Author: Gold News Club

Basel III and Gold, Silver and Platinum

Source: Maurice Jackson for Streetwise Reports 09/08/2020

Maurice Jackson of Proven and Probable talks with Andy Schectman of Miles Franklin Precious Metals Investments about macroeconomic policy and its effect on precious metals prices.

Maurice Jackson: Joining us for a conversation is Andy Schectman, the president of Miles Franklin Precious Metals Investments.

Let’s begin today’s discussion with gold, which has recently surpassed its all-time high since we last spoke, but this is no surprise. You forewarned us this would come to pass in our discussion back in December 2019, regarding the Bank of International Settlements and Basel III and its impact on gold. For those that missed that conversation, can you please shed some light on the importance of Basel III?

Andy Schectman: Readers should note, Basil III is the most significant event of my career. And really if people were to take a broad look at this and understand what it means, quite frankly, I don’t think you need to know anything else. Everything else that we see is just noise. Since 1944, there’s only been one tier 1 asset, and that has been United States Treasuries or fully funded dollar deposits. Gold was considered a tier 3 asset where only 50% of its value was allowed to be calculated on a balance sheet. Therefore, there would be four reasons that central banks would be de-incentivized to own gold. It wouldn’t pay interest, costs money to store, it was unpredictable in its movements, but the tier 3 status meant that a 50% denigration on the balance sheet would limit a central bank’s ability to sell bonds or transact international business. So really, the only purest form of collateral, and by the way, if your readers were to Google tier 1 asset, it’s listed as a riskless asset.

So the Bank of International Settlements, which is the central bankers’ central bank in Basel, Switzerland, reclassified gold in April of 2019, as the only other tier 1 asset in the world next to U.S. dollars in Treasuries. So since 1944, there’s only been the dollar and the treasury bill that would give a tier 1 status for a central bank and or commercial bank collateral. Now, with gold brought up to that table, it’s important to note that the central banks of the world front-ran this decision. In 2018, they bought more gold cumulatively as a group than they did in the 60 years previously. And in 2019, those numbers were up 90% and continue unabated higher now. And so you’re seeing the most sophisticated, well-funded, well-informed traders on the globe accumulate what they call a riskless asset and have been front-running that decision, of course, now for over three years.

I think it’s only a matter of time before gold goes higher than anyone thinks possible. And they’ll continue to let it move up at this methodical pace with volatility inside of it, to keep people from really making a committed move to it. And before long they’ll look at it and say, “Geez, we missed the boat. We waited too long.” And I don’t think that’s the case right now, but I think that will begin to be conventional wisdom for most people, they will have thought that they missed the boat. I think it’s going multiples higher.

Maurice Jackson: Speaking of central banks, let’s take the conversation now home to the United States. What are your thoughts on the Federal Reserve’s unprecedented fiscal policy, and what type of impact is this going to have on precious metals short term? And then the bigger picture long term?

Andy Schectman: Well, you’re going to see inflation, and what they’re trying to do is stave off global deflation, the deflating of all of the assets and the bad loans, and deflation is bearing down on the globe, and the Fed is doing all it can to fight it with the printing press, and the inflationary forces will have ramifications. When we talk about inflation in 2008, with all the money thrown at the system, it went to the Wall Street banks, and that that money was holed up in financial assets. And so stocks, bonds, and to a maybe a slightly lesser degree, real estate, but financial assets were inflated, and they were able to reflate the bubble of those assets.

This time around, however, you’ve seen trillions of dollars being poured into the real economy through the PPP and the CARES Act and the $1,200 checks to people, and all of this stuff that has impacted M1 and M2, the money supply, you will see, beginning to see, I think, the inflationary effects of the Fed pumping money into the system, not just to the banks, continuing to inflate financial assets, ala the Dow Jones at an all-time high, etc., with 50 million people unemployed, completely detached from reality.

But you’re also going to begin to see, I think, real price inflation in the real economy, because on top of all the money that’s been thrown into the M1 and M2, which is inflationary already, remember, Maurice, it took 300 years to create $800 billion in wealth in this country. And in 10 months, the Fed’s created, what, $7, $8, $9 trillion, a good portion of which has already been sent directly to people in the form of subsidy checks. And now you have a situation where even people who have ridden this bull market back up, this illusionary recovery, created courtesy of the Federal Reserve’s policies, I think they’re beginning to sense that, Jesus, this just doesn’t make sense that the market continues to roar higher, defy gravity, in an environment where so much of the economy has shut down, may never come back. A lot of it won’t. And I think people are realizing that.

But here’s where it gets crazy. When these people pull out of the equity market of the stocks and the bonds, where do they go? That money is going to buy things in the economy, anything, tangibles, real estate, precious metals, art, jewelry, you name it, as inflation begins to rear its head and money comes out of the equity markets. I think you’ll see massive price inflation. So this is just the very beginning, but what the Fed has done, in my opinion, has sowed the seeds for perhaps a hyper stagflation type of scenario, where you have an environment of little or no economic growth and higher taxes, coupled with much higher prices.

