Author: Gold News Club

What Presidents Are on Coins and Why?

Abraham Lincoln appears on the penny, Thomas Jefferson is on the nickel, Franklin D. Roosevelt is featured on the dime, George Washington adorns the quarter-dollar, and John F. Kennedy is honored on the half-dollar. Ever wonder how certain presidents ended up being featured on American coins?

Learn about each president’s place in the history of American coinage and why each leader was chosen.

Abraham Lincoln on the Penny

The profile view of Abraham Lincoln first showed up on the front of the one-cent piece in 1909—nearly 120 years after the first U.S. penny was minted, and 44 years after he was assassinated. Lincoln served as our 16th president during the Civil War. He oversaw Union efforts to defeat the Confederacy, and he subsequently pushed for the abolition of slavery with the Emancipation Proclamation.

The first Lincoln penny came out 100 years after he was born. (While Lincoln didn’t live long enough to see his portrait on the penny, he did live long enough to see Congress’s passing of the 13th Amendment, which formally abolished slavery in the United States, on January 31, 1985.)

“A strong feeling had prevailed against using portraits on our coins, but public sentiment stemming from the 100th-anniversary celebration of Abraham Lincoln’s birth proved stronger than the long-standing prejudice,” the U.S. Treasury Department notes.

President Theodore Roosevelt commissioned sculptor Victor David Brenner to redesign the penny with Lincoln’s likeness on it. The coin was released to the public in August 1909.

Thomas Jefferson on the Nickel

The likeness of Thomas Jefferson, our third president and author of the Declaration of Independence, debuted on the country’s five-cent coin in 1938. This five-cent coin replaced the Buffalo nickel. The U.S. Mint issued the Jefferson nickel five years before the bicentennial of his birth.

The Treasury Department chose artist Felix Schlag to design the coin. According to History.com, Schlag based his left-facing profile of Jefferson in a period coat and wig on a marble bust sculpted by France’s Jean-Antoine Houdon. The back of the coin initially featured Jefferson’s Virginia home, Monticello.

As noted by the Thomas Jefferson Encyclopedia, the 1938 coin was not the first depiction of Jefferson on U.S. currency. In 1869, his likeness appeared on the $2 bill.

Franklin D. Roosevelt on the Dime

The likeness of Franklin D. Roosevelt, our 32nd president, replaced the image of Lady Liberty on the 10-cent coin in 1946. That was a year after FDR died.

FDR served the U.S. during two of our toughest times, the Great Depression and World War II. Accomplishments during his tenure include the New Deal, a series of government reforms designed to help pull the U.S. out of the Great Depression. A key component of the New Deal was the Social Security program.

The artist responsible for the image of FDR on the front of the dime remains a source of controversy. Some credit John Sinnock, the U.S. Mint’s chief engraver from 1925 to 1947. Others credit sculptor Selma Burke.

George Washington on the Quarter-Dollar

A portrait of George Washington, our first president, graces the front of the U.S. 25-cent coin. The U.S. Mint first produced the Washington quarter in 1932 to commemorate the 200th anniversary of his birth. According to CoinWeek, sculptor John Flanagan designed the iconic image of Washington.

Washington became president in 1789 after commanding the Continental Army during the Revolutionary War and presiding over the Constitutional Convention. The website for Mount Vernon, which was Washington’s Virginia estate, notes that the two-term president “played an essential part in shaping the role and function” of the presidency.

John F. Kennedy on the Half-Dollar

A coin representing John F. Kennedy, the 35th U.S. president, was conceived the day of his assassination, according to the National Museum of American History. JFK was shot to death on Nov. 22, 1963, while riding in a motorcade in Dallas.

Within hours of the assassination, Mint Director Eva Adams spoke with Chief Engraver Gilroy Roberts about depicting Kennedy on a coin, the museum reports. First Lady Jacqueline Kennedy chose the half-dollar for the denomination of the commemorative coin. Roberts designed the front of the coin, and Assistant Engraver Frank Gasparro designed the back.

