Source: Michael Ballanger for Streetwise Reports 06/29/2020

Sector expert Michael Ballanger breaks down the Canadian government’s monetary policies, and offers an anecdote drawing correlations between positioning in gold now and positioning in gold in the 1970s, before the commodity’s “parabolic” ascent.

As I sit here on a Thursday evening, contemplating the logic behind my most recent additions to a highly tentative short position on the SPY:US (the exchange-traded fund [ETF] tracking the S&P 500), I am doing everything in my power to not take my quote machine and project it into the watery abyss of lovely Lake Scugog.

If there were a number of politicians or central bankers lined up on the shoreline, I would not hesitate to fire off a volley of quote machines, cellular phones, portable chargers, paperweights, ash trays and medicine balls all in a concerted effort to decapitate the singular most useless collection of heads ever assembled on any shoreline, notwithstanding the fact that the bodies would only float on a one-inch layer of water, while the weeds, algae and flotsam exist in the four feet to the lake bottom (not that anyone can see it after June 10).

The venerable Justin Trudeau, son of Pierre, the current prime minister of Canada and the son of the most treasonous politician in Canada’s history, has now officially assumed the role as the most incompetent human being ever to have been elected to public office in any jurisdiction north of the 49th Parallel. Not only is he the most incompetent, he is arguably the most malleable elected official in the history of post-Magna Carta politics, kowtowing to every liberal cause that surfaces while carefully turning a blind eye to corporate malfeasance in order to protect donations.

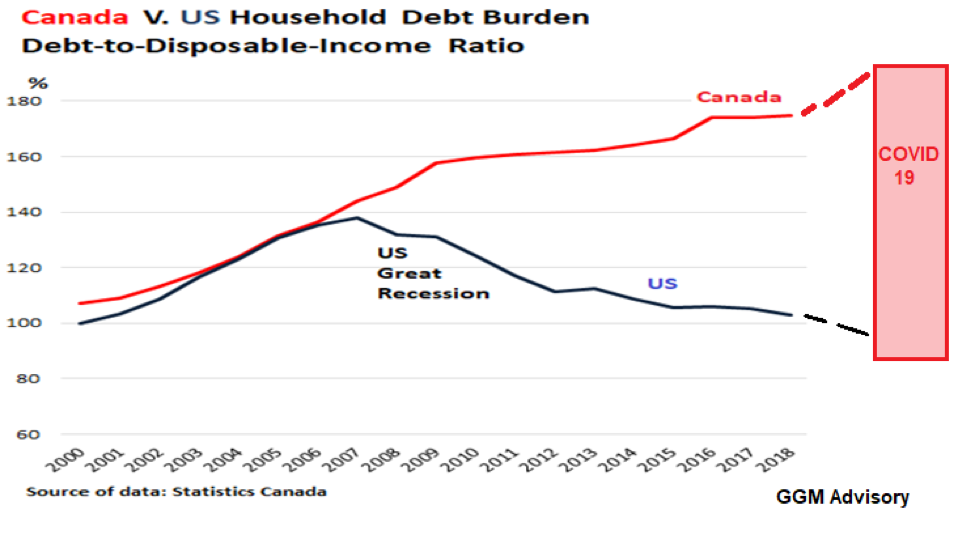

Under the stewardship of Monsieur Trudeau, Canada has finally forfeited its AAA rating by the bond market handicappers. Layer upon layer of government debt has been added to the already burgeoning household debt figures, and thanks to the Canadian banking industry’s shameless practice of laundering illicit Asian money in order to pump up the real estate bubble, young citizens are taking on massive mortgage exposure just to get a roof over their heads close to the workplace.

Canada is now rated alongside Portugal, Italy and Greece in terms of credit “worthiness.” This is not because it is without natural resources or a sophisticated, educated labor force; the country is rated like a banana republic for two reasons. The first is the sub-par quality of its leadership and the second is its educators, the incredibly powerful Canadian Teachers Federation, is actively promoting the idea that liberal is “good,” conservative is “bad,” and that “Modern Monetary Theory” can be implemented to remove all financial responsibility as an obligation of success.