Any way you look at it, I’m looking for inflation with an economy that is severely wounded, may not come back for a very long time. And that is, in essence, the printing press meets the Great Depression, and if I had to guess an outcome a couple of years from now before things get better, that’s the environment we see, much higher prices and an economy that struggles to get going again.

Maurice Jackson: Speaking of higher prices, the old saying is: “Buy low and sell high.” So one may conclude that it’s not a good time to be buying gold right now since it is at or near an all-time high. Well, not so fast. Andy, what is the Dow gold ratio telling investors?

Andy Schectman: Well, we’re right at the higher end of the Dow gold ratio. Typically, when the ratio is 5 or lower, meaning 5 ounces of gold by the Dow, you want to sell gold and buy the Dow. Currently, it takes 15 ounces of gold to buy the Dow, investors should be looking to sell the Dow and buy gold. But not only is the Dow horrifically overvalued in and of itself, one could argue that at this rate, selling the Dow and buying gold would be a very prudent decision based on the ratios.

Maurice Jackson: If you use those ratios in that perspective of 5 if you took the price of gold right now, and you multiplied it times five, the result is 9,700, and the Dow is close to 29,000. We have discussed perception in deception, and you see it in the numbers, but you have to know what numbers to look at. And that’s what we’re here to provide you, guidance, and not to be deceived by the nefarious tools of the Federal Reserve, because that is deception, and we want to make sure that you make the right decisions. Now, if we’ve convinced you that gold is on sale, let’s move on to silver. What is the gold-silver ratio telling investors right now?

Andy Schectman: The same thing really, in that we are not at its upper, upper end like we saw in March of 110 or 120:1, which was the biggest discrepancy in human history. But even still at 70:1, people should be much more heavily in the silver than in gold. And when I talk about people playing these ratios, the gold-silver ratio, if someone were to be much more heavily invested in silver, to me, it is a temporary investment until the ratio normalizes. And when you talk to guys like Keith Neumeyer who I know you know, he’ll tell you that what’s coming out of the ground is 6:1 currently. And when you take a look at silver and the fact that it is a depleting asset, one that has such massive amount of uses in industry, when you see a company like JP Morgan amass a billion ounces of it, while holding down the paper price, there are all sorts of signs in the road pointing to that this is very relevant and very important, and some pretty sophisticated people have been holding down the price to corner the physical market.

I think that silver is still one of, if not the best investments on the planet, but I would tell you that when that ratio does normalize, in 2011, we saw a 35:1 ratio or thereabouts after it being 85:1 the year before. So if someone were to put $25,000 into silver today at 70:1, if we were to see it do what it did in 2011 and get to 35:1, the idea would then be to sell gold or silver rather and buy gold. And that money that would’ve gone into gold today, but instead went into silver, would be worth twice as much then when that ratio normalizes.

And so playing the ratio is really, really, really good, but when we look at the Dow and saying, at 15, you want to be in gold, and at five, you want to be in the Dow, well, here in at 70 or above, you want to be in silver, and 35 or below, maybe even 40, you want to be in gold. So we’re closer to the be in the silver side of the equation, always mindful of that ratio and allowing us to double up the amount of gold we otherwise would be able to get. Or if someone were to trade 20 ounces of gold for silver at 70:1, when the ratio normalizes you go back and that 20 ounces turn into 40 ounces of gold.

Maurice Jackson: It’s simple and it’s brilliant. Bob Moriarty of 321gold has shared the benefits of applying the ratio with us many times. And I know that a number of your clients, as well as my clients, who are more heavily weighted towards gold, they’ve been taking advantage of the opportunity before us. Let’s get into my favorite metal, platinum, which is currently trading at half the price of gold right now. What are your thoughts on platinum, sir?

Andy Schectman: Stupid and expensive. I wish it was easier to get, it’s not very easy to get. The price is misleading, Maurice, because I mean, we can get it and we have had it, and we are lately having a hard time keeping it in stock, but the high premiums and the difficulty getting the product with any regularity speaks to me that the physical side is continuing to stay tight and maybe even get tighter. But if you are a ratio guy, the ratio between gold to platinum is every bit as out of whack, in fact, more so probably than the gold to silver ratio. The one thing against platinum is that it doesn’t have the history as a monetary metal, the way that gold and silver do. It’s more used or viewed as an industrial metal and mostly in catalytic converters for diesel automobiles.

But when something is so far away from historical price averages, the magnetism is pulling us back to the mean every day. So it’s got to come back into line. Most of the last 100 years, platinum has been more expensive than gold, so I think it’s as good of an investment as anything out there right next to silver. And the only reason I slightly have favored silver this whole way up, even though the ratio is every bit as good or better, is that I think silver always does first in these types of situations wear its industrial hat, but before it’s all said and done is wearing its monetary hat as well. And people view silver as a substitute for gold, as a monetary metal, not just an industrial metal, whereas platinum is more as an industrial metal and an investment but not so much a monetary metal. But I do think it’s a heck of a value, Maurice, and I’m continuing to buy it myself. To me, truthfully, it comes in third in my portfolio in terms of volume to gold and silver.

