Source: Maurice Jackson for Streetwise Reports 06/09/2020

Millrock Resources CEO Gregory Beischer speaks with Maurice Jackson of Proven and Probable about his company’s drill program in the shadow of the Pogo gold mine.

Maurice Jackson: Welcome to Proven and Probable. Joining us for a conversation is Gregory Beischer of Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQB).

Gregory for someone new to Millrock Resources, please introduce the opportunity the company presents to the market and in particular, the 64North project, which has market participants anxiously awaiting news results.

Gregory Beischer: Millrock is a team of early-stage exploration geologists. We want to make a discovery of a giant ore deposit and sell it to a major mining company, that’s our goal, but we take a different approach than a lot of early-stage explorers. It’s a risky business. So we will invest our capital to generate projects, come up with a new idea, acquire the mineral rights, but before any really big dollars are spent for exploratory drilling, we’ll bring in a partner. And that way we can operate five or six projects at any one time, increasing our odds of making the discovery that will drive our share price way up, but also it’s a sustainable company, one that has a core group that’s with us year after year doing excellent scientific work. And we know that’s one of the key ingredients to successful mineral exploration and discoveries.

Maurice Jackson: Sticking with the 64North project, can you provide us with an update on drilling?

Gregory Beischer: These are exciting times for Millrock right now. We’ve developed a huge district-scale project looking for another gold deposit in the vicinity of the Pogo gold mine. Pogo was discovered in 1994–1995. It’s been producing excellent gold grades and ounces over the past decade. Millrock is confident that we may find another mine just like it. And I believe the area around Pogo has the potential to host multiple mines in the future. I think the Goodpaster Mining District in which our 64North project is located will have in the end multiple mines that will produce tens of millions of ounces of gold, comparable to something like Red Lake in Ontario, or Val-d’Or in Quebec, or Kalgoorlie in Western Australia. Millrock has the dominant land position by far in the district. We had a unique opportunity a year ago where after eight bad years in the mining cycle, the ground had all come open.

And so we were able to stake the whole district. And there was an aggressive move on our part, but one that’s paid off. We have an Australian junior company funding the work. We’re executing that work in collaboration with their technical team. I am glad to convey that our geological crews are mobilizing to the field today. And the drill is meant to have arrived on site today. And by the end of the week, we should be drilling again at the Aurora target on the 64North project, just to the immediate west of the Pogo gold mine, so exciting times. I know you and other shareholders have been following this particular project quite closely. And it’s a relief now to be exploring again, after being slightly derailed by this pandemic.

Maurice Jackson: Besides drilling, what other work is being conducted to delineate the 64North project to increase the chances for success?

Gregory Beischer: Millrock is conducting work on multiple fronts. It’s an enormous attractive claim, we’ve done a lot of studies, desktop studies looking at our extensive database for the district generating new drill targets. We have this obvious, compelling target at Aurora west of Pogo, but there are lots of other places that are coming forward too. We’re going to have a steady pipeline of drill-ready targets on this project for years to come. And so we’ve developed plans, exploration plans for each one of those prospects that will be executed later in the year, but also more particularly on the West Pogo, we’re about to do two geophysical surveys, airborne geophysical surveys that will help our image below the surface of the Earth, map out the structures. And as you know, the deposits at the Pogo mine are relatively flat-lying.

They dip gently, and so at about 25 or 30 degrees. As those dip off to the Northwest, they’re going to come on to Millrock’s ground. And these geophysical surveys will help confirm the existence of the structures, and to determine the depth to which we’ll have to drill, to intersect them. And we would plan to do the geophysics, in early June, but we would plan then to drill those targets in the down-dip direction from the Goodpaster Deposit Pogo Mine later in the summer. The Aurora is being drilled now, geophysics happening now, but we should be drilling through the year on this project.

Maurice Jackson: Truly exciting times for Millrock Resources. Sir, what is the next unanswered question on the 64North project? When can we expect a response, and what will determine success?

Gregory Beischer: The very first hole we drilled at 64North in March had a lot of great geological signs in it. We could see a lot of hydrothermal fluids had moved through the rocks, mineralizing them with quartz veins and veinlets and sulfide minerals that are very typically associated with gold. Everything looked great, but surprisingly the gold values were pretty weak. But we know we’re in the right area, and we’re probably peripheral to a deposit by a short distance. And we know we’ve got the structures. We know we’ve got the right mineralization. We just need the gold. Millrock will be moving our drill northward. And I’m very hopeful that we’ll intersect the same structures, but this time with lots of gold in them, and that’ll be the next big test and measure of success for Millrock and its team.

So we’re hoping to make in this drill program that we’re currently executing a new gold deposit discovery. And if we do, I don’t think Millrock’s share price will be 22 cents much longer. It’s been great to see some exploration companies having exploration success, and shareholders being rewarded at the same time as there are some good drill holes lately, and one particularly in Alaska that resulted in a tenfold share price increase. So we’re hoping to repeat that kind of success.

