Source: Peter Krauth for Streetwise Reports 09/09/2020

Peter Krauth profiles three junior mining companies that he believes hold the potential to produce stellar results.

So far this year, the S&P 500 is up 6%. Considering the massive challenges we’ve faced, that’s not bad.

By comparison, gold has clocked stellar returns. It’s up 26% year-to-date.

But a small subsector of the gold space has far outpaced even gold’s returns.

Imagine making 19 times your investment in just 5 months. Sound impossible? That’s what some junior explorers’ shares have done already this year.

To be fair, these can be some of the most volatile equities on the planet. Of course, the rising tide of a secular gold bull market can go a long way to moderate some of that risk.

Also, allocating capital wisely and across several explorers can help mitigate the hazards these companies might present.

The fact is just one outstanding success, even alongside a few other mediocre performers, can still lead to life-changing returns for investors.

With gold continuing to consolidate, as I’ve been saying to expect in my recent articles, now is a great time to consider where to invest for the next leg up.

Let’s dig in…

Gold Juniors Outperform

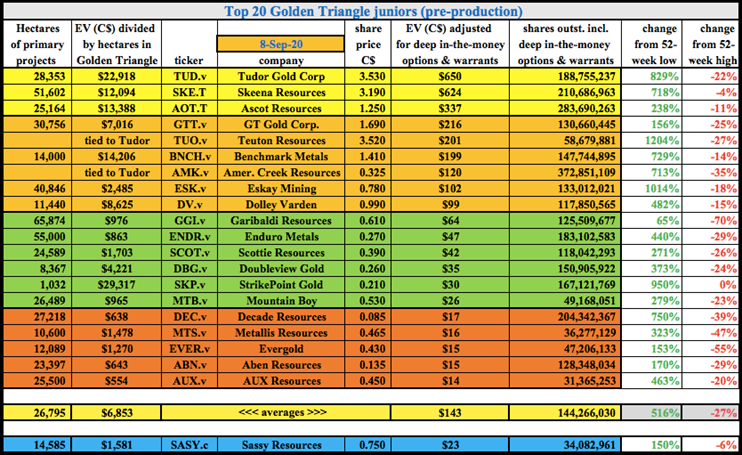

The following chart compares the performances of gold, large gold producers, and junior gold miners.

Since March 13, 2020, gold is up 25%, gold producers are up a whopping 89%, and gold juniors are up 111%.

Now if that doesn’t grab your attention, I’m not sure what will.

The fact is, the leverage offered by junior gold companies is downright explosive. Some individual junior gold explorers are up over 1,900% or more in that time frame. That’s testament to the kind of wild upside they can offer.

Needless to say, such high potential reward is commensurate with high risk. Explorers can burn through lots of cash securing land rights, permits and drilling all to turn up nothing.

Other times, big success is followed up with big duds. As well, the commodity cycle can work with or against. That’s why rising gold prices are so important for gold explorers.

Some discoveries that lead to deposits could be uneconomic at $1,400 gold, but highly profitable at $1,800.

Gold’s 4-year bear market from 2012 to 2016 forced miners to dramatically cut costs, sell assets, and put some mines on care and maintenance while expansions were put on ice.

Exploration was one of the first victims, which has led to a dearth of discoveries. But with gold back to marching higher on strongly sustained fundamentals, miners are realizing they need to replace depleting reserves.

As a result, successful explorers become takeover targets as they expand known deposits and discover new ones.

Here are three companies that have the right people and are looking in the right places to potentially produce stellar results.

Nevada Nano Cap

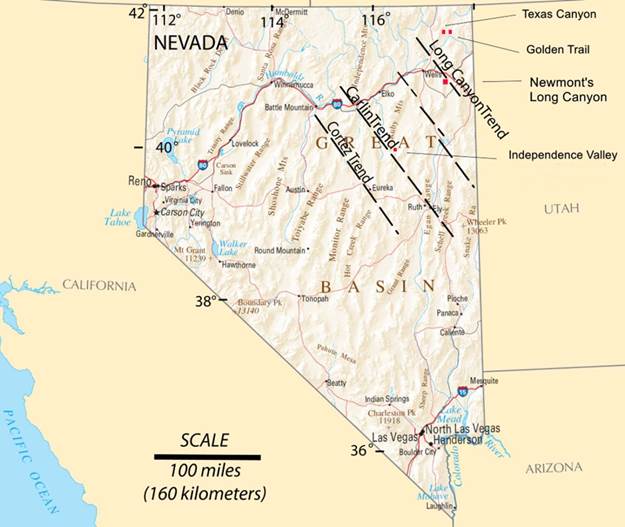

Nevada was ranked as the world’s third most attractive jurisdiction for mining investment by the Fraser Institute this past February. Nevada is exceedingly attractive with its second largest gold reserves in the world and 23 major gold mines, all while producing 5 million ounces of gold annually.

If it were a country of its own, it would be ranked as the 4th largest gold producing nation globally. Considering its stable tax regime, robust legal basis, qualified labor, streamlined permitting and developed infrastructure, there are many reasons to look for gold in Nevada.