Maurice Jackson: I always share with my clients that I own a little bit of gold, a lot of silver, and a lot of platinum, but to me, the ultimate metal is gold. And the reason I’m buying silver and platinum is that I want to use those ratios as you’ve expanded upon and purchase more gold when the opportunity presents itself. So we’ve addressed gold as a great value proposition, but silver and platinum are even better value propositions right now. Let’s switch topics here and let’s address some questions that we received from prospective clients. And that is, I often hear, what is the minimum requirement to purchase from Miles Franklin?

Andy Schectman: No, there isn’t a minimum order. We’d like to help anyone we can, so we don’t have a minimum order, but I think you would at least have to spend a few hundred dollars to make it worthwhile when you factor in a $15 shipping charge on small orders. So no minimum, we work with everyone. And so whether it be a million dollars or $150, we’ll work with the client.

Maurice Jackson: Absolutely. Every client is important to us. We do not look at you from a numerical standpoint. We understand that you’re entrusting us with a big responsibility, and we wear that as a badge of honor. Here’s the big one. Why aren’t your prices listed?

Andy Schectman: I could list prices. I’ve chosen not to, Maurice, because the minute we took it off, the minute we said call for a price, all the fraud that we had fought for years stopped. And I know it frustrates a lot of people that our prices aren’t listed, but we’ll beat any price. Find a price, we’ll match it, we’ll beat it, we won’t be undersold. And I know it takes another step, but we are old-school and analog in a digital world. And I think when you talk about privacy… precious metals, to me, deserve to be offline, and it’s not a cop-out. I can turn our online store on again. But when I had it on, we fought fraud every single day, so much so that they found ways to try to hack our emails, try to do identity theft, tried to do mortgage fraud. The list goes on and on and on and on.

And every day we were dealing with, in many cases, state-sponsored Eastern European professional hackers, trying to find a way to disrupt our business and steal money from us or our clients. So I think it is every bit as important to the safety of our clients as it is to us. And for now, I guess I just choose to do things old-school, Maurice, and I know we’ll lose some people who don’t want to pick up the phone and call, but for those that do, I can assure you we’ll make it worth your while. And if you find a nationally listed price better, let us know. We’ll do our very best to beat it. In most cases, we can.

Maurice Jackson: Very responsible words there. I get that question asked to me several times, and also one last thing here. You talked about fraud. Somebody who’s looking to set up an account with us, what’s the best way for them to do that?

Andy Schectman: Just give us a call, get your questions answered. And literally, that’s it. I mean, when it comes to placing an order after we’ve had a discussion, got all the questions answered, we need your name, address, phone number, email address, and how they want to pay. Regular check, ACH, or wire. Once all those boxes are checked, your order is placed, and if the funds need to clear, upon clearing, the client receives UPS-insured tracking numbers to follow it in, it’s literally that simple. It’s as easy of a transaction as there is any longer in the world of decreasing privacy and increasing complexity. This is one of the few simple, straightforward things that still is.

Maurice Jackson: As a reminder, if you’re looking to set up an account with Miles Franklin, all you have to do is give me a call 855.505.1900. I’ll get your information, find out what you’re looking to purchase, and we’ll find the best deal for you, but you would not set up your account online. We do that to protect your privacy. Last question regarding questions that we received from prospective clients. What about credit card payments? Why don’t you accept those?

Andy Schectman: Same reason. Just a tremendous amount of identity theft and fraud. And to me, it’s just not worth being on the wrong side of that, Maurice. And with a credit card, as an example, someone steals a credit card, does identity theft, they place an order for $5,000, we ship them the product, and then the charge is disputed due to identity theft. On a $5,000 order, we may make a hundred bucks, but the 90-day investigation pulls the $5,000 out of our account while the charge is investigated.

So have that happen five, six, seven times a month, 10 times a month, whatever, you end up making it not worth the while. I know there are a lot of companies out there that do it. I don’t know what their level of fraud is. To me, it’s just not worth it. You just open yourself up to identity theft, hacking, fraud, and experience demonstrated to me that the minute I shut that off, that side of things just disappeared.

Maurice Jackson: So to make my purchase, I can do it with a check, a wire, and ACH, is that correct?

Andy Schectman: Yes, sir.

Maurice Jackson: All right, sir. Last question for you here. Or actually, two. Let me ask you, my favorite one here is, what keeps you up at night that we don’t know about?

Andy Schectman: I don’t like the way the things are going in this country, and with the success that we’ve had as a company, we have had great success this year, working 15 hours a day, seven days a week, but there’s nowhere to go and nothing to do. And kids going back to school, but doing so online, and the destruction of the economy right in front of us, and I just don’t like the path we’re heading down. I think this winter as we head towards the election is going to be incredibly bumpy. And I think it’s going to come with some very scary things. I live in the epicenter of stupidity and insanity in Minneapolis, and it’s been one thing to make it through what has been a really beautiful summer weather-wise, but I can’t imagine what it’s going to be like here in the northern states come wintertime, when the restaurants that are working 20% or 30% capacity, hanging on by a thread, are forced to shut down.