The design change required Congress’s authorization, since law did not allow coinage designs to be changed more often than 25 years (and the current half-dollar was only 15 years old).

A little over a month after JFK’s death, Congress approved the Kennedy half-dollar to memorialize him with Public Law No, 88-253. The Kennedy coin was minted the following year in 1964.

In 1960, Kennedy became the youngest person ever elected president. He served less than three years. During that relatively short amount of time, JFK launched the Peace Corps, proposed comprehensive civil rights legislation, and challenged the U.S. to put astronauts on the moon.

His 1963 assassination “turned the all-too-human Kennedy into a larger-than-life heroic figure. To this day, historians continue to rank him among the best-loved presidents in American history,” History.com writes.

Ronald Reagan Coin & Chronicles Set

The U.S. Mint’s Ronald Reagan Coin & Chronicles Set pays tribute to America’s 40th president. The series include three sought-after coins: the 2016 1 oz. Proof Silver American Eagle, 2016 Reverse Proof Reagan Presidential Dollar, and the Ronald and Nancy Reagan Bronze Medal. Each coin set also comes with a special booklet about Reagan’s extraordinary life.

Ronald Reagan served two terms as president, from 1981 to 1989. Among the highlights of his White House tenure were bringing an end to the Cold War, enacting middle-class tax cuts, and bolstering the U.S. military.

“The eight years of the Reagan presidency was one of the most dynamic periods in recent U.S. history, resulting in a major refocusing of the nation’s social, business, and international agenda. Few presidents have enjoyed the affection of so many of the American people,” the Ronald Reagan Presidential Library & Museum notes.

Presidents aren’t the only iconic American figures on coins. There’s also Lady Liberty, the Marines of Iwo Jima, and America’s proud bald eagle. Call U.S. Money Reserve today to learn more about the various government-issued and guaranteed coins that are available.

The post What Presidents Are on Coins and Why? appeared first on U.S. Money Reserve.

How Long Will the Recession Last?

COVID-19 has resulted in the most rapid shutdown of economic activity that the U.S., or the global economy, has ever seen.— Jason Furman, economist and professor at Harvard Kennedy School[1]

“Are we in a recession yet?” It was the question on many Americans’ minds as we entered 2020. Declining corporate profits, an upside down Treasury yield curve, waning investment, and the trade war with China made a downturn seem inevitable.[2][3] It was.

The recession hit last February. Suddenly. And not how anyone could have anticipated. Within days, the COVID-19 pandemic shut down the country.

Now the question the more than 44 million unemployed Americans are likely wondering is, “How long will the recession last?”[4]

Economists’ predictions for how long the recession could last range from the first two quarters of 2020 to well into 2021.[5][6]

Learn How to Avoid Costly Rookie Mistakes & Invest in Gold Like a Pro!

Get Free Gold Investor Guide

What could cause a deep, prolonged economic downturn? Keep reading to find out and get in-depth analysis of the COVID-19 Recession.

What Is a Recession?

Every year, economists predict one is just around the corner, but what does recession mean? What conditions might the average American experience during an economic downturn?

A recession is defined as a period in which economic activity declines significantly. Many economists look at gross domestic product (GDP) when determining whether or not we’re in a downturn. When this measure of all the goods and services produced in the country contracts for two consecutive quarters, its usually an indicator that we’re in a recession.

Workers lose their jobs, consumers tighten their wallets, employers postpone raises, sales stagnate, production falls, and the economy contracts further. It’s a vicious cycle.

The loss of confidence in the economy usually translates into investor risk aversion: stocks fall and gold prices rise in a flight to safe haven investments.[7]

When Did the Recession Start?

The COVID-19 Recession started in February 2020. It marked the end of the longest economic expansion in U.S. history, and it hit faster than any other downturn.

The unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession,–explained the economists at the National Bureau of Economic Research who first called the recession

So what happened? The economy heated up for the 129th month in a row in February. Employers added 273,000 workers. Unemployment fell to the lowest rate in 50 years, 3.5%. On March 11, 2020, the World Health Organization declared the coronavirus outbreak a pandemic.[8] By March 16, the President issued stay-at-home guidelines.[9]Thousands of American deaths, millions of business closures, and tens of millions of job losses followed. All in a matter of weeks.

The unemployment rate was 13.3% in May, higher than any other recession since World War II. However, the broad measure of unemployment, which includes those who are out-of-work and have given up looking and those whose hours have been cut from full to part time, is 21.2%.

GDP fell by 5% in the first quarter and is set to contract by as much as 40% in the second quarter.[10]

How Bad Will the 2020 Recession Be?

‘The Great Lockdown, as one might call it, is projected to shrink global growth dramatically. A partial recovery is projected for 2021 … but the level of GDP will remain below the pre-virus trend, with considerable uncertainty about the strength of the rebound. Much worse growth outcomes are possible and maybe even likely.’ — the International Monetary Fund (IMF)

COVID-19: Unlike Any other Recession

Economists may not agree on an exact date for the end of the COVID-19 Recession, but there is a consensus that this downturn is unlike any other:

COVID-19 Recession Source

COVID-19 Recession Source

Unlike the Reagan Recession (July 1981 – November 1982) and the Great Recession (December 2007 – June 2009), the COVID-19 Recession was not financial in origin. A public health crisis triggered it.

COVID-19 Recession Speed

COVID-19 Recession Speed

Even though the Great Recession started in December 2007, U.S. unemployment didn’t reach its 10% peak until October 2009. Just weeks into the COVID-19 Recession, the unemployment rate surpassed the 2009 high. As of May 2020, it was more than twice that at 21.2% (broad measure).

COVID-19 Recession Scope

COVID-19 Recession Scope

“‘The most distinguishing characteristic is that this [downturn] is so much more pervasive.’ The Great Recession was an economic slowdown that began in finance and trickled down to the rest of the economy. But now, everyone is affected. It’s hitting everywhere all at once, from travel to food service to health care.” — Joseph Stiglitz, a Nobel Prize-winning economist.

And it’s exactly these differences—this lack of historical precedent—that’s making it hard for economists to predict the outcome of the COVID-19 Recession.[11]

The economic projections that do exist aren’t pretty.

Coronavirus Pandemic… “Deepest Slump since the Great Depression”