Peloton Minerals Corp. (PMC:CSE; PMCCF:OTCQB), at CAD $10M, is a true nano cap junior. Despite no resource so far, its quality properties and outsized potential make up for the higher risk profile.

In 2011 Newmont acquired Fronteer Gold through a $2.3 billion takeover for its Long Canyon project. Also on the Long Canyon Trend is Peloton’s Golden Trail Project, located just 50 km north of Newmont’s Long Canyon mine. Golden Trail is 100% owned by Peloton with no royalties and comprises an 880 acre claim package.

The initial drill program in 2019 delivered 82% of footage mineralized above the detection rate for gold and silver, with a range of 0.005ppm to 0.095ppm Au and 0.5 to 72.0 Ag, and all holes bottomed in mineralization. Golden Trail should see 2,000–3,000 feet of further drilling this fall, going deeper than last year’s efforts, and testing 3,000 feet to the south for Carlin-Style hydrothermal anomalies.

7 kilometers due west is the Texas Canyon project. Armed with good historical data from the previous operator, management is advancing is drilling permits to be able to drill this project by next spring. An NI 43-101 technical report is being compiled to publish data and set out recommendations for further steps. A project summary-abstract was published in the 2020 Geologic Society of Nevada’s virtual symposium. That could help attract a JV partner to participate and advance Texas Canyon.

Source: September 2020 company presentation

Independence Valley is Peloton’s third Nevada project, this one located on the southern extension of the world-renowned Carlin Gold Trend. It’s the largest concentration of gold deposits in North America, with over 40 deposits discovered along the 64 km-long trend.

Located in Elko County, Independence Valley is composed of 1,160 acres and within the historical Spruce Mountain mining district which hosted many historical base and precious metals mines since the 1840s. This project hosts the largest untested Rhyolite Dome int the Spruce Mountain district.

The 2020 drill program will comprise 2,000–3,000 feet, and geophysical modelling of magnetic and CSAMT data have identified three structures within the dome complex that are recommended for testing.

The company’s fourth project is Silver Bell & St. Lawrence (SBSL). It’s a 390-acre claim package with two historical gold mines (Silver Bell & St. Lawrence). Located in Montana, SBSL is under option by Frederick Private Equity to earn a 75% interest through annual option payments and spending $2M within six years of March 2018. Last year’s initial drill program intersected up to 34.4 g/tonne gold. Historical smelter records show gold grades from 0.15 to 0.52 ounces per ton and silver grades from 2.7 to 15.6 ounces per ton.

Catalysts this year and early next will be follow up exploration results on Golden Trail and Independence Valley, plus the technical report on Texas Canyon. As well, potential activity on SBSL could all generate plenty of news flow over the next 6–12 months with exciting potential.

Nevada Elephant Hunter

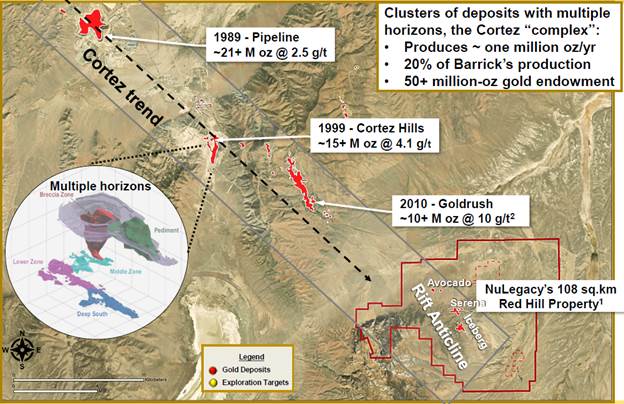

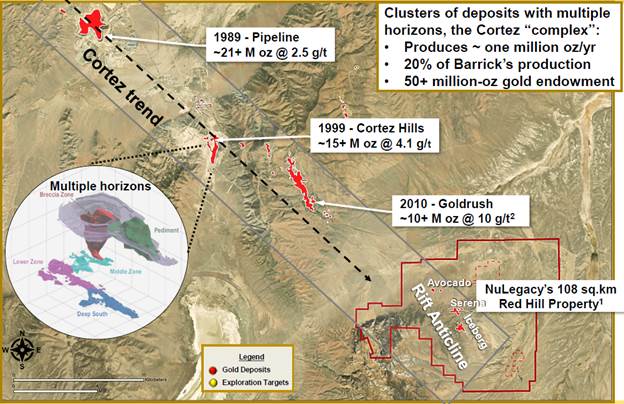

Also operating in Nevada is NuLegacy Gold Corporation (NUG:TSX.V; NULGF:OTCQB), whose market cap has soared to CAD $103M in recent months. The company holds a 100% interest in the Red Hill project, located on the prolific Cortez Trend, which hosts three of Barrick Gold’s largest and highest-grade Tier 1 Gold deposits: Pipeline with 21 million ounces (Moz) at 2.5 grams/tonne (g/t), Cortez Hills with 15 Moz at 4.1 grams/t, and Goldrush with 10 Moz at 10 g/t.