Job losses due to shrinking global trade are replaced with government paychecks because, after all, it was not the fault of the worker loading pallets onto trucks that the employer could not afford to use him anymore. Justin and his band of spendthrifts throw money at the unemployed pallet loader and then backstop the employer’s junk bond issue with yet another bailout, thus covering both ends of the voting spectrum with money printed in a manner most popular with Federal Reserve Chairman Jerome Powell—digitally.

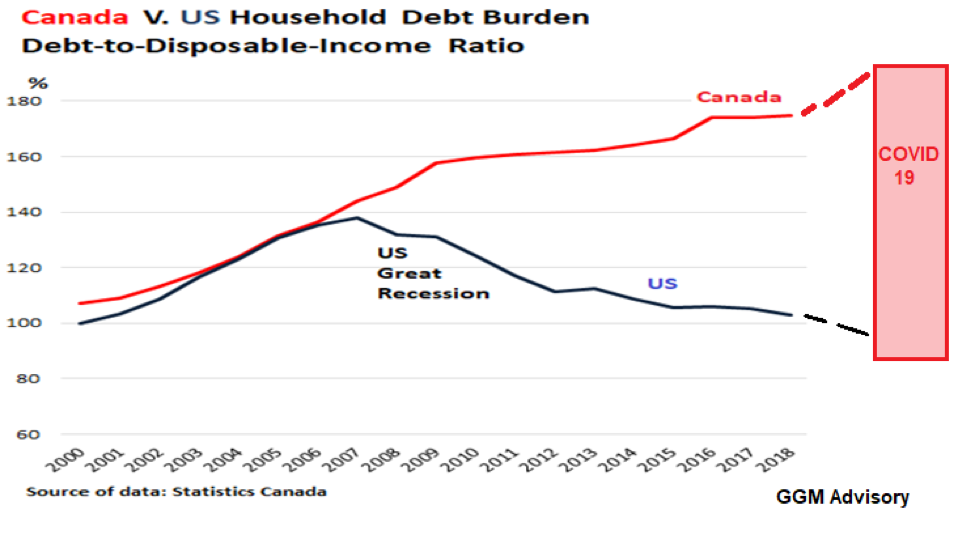

The percentage of household debt to disposable income is today approaching 180%, and that is a meaningless number to most until one sees that at the peak of the U.S. housing bubble in 2007, that number peaked at 140%. The U.S. is certainly no ideal model of sound money practices either, at the household or the federal level, but one can see that the trend in the U.S. is down while Canada (at least as of two years ago) was accelerating. With the insanity of the liberal government reaction to the pandemic and economic collapse, the Canadian numbers are certainly no better today.

