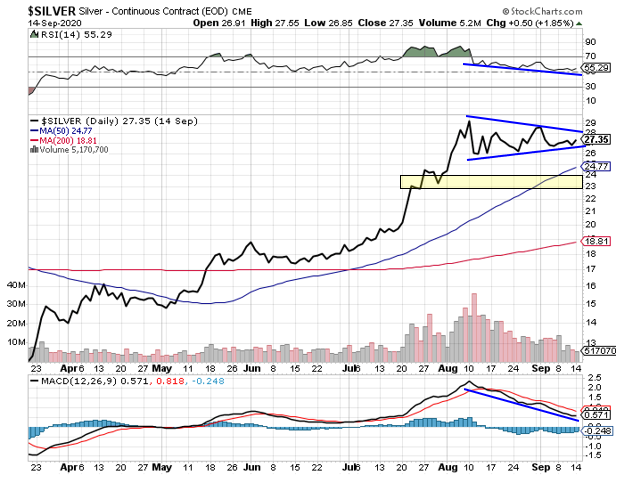

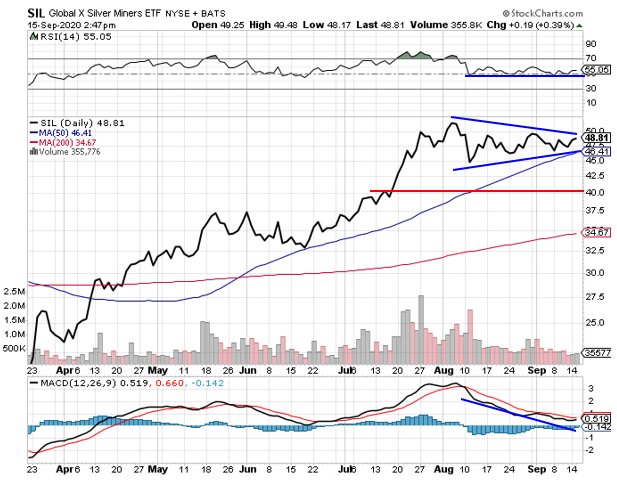

Silver’s Technical View

With fundamentals lining up, let’s examine the technical side of silver’s near-term outlook.

Silver has been forming a symmetrical triangle pattern since early August. Volume’s been dropping over the past month, and the RSI and MACD momentum indicators continue to move downwards. This suggests more consolidation and, for now, a possible downside move once the triangle is breached. The $26 level is the first downside target, then the $23–$24 range would be next.

Silver stocks are reacting in much the same way as silver itself.

The only difference here is the RSI has gone mostly sideways for five weeks. For SIL I’d expect a first downside target to be $45, followed by $40.

But once the current consolidation/correction is over, which could still play out over several more weeks, I’d expect silver to come back with a vengeance.

The Fed is standing ready to “print more on demand,” while the European Central Bank and others are signaling more as well. The Covid pandemic is seeing cases tick up as kids head back to school and we head indoors. Oh, and there’s a critical federal U.S. election, amid a highly antagonistic political environment, in under two months.

Silver is likely going to reach above $37 before the year is out, as its monetary role starts to dominate once again.

Rest assured, your patience will be rewarded.

Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Metalla Royalty & Streaming Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The Fed Delivers What’s Expected