Red Hill is a highly prospective 108 square kilometer property on the southern end of the Cortez Trend, in close proximity to the cluster of Pipeline, Cortez Hills and Goldrush. Nulegacy boasts a strong technical team and institutional ownership. Oceana Gold owns 10.3%, Barrick owns 6.6%, and Sprott Gold Equity Fund holds 6.4%.

Source: May 2020 company presentation

Its nine-member technical team, most of whom worked at Barrick, have all made significant direct contributions of some kind towards the discovery of over 50 million ounces in Nevada’s Carlin and Cortez trends.

Red Hill could turn out to be an elephant. This summer the company performed a CSAMT survey to help measure the Rift Anticline. Drill intercepts over the last couple of years have produced 9.6 g/t gold over 5.1m, within 20.8m of 2.7 g/t gold at Western Slope, and 16.9 g/t gold over 8.7m within 22.1m of 6.6 g/t gold. That’s high-grade rock which looks a lot like Barrick’s Goldrush deposit of 10M ounces at 10.2 g/t gold.

An initial 16 hole, 11,500-meter drill program on the Rift Anticline this fall, followed by 4–5 holes in the winter and more in the spring should produce some steady news flow.

Nulegacy is aiming to prove up a Tier 1 asset, then look to a merger or JV to develop toward production.

This is elephant country, and that’s what Nulegacy is hunting for.

Canadian Consolidator Explorer

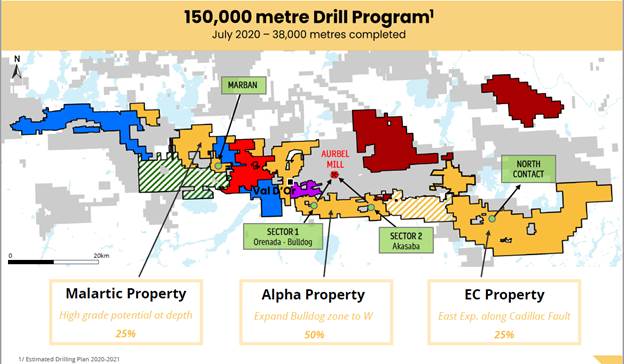

O3 Mining Inc. (OIII:TSX.V) is a larger junior gold explorer with a market cap of CAD $142 million. Their portfolio of assets in the provinces of Quebec and Ontario, Canada, two of the better mining jurisdictions anywhere, span more than 460,000 hectares.

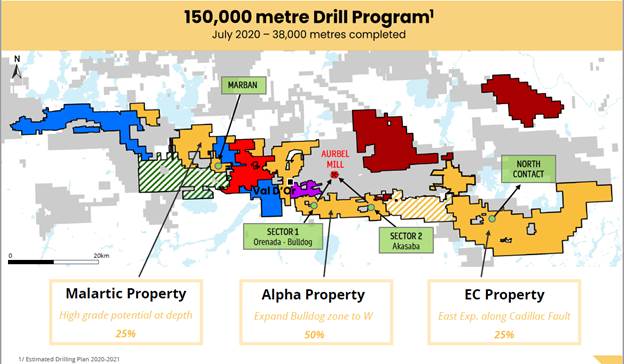

As part of the Osisko Group of companies, O3 is consolidating exploration properties, aiming to become a multi-million ounce high-growth company. In Quebec, the 4th most attractive mining jurisdiction on the planet, O3 controls 61,000 hectares in historically productive Val d’Or and over 50 kilometers of strike length on the Cadillac-Larder Lake fault.

Val d’Or, a district responsible for producing over 30 Moz of gold, holds O3’s flagship Marban project on the Malartic Property, representing 75% of the company’s total resources at 2.5 million gold ounces. That’s up by 40% since the 2016 resource estimate. More than 600,000 meters have already been drilled, with over $60 million invested in the ground. A large 40,000-meter drill program is ongoing to extend the deposit. There is a lot of brownfield upside potential.

Source: September 2020 company presentation

A positive Preliminary Economic Assessment was just delivered on Marban, boasting an after-tax NPV of $423 million, after-tax IRR of 25.2%, a 4-year payback and 15 year mine life. The average cost to produce the gold will be a respectable $822 per ounce, offering nice margins.

With a huge overall 150,000 meter drill program on its Cadillac Break properties, O3 continues to advance this highly prospective district by using AI technology to help identify drill targets.

In Ontario, the Golden Bear Group of properties includes the Garrison project which hosts 2 Moz gold in three main zones. It’s a potential consolidation play as bigger neighbors include Kirkland Lake, Pan American and Moneta Porcupine, some with established deposits of multiple millions of ounces.

As a consolidator/developer/explorer, O3 doesn’t hesitate to joint venture or sell off properties it deems non-core. This allows it to unlock value, while retaining participation in the case of JVs.

Junior gold explorers come in all sizes and varieties. Given their nature of high risk, it makes sense to build a portfolio of at least 5 names. It’s also wise to allocate small amounts and to add to positions over time.

But the moon-shot potential is undeniable, especially in a secular gold bull market that’s starting to heat up.

Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.