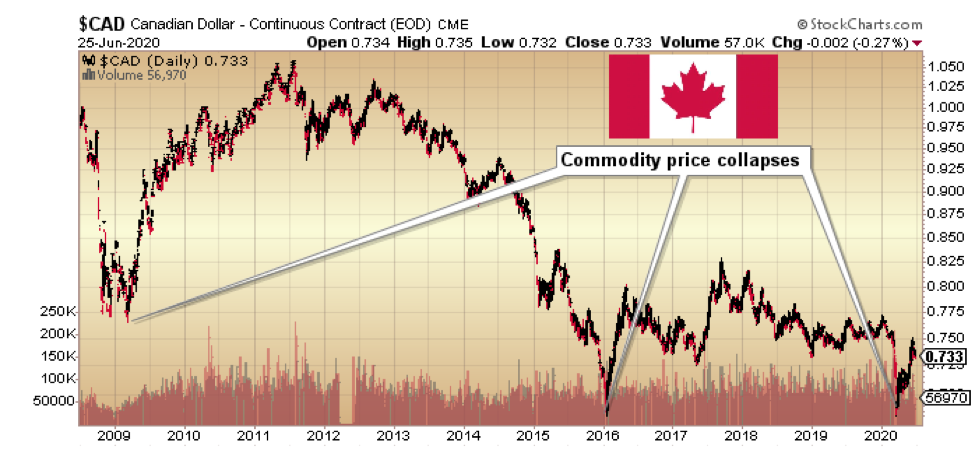

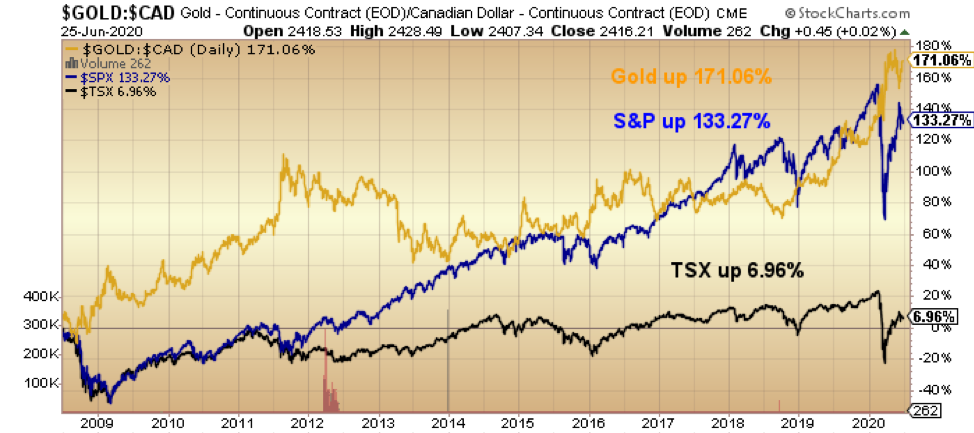

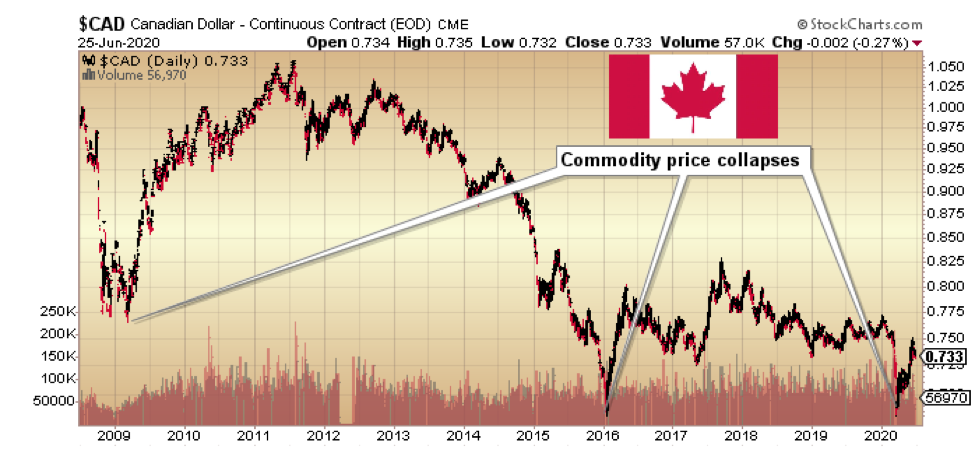

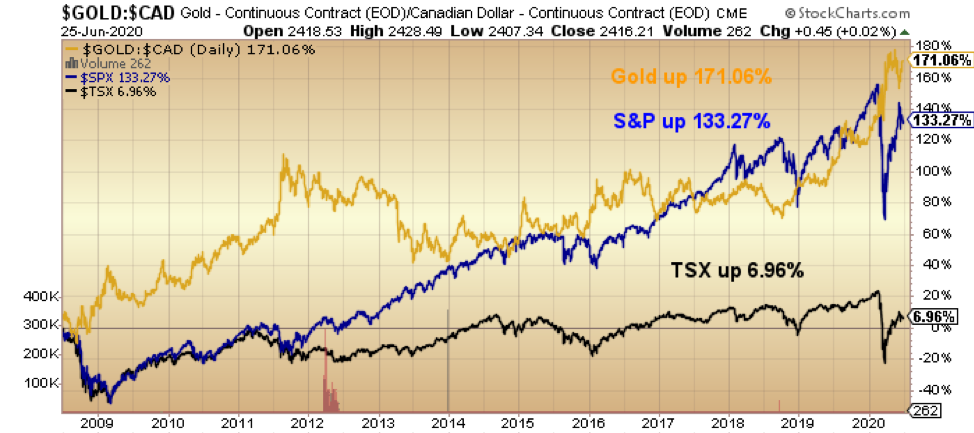

The Canadian currency has been on a roller coaster ride since the lows of 2009, and has been almost perfectly correlated to oil prices. But for Canadians, the significance of the CAD/USD relationship lies in how gold has responded since 2009, in light of the fact that neither the Bank of Canada nor the Canadian treasury owns as much as a single ounce of gold.