And all of the other establishments that are just hanging on in the winter, I think most of them will just go by the wayside. And I’m very concerned about what things look like over the next few months. And so I guess preparation is very important. People forget it’s just a few months ago in March and April when people couldn’t find bottled water and toilet paper anywhere. I think that that was the front edge of the storm. And I’ve been saying recently that I think we’re in the eye of the hurricane right now, people have been lulled into a sense of complacency, but I think the trailing edge of the storm is coming. And don’t forget that we had the repo market crisis last September before any of this happened. The banks have been hanging on by a thread for the past 10 months. Many of these banks have loans made to companies that are either bankrupt or close to being bankrupt.

And don’t forget about real estate and commercial real estate and all of the things that are dependent upon loans and credit. These banks are in big trouble. I think we’re in trouble as an economy, Maurice, and if anything keeps me up at night, it is that my success will come at the expense of everything around me that I love. Sitting at a bar, watching a Twins game, eating a hamburger and a beer. I can’t tell you what I’d pay for that right now, but it’s just, those are the kinds of things that mostly looking through my kids’ eyes that keep me up at night above all else. And I’d like to be optimistic and hope things turn around for us sometime soon, but I guess I just can’t logically get to that point yet. I think we’re too far away from seeing anything like what was last year, we’re a long ways away from that. And that keeps me up at night more than anything,

Maurice Jackson: I’m a vegetarian and you’re referencing the hamburger, but I just find it disgusting that you would want to watch a Twins game. Last question, sir. And that is, what did I forget to ask?

Andy Schectman: You didn’t forget to ask anything, Maurice, you asked the right questions. There are opportunities in ratios, and there’s an opportunity in platinum, there’s an opportunity in silver, there’s opportunity to sell Dow and to get on the sidelines before things get crazy. You asked the right questions, you made the right statement.

Maurice Jackson: Well, thank you, sir, and it’s a pleasure as always, but before we close, for someone listening that wants to contact you, please share the contact details.

Andy Schectman: I can be reached directly at andy@milesfranklin.com. That goes right to my cell phone. Please sign up for our newsletter, it’s free, seven days a week, at milesfranklin.com. On the homepage, sign up for our newsletter, and it’s a good way to stay in touch and in contact with what’s going on. In the meantime, I wish you and all your listeners prosperity and health and safety and good fortune moving forward.

Maurice Jackson: And if you visit Proven and Probable, on the right-hand column, you will see a link for the Miles Franklin newsletter as well. I’m a licensed broker for Miles Franklin Precious Metals Investments where we provide unlimited options to expand your precious metals portfolio, from physical delivery, offshore depositories, and precious metals IRAs. Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com.

Mr. Schectman, it’s been a real pleasure speaking with you today. Wishing you the absolute best, sir.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Maurice Jackson and not of Streetwise Reports or its officers. Maurice Jackson is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Maurice Jackson was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Source: Bill Powers for Streetwise Reports 09/08/2020

Orefinders CEO Stephen Stewart tells Bill Powers of MiningStockEducation.com about his company’s plans for three discovery campaigns in historical and prolific mining districts in Ontario and Nevada.

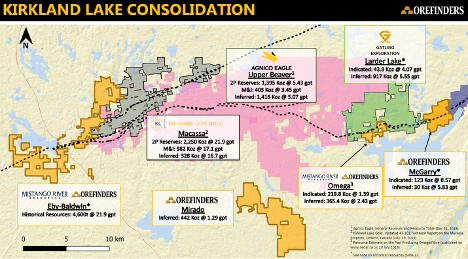

Eric Sprott invested in Orefinders Resources Inc. (ORX:TSX.V) in February 2020 due to the discovery potential at its numerous projects in close proximity to Kirkland Lake Gold Inc.’s (KL:TSX; KL:NYSE) world-class Macassa Mine. Only after Sprott’s investment did the market begin to awaken to Orefinders’ compelling investment value proposition.

Over the last five years, Orefinders operated under the radar and quietly assembled a portfolio of assets in the Kirkland Lake area that CEO Stephen Stewart believes could one day deliver “that billion-dollar drill hole.”

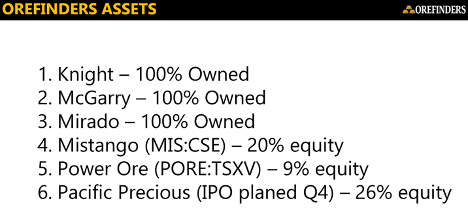

Orefinders is a gold explorer with the third largest land package on the Ontario side of the prolific Cadillac Break in Canada, and is about to commence on six to nine months of nonstop drilling at its projects. In addition to the tremendous discovery potential, the company has an approximately one-million gold-ounce resource (historic and NI-43-101) at its three projects combined, as well as three control block positions in three prospective junior miners.

In this interview, CEO Stephen Stewart explains the inherent value within Orefinders as well as the blue-sky discovery potential.