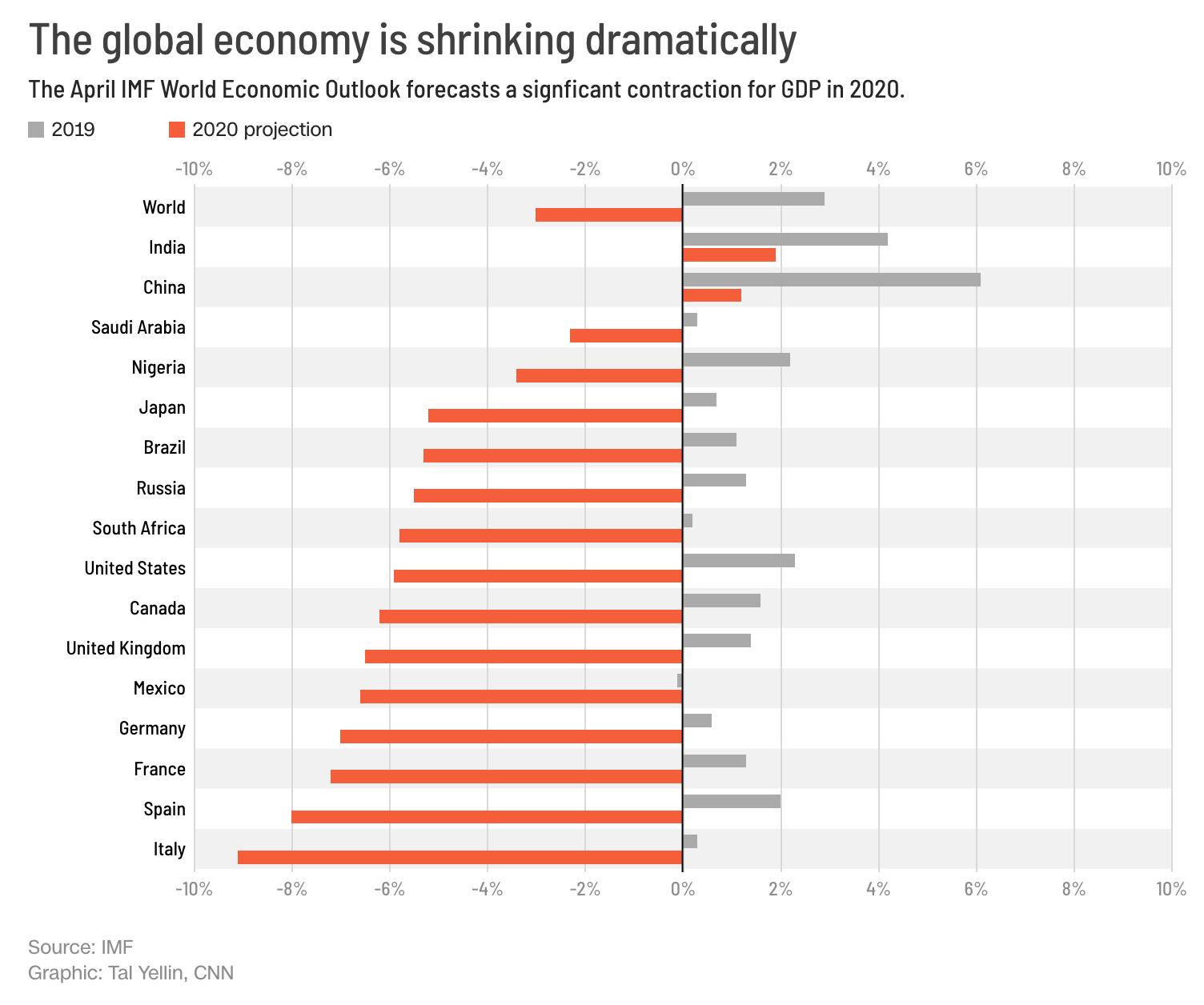

How bad? Instead of growing by 3.3% like it predicted last January, the IMF predicts global GDP to shrink by 3% in 2020.

Despite the government pumping trillions of dollars into the country, America’s economy is expected to contract by 5.9% this year.

If the global community can contain the virus, the economy could rebound in 2021, said the IMF, and growth could shoot to 5.8%.

But a number factors could derail the recovery. Consumer and corporate behavior may undergo permanent shifts, resulting in lackluster demand and failing supply chains. Investment could be insufficient to reignite an economy scarred by mass bankruptcies.

And, of course, ‘the pandemic could prove more persistent than assumed…testing the limits of central banks to backstop the financial system and further raising the fiscal burden of shock.’[12]

Pre-COVID-19 Economic Vulnerabilities

Most economists and reporters are so focused on how “unprecedented” the COVID-19 Recession is that few have mentioned where the economy was before the pandemic hit: not so great.

Recession predictions were mounting.

Why?

Negative Growth in Manufacturing

The Institute for Supply Management issued a report in October 2019 indicating the manufacturing sector had contracted in September at the fastest rate since 2008’s Great Recession.

‘The bulls dismiss the manufacturing recession as old news that doesn’t matter,’ wrote Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management. ‘We believe that they are ignoring that not only is the data deteriorating, but that it is surprising to the downside—a combo that the market has historically not liked.’[13]

Rising Income Inequality

Former Federal Reserve Chair Janet Yellen expressed concern last November about a coming recession during an appearance at the World Business Forum.