At the lows of Q1/2009, had the average Canadian sold all bonds and stocks and simply bought gold, he/she would be ahead 171.06% in that time frame. In the same period, the TSX is up a hair below 7%. The S&P 500 is up 133.27% in U.S. dollar terms, but a striking 215% when the currency gain is calculated.

Nevertheless, the point I make is that for a country that has just seen its credit rating slashed and whose household finances are, on a per capita basis, simply dreadful, its citizens have an urgency to place a significant portion of their investible net worth into gold. Currencies of countries that get downgraded tend to experience sustained and significant drawdowns in purchasing power, so Canadians that are ten to twenty years from retirement should not be relying on traditional sources of capital (like one’s residence) to make up the shortfall.

Foreign investors need not worry about Canadian markets as long as they stick to precious metals producers and developers, because any domestic currency risk will be offset by the domestic hedge that Canadian gold producer/developers hold through ounces in the ground. In fact, valuations could be accentuated because of rising cash-flows and increased dividend payouts.

As we approach the end of June and move into the seasonally strong period of August-to-May for precious metals, I deem it important to relate a story from the 1970s, when I was a trainee for a big Canadian brokerage firm (McLeod Young Weir Ltd.).

There was an Irishman named “Jimmy” who, in the early ’70s, before gold exploded, was one of the “marginal” producers in the Toronto branch. He came in every morning with a brown paper bag full of sandwiches and a cookie and quietly went about his business of calling his clients and discussing his strategy for the next five years. Not too many people paid any attention to Jimmy because he had little to say about stocks and nothing to say about bonds; he never bought any of McLeod’s underwritings and he never read any McLeod research.

Many around me wondered why he was still employed but somewhere around 1977 (shortly after I entered the training program), I got to know him because he would give me these European reports on a group of companies called the “South African golds,” and they absolutely fascinated me. Why, I thought, was this man accumulating all these 10-cent and six-cent and 15-cent South African gold miners? Was South Africa not a risky place to do business? Was apartheid not attracting the scorn of the world with increasing frequency?

One afternoon in 1978, I saw the brokerage rankings for the firm, and Jimmy had inexplicably vaulted from back-of-the-pack to the Top Five in the entire firm. I raced over to congratulate him and asked him how he did it. The story he told me changed my life for many years.

He began to doubt the U.S. dollar’s role as the world’s reserve currency after listening to a 1969 European speech by former French President Charles De Gaulle, in which he told a group of French business leaders that France would no longer accept American dollars as payment for bonds that were maturing. Instead, they would choose to receive gold, because back then the U.S. dollar was exchangeable for gold at a predefined ratio.

As this trend accelerated due to Vietnam War costs and other profligate spending by the U.S., it became apparent to President Nixon that if it continued, Fort Knox would be stripped of its gold. Shortly thereafter, the gold exchange “window” was closed, and the Bretton Woods agreement was shelved, thus allowing the gold price to freely float as opposed to the U.S.-imposed “peg” at US$35 per ounce.

Jimmy saw this and started to put all clients into a group of South African gold miners (“ADRs”), but his top pick was a stock called “Vaal Reefs,” which he was buying at around US$1.00 per share. He explained to me that it had a dividend at $0.20 per annum, so while other brokers were buying the Canadian banks at 5% yields and long Canadas at 8% yields, Irish Jimmy was buying this obscure gold miner at a 20% yield, with gold then at US$200 per ounce.

By 1979, gold had moved from US$200 to $500, but what turned out to be “the wonder of commodity price leverage” was that Vaal Reefs management, in keeping with their dividend payout policy, had been steadily increasing that dividend. By the time gold started its parabolic ascent to US$857 in 1980, that $0.20 dividend had grown to $1.00, which was the original price Jimmy had paid for his shares! Needless to say, by 1980, Vaal Reefs had something like a $2 dividend and traded north of US$30.

Jimmy had started his career in the investment business in 1968 with a $5 million book of clients, but by 1980, his wizardry during the Great Inflation of the Seventies, focusing on the leverage of rising dividends during a commodity boom, grew his book to over $300 million. After that, he sold all positions in the South Africans, sent his clients all of their money, and promptly retired.

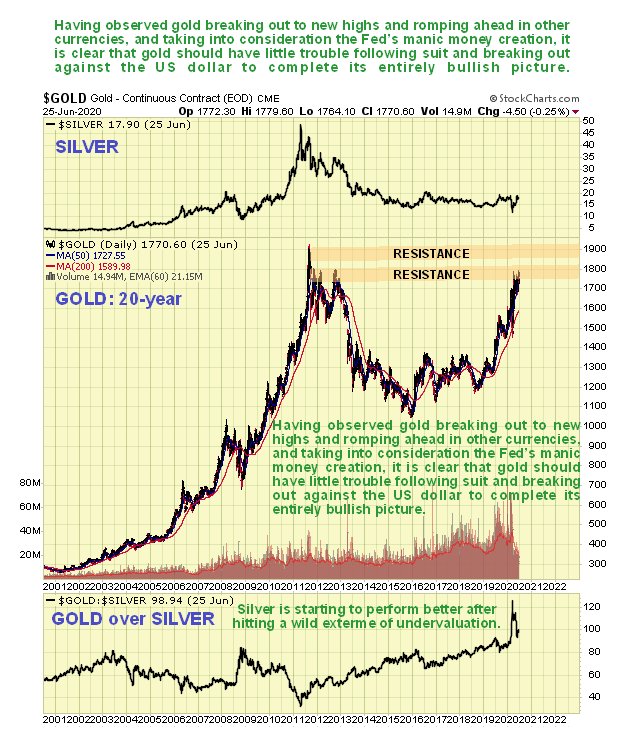

That is precisely what I envision in the coming months and years, as a direct result not of “profligate wartime spending,” as in 1968, but of the total disrespect by central banks the world over for the sanctity of currency purchasing power. I urge all of you to remember the story of Irish Jimmy, who placed faith and trust in gold as a bastion of financial prudence and was rewarded by clients and the fates for his efforts.

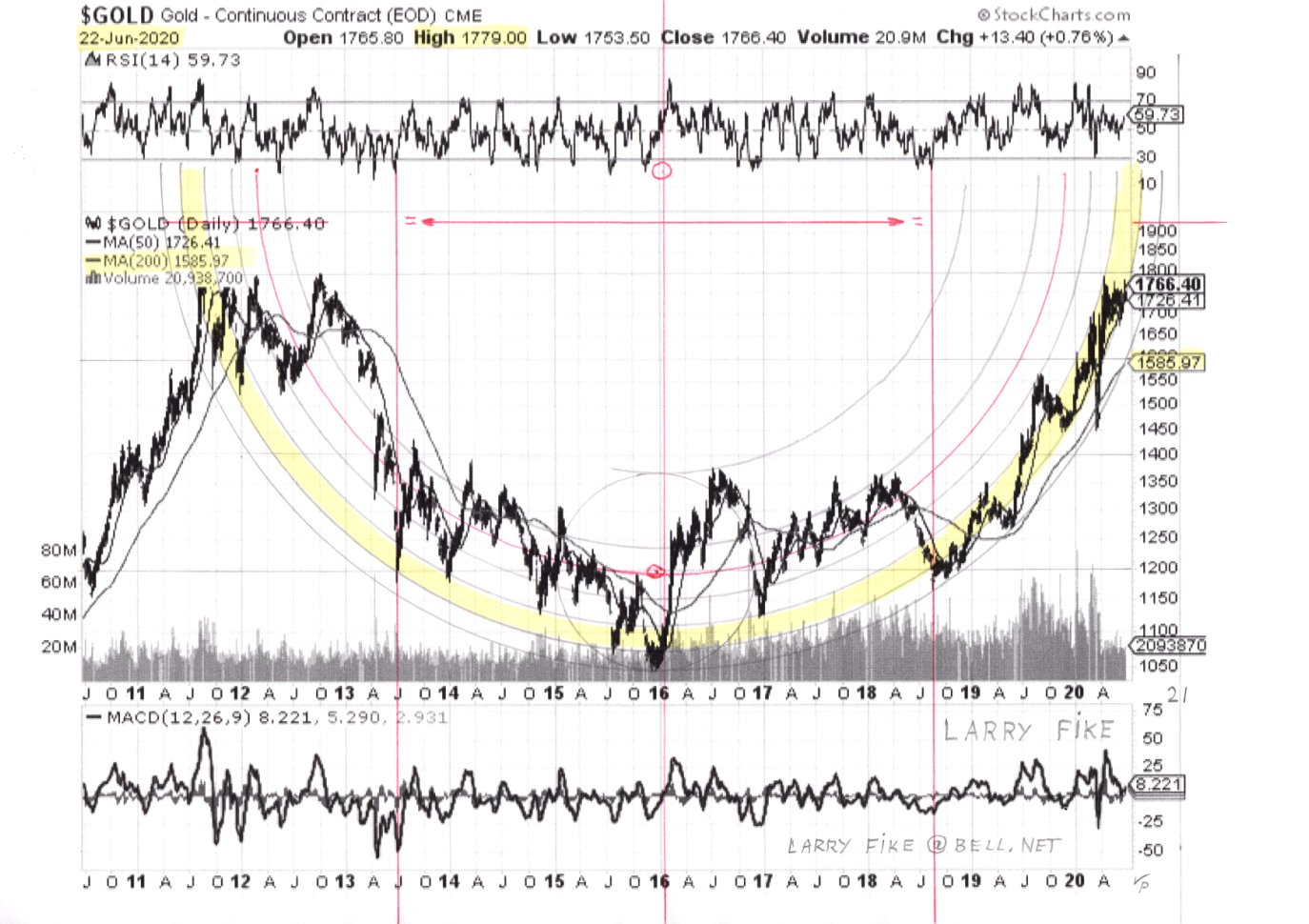

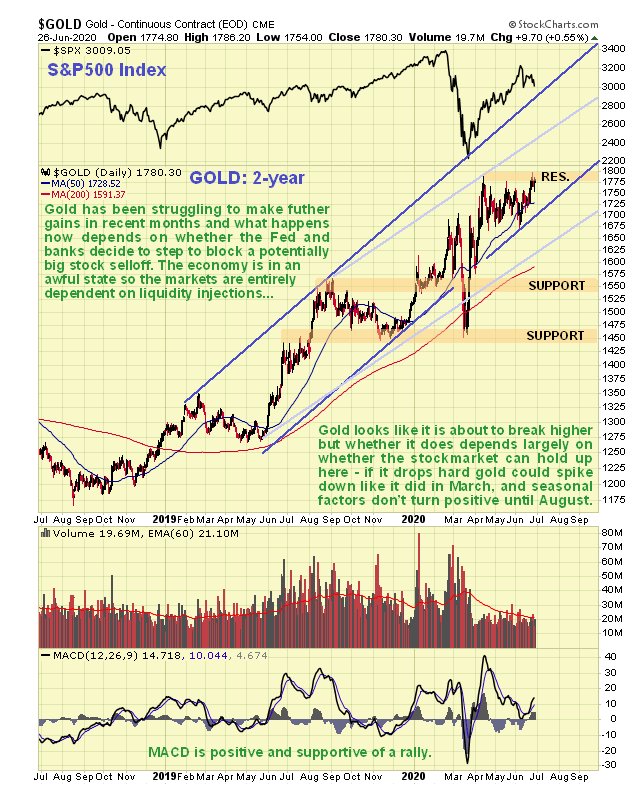

We are in the early stages of a Seventies-style enrichment event, and the vehicle of delivery is gold. I see another month of sideways action, and then all hell is going to break loose.

You want to be positioned.

Originally published June 26, 2020.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Sources: Federal Reserve Board of Governors, ICE Benchmark Administration, St. Louis Federal Reserv [FRED]

Sources: Federal Reserve Board of Governors, ICE Benchmark Administration, St. Louis Federal Reserv [FRED]

“First, in the short run, some caution is warranted. While U.S. equities still look attractive relative to Treasuries for the long run, there is a significant risk of disappointment in either the medical data or the economic numbers. This suggests the need to hedge equity exposure using either high-quality, long-duration bonds or, better still, more explicit hedging techniques.”

“First, in the short run, some caution is warranted. While U.S. equities still look attractive relative to Treasuries for the long run, there is a significant risk of disappointment in either the medical data or the economic numbers. This suggests the need to hedge equity exposure using either high-quality, long-duration bonds or, better still, more explicit hedging techniques.”