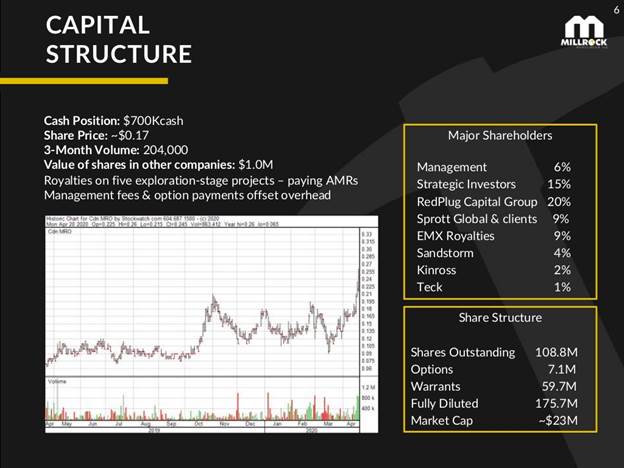

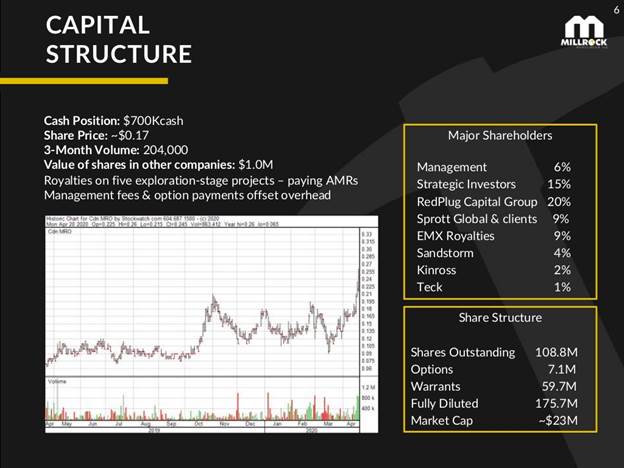

Maurice Jackson: Well, in many regards you have, in nine months the stock prices almost tripled. What are the current stock price and the capital structure for Millrock Resources?

Gregory Beischer: Now, the last time I looked, an hour or so ago, we were at 22 cents. That’s three times higher than it was a year ago when you and I and others participated in a private placement financing when Millrock raised some money. So that feels good to have had that success, but I think we’re just barely getting going. Maurice, I think about 2009, Millrock share price has got all the way down to a similar level of 5 cents when the market crashed badly in 2008, but 12 months later Millrock was at $1.05. And that was simply because we had a very supportive market. Things came roaring back, and Teck invested in Millrock; Altius Minerals and Kinross all invested in Millrock. We were doing really good work and in that rising tide, in that good market, our share price increased significantly. Today we’re a much, much stronger company. And if we were to make a real bona fide gold deposit discovery at this time, it would be a remarkable thing for our share price.

Maurice Jackson: Well, speaking of a strong company, what is the capital structure?

Gregory Beischer: Millrock has 109 million shares outstanding right now. The market cap is roughly $20 million. We also have warrants that are outstanding and now in the money. And so we anticipate that we may get some warrants exercised and that would bring some more money into our treasury. We want to deploy some cash as soon as we can to buy up more gold projects. We see that the market is here. We’re getting inquiries from other junior explorers looking for projects. And so we want to make some quick moves to generate more gold projects in Alaska, as soon as we possibly can.

Maurice Jackson: Sir, what keeps you up at night that we don’t know about?

Gregory Beischer: Well, I’m like everyone concerned about this pandemic. We put in rigorous safety precautions for our teams, so they can get back to work safely. As you can imagine though, traveling together in vehicles and that sort of thing poses some risks. We think we’ve got it well handled, but it’s a worry. We would hate for this drilling program to get derailed again. And so we’re trying our very best to have those safety protocols to minimize the chance that that’s going to happen.

Maurice Jackson: Last question, what did I forget to ask?

Gregory Beischer: Well, often, Maurice, we talk about the gold price, and I’ve already done that to some degree, seems like it’s moving up and so much of capital availability and interest in the mining and mineral exploration sector seems to depend on the gold price, but everything’s moving the right way now. And I’m sure you’re seeing it, but the generalist investing public now is starting to pour into precious metals. And it’s great to see because it’s putting some wind under the wings of mining companies and explorers.

Maurice Jackson: Yes, sir. A lot of synergies and a lot of catalysts coming into the space. Mr. Beischer, where can audience members receive more information on Millrock Resources?

Gregory Beischer: The website address is www.MillrockResources.com. There you’ll find the contact information for Melanie Henderson who’s in charge of investor relations for Millrock. And if any of the current shareholders or future shareholders would like to speak directly to me, I’d be glad to take the time to speak with them.

Maurice Jackson: Mr. Beischer, thank you for joining us today on Proven and Probable. Wishing you and the entire Millrock team the absolute best, sir.

Millrock Resources is a sponsor and we are proud shareholders.

And as a reminder, I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, off-shore depositories, and precious metal IRAs. Call me directly at 855-505-1900 or you may email, maurice@milesfranklin.com.

And finally, please subscribe to provenandprobable.com, where we provide mining insights and bullion sales.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Millrock Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Millrock Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: MRO:TSX.V; MLRKF:OTCQB,

)