I would bet that there would not be a recession in the coming year. But I would have to say that the odds of a recession are higher than normal and at a level that frankly I am not comfortable with,–Former Federal Reserve Chair Janet Yellen

The specter of continually increasing income inequality is one of the recession risk factors Yellen cited. The longest economic expansion in history just ended; however, most of the benefits flowed toward top earners and people with a postsecondary education. This has caused serious social discontent and a lack of faith in the market, both of which can endanger future growth, said Yellen.[14]

U.S. China Trade Cold War

The trade war with China cast a pall over investors since it started in March 2018 up until a deal was struck last January. Many have felt new optimism in the wake of the limited deal, which makes way for $700 billion in trade flow.

However, critics rightly assert that, while this provides some relief, the deal does not address most of the damaging trade practices that spurred the tariffs in the first place. The U.S.’ chief trade negotiator Robert E. Lighthizer described the deal as a very important first step forward.[15]

Investors and others would be right to remain skeptical about our ability to curb unfair trade practices, such as the intellectual property theft that hurt American companies. Whether these will be satisfactorily addressed remains to be seen.

Meanwhile, American consumers and businesses have absorbed the cost of the tariffs in the form of higher prices and a greater cost of doing business. The double-edged sword of higher costs paired with Chinese practices like IP theft could make it harder for American companies to compete and stay profitable, especially after the massive and unexpected blow of months of forced closures due to the pandemic.

Worse yet, all of the work to pass the trade deal could prove futile. Tensions between President Trump and Chinese leaders are heating up again, with rumors of another Cold War swirling after Beijing’s reported mishandling of the coronavirus pandemic.[16]

How to Survive a Recession

Even if the global community can contain the spread of the COVID-19 virus or come up with a vaccine—both lofty goals at best—underlying economic vulnerabilities could prove further hurdles to recovery.

There are, however, steps you can take to minimize the impact of the economic downturn on your everyday life and financial future.

Tips to Recession-Proof Your Life

- Stay out of debt: credit card balances will keep growing if a sudden job loss prevents you from paying them off.

- Find additional streams of income: these could keep you afloat in the event of changes to your primary source of income.

- Keep your credit score high: this could allow you to borrow when the credit markets tighten.

- Maintain a savings: having savings available means security in good times and bad.

- Protect your savings by diversifying your portfolio: hold assets that are negatively correlated to each other. For example, when stocks are down, gold is usually up.[17]

What to Invest in During a Recession?

Uncertainty. It’s the only thing you can count on during a recession. Especially a recession unlike any other in history. And it can make betting on which assets will perform well in the next year a nightmare.

While the stock market’s been a roller coaster ride for investors, gold prices have been steadily moving in one direction since the start of 2019: UP! Selling at $1,710.45 per ounce on June 15, 2020, gold is up more than 33% from that start of 2019, making it the choice investment right now.[18]

If you’ve been taking a “wait and see” approach, thinking that you still have some time to adjust: the time to act is now. Gold prices will only keep rising in these uncertain economic times.

Not sure where to start? Learn more now about how you can protect your portfolio with gold today.

Kitco News

(Kitco News) – “It’s over,” Navarro told Fox News in an interview when asked about the trade agreement. He said the “turning point” came when the United States learned about the spreading coronavirus only after a Chinese delegation had left Washington following the signing of the Phase 1 deal on Jan. 15.

![]()

The post White House adviser Navarro says China trade deal is ‘over’ appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Venezuela’s central bank is suing the Bank of England (BoE) to get access to its London-stored gold that is worth more than $1 billion.

![]()

The post Separate ‘law from politics’, says Venezuela’s lawyer in spat over $1 billion worth of gold stored at the BoE appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Estimated life-of-mine annual gold production is now 311,000 ounces instead of last year’s estimated 441,000 ounces, a 29% reduction.

![]()

The post Vice president of operations leaves Pretium Resources appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Matysek said he is happy to stand aside for Friedland.

![]()

The post Friedland joins gold company ‘given state of the markets’ appeared first on WorldSilverNews.

“”silver price”” – Google News

All that glitters when the world jitters is probably gold Kitco NEWS

The post All that glitters when the world jitters is probably gold – Kitco NEWS appeared first on WorldSilverNews.