Bill Powers: I’d like you to start off by sharing a little more about your background, your group’s background and your past success. I don’t think the market is aware fully of your past success, which you shared with me back in February when we were originally chatting about your company. Please share a little more about your background.

Stephen Stewart: Sure, happy to. So, I grew up in the mining industry. My father was a mining lawyer and I always worked side by side with hi and I still do. He’s still involved in all of our companies. In a sense, I grew up discussing and thinking about this industry at the breakfast table and the dinner table.

Formally speaking, my background is in finance. So I understand how money works and how things are valued. That’s really been my focus and I apply that toward the junior mining industry, which isn’t really high finance but, certainly in dollars and cents, matters.

And in terms of my past successes, our group, I guess, largely is known for being the assembler of what became the Cote Lake project. We drilled a discovery hole and we were significant shareholders in Trelawney when it was sold back in 2012 to IAMGOLD Corp. (IMG:TSX; IAG:NYSE)for over $600 million; almost $700 million. So, that was one of our big wins.

And we were also involved with the early days of what’s now called the Ring of Fire in northern Ontario, which is a phenomenal world-class deposit up there that sadly has fallen on hard times due to infrastructure and issues. . .[E]ver since 2015, we have been involved with Orefinders and other companies that are in its portfolio.

Bill: When a new speculator or investor is looking at a potential exploration and development company, one of the things, as you know, we need to look at is the management’s perspective. Can we trust them with our money? And one of the first things you look at to see is how do they compensate themselves. Share a little bit about your perspective on the whole idea of founder shares, options. How have you bought your shares? When do you plan to sell your shares?

Stephen: Okay, good question. Firstly, I pay myself $10,000 a month. Very simple. In terms of founders’ shares, there are zero founders’ shares that I have received from Orefinders, or actually from any of the companies I’m involved with, and I’m involved with a few. So I have bought, with cash, every single share that I own, vis-a-vis on market or in a private placement. And I typically participate in every single private placement I’m involved with—not everyone, but most. So I am directly aligned with shareholders, in that sense.

Bill: If someone sees you selling in the open market, what should they think?

Stephen: They should sell too. Frankly, unless we have a tremendous success and we are multi-dollar stock, I don’t believe that anybody sitting in my seat should be selling their shares while trying to convince the public that they should be buying those very same shares. That sends the wrong message. We are in this to make a discovery. We are in this to sell this company and make money, just like the rest of our shareholders.

And I’ll note that I do pay myself, of course, a salary. I think I earn every penny of it. But I will also note that in the last number of years, I put more money into this company than my salary by quite a distance, I would imagine. I own about 5 million shares Orefinders.

Bill: So you’re an investor even more so than an employee?

Stephen: Well, that’s the only way I’m going to make money. I mean, nobody got rich off a salary. I’m in this business to make substantial money. And I think with Orefinders, we’re in a good position to do that. So, $10,000 a month pays the rent, so to speak, but I’m here to make 10, 20, 50 times my money.

Bill: Stephen, when we spoke 18 months ago, I remember you sharing with me that your approach was to acquire assets. And at that time you weren’t particularly focused on drilling because you just didn’t feel like the market would reward that, and that, at that time, it wouldn’t be in the best interest of shareholders.

However, when we spoke in February this year, your mentality and your outlook seemed to change. Can you talk to us now about what you’ve done in the last few years with Orefinders to set yourself up for what you’re about to do right now?

Stephen: Sure. Well, you’re absolutely right. From 2015 to December 2019, Orefinders had a very clear philosophy, which we were very forthright with investors. And we said, “We refuse to drill, all else equal.” It just didn’t provide the appropriate return on investment, which we seek, which starts at 10 times your money.

And also, the cost of capital was too high, meaning we had to give away 25%, 30% of our company to do any drill program of significance. So our share price was too low. And if you met or exceeded expectations, it was often met with the liquidity event.

Now, if you made a world-class discovery, like a Hemlo or a Voisey’s Bay, that would have been superseded, but that’s not really an investment proposition that we were interested in. We’re most interested in mitigating the risk.

And so we saw the opportunity to take advantage of the market. The market was a down market, and we could buy other people’s projects that they were having a hard time raising money for.

And so, Orefinders really developed this portfolio, we now have six assets. We accumulated them in a down market and perhaps more importantly, we accumulated them largely out of distressed, or call it unique, situations. We bought problems that we believe we can sell.

And now, if people go to our [Dec. 30, 2019] news release, we announced before gold really started to move. We felt that the pivot was in place. And what I mean by that, it was time to go back to the drill bit. We feel, and felt, that investors are going to start to pay for quality results and discovery.

And so we’ve developed this portfolio, we bought it cheap, and now we’re cashing ourselves up. We’ve got $2 million in the treasury. We’ve got another probably $8 million in marketable securities. And we just announced a $2 million financing that’s closing in a few weeks; that’s going to give us a great position. And now it’s all about putting the money into the ground and looking for that billion-dollar drill hole that we seek.

Bill: Great. I want to talk about the fundamental value in your company. So if I do just some quick back-of-the-napkin math, your market cap, as we speak is about $20 million, and your enterprise value would be about $10 million. Is that correct?

Stephen: That’s fair to say with our cash. And if you strip out our cash and marketable securities, yes.

Bill: Okay. So with a $10 million enterprise value, let’s first talk about your projects, your three projects, Knight, McGarry and Mirado. Where’s the value currently, before you begin to drill these projects?

Stephen: Well, I guess you could say the value is retained in the ounces in the ground, and not all ounces are created equal, as we should know. However, each of those projects has 43-101 historical ounces in the neighborhood collectively, of about a million ounces. And you can attribute all sorts of different multiples on a per ounce basis.

But if you’re going to attribute a million dollars relative, or a million ounces relative to our market cap, that’s $10 an ounce, which is extremely low. So I think our enterprise value is quite attractive, at this point in time.

Bill: Then you also have three equity stakes in companies. Talk to us about this please.

Stephen: That’s correct, we own three positions—I would say control block positions—one in Mistango River Resources (MIS:CNS.X), which we acquired vis-a-vis a hostile proxy battle that ended last year. And we’ve got a very exciting project in Kirkland Lake that we’re going to be drilling extensively very soon; it’s right beside all of Orefinders assets as well, so that’s why we got attracted to that project. As well we have about an 9% position in a company called Power Ore (PORE:TSX.V). It owns a very sexy copper-gold, very large-scale mine that was operated by Falconbridge. They took out 1.5 billion pounds of copper; a million ounces of gold out of that. And we spun that off in 2018 because. . .we had a non-core asset that we weren’t getting any value for—it was not a gold asset—and then went on to create that company.

And then last we’ve got a 26% interest in a company called Pacific Precious. Pacific Precious is a private company, and its planned IPO [initial public offering] is later this year, in Q4. It’s led by a gentleman by the name of Ron Stewart. Ron is not related, we just happen to be from the same clan in Scotland, if you go back far enough, I suppose. But that focus is going to be in Nevada. It controls a project, right beside Barrick Gold Corp.’s (ABX:TSX; GOLD:NYSE) Goldrush, which is a monster deposit. And I think investors can anticipate that company to grow in terms of its portfolio in Nevada as well.

Bill: Okay, so you’re raising $2 million. You’ll have about $4 million in the treasury. How are you going to spend that to advance these projects?

Stephen: We’re going to put as much of that into the ground as possible, as I said before, and as we said in December. We believe the time is now to put it into the ground and make a discovery. The accumulation of these assets was phase one. Now phase two is to drill.

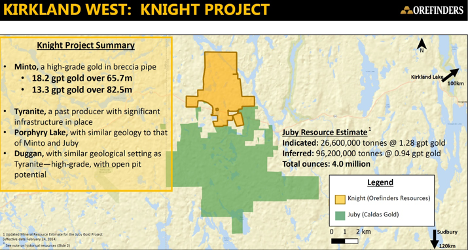

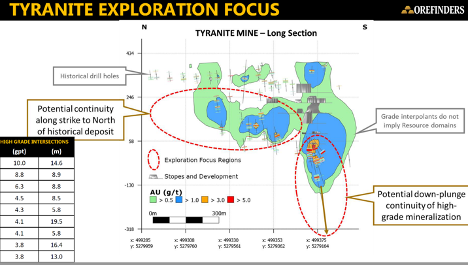

And so, a couple of weeks ago, we put out a news release that we’re going to be drilling our Knight project, which is just 60 kilometers west of Kirkland Lake. We’ve got 5,000 meters planned. I think investors can expect us to probably double that when we close this financing. So that’ll be our first drill program. It’s got a very attractive discovery drill target on it. We’re going to put about 10% of those meters into [a] discovery target. It’s sort of binary. If we hit it, it’s going to be very interesting, potentially game-changing. If we miss it, it’s no big deal.

The vast majority of those meters are going to go toward our Tyranite project, which is an existing high-grade mine, more traditional style. It’s got very good historical intersects. Now we’re going deeper and we’re going laterally. So we’re going to be expanding those resources. So, that’s our first drill program on the Knight.

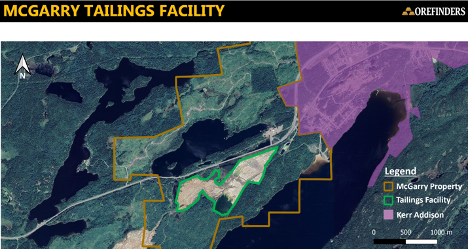

Then we’ll subsequently pull the drill over to our McGarry project, which is about 20 kilometers west of Kirkland Lake, and it’s beside the Kerr-Addison, which was a world-class, 12-million-ounce, high-grade producer. We have the same style of mineralization on there. Again, we’ll have a sort of a two-pronged drill program approach. One is some. . .lower-hanging fruit on known mineralization, which is right beside the Kerr-Addison. We’ll look to expand our existing resource there, which we have an eight-gram per ton resource there.

But also, [on] the McGarry, there’s about a kilometer and a half of strike length on the Cadillac Break, which is a world-class fault, where all this gold in Kirkland Lake came from. It’s really never been drilled. And so that’s going to be the discovery aspect, and investors can expect us to come out with probably a 7,000- or 8,000-meter drill program toward the end of this year on that one as well. So, details to come forth on the McGarry.

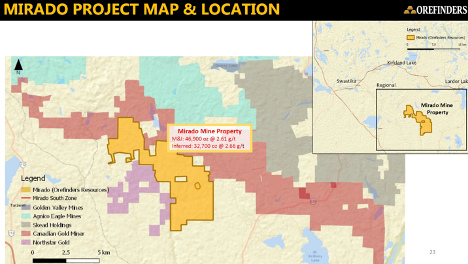

And our last project is called Mirado. We’ve got about 450,000 ounces in an open pit there. We view that as having multimillion-ounce potential, but it’s really just a function of drilling it out. Without getting too technical, it’s just step-out drilling, but there’s definitely potential to grow that.

And. . .I’ll note that on our McGarry, our Knight and our Mirado. . .we have direct exposure to in Mistango—[all are] very proximal. They’re all next-door neighbors. And that was by design, certainly not by accident.

I do believe that—and I’ve been vocal about this—mergers and acquisitions are inevitable in this industry, and Orefinders, Mistango and all of our properties have really put ourselves in front of what we see as a coming wave of mergers and acquisitions. Not that we’re waiting on being bought out, far from it. We’re going to go and drill our own properties and see what happens. But, we plan to make ourselves so attractive that the big guys, the guys that build mines and operate mines, just can’t resist.

Bill: Stephen, speculators that focus on Canadian mining stocks will understand the significance, geologically and location-wise, of your projects and why it’s so good. But perhaps [some] don’t pay as much attention to Canada, or maybe they’re newer to investing and speculating in mining stocks. You mentioned Kirkland Lake—can you elaborate a little more on the grade and the resource at Kirkland Lake and why where your projects are located is excellent?

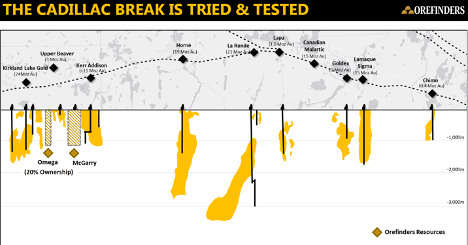

Stephen: Sure. Well, Kirkland Lake can be defined as the third largest gold ore body in the history of the world. Not many people know that, but Kirkland Lake or Kirkland Lake Gold, the corporation, now mines the highest-grade mine in the world. It’s called the Macassa, and the Macassa, next year, is going to be pulling out 400,000 gold ounces at nearly 20 grams per ton, which is just phenomenal.

And they’ve just made a new discovery there called the South Mine Complex, which they think is going to be putting that mine in operation for the next 30, 40 years. I mean, so who said mining is not sustainable? And so that is, I guess, the big dog in Kirkland Lake town; the Kirkland Lake mine.

Now, just about 20 kilometers to the east of that is something called the Kerr-Addison, and I mentioned that before. We’re right beside that on the McGarry. That mine was also, in its day, world-class.

And these two mines really are the goalposts of the Cadillac Break on the Ontario side, which is by no exaggeration is a world-class fault system—which is just a crack in the earth where this hydrothermal fluid carrying the gold can seep into and deposit this gold over millions of years.

There is another orebody lurking in between those two world-class monsters. And we are the third largest landowner collectively in that region, between those two projects, aside from Kirkland Lake Gold, themselves multi-billion dollar company, as well as Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), the other major in the area. So those are the two big dogs and then it’s us. So we think we are phenomenally well positioned.

Bill: I also think it’s unique that at your McGarry project, you own a tailings facility right next to the Kerr-Addison. So as I was going through your presentation, the word that came to mind was “ransom.” It’s almost like you have a ransom on that project, don’t you?

Stephen: Well, I don’t know if I’d use that word, but certainly strategic would be the word that would come to mind. The Kerr-Addison itself right now, as I said, is shut down. It was a high-grade underground mine in 1996, but it has been reinterpreted into an open pit-type of a deposit. . .It’s a big deposit too. So that’s going to get a lot of attention. And, as you know. . .Orefinders owns the tailings facility on its McGarry project. That is not an insignificant fact.

So it is my belief that whoever buys the Kerr-Addison—and somebody is going to buy the Kerr-Addison, somebody large I think—they are going to require our property because they need to put that waste material somewhere. Now, again, that’s not our strategy, but that’s a nice card to have in our back pocket.

However, the McGarry, I think, offers the potential to discover its own Kerr-Addison 2.0 on it. And that’s ultimately why we’re there. We’re not there to be in a blocking position. We’re there to discover an ore body and sell it to the highest bidder. But if having the tailings facility is a plus, well, then we have that plus.

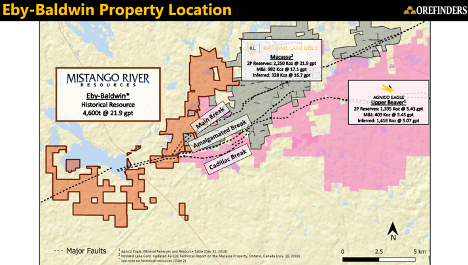

Bill: What about Mistango River Resources, one of your equity positions. Eric Sprott invested in this company as well. Talk to us about the prospectivity that the Orefinders investors would get through the stake in Mistango.

Stephen: Orefinders owns 20% of Mistango, and you’re right, Mr. Sprott came in. Actually, he came in on four separate occasions this year, two times into Orefinders and two times into Mistango.

And Mistango has $4 million in its treasury right now. It announced a $3 million financing, contemporaneously; it announced the same day as the Orefinders. It’s a broker deal done by Echelon, and we’ve got large institutional names coming in. And I certainly hope Mr. Sprott is going to come in again—we’ll make that announcement at close.

And it is going to be drilling. It is in the process of defining a very substantial drill program on its Eby-Baldwin project, which is directly beside the Macassa mine—which I told you about; that 400,000-ounce per year, 20-gram per ton gold deposit that Kirkland Lake Gold owns. The Eby-Baldwin, owned by Mistango 100%; it’s right there.

We believe it’s the same geologic setting, and it’s well financed to go and find a discovery on its own. What Mistango is seeking [are] a couple of intersections to prove that that Kirkland Lake orebody, which I mentioned—which has been mined for nearly 100 years, and is the third largest gold orebody in the world—we are trying to prove that it continues to go west onto our property.

And when I say continue, I mean, the Macassa is one of seven mines in history [that] have extracted from this ore body. We believe that Mistango has the eighth, and we will, come closing this financing, have $7 million worth of drilling to go out there and prove it. If we do, then, oh boy, is that 20% that Orefinders owns going to be worth an awful lot.

Bill: And Pacific Precious—if you could give us your commentary on the speculative upside.

Stephen: What’s going to happen there is that Orefinders owns 10 million shares. It’s going to dividend out at least 5 million of those directly to our shareholders as a part of the IPO process. So Orefinders shareholders can expect a zero cost-basis dividend coming to them by the end of the year.

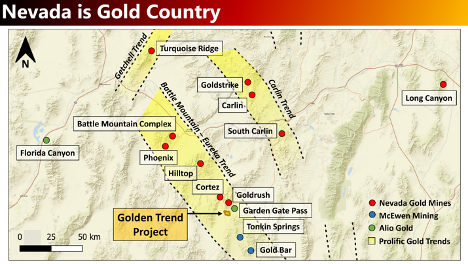

It owns a project called the Golden Trend, which is again, contiguous. . .I guess we like contiguous projects. . .but this project is contiguous to Gold Rush, which is nearly a 15-million gold ounce, 10-gram per ton, monster deposit owned by Nevada Gold Mines, which is the joint venture between Barrick and Newmont Corp. (NEM:NYSE). This is a monster mine. We believe we are in the same geological context; this is in the Cortez Trend. It is really the Beverly Hills 90210 zip code to be in for gold mining.

So, that is a very prospective project that Pacific Precious is going to raise money for in the very near term, and put some holes in there and try to find a deposit. In addition to that, you can expect the leadership, led by Ron Stewart, to go out and acquire additional projects.

We love Nevada. Well, we love. . .First all, I love Ontario; I love Quebec. There’s no better place to do business. If we’re going to do business anywhere else, it would be in Nevada. And so that’s giving us, and Orefinders shareholders, direct exposure to Nevada.

Bill: With an enterprise value of about CAD$10 million, just with the funda

mental value within the company, I find that compelling before the speculative blue-sky potential. And then Stephen, just to recap here with your position in Pacific Precious, Mistango, and the three projects, how many projects will be drilled, let’s say, within the next six months, and potentially more value created?

Stephen: I think, once we close this financing, we’re going to be drilling in just a matter of days. I don’t anticipate we’ll stop drilling for the next six to nine months. That’s my plan.

So we’re going to start drilling on the Knight. We’re probably going to double that to 10,000 meters. We’re going to have at least 6,000 to 8,000 meters on McGarry. And then, last, we’re going to drill our Mirado project, which was our first project, but certainly doesn’t deserve to be mentioned last.

Those three projects are going to get an awful lot of attention. As I said off the top, we spent an awful lot of work putting together this portfolio, with the idea that when the time is right, we’re going to raise money and put it into the ground, and the time is now. And so our shareholders can expect us to do exactly what we said we’re going to do. And we’ll see if Mother Nature cooperates.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Orefinders Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Orefinders Resources is a MiningStockEducation.com advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Images provided by the author.

( Companies Mentioned: MIS:CNSX,

TSXV:ORX ,

)

Central Banks Still Buying Gold

The New Puritans Are On The Prowl

This is clearly not the first time in history that a small number of crazy people end up causing havoc and devastation to an entire society… by Simon Black of […]

The post The New Puritans Are On The Prowl appeared first on Silver